Globalization opens the door for some of the developing countries, such as India, to grow with a faster pace by adopting constructive policies and reforming strategies parallel to advance nations.

However, some of the countries are still lagging behind.

The reason behind the lackluster performance of these countries is increase in population.

This further leads to slowdown of economic development and low per capita income and GDP. Growth in per capita income and the living standards sparks from the accumulation of physical and human capital and advances in productivity and technology.

ADVERTISEMENTS:

Studies reveal that approximately 60-70 per cent of per capita growth in developing countries is an outcome of increase in physical capital; 12-20 per cent is due to increase in efficient and skilled human capital, and the remaining 10-30 percent is attributed to improved productivity.

The policies and reforms adopted by countries to increase the pace of economic growth and enter in the mainframe of global economic development are as follows:

(a) Macroeconomic Stability:

Implies that the economy of a country must be stable and in control in terms of the inflation rate, exchange rates, foreign exchange markets, and balance of payment, trade, and fiscal deficits. Macroeconomic stability in a country attracts foreign investors and traders and creates a favorable condition for investments and saving.

ADVERTISEMENTS:

(b) Outward-oriented Policies:

Refer to policies supporting free trade or open market economy. These policies promote unhindered inward and outward movement of goods and services across the border. As a result, industries in the domestic market get an opportunity to compete with foreign industries, which compel them to innovate and improve productivity and reap the benefits of economies of scale and improved factors of production.

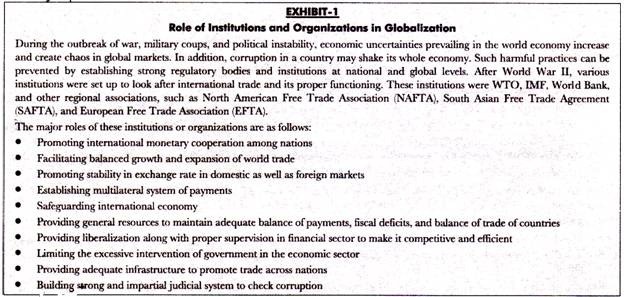

(c) Government Institutions:

Imply that the strong and effective government institutions can be incorporated to encourage good governance. The government policies must be such that they attract more and more foreign investors in the country. The decline in trade restrictions and physical and monetary support to foster domestic organizations to go global, improves the country’s economic condition.

ADVERTISEMENTS:

(d) Highly skilled Human Resource:

States those nations with large population have a huge pool of human resource, which needs to be converted into skilled workforce. Therefore, nations, lagging behind the global economic development, must promote education, training, and research and development facilities. This helps in developing the existing human resources to highly skilled and knowledgeable resources to enhance productivity.

(e) External Debt Management:

Emphasizes that judicious use of external funds and aids provided to poor nations can lead to systematic growth of countries. In addition, the allocation of adequate resources is necessary for the social, economic, and sustainable development of the country.

(f) Apart from aforementioned measures:

the developed nations should also make a vital contribution to integrate countries, which are lagging behind, with the global economy. Some of the measures that should be taken by developed countries are as follows:

(g) Trade Promotion:

States that the developed nations should reduce or completely remove the quota or other restrictions on the import of items from nations lagging behind the economic development. The developed nations should encourage underdeveloped nations to export processed goods instead of primary commodities.

The burgeoning needs of the processed foods, such as canned fruit pulps, vegetables, and non-vegetable items, in developed countries increase the scope of international trade. The gulf nations and western countries are rapidly becoming a huge market for these items.

ADVERTISEMENTS:

(h) In-flow of Private Capital:

Implies that the developed countries should encourage FDI in lower income countries. Technology transfer and steady financial (lows should be provided to help domestic industries of underdeveloped countries to meet the current production needs and demands.

(i) Debt Relief:

Infers that the debt relief and financial support help lower-income countries to improve their economic condition and induce more development programs. Therefore, more debt relief can be supplemented with the increased level of new financial support. To summarize, government policies and suggested measures can assist the poor nations to catch up with the global economy more rapidly.

ADVERTISEMENTS:

Concept of International Trade:

International trade refers to selling and purchasing of goods and services by the organizations across the national borders. It helps countries in finding the profitable markets for their goods and services. International trade contributes largely towards the development of nations by increasing their income, which ultimately increases their Gross Domestic Product (GDP). The political, economic, and social uplifting of various countries is mainly attributed to international trade.

The countries indulge in international trade to reduce the cost of production and take advantage of abundant natural resources available in other countries. The availability of advance means of transportation and rise in industrialization has a main impact on international trade.

ADVERTISEMENTS:

The main aim of international trade is that a country can import specific goods or services at a lower cost from other countries than to produce it domestically. In other words, the basic principle in international trade is that a country would trade with another country when it is getting goods and services at lower costs.

The international trade allows the less developed countries to keep pace with the economic development as they can import advanced technology. International trade reduces inequalities, facilitates growth in the economies of different countries, and eliminates tariffs through agreement between the countries.

The positive effects of international trade are as follows:

a. Increases global competitiveness when the domestic organization enters into the foreign market

b. Leads to easy access to technological innovations that help in increasing productivity

c. Eliminates all the trade barriers that lead to decline in growth

ADVERTISEMENTS:

Regulatory Framework of International Trade:

In earlier days, trade was carried between the countries with lot of restrictions. Generally, it was based on bilateral treaties formed between two countries. Gradually, a uniform trade structure came into place with the introduction of multilateral treaty, which is an agreement that facilitates international trade among three or more countries.

In 1949, General Agreement on Trade and Tariff (GATT) was formed to promote the concept of free trade. This move was not welcomed by many countries as they were of the opinion that GATT would not see the interests of all the nations equally. Thus, GATT was replaced by WTO in 1995.

The international trade is now regulated by WTO at the global level and through other agreements among the countries, such as North American Free Trade Agreement (NAFTA), which is signed by Canada, Mexico, and the United States.

Instruments of International Trade Policy:

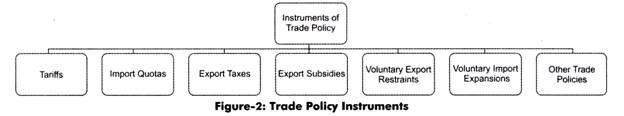

There are various instruments used by different countries to carryout international trade. In general, these instruments consist of taxes and subsidies on exported or imported goods or services.

ADVERTISEMENTS:

Figure-2 shows the different instruments of trade policy:

Let us discuss these trade policy instruments in detail:

(a) Tariffs:

Imply the taxes imposed by the government on imported goods. The government of a country imposes tariffs to discourage the imports of those goods that are not considered as essential. In addition, tariffs help in generating revenue for the importing country.

Tariffs are of two types, namely:

ADVERTISEMENTS:

(i) Specific tariff:

Refers to a fixed amount of tax levied on each unit of goods imported

(ii) Ad valorem tariff:

Refers to tax that is equal to the fixed percentage of price of the goods imported.

(b) Import quotas:

Specify a maximum quantity of goods that can be imported during a particular time period.

ADVERTISEMENTS:

These are of two types, namely:

(i) Absolute quotas:

Limit the imports to certain quantity for a specified period of time. These quotas may be set globally or in some selected countries.

(ii) Tariff rate quotas:

Allow the particular quantity of goods to be imported at a reduced tariff rate during a specified time period.

(c) Export taxes:

Refer to a tax levied on export of goods to raise the government revenue. These taxes are also divided into specific and ad valorem taxes.

(d) Export subsidies:

Imply the payment made by the government to encourage the exports of goods and services. These are mainly provided in case of dairy products and agricultural products. Export subsidies are also called as negative export taxes.

(e) Voluntary Export Restraints:

Imply the limit set on the amount of export during a particular time period. This is an agreement in which importing country pressurizes exporting country to stop the export for some time. If the exporting country does not stop or reduce the export, then the importing country may impose a quota on export.

(f) Voluntary Import Expansions:

Imply an agreement among the countries to increase the quantity of import of goods over a specified period of time. This was introduced between US and Japan for the first time.

(g) Other Trade Policies:

Include the following:

(i) Government procurement policies:

Involve the procurement of goods and services by the government on behalf of public. This policy requires that government should purchase goods and services from domestic organizations rather than foreign organizations.

(ii) Red tape barriers:

Imply costly administrative procedures for the import of foreign goods.