The below mentioned article provides an overview on the Proportionality Rule or Consumer’s Equilibrium.

The Proportionality Rule is known by various names. It is termed as the Law of Substitution, the Law of Maximum Satisfaction, the Law of Indifference, the Law of Equi-marginal Utility and Gossen’s Second Law.

Marshall defined it thus:

“If a person has a thing which he can put to several uses, he will distribute it among these uses in such a way that it has the same marginal utility in all.”

ADVERTISEMENTS:

Every consumer has unlimited wants but the money income available at his disposal at any time is limited. The consumer will so allocate his given income on the various purchases as to get maximum satisfaction. For this, he will compare the marginal utilities of the different commodities he wants to buy and also the marginal utility of each commodity to its price.

If he finds that the marginal utility of good A is higher than that of good В he will substitute the former for the latter till their marginal utilities are equalized. Since each commodity has a price of its own, the consumer will so allocate his budget on food, clothing, recreation and medical care, etc., that the last rupee spent on each good or service gives him the same marginal utility.

If the last rupee spent on good A gives him less marginal utility, he will withdraw this amount from A and spend it on good В if this gives him higher marginal utility.

The consumer will thus go on substituting one good with a higher marginal utility for another with a lower marginal utility till the marginal utility of each good is in proportion to its price, and the ratio of the prices of all goods is equal to the ratio of their marginal utilities.

ADVERTISEMENTS:

This is known as the Proportionality Rule which sets the condition of consumer’s equilibrium in the case of two commodities as:

MUA/PA =MUB/PB here MU is the marginal utility of commodity A and B, and P is the price. This can be restated as:

MUA/MUв = PA/PB

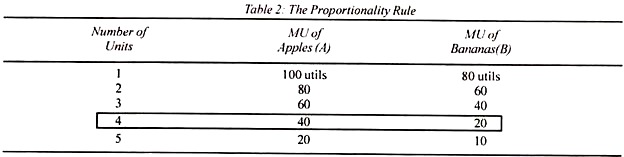

This law is explained with the help of Table 2.

Suppose the consumer is prepared to spend Rs.12 on the two goods, apples (A) and bananas (B) and whose prices are Rs.2 and Re. 1 respectively. Further, the consumer has preference for no other goods and his income remains constant.

The first condition of our consumer’s equilibrium is when the ratio of the Marginal Utility (MU) to price (P) is equal for apples (A) and bananas (B), as shown in the above equation. It is satisfied when he buys 4 apples and 2 bananas. Thus MUA/PA= 40/2=MUB/PB=20/1

This combination gives him maximum satisfaction. If he varies this order by purchasing 5 units of apples and 2 units of bananas, the marginal utility-price ratio will be distorted thus:

20/2=/60/1.

This does not satisfy the first condition of consumer’s equilibrium. The second condition is that the consumer equalises MUA/MUB = PA/PB = 40/20 = 2/1 = 2

The third condition for consumer’s equilibrium is that the consumer must spend his entire income on the purchase of the two commodities. This is expressed as

Y = PA x A + PB× В

where Y is income and A and В are units of apples and bananas respectively.

The third condition is fulfilled when the consumer buys 4 units each of apples and bananas and spends his entire income of Rs.12. Thus

ADVERTISEMENTS:

Rs.12 = (2 x 4) + (1 x 4)

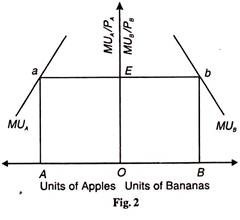

The consumer’s equilibrium in terms of the Proportionality Principle is explained in Figure 2 where on the vertical axis MUA/PA and MUB/PB is measured. The units of apples and bananas are measured on horizontal axis. The horizontal line ab satisfies both the conditions. When the consumer buys OA units of apples and OB units of bananas, MUA/PA =MUB/PB are equal to EO.

The consumer’s equilibrium can thus be stated in three ways:

(i) When he equalizes the marginal utility of each good weighted by its price: MU./P=MUB/PB

ADVERTISEMENTS:

(ii) When he equalizes the ratio of marginal utilities with the ratio of the prices of all commodities MUA/MUB = PA/PB; and

(iii) When the marginal utility of a rupee’s worth of A commodity is equalized to the marginal utility of a rupee’s worth of В provided that the consumer’s entire income is spent on A and В commodities, i.e..

MUA/Rupee’s worth of В = MUB/Rupee’s worth of A, subject to Pa × A + Pb × B = Y.

ADVERTISEMENTS:

This principle is based on a number of unrealistic assumptions which undermine its practical utility.

(1) Imperfect Knowledge:

It is assumed that the consumer has a perfect knowledge of the alternative choices open to him. In reality, most of the consumers are ignorant about other useful alternatives on which they could spend their income. This makes the act of substitution difficult and the law inoperative.

(2) Goods Indivisible:

It is assumed that all quantities like utilities, goods, income, etc. are fully divisible. This is again is an unrealistic assumption which stands in the smooth functioning of the law. Though money and utilities may be divided according to the convenience of the consumer, it is not possible to divide all goods in small units.

There are certain commodities which are lumpy like a fan or a radio and cannot be divided into small bits. It is not possible to have combinations of 21/2 fans and 31/2 radio sets.

ADVERTISEMENTS:

(3) Choices Uncertain:

The alternatives open to the consumer are also assumed to be certain. But consumer’s choices are uncertain and even risky. It is, in fact, expected utilities that determine consumer’s choices of the various commodities he can buy with a given money income.

(4) Consumer Irrational:

One of the most crucial assumptions is that the consumer acts rationally in allocating his given money income on goods of his choice. He is expected to be of a calculating mind, and capable of weighing the utilities of the commodities in a fine manner.

But how many of us calculate and weigh the utilities when we buy commodities? Most of our purchases are casual, prompted by habit or taste. Often we buy goods under the impact of fashion, custom or advertisement. Under the circumstances, it cannot be expected of the consumer to act rationally.

(5) No Fixed Accounting Period:

ADVERTISEMENTS:

Another limitation of this principle is that there is no fixed accounting period of the consumer in which he can buy and consume commodities. Even if a definite period of, say, a month is taken in which he is to spend his given income on certain commodities, he cannot measure their utilities accurately if they happen to be durable consumer goods.

Since a durable good like a bicycle is available to him in several subsequent accounting months, its utility cannot be accurately measured.

(6) Utility not Measurable:

Like other Marshallian concepts, this principle of maximum satisfaction is also based on the unrealistic assumptions of the cardinal measurement of utility and the constancy of the marginal utility of money. Hicks have discarded both the assumptions and have explained consumer’s equilibrium with the help of indifference preference approach.

Applications of the Law:

The law of maximum satisfaction is of great practical importance in economics. According to Marshall, “The applications of this principle extend over almost every field of economic enquiry.”

ADVERTISEMENTS:

1. Basis of Consumer Expenditure:

The expenditure pattern of every consumer is based on this law. Every consumer spends his money income on certain goods or services in such a manner as to have equi-marginal utilities in each use.

2. Basis for Saving and Consumption:

Similarly, a prudent consumer will try to distribute his limited means between his present and future uses so as to have equal marginal utility in each. If he thinks that a rupee spent now gives him utility just equal to the loss in utility for not saving it for the future, he will spend that instead of saving it for future consumption. This is how he gets maximum satisfaction from his income.

3. In the Field of Production:

An alert businessman always applies this principle to maximize his profits. His endeavour is ‘to obtain better results with a given expenditure, or equal results with a less expenditure.’ For this, he continues to substitute one factor unit for the other till the marginal returns from all factors are equalized.

ADVERTISEMENTS:

This principle can be extended to imply that a businessman continues to invest capital in several directions of his business till he finds that the benefit accruing from further investment in that direction would not compensate him for his outlay.

4. In the Field of Exchange:

Exchange, barter or money, is nothing but the principle of substitution itself. A person engaged in barter trade will continue to exchange his commodities with those of another person till their marginal utilities are equalized. In the case of monetary transactions, a person will buy or sell a commodity for a given unit of money if the marginal utility of the commodity equals the money spent on it.

5. For Determining Prices:

The principle of substitution is also applicable in the determination of prices. A scarce good carries a high price. In order to bring its price down, if we start substituting an abundant good for it, its scarcity will end.

6. In Distribution:

A prudent producer tries to have the most profitable application of his resources. Acting on this principle, he continues to substitute one factor service for another till the cost of employing each equals the marginal revenue resulting from its use.

7. In Public Finance:

It is also applicable in the realm of public finance. Taxes are levied in such a manner that the marginal sacrifice of each taxpayer is equal. Similarly, in deciding about the projects and their outlays, the government tries to equalize the social marginal utility of each.

If it finds that spending more on the construction of administrative quarters gives less social utility than on workers’ quarters, it will spend more on the latter and less on the former so that the social marginal utility from each is equalized.