Learn about the comparison between Monetarism and Keynesian Approaches.

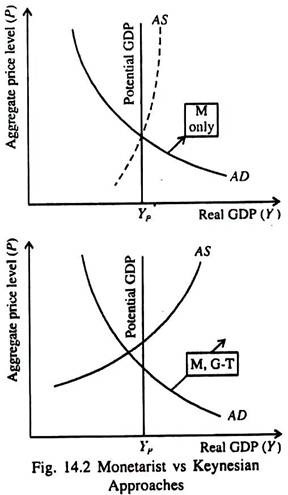

In essence, monetarists say, “only money matters for aggregate demand”; Keynesians reply, “Money matters but so does fiscal policy”.

See Fig. 14.2, which is self-explanatory.

A second difference revolves around aggregate supply. Keynesian economics stresses that the AS curve is relatively flat. If prices and wages are relatively flexible, as monetarists believe, then output will generally be close to its potential.

ADVERTISEMENTS:

The essence of monetarism centres on the importance of money in determining aggregate demand and on the relative flexibility of wages and prices.

Monetary Rule:

A cardinal part of monetarist economic philosophy is a monetary rule optimal monetary policy sets the growth of money supply at a fixed rate and holds on to that rate through all economic conditions.

ADVERTISEMENTS:

This means that a fixed monetary growth (at 3 to 5% per annum) will eliminate the major source of instability in a modern economy — sudden, unpredictable and unreliable shifts of monetary policy. With stable velocity, nominal GDP would grow at a stable rate and if money supply grew at the same rate, the economy would soon attain price stability.

Monetarists also attacked Keynesian economics on the ground that a long run trade-off between inflation and unemployment seemed to exist in most Keynesian models. According to Friedman and Phelps, there is no long run trade-off between inflation and unemployment.

The Friedman-Phelps hypothesis has been part of the accepted assumption of most macroeconomists.

Decline of Monetarism:

ADVERTISEMENTS:

Monetarists rely upon stable velocity of money to argue for a constant rate of growth of the money supply. Velocity of money was fairly constant until the early 1980s. Since then, an active monetary policy, more volatile interest rates and financial innovations led to extreme instability of velocity. This very fact falsified the basic tenet of monetarism: if V is constant, movements in M will affect nominal GDP proportionately.

However, this development did not diminish the importance of monetary policy. Indeed, monetary policy is currently the major macroeconomic policy tool used for control of economic fluctuations in the USA and Europe.

As Paul Samuelson commented:

“Although monetarism is no longer in fashion, monetary policy is the central tool of stabilisation policy in large market economies today”.

The Neoclassical Growth School:

Another significant development in macroeconomics was the emergence of the neoclassical growth school — an approach to macroeconomics that uses the aggregate production function and the growth accounting formula in describing long-term growth emphasising aggregate supply than aggregate demand.

To be more specific, R. M. Solow’s growth accounting formula and the production function that underlines potential GDP are the heart of the neoclassical growth model. As stated by Solow: “The aggregate production function is only a little less legitimate a concept than, say, the aggregate consumption function, and for some kind of long-run macro-models it is almost indispensable as the latter is for the short-run”.

No doubt neoclassical growth theory has had a profound influence on modern macroeconomics. Most importantly it brought aggregate supply — that is, production function and the growth of potential GDP — back into macroeconomics.

Both the monetarist school and the neoclassical school re-explained the three ingredients — inflation, money and the growth of potential GDP — that were ignored by Keynesians who had let aggregate demand and fiscal policy completely dominate macroeconomic theory and policy.

ADVERTISEMENTS:

The neoclassical growth school brought basic microeconomic — principles — such as the notion of an equilibrium price and the importance of relative prices — into macroeconomics. These principles were frequently missing from simple Keynesian theories.

The emphasis of neoclassical growth theory on technology is clearly visible. Growth economists such as Paul Romer have built new models of the technology process on his endogenous growth model.