The below mentioned article provides a beginners’ guide to Macroeconomics. This article will help you to understand the following things:- 1. Concept of Macroeconomics 2. Scope of Macroeconomics 3. Concept 3. Limitations.

Concept of Macroeconomics:

Macroeconomics has been variously described. According to R.G.D. Allen, “The term ‘macro economics’ applies to the study of relations between broad economics aggregates.”

In Culbertson’s view, “Macroeconomic theory is the theory of income, employment, prices and money. Professor K.E. Boulding calls macroeconomics “that part of economics which studies the overall averages and aggregates of the system.”

These definitions do not adequately describe the nature and scope of macro- economics.

ADVERTISEMENTS:

As Edward Shapiro puts it, “Macroeconomics attempts to answer the truly “big” questions of economic life-full employment or unemployment, capacity or under capacity of production, a satisfactory or unsatisfactory rate of growth, inflation or price-level stability.”

In short, macroeconomics gives bird’s eye view of the economic system as a whole. It examines the forest, not the trees. It is concerned with the basic problem of the determination of the flow of national income. The basic theoretical structure is the model of the circular flow of income in the economy explained below.

A Simplified Circular Flow Model:

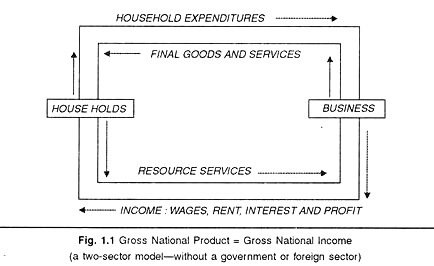

There are two ways of looking as Gross National Product. Firstly, GNP is the market value of the nation’s output of final goods and services. Secondly, from the income side it shows the costs incurred and payments received in producing those goods and services. Therefore, Gross National Product must be equal to the Gross National Income.

This is the fundamental identity which can be expressed conceptually by the simple diagram drawn below:

ADVERTISEMENTS:

The figure says that in the whole economy the total amount spent equals the total amount received. The diagram is a simple circular flow model which illustrates the fundamental identity. The nation’s flow of output in the upper pipeline equals the nation’s flow of income in the lower pipeline.

Profit is the residual or ‘balancing’ item, which brings this equality out. This is because wages, rent and interest are always positive. These are contract incomes, profit is not. The value of final goods and services is equated to the rent, wages, interest and profits as the total of income. Profits can be positive, zero or even negative. So this is the ‘balancing’ item in the circular flow model given below.

Scope of Macroeconomics:

The scope of macro-economics is quite wide and engaging. Here we examine the economy on a whole. We study the total level of spending in the economy and the total level of production. In other words, we examine the aggregate demand and aggregate supply.

ADVERTISEMENTS:

We study national output, the factors behind its growth. We also try to know as to why the growth rates fluctuate. These are the typical macroeconomic questions we deal with.

We study national employment and the level of unemployment. We also ask: what causes unemployment? We examine the determination of the general level of prices. We also want to know what causes rise in prices i.e. inflation.

In macroeconomics, we just do not focus on a country in isolation. We need to examine its economic relationship with the rest of the world. We ask: “What determines the level of imports and exports? What determines the rate of exchange of its currency into other nations’ currencies? How do these relationships with other countries affect the domestic economy?” These are all big issues. These are the sort of issues the electorate is concerned with when deciding which way to vote in elections.

In particular we focus on four issues which seem to be of uppermost concern to the electorate and hence to the politicians who want to return power, the major macro-economic issues are:

(1) Economic growth,

(2) Unemployment,

(3) Inflation, and

(4) The balance of payments and the exchange rate.

Government Macroeconomic Policy:

From the above four issues we can identify four macroeconomic policy objectives which governments typically pursue:

ADVERTISEMENTS:

1. High and stable economic growth

2. Low unemployment

3. Low inflation

4. The avoidance of balance of payments deficits and excessive exchange rate fluctuations.

ADVERTISEMENTS:

Unfortunately, these policy objectives may conflict. For example, a policy designed to accelerate the rate of economic growth may result in a higher rate of inflation and a balance of payments deficit. We examine these policy conflicts in macroeconomics. The actual policies a government pursues will depend upon two major factors.

Its Order of Priorities:

If its economic goals conflict, the government must choose which is the most important. For example, if it makes the fight against inflation its major short-term objective, it may be prepared to accept, at least for the time being, a lower rate of economic growth and a higher level of unemployment.

On the other hand, if it is anxious to reduce unemployment significantly in time for the next general election, it might be prepared to allow the rate of inflation to rise and the exchange rate to fall which macro-economic theories it believes to be the most accurate. There is not just one set of macro-economic theories. If there were, it would make our life simpler—there would be less to learn! On the other hand, macroeconomics would be less controversial and hence less exciting.

One broad distinction between macro-economic theories is between these that imply that the four policy objectives are generally best achieved through the free market, and these which imply that the market will probably fail to achieve some or all of them. Obviously, the government which believes in the first set of theories is likely to pursue policies designed to ‘free up’ markets: policies that involve the minimum of government interference. In contrast, the government that believes in the second set of theories in likely to intervene much more actively in trying to steer the economy.

ADVERTISEMENTS:

Macroeconomic theories are thus frequently associated with political parties: the non-interventionist, market orientated theories are adopted by the political right, the interventionist theories are adopted by the political left. It would be wrong to suggest that there are just two schools of macroeconomic thought. Just as there are many shades of political opinion about the success or otherwise of the market economy, so too there are many shades of economic opinion about how the market works or fails to work to achieve the macroeconomic goals.

There are Keynesians and there are monetarists. Keynesians would like the government to pursue an active fiscal policy. Monetarists, on the opposite, like the government to ensure free markets and fallow a monetary rule to ensure stability. Macro-economic bodies at the range of possible causes of macro-economic problems. It has different schools of thought – Keynesian, monetarist, neo-Keynesian, and the New Classical school of thought. We study which schools of thought stress which causes, and what policy implications follow.

Importance of Macroeconomics:

Prof. J.K. Mehta feels that so long as men live in society, the economist cannot afford to neglect the study of macro-economy.

The theoretical and the practical importance of macroeconomics would be clear from the following arguments:

1. Functioning of an Economy:

Macroeconomic analysis is of paramount importance in getting us an idea of the functioning of an economic system. It is very essential for a proper and accurate knowledge of the behaviour pattern of the aggregative variables, as the description of a large and complex economic system is impossible in terms of numerous individual items.

2. Formulation of Economic Policies:

Macroeconomics is of great help in the formulation of economic policies. The days of ‘laissez faire’ are over and government intervention in economic matters is an accomplished fact. Governments deal not with individuals but with groups and masses of individuals, thereby establishing the importance of macroeconomic studies. For example, during depression, when machines lie idle and men roam from pillar to post in search of employment, macroeconomics helps us to analyse the causes leading to depression and unemployment and in the adoption of suitable policies to cope with such a situation.

3. Understanding Microeconomics:

ADVERTISEMENTS:

The study of macroeconomics is essential for the proper understanding of microeconomics. No micro- economic law could be framed without a prior study of the aggregates; for example, the theory of individual firm could not have been formulated with reference to the behaviour pattern of one single firm, howsoever representative it might have been; the theory was possible only after the behaviour pattern of several firms had been examined and analysed. For example, the forest, though an aggregation of trees, docs not exhibit the behaviour and characteristics of individual trees. Microeconomics has been, and, to some extent, remains a jungle of special assumptions, special cases, unsatisfactory measurements and abstract theorising.

4. Understanding and Controlling Economic Fluctuations:

Economic fluctuations are a characteristic feature of the capitalist form of society. The theory of economic fluctuations can be understood and built up only with the help of macroeconomics, for here we have to take into consideration aggregate consumption, aggregate saving and investment in the economy.

Thus, we are led to analyse the causes of fluctuations in income, output and employment, and make attempts to control them or at least to reduce their severity.

5. Inflation and Deflation:

Macroeconomic approach is of utmost importance to analyse and understand the effects of inflation and deflation. Different sections of society are affected differently as a result of changes in the value of money. Macroeconomic analysis enables us to take certain steps to counteract the adverse influences of inflation and deflation.

6. Study of National Income:

It is the study of macroeconomics which has brought forward the immense importance of the study of national income and social accounts. In micro-economy such a study was relegated to the background. It is the study of national income which enables us to know that three-fourth of the world is living in abject poverty. Without a study of national income, as a result of the development in macroeconomics; it was not possible to formulate correct economic policies.

7. Study of Economic Development:

As a result of advanced study in macroeconomics, it has become possible to give more attention to the problem of development of underdeveloped countries. Study of macroeconomics has revealed not only the glaring inequalities of wealth within an economy but has also shown the vast differences in the standards of living of the people in various countries necessitating the adoption of important steps to promote their economic welfare.

Limitations of Macroeconomics:

Excessive Generalisation:

Despite the immense importance of macroeconomics, there is the danger of excessive generalisation from individual experience to the system as a whole. If an individual withdraws his deposits from the bank, there is no harm in it, but if all the people rushed to withdraw deposits, the bank would perhaps collapse.

Excessive Thinking in terms of Aggregates:

ADVERTISEMENTS:

Again, macroeconomics suffers from excessive thinking in terms of aggregates, as it may not be always possible to get the homogeneous constituents. Prof. Boulding has pointed out that 2 apples + 3 apples = 5 apples is a meaningful aggregate; 2 apples + 3 oranges = 5 fruits may be described as a fairly meaningful aggregate, but 2 apples + 3 sky-scrapers constitute a meaningless aggregate; it is the last aggregate which brings forth the fallacy of excessive macro thinking.

Heterogeneous Elements:

It may, however, be remembered that macroeconomics deals with such aggregates as consumption, saving, investment and income, all composed of heterogeneous quantities. Money is the only measuring rod. But the value of money itself keeps on changing, rendering economic aggregates immeasurable and incomparable in real terms.

As such, the sum or average of heterogeneous individual quantities loses their significance for accurate economic policy.

Differences within Aggregates:

Under this approach one is likely to overlook the differences within aggregates. For example, during the first decade of planning in India (from 1951-1961), the national income increased by 42%; this, however, doesn’t mean that the income of all the constituents-the wage earners or salaried persons- increased by as much as that of entrepreneurs or businessmen.

Hence, it takes no account of differences within aggregates.

ADVERTISEMENTS:

But these limitations may be taken more in the nature of practical difficulties in formulating meaningful aggregates rather than factors invalidating the immense importance of macroeconomic analysis. With the commencement of Keynes’ General Theory and his basic equation, Y = C + I, interest in the study of macroeconomics has deepened.

Significant ‘breakthroughs’ in the computation of national income accounts (the study of which forms the very basis of macroeconomics) prove it beyond doubt that the limitations of macroeconomic studies are not insurmountable.