I. Inflation and indexation:

Inflation proofing the economy.

Generally, there are two kinds of contracts that are especially affected by inflation:

(a) Long-term loan contracts:

ADVERTISEMENTS:

Contracts made for 25 or more than 25 years, where the nominal interest rate is fixed for the contract period.

(b) Wage contracts:

Indexation is a process which ties the terms of contract to the behaviour of price level so as to reduce people’s vulnerability towards inflation.

II. Inflation and interest rates:

ADVERTISEMENTS:

(a) Inflation and Housing:

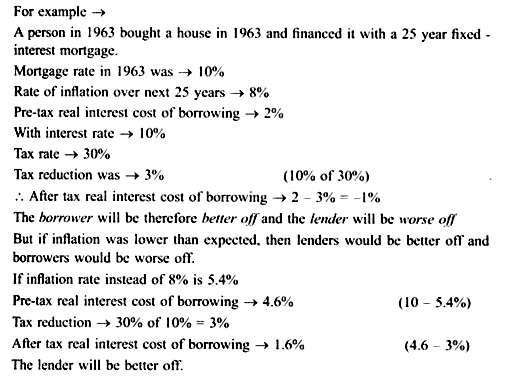

Interaction of inflation and taxes have a large impact on the real cost of borrowings. The mortgages set a fixed nominal interest rate for a duration of 20 or 30 years. The interest payments are deductible while calculating income- taxes, thereby reducing the effective interest cost of the loan.

To reduce uncertainty about inflation, a new financial instrument was made called Adjustable Rate Mortgage (ARM), which is an example of a floating rate loan.

ADVERTISEMENTS:

[ARM is a long-term loan with an interest rate that is periodically adjusted in line with prevailing short-term interest rates].

ARM reduces the effects of inflation on long-term real costs of financing home purchases.

(b) Indexed Debt:

In countries where inflation rates are high and uncertain, long-term borrowing using nominal debt becomes impossible. Lenders are uncertain about the real value of repayments they will receive. The Government therefore, issues Indexed Debt.

A bond is indexed (to the price level) when either the interest or the principal or both are adjusted for inflation. The holder of the bond will receive interest equal to the real interest rate and whatever the inflation rate turns to be.

For example,

Inflation rate is 18%

Bond holder will receive →21%

In this way, the bond holder is compensated for inflation. Many economists have argued that Government should issue indexed debt so that the citizens can hold at least one asset with a safe real return. Only the Governments in high-inflation countries like Brazil, Argentina have done this.

ADVERTISEMENTS:

Argument in Favour of Indexation:

Indexation of wages — Many labour contracts include automatic Cost-Of-Living Adjustment [COLA] provisions. COLA provisions link increase in the money wage to the increase in the price level which allows workers to recover, wholly or in part the purchasing power lost through price rise (when they had signed the contract). Indexation tries to maintain the real wages by maintaining a balance between the advantages of long-term wage contracts and the interest of workers and firms.

Broadly, there are two ways to increase the wages:

1. Index wage to the CPI or the GDP deflator and through periodic reviews, increase wages by the increase in prices.

ADVERTISEMENTS:

2. Have periodic preannounced wage increases based on the expected rate of price rise.

If inflation is perfectly anticipated, then both the methods would produce the same result; but if inflation is unanticipated; then discrepancies will arise. To avoid this discrepancy, we should find indexation rather than have preannounced wage increase. Since inflation is more uncertain when inflation rate is high, wage indexation is more prevalent in high inflation countries.

Arguments against Indexation or why not to Index:

1. Effect of Wage Indexation: Source: Mankiw

ADVERTISEMENTS:

Demand shocks:

There is a ‘pure’ inflation disturbance. Since the firms can afford to pay the same real wages, they will not be adversely affected in real terms by 100 per cent indexation.

Supply Shocks:

In case of adverse supply shocks, real wages must fall but full indexation prevents the real wages from falling.

For instance:

Cost of inputs rise. The price of final goods will also rise. Due to wage indexation wages will also rise, which will further lead to rise in price and then further in wages and the process will continue. Thus indexation results in inflationary spiral.

ADVERTISEMENTS:

2. Indexation reduces the cost of unanticipated inflation but the Government is reluctant to index because of the following reasons:

(a) In case of wage indexation, indexing makes it harder for the economy to adjust to shocks whenever changes in relative prices are needed.

(b) Indexing in practice is complicated. It adds another layer of calculation to most contracts.

(c) Government fears that by making inflation comfortable to live with, indexation will weaken the political will to fight inflation. This will lead to a higher inflation, making the economy worse off since indexation can never deal perfectly with the consequences of inflation.