The law of demand, as stated by Alfred Marshall, establishes a qualitative and functional relationship between price of a commodity and the quantity demanded of it. It states that, ceteris paribus, a fall in the price of a commodity increases the quantity of the commodity demanded and a rise in the price causes a fall in its quantity demanded.

Marshall puts the law as such:

“The greater the amount to be sold, the smaller will be the price at which it is offered in order that it may find purchasers, or in other words, the amount demanded increases with a fall in price and diminishes with a rise in price”.

This simply means that, everything else remaining the same, the quantity demanded of a commodity becomes large at a low price and becomes small at a high price. In mathematical terms, this relation is expressed as qdx = f(px) i.e., demand is a function of price.

The Demand Curve:

The law of demand is illustrated by drawing the demand curve for a commodity. The demand curve is a graphical representation of the demand schedule. The demand schedule, which is plotted on a diagram to derive the demand curve, shows a definite relationship between the quantity of a commodity demanded and its market price. As the quantity and price are inversely related the demand curve of a commodity slopes downward from left to right.

ADVERTISEMENTS:

This is true of an individual consumer’s demand curve as also of a market demand curve. In fact, the market demand curve for a commodity is derived by adding up the demand curves of individual consumers.

A demand curve simply indicates that the quantity demanded of a commodity falls with a rise in its price and rises with its fall. In other words, the demand curve illustrates the law of demand. In case of most commodities, such as rice, wheat, soap, tea, motor cars, TV sets etc., we observe such a downward slope in demand curve.

The demand curve is usually drawn as a continuous line and it is based on the assumption that there exists a price of every unit of a commodity, however small, and the individual or the market responds to very small changes in the market price. But, this assumption is not always true.

ADVERTISEMENTS:

In fact, an individual consumer’s demand curve may be discontinuous because the consumer does not react to small changes in price and because the commodity may be indivisible, i.e., cannot be divided into small parts. On the other hand, the market demand curve will not usually display important discontinuities, because the price changes necessary to effect a change in quantity purchased will vary among individuals.

Illustration of the law of demand:

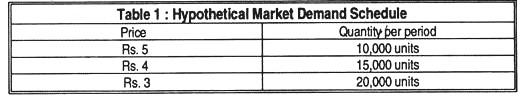

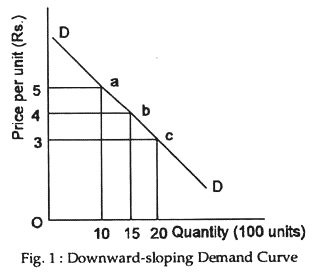

The law of demand may now be illustrated. Table 1 shows a market demand schedule and Fig. 1 shows the corresponding market demand curve.

The table shows that the quantity demanded of a commodity is small at a high price and large at a low price. In other words, the table illustrates the law of demand. The law is now illustrated with the help of Fig. 1. In Fig. 1 we measure quantity demanded per period on the horizontal axis and price per unit on the vertical axes. We have considered three price-quantity combinations as are indicated by three points: a, b, and c.

The locus of these and similar points is the demand curve, dd. In this context, we draw a distinction between demand and quantity demanded. Demand is a concept but quantity demanded is a number. We use the term ‘demand’ in a broad sense to refer to the entire demand curve for the commodity.

But, we use the term ‘quantity demanded’ in a narrow sense just to refer to a particular point on the demand curve. A particular point like a, b, or c indicates the maximum amount of commodity a consumer is willing to buy at a Particular price per period, neither one unit more nor one unit less. The quantity shown on the horizontal axis is a desired flow.

By joining points like a, b, c, etc., we draw the market demand curve. The figure shows that the demand curve slopes downward from left to right, indicating a large quantity at a low price and a small quantity at a high price. The demand curve is downward sloping because, as per the law of demand price change and quantity change are in the opposite direction. In other words, due to the operation of the law of demand a typical demand curve has a negative slope.

The demand curve for a normal good slopes downward from left to right for the following reasons:

1. Operation of the law of diminishing marginal utility:

The law of demand is a logical deduction from the fundamental psychological law, viz., the law of diminishing marginal utility. This law simply states that, the marginal utility of a commodity is high when quantity demanded is low and is low when the quantity demanded is high. When a consumer reaches equilibrium by equating the marginal utility of a commodity with its price, marginal utility must be high at small purchases or when the price is high the quantity demanded will be small.

On the other hand, the price must be low at large purchases or when the price is low the quantity demanded will be large. It shows that the law of demand is derived directly from the law of diminishing marginal utility. In fact, the marginal utility of a commodity indicates the maximum price a consumer is ready to pay for a commodity. As the .consumption of a commodity increases marginal utility gradually falls.

This means that the consumer will be ready to pay less and less price to acquire every additional unit that he intends to buy. This means that he will buy more and more units, if and only if the price of the commodity under consideration falls. This, in its turn, means that price change and quantity change are in the opposite direction or, in other words, the quantity demanded of a commodity varies inversely with its price. This is the essence of the law of demand.

Modern Explanation:

Modern economists like J.R. Hicks and R.G.D. Allen developed an alternative approach which also helps explain the law of demand. This new approach introduces two new concepts, viz., the substitution effect and the income effect of a change in price. These two effects together explain why the quantity demanded of a commodity increases when its price falls. A fall in the price of a product normally results in more of it being demanded. A part of this increase is due to substitution effect.

ADVERTISEMENTS:

2. Substitution effect:

The first factor explaining increasing consumption when price fall is known as the substitution effect. The substitution effect refers to the substitution of one product for another resulting from a change in their relative prices.

A lower price of good X, with the prices of other goods remaining unchanged, will increase its relative attractiveness, inducing consumers to substitute good X in place of some of the new, relatively more expensive items in their budgets. If the price of coffee increases while other prices (including the price of tea) do not, then coffee appears to be relatively more expensive.

When coffee becomes more expensive relative to other items, less coffee and more tea will be consumed. Similarly, a fall in the price of video-cassettes relative to movie tickets will induce people to seek more of their amusement in the cheaper direction.

ADVERTISEMENTS:

As a general rule, the substitution effect of a fall in the price of a commodity is to induce consumers to substitute other goods for the more expensive good in order to acquire the desired satisfaction as cheaply as possible. Thus, when consumers substitute less expensive goods for more expensive ones, they are buying desired satisfaction (utility) cheaply (i.e., at least cost).

3. Income effect:

Moreover, when a consumer’s money income is fixed, a fall in the market price of one of the purchasable commodities is just like an increase in his real income or purchasing power. To be more specific, the income effect signifies the impact of a price change on the real income of a consumer. When a consumer’s money income is constant, a fall in the price of a commodity is equivalent to an increase in his real income.

The income effect refers to changes in a consumer’s real income resulting from a change in product prices. A fall in the price of a good normally results in more of it being demanded. A part of this is done to real income effect (i.e., income adjusted for changes in prices to reflect current purchasing power).

ADVERTISEMENTS:

If a consumer has a money income of, say, Rs. 10 and price of X is Re. 1 he can buy 10 units of the good. If the price of the good now falls to 50 paise, he can buy the same 10 units with only Rs. 5. The consumer now has an extra Rs. 5 to spend in buying more of good X and other goods.

This will induce the consumer to buy more of almost every commodity, including the one whose price has fallen. With a higher real income, our representative consumer will want to buy more of both tea and coffee (provided both are normal goods). Thus, in the most usual situation, the income effect will normally reinforce the substitution effect in making the demand curve for a normal good downward sloping.

In short, as the price of a commodity falls people may buy more of it for two reasons:

(1) It is cheaper (substitution effect).

(2) The fall in price in effect leaves more income with the consumers to spend (income effect).

The two effects together constitute the price effect or the total effect of price change on the purchase of a commodity. By using indifference curve approach we can distinguish between the magnitude of these two effects. The income effect, together with the substitution effect, provides an explanation of why demand curves are usually downward sloping.

ADVERTISEMENTS:

In fact, when the price of a commodity changes, both these effects operate simultaneously. A change in the price of a commodity brings about a change in its quantity demanded owing partly to income effect and partly to substitution effect. The combination of these two effects is known as the price effect.

4. Change of the number of uses:

The law of demand operates owing to a change of the number of uses of a commodity, which the change in the price brings in. Thus, a fall in the price of electricity or steel increases the number of its uses. As a result the demand for electricity or steel rises. On the other hand, a rise in the price of electricity or steel reduces the number of its uses, causing a fall in its demand.

5. Change of the number of buyers:

Another reason for the validity of the law of downward-sloping demand curve comes from the fact that the lowering of prices brings in new buyers and the raising of prices reduces the number of buyers. These buyers are also known as marginal buyers. Thus, at present in our country the demand for TV sets is very small because of its high price. But a fall in its price will bring in gradually a large number of buyers and as a result its market demand will increase.