FDI refers to the physical investment that an organization of a country makes into another country.

Examples of physical investment are opening a manufacturing unit, acquiring a plant, or building infrastructure.

In other words, FDI is the investment by a domestic organization in a foreign country in the form of joint ventures and mergers and acquisitions.

According to US Department of Commerce, when the organization of a country invests in the foreign country to acquire at least 10% stake of a foreign organization, then this investment is considered as FDI. Increase in foreign investment in a country is considered as a measure of economic development.

ADVERTISEMENTS:

FDI provides an opportunity to the domestic organizations to form joint ventures with the foreign organizations. Every nation desires for attaining FDI, which is a capital resource that helps in increasing the production of goods and services.

In addition, FDI has many benefits over other types of foreign investment that make it attractive for developing countries having shortage of resource. It is a non-debt inflow that helps in transferring new technology, bringing new skills in markets, providing new markets for domestic products, and creating new employment opportunities.

FDI acts as the ready resource that can be used for the growth of an economy. If we take the case of India, it was self-reliant for various decades after its independence. India had set up its own large-scale industries that were regarded as the main source of economic growth.

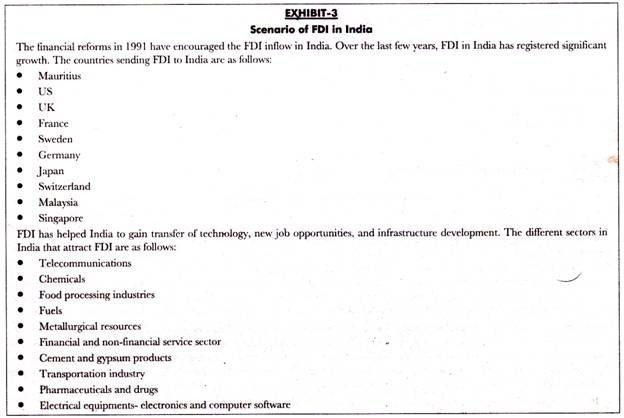

In 1970s, some foreign organizations entered in India. At that time, the Indian government had set very high tariff rates; therefore, FDI was very low. However, with the advent of liberalization and globalization in 1991, FDI in India started increasing.

ADVERTISEMENTS:

In 1991, FDI in India was SI54 million, which increased to S3.6 billion in 1997-98. FDI was allowed in India at a very late stage, as compared to other countries, thus the growth of FDI was slower in India. Now, FDI is playing an important role in the growth of India. It has allowed India to look at the factors that needed great attention and address the problems that continue to challenge the country.

The whole world has seen a dramatic boom in FDI in early 1990s. The world’s investment report given by UNCTAD for 2009- 2011 provides the outlook on the future trends of FDI. According to the report, FDI is going through dramatic changes since 2008.

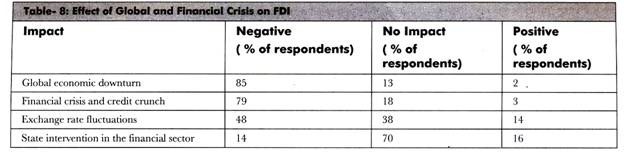

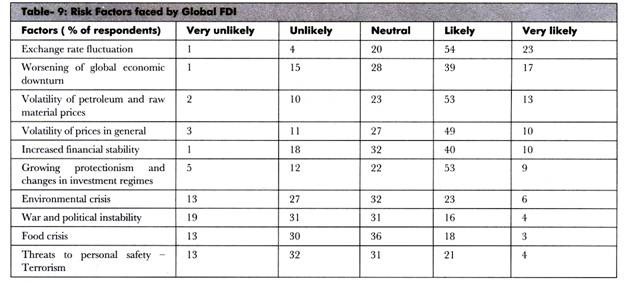

The worst financial crisis of 2008 has raised the concerns about the capability of MNCs to invest abroad. The investment plans of organizations are significantly affected by the financial and economic crisis. The volatility of petroleum prices and exchange rate is also the major threat reported by various organizations.

ADVERTISEMENTS:

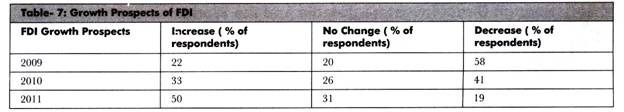

Table-7 shows the growth prospects of FDI in different years by MNCs, which participated in the UNCTAD’s survey:

Table-8 shows the impact of global economic and financial crisis on FDI plans of MNCs:

Table-9 shows the major risk factors associated with FDI flow in different countries:

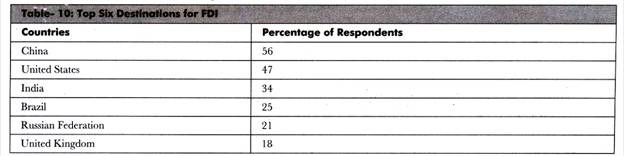

The UNCTAD survey also concluded the top six destinations for FDI in 2009-2011.

This is shown in Table-10:

As shown in Table- 10, India is the third most important FDI destination for MNCs. The sectors that attract FDI in India are services, telecommunications, construction, and information technology. In 2009-10, global FDI was $ 25.88 billion as compared to $ 27.33 billion in 2008-2009.