In this article we will discuss about the Impact of Real GNP in Business Cycle.

A stable macro-economy is crucial to the smooth and efficient functioning of a business firm which is basically a micro-unit.

The question of economic stability can be divided into three specific economic goals:

(a) Growth of real output,

ADVERTISEMENTS:

(b) Full employment and

(c) Price level stability.

These three macro-economic goals are different but interrelated. Without full employment of resources including manpower, it is not possible to fully realize the potential output of an economy.

In a like manner, constant fluctuations in the general price level will generate uncertainty and retard economic growth. This explains why the most important task of a modern government is to pursue policies designed to “promote maximum employment, production and purchasing power.”

ADVERTISEMENTS:

Swings in the Economic Pendulum:

During this century, the growth rate of real GNP in the U.S.A. and other industrially advanced countries has never been steady. In some years GNP has grown at a steady rate of 5% to 6%. In other years, output as measured by real GNP has actually declined. During the Great Depression (1929-31), economic growth plunged.

A Hypothetical Business Cycle:

ADVERTISEMENTS:

Historical data show that periods of economic expansion have traditionally been followed by economic slowdown or contraction. During the slowdown, real GNP also grows at a slower rate, if at all. In contrast, during the expansionary phase, real GNP grows rapidly.

In fact, business conditions never run smooth. A period of prosperity is followed by a period of panic or a crash. Economic expansion yields place to recession. National income (GNP) and employment fall. Prices and profits decline and workers are made redundant.

Ultimately the rock bottom is reached and recovery starts. As Samuelson and Nordhaus have put it, “The recovery may be slow or fast. It may be incomplete, or it may be so strong as to lead to a new boom. Prosperity may mean a long, sustained plateau of brisk demand, plentiful jobs and rising living standards”.

Or it may be marked by a quick, inflationary flaring up of prices and speculation, to be followed by another “slump.” To such fluctuations in economic conditions the name business cycles is given. In truth, “upward and downward movements in output, prices, interest rates and employment form the business cycle that has characterized the free-enterprise economies like the U.S.A., Germany, Japan, Canada, etc. for the last two centuries or so. As the name suggests, a business cycle is a period of up-and-down motion in aggregate measures of current economic output and income.”

In the language of Samuelson and Nordhaus, “A business cycle is a swing in total national output and employment, usually lasting for a period of 2 to 10 years, marked by widespread expansion and contraction in many sectors of the economy.”

As K.E. Boulding has put it, “One of the most striking phenomena of the western world is the alteration of periods of prosperity and depression which goes by the name of the business cycle. This is perhaps the most complex problem of modern economic society.”

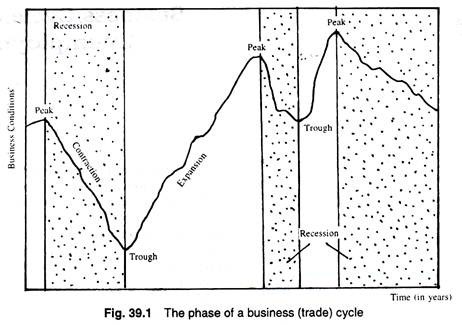

Fig. 39.1 illustrates a typical business cycle and its successive phases. It is to be noted at the outset that ‘peaks’ and ‘troughs’ make the turning points of the cycle, while ‘recession’ and ‘expansion’ are the major phases. Fig. 39.1 shows that a business cycle, like a year, has its own seasons.

Business cycle are of different types. They have some similarities, but they are not identical twins. Paul Samuelson compared business cycles with mountain ranges with different levels of heights and valleys. The periodicity (duration) of business cycles also differs.

When the aggregate business conditions show signs of slowing down, the economy moves into the contractionary (recessionary) phase of the business cycle. During the contractionary phase, the sales of most business fall, real GNP grows at a slow rate or even declines, and there is growing unemployment in all the important sectors of the economy.

ADVERTISEMENTS:

The bottom or the lower turning point of the business cycle is referred to as the recessionary trough. As Samuelson has put it, “The downturn of a business cycle is called a recession, which is defined as a period in which real GNP declines for at least 2 consecutive quarter-years. The recession begins at a peak and ends at a trough.”

After the downward phase reaches bottom and economic conditions begin to improve, the economy gradually enters the expansionary phase.

During the expansionary phase business sales rise, GNP grows very fast, and there is a decline in the rate of unemployment. The expansion eventually blossoms into another business peak. The peak, however, peters out and turns to be a contraction, starting a new cycle.