Let us make an in-depth study of the Business Cycle Theory. After reading this article you will learn about: 1. Components of any Business Cycle Theory 2. The Essence of the RBCT 3. Explaining Cycles 4. Criticisms of the Real Business Cycle Models.

Components of any Business Cycle Theory:

In general there are two main components of any theory of business cycle.

The first is a description of the types of factors that are exogenous in nature and have major effects on the economy for example, wars, new inventions, crop failures and changes in government policy.

Economists often refer to these largely unpredictable forces knocking the economy as external shocks.

ADVERTISEMENTS:

Such shocks or disturbances are supposed to affect the economy the most. Business cycle theories refer to various economic disturbances, such as supply shocks, changes in monetary or fiscal policy, and changes in consumer spending.

The second component of any theory of business cycle is a model that describes how the economy responds to the various shocks. The model describes how key macroeconomic variables — such as output, employment and prices — respond to economic shocks.

The model presented by the real business cycle theory (RBCT) is the market-clearing equilibrium version of the IS-LM model. The leader of the real business cycle school is Edward C. Precott.

The Essence of the RBCT:

The RBCT has two planks. The first is to explain the shocks or disturbances that hit the economy, causing fluctuations in the first place. The second is to explain the propagation mechanism. A propagation mechanism is the means through which disturbance is spread throughout the economy. In particular, the aim is to explain why shocks to the economy seem to have long-lived effects.

(a) Propagation Mechanism:

ADVERTISEMENTS:

The various mechanisms that cause business cycles are inventory adjustments and changes in investment caused by shifts in productivity of resources and profitability of investment. The RBCT explains fluctuations in output and employment in terms of variety of real shocks hitting the economy. Such shocks affect output for several years.

The mechanism that causes business cycles is the intertemporal substitution of labour. Any theory of the business cycle has to explain why people work at certain times than at other times; during booms — employment is high and jobs are easy to find; during recessions — people are workless.

(b) Disturbances:

The most important disturbances isolated by equilibrium business cycle theories are productivity shocks, or supply shocks or shocks to government spending. Examples are good weather and new methods of production.

To start with provide a micro-foundation of the RBCT in terms of the behaviour of an isolated individual such as Robinson Crusoe living in a distant island economy. Then we extend the analysis to study the importance of technology shocks and other disturbances to explain business cycles.

Explaining Cycles:

The RBCT has been developed by criticising the Solow Model of economic growth. According to the Solow Model, GDP grows as population, capital and the available technology evolve over time. In this model, the economy approaches a steady state in which most variables grow together at a rate determined by the consistent rate of technological progress.

ADVERTISEMENTS:

Most economists feel that technological progress and economic growth occur unevenly. Various shocks in the economy induce short-term fluctuations in the natural rates of output and employment.

According to the RBCT, fluctuations in output, employment, consumption, investment and productivity are all natural and desirable response to the inevitable changes in the macro- environment. Shocks to the economy’s ability to produce goods and services alter the natural rates of employment and output.

Although these shocks are not necessarily desirable, the sad truth is that they are inevitable. Once the shocks occur, it is desirable for GDP, employment, and other real macroeconomic variables to fluctuate over time in response to such extreme shocks.

However, real business cycle theories, which are an outgrowth of new classical models, have microeconomic foundations. These models are basically equilibrium model in contrast with Keynesian disequilibrium models.

These models are based on the following two microeconomic assumptions:

1. Economic agents optimise.

2. All markets clear.

So the business cycle is an equilibrium phenomenon. But in the Keynesian model the labour market does not clear. There is the problem of involuntary unemployment. In real business cycle models, if there is any unemployment in the economy it is completely voluntary.

ADVERTISEMENTS:

New classical models also make the same assumption. For this and other reasons real business cycle models are also called the second generation of new classical models.

i. The Interpretation of the Labour Market:

The central theme of RBCT is that the quantity of labour supplied at any given time depends on the incentives to work. When workers are suitably rewarded they get the incentive to put more effort. When incentives are lacking or are very much on the low side, workers are reluctant to work hard.

At times if the reward for working is grossly inadequate, workers decide not to work at all, at least for some time. The desire to reallocate hours of work over time in response to changing incentives is known as the intertemporal substitution of labour.

Let w1 be real wage in period 1 and w2 that in period 2. A worker will compare the real wage of the two periods in order to decide whether to work in period 1 or in period 2. In

ADVERTISEMENTS:

a world in which the rate of interest is not zero a worker will always compare w1 with w2 since he (she) can earn interest on money earned in period 1. If r is the rate of interest, the worker who works in period 1 and saves his earnings will have (1 + r)w1 in period 2. If he works in period 2, he will have w2. The intertemporal real wage — the earnings from working in period 1 relative to the earnings from working in period 2 — is

Intertemporal relative wage = (1 + r)w1/w2

Working in period 1 is more attractive if the interest rate is high or if the wage rate is high relative to the wage rate expected in the future.

The RBCT suggests that all workers do this type of cost-benefit analysis before deciding whether to work or not (i.e., to enjoy leisure). It is always better to work if the wage rate is temporarily high or if the interest rate is high. In contrast, it is in the Tightness of things to enjoy more leisure if the wage rate is temporarily low or if the interest rate is low.

ii. The Propagation Mechanism:

ADVERTISEMENTS:

Employment and output fluctuate due to intertemporal substitution of labour. Any macroeconomic shock that causes the interest rate to rise — or the wage rate to be temporarily high induces people to work harder. As they put more effort the level of employment and the volume of production rise.

Critics comment that fluctuations in employment do not affect people’s desired intensity of work. In their view desired employment does not respond much to either the real wage or the real interest rate. Instead the magnitude of unemployment is related to the phase of the business cycle under consideration.

During recession there is considerable unemployment. But this is of a voluntary nature, not of the Keynesian (involuntary) type. If some people voluntarily decide not to work in the contractionary phase of the business cycle they do not prefer to be called by the name “unemployed”. So labour markets do not clear in such times — the wage level changes.

In contrast, according to the supporters of RBCT a high rate of unemployment does not imply that intertemporal substitution of labour is unimportant.

Those who are voluntarily out of the labour market may — and often do — call themselves unemployed for one of the two reasons:

(i) in order to get unemployment compensation (benefit); or (ii) to express their desiredness to work at a normal wage rate (which is an average of the wage rate of the last few years). In truth, measuring the magnitude of unemployment is difficult because unemployment statistics are difficult to interpret.

iii. Disturbances:

ADVERTISEMENTS:

The mechanisms that propagate business cycles are set in motion by external shocks. These are disturbances that changes the equilibrium levels of output and employment in individual markets and in the economy as a whole.

The most important disturbances identified by the RBCT are shocks to productivity, or supply shocks, and shocks to government spending. A productivity shock changes the level of output produced by given amounts of inputs. Examples of such shocks are changes in the weather and new methods of production.

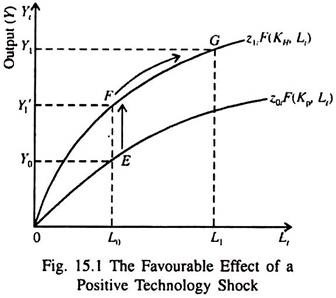

Let us suppose that there is a temporary productivity shock in the current period which is favourable to the economy. A rise in productivity will raise wages and improve the living standards of the people. Workers will respond to this by putting extra effort because they want to take advantage of the higher productivity.

As workers put extra effort, GDP will increase. This will lead to an increase in saving and investment. Thus the beneficial effects of productivity shocks will be transmitted to future periods by augmenting the economy’s stock of capital. If the effect of the intertemporal substitution of labour is strong, even a small productivity shock could have a strong effect on GDP.

iv. The Importance of Technology Shocks:

The RBCT suggests that employment and output fluctuations are caused by technology shocks or fluctuations in technology which the economy experiences over time. With an improvement in production technology it is possible for the economy to produce more output. As labour productivity rises real wages rise, too.

Moreover, due to intertemporal substitution of labour the level of employment also increases in the event of improved technology, since technology determines an economy’s ability to turn inputs (capital and labour) into output (good and services). By contrast employment falls during recessions and the available production technology deteriorates, lowering output and reducing the incentive to work.

ADVERTISEMENTS:

According to critics, technological progress is slow and gradual, sporadic rather than spontaneous. They argue that technological progress is especially implausible. The growth of technological knowledge may slow down but the process is unlikely to be reversed.

According to the supporters, there are many non-technological events which affect the economy in the same way as adverse technology does, such as adverse weather, strict enforcement of environmental laws and regulations or even international supply shock such as oil price hike.

All these factors may reduce the economy’s capacity to convert inputs into output. Whether such events are sufficiently common and powerful to explain the frequency and magnitude of business cycles is not yet transparent.

v. The Neutrality of Money:

The RBCT is based on another important (and radical) assumption — money is neutral in its effect — even in the short run. This means that monetary variables such as the rate of interest and the price level do not affect real variables such as output and employment.

According to critics there is empirical support to short-run monetary neutrality. To them reductions in monetary growth and inflation are invariably associated with periods of high unemployment. Monetary policy exerts a strong influence on the real economy.

Supporters of the RBCT argue that the critics confuse the direction of causation between money and output. To them the money supply is endogenous fluctuations in output are likely to cause fluctuations in the money supply. For instance, even when real output rises due to a beneficial technology shock, the quantity of money demanded increases automatically.

ADVERTISEMENTS:

The monetary accommodation will be made by the central bank. This endogenous response of money to economic activity may create the wrong impression that money is having a non- neutral effect on real variables.

vi. Wage-Price Flexibility:

Like the classical economists the RBCT assumes that wages and prices adjust quickly to clear labour and commodity markets. Rigidity of wages and prices cannot explain business cycles. Moreover, the assumption of flexible prices is methodologically superior to the assumption of sticky prices, simply because it ties macroeconomic theory more closely to its microeconomic counterpart.

According to critics wages and prices in most real life markets are not flexible. This inflexibility, according to them, explains both the existence of unemployment and the persistence of non-neutrality of money. In order to explain the rigidity of prices, they rely on the various neo-Keynesian theories to which we turn later in this chapter.

The RBCT has failed to create much impact mainly due to strong evidence in support of the importance (non-neutrality) of money. This is why most policy-makers continue to rely on the AS-AD model.

vii. Fiscal Shock to Explain RBC:

According to the RBCT two types of shocks cause output (income) fluctuations one is productivity shock, the other is fiscal shock, which plays some role in business cycles. Both are external shocks to the economy and are thus exogenous to the economy or to its two components — the household sector and the business sector.

According to RBCT a source of business cycles is a change in fiscal policy, such as an increase or decrease in government purchases of goods and services for, say, the army (as during war or emergency) or large government expenditure on infrastructure (on road building or public works programmes).

ADVERTISEMENTS:

Government expenditure adds to private expenditure during depression and are thus procyclical in nature. According to new classical economics fiscal shocks in the form of government purchases affect output and employment.

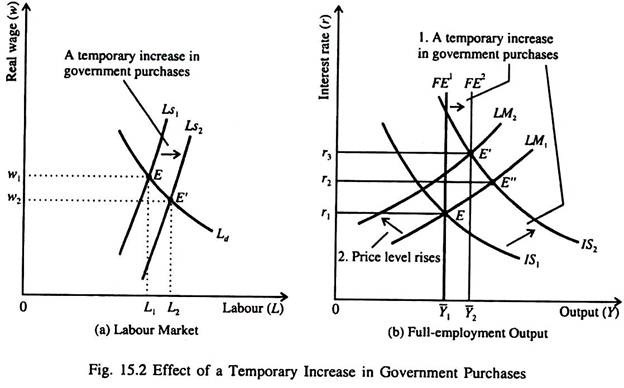

We may now present a simple model of fiscal shock to explain real business cycles. Fig. 15.2 shows the effects of an increase in government purchases in terms of the IS-LM model. The economy starts from point E in both part (a) and part (b). Part (a) shows the labour market.

An increase in government purchases affect only the labour supply by reducing workers’ wealth. (Since it does not affect the production function or the marginal product of labour, it does not shift the demand curve for labour.)

People become less wealthy because, in the event of more government purchases of society’s output, less output will be left for private consumption and investment under the assumption that output is always at its full employment level.

According to new classical economists a fall in wealth increases the supply of labour because poor workers work harder and enjoy less leisure. Thus an increase in government purchases increases the supply of labour. As a result the supply curve of labour shifts to the right from Ls1 to Ls2 in Fig. 15.2(a). Consequently the equilibrium in the labour market shifts from E to E’. This means that employment increases and the real wage decreases.

Fig. 15.2(b) shows that since equilibrium employment increases, full employment output, Y also increases. Thus the full employment line shifts to the right from FE1 to FE2.

The fiscal policy change shifts the IS curve from IS1 to IS2. The reason is that, at any level of output, a temporary increase in government purchases reduces desired national saving and raises the real interest rate that clears the goods market.

For full employment equilibrium to be restored, prices must rise. This will happen if the LM curve shifts to left so that the LM2 curve intersects the FE2 curve at point E’. However, whether the price level will rise or not is not clear. The reason is that fiscal policy change has increased both the aggregate demand for goods (by reducing desired saving and shifting the IS curve to the right) and the full employment level of output (by increasing labour supply and shifting the FE line to the right).

If we make the fairly reasonable assumption that the effect on labour supply and full-employment output of the increase in government purchases is not very large, the aggregate demand for goods is likely to exceed full-employment after the fiscal shock.

In Fig. 15.6(b) the aggregate demand for goods at point E” (where the new IS curve intersects the original LM curve) exceeds the full employment output, Y2. Thus the price level has to rise, shifting the LM curve to the left and causing the economy to return to full employment equilibrium at E”. At this point both output and real interest rate are higher than at the initial equilibrium point E.

Therefore, a fiscal shock in the form of an increase in government purchases increases output, employment, the real interest rate and the price level.

This is why such shocks have been incorporated in the RBCT. Since the increase in employment in this model is due to an increase in the supply of labour rather than an increase in labour demand, real wages fall when government purchases rise. Due to diminishing marginal product of labour, an increase in employment also implies a fall in average product of labour when government purchases rise.

Criticisms of the Real Business Cycle Models:

Although real business cycle models have generated considerable interest among economists in the last few decades, they are still in their infancy. They are still to get much empirical support.

Critics put forward the following arguments:

A. The Importance of Technological Shocks:

1. All industries do not experience positive shocks at the same time. Some industries receive negative shocks.

2. Some technological shocks — such as information transmission revolution — affect a wide range of industries. But these are not enough to explain recessions.

3. Real supply-side shocks — such as oil price hikes — are at times more important than technology shocks in explaining some business cycles (as had been experienced by the USA and other industrialised countries in the mid-1970s). At times changes in aggregate demand such as restrictive monetary policy provide better explanations of economic fluctuations (as had been found in the USA in the early 1980s) than do supply sight policy changes.

B. Voluntary Employment Changes:

For optimising individuals to move along their supply curves in response to changes in their marginal product and, therefore, their real wage, the labour supply curve has to be very flat. This is one basic postulate of real business cycle models. Such an outcome follows because — although swings in employment over the business cycle are large, changes in the real wage are small.

Studies show only small responsiveness of hours worked to changes in the real wage (a steep labour supply curve). Statistical evidence is more consistent with the Keynesian explanation in which workers are assumed to be thrown-off their labour supply curves: unemployment is involuntary.

Real business cycle models suggest that the business cycle phenomenon can be explained as an equilibrium phenomenon. Fluctuations in output occur because optimising economic agents respond to real stocks that affect production possibilities. So there is no need to prevent such fluctuations by adopting monetary and fiscal policies. If such policies are adopted the economy will be misdirected.

At times the cure is worse than the disease! Critics of the real business cycle approach — most of whom look at the business cycle from a Keynesian perspective — disagree. According to them business cycles occur both due to changes in nominal aggregate demand and changes in real supply-side variables.

So they call for active interventionist policy in order to prevent costly deviations from potential output so that the economy is enabled to reachieve full employment.

Policy Implications:

Real business cycle theory explains business cycles by random shocks to technology. If this view is correct there is no role for policy.