Read this article to learn about the Payment Options in International Trade!

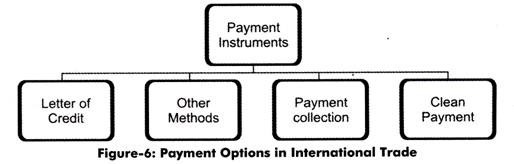

In international trade, various instruments for payment are used by exporters and importers.

These payment instruments are the documents that are needed to fulfill the legal requirements of a contract between the exporter and importer.

These instruments are given in Figure-6:

The discussion of these trade instruments are given as follows:

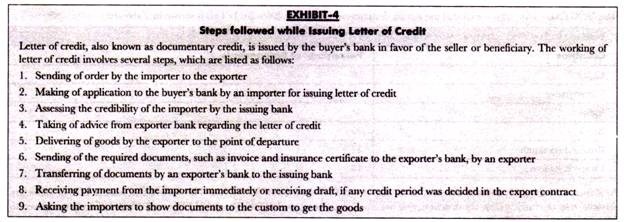

(a) Letter of Credit:

Refers to a document issued by the buyer’s bank that promises to pay to the seller an agreed amount. This is the most significant instrument of payment used in the international trade. Letter of credit is issued on the request of the buyer by the bank. The bank issues the letter of credit after assessing the paying capacity of the buyer.

According to International Chamber of Commerce (ICC), letter of credit is defined as “an arrangement, however named or described, whereby bank (the Issuing hank) acting at the request and on the instructions of a customer (the Applicant) or on its own behalf:

ADVERTISEMENTS:

1. Is to make a payment to or to the order third party (the beneficiary) or is to accept bills of exchange (drafts) drawn by the beneficiary.

2. Authorized another bank to effect such payments or to accept and pay such bills of exchange (draft).

3. Authorized another bank to negotiate against stipulated documents provided that the terms are complied with.”

(b) Clean Payment:

ADVERTISEMENTS:

Refers to a payment method in which the bank’s role is limited to clearing the payment only. Clean payment is a very easy method of payment for importers and exporters.

There are two types of clean payment methods, which are as follows:

(i) Advance Payment:

Implies a method in which the importer pays first and then the exporter delivers goods.

(ii) Open Account:

Implies a method in which the exporter delivers goods first and then the importer pays the bill. In this, the exporter takes all the risks by assuming that the importer would pay on time.

(c) Payment collection:

Implies a method in which the banks handle the commercial and financial documents given by the exporter. The bank follows the important instructions regarding the release of documents to the importer.

ADVERTISEMENTS:

There are two types of payment collection documents, which are discussed as follows:

(i) Document against Payment:

Refers to a document that is submitted to the importer only when the payment is done.

(ii) Document against Acceptance:

ADVERTISEMENTS:

Refers to a document that is submitted to the importer against the acceptance of a draft.

(d) Other methods:

Include the following:

(i) Direct debits:

ADVERTISEMENTS:

Imply the simplest way to make payment. The account holder gives the instruction to his/her bank to collect amount directly from another bank. Direct debit method is primarily used by exporters. This method is also called as pre-authorized debit or pre-authorized payment and often used in case of recurring payments.

Payment cards:

Include debit or credit cards issued by a financial institution. These cards are presented by the importer to make a payment to exporter. Credit card has a certain line of credit limit from which an importer can borrow to pay. Debit and credit cards help in paying directly from the bank account.

(ii) Check:

Refers to a document that involves a drawer and a drawee. The drawee pays the required amount on demand to the drawer or to a third party specified in the check.

(iii) Electronic Money:

ADVERTISEMENTS:

Involves money that is exchanged only electronically. This involves the use of the Internet for transferring money from one bank account to another.