The below mentioned article provides Short-Run Trade-Off between Inflation and Unemployment.

In the short run, there is a trade-off between inflation and unemployment.

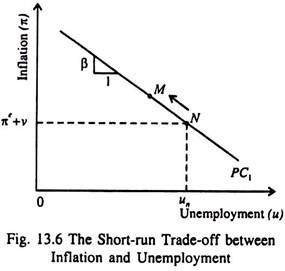

There is an inverse relation between the two. In Fig. 13.6, when unemployment is at its natural rate (u = un) and cyclical unemployment does not exist, inflation depends on expected inflation and the supply shock (π = πe + v).

ADVERTISEMENTS:

The parameter β is the marginal rate of substitution (MRS) between inflation and unemployment. It indicates how much inflation has to be tolerated by a society in order to reduce unemployment rate by 1%. So it is a measure of the terms of trade or exchange ratio between inflation and unemployment.

Although policymakers have no control over πe and β, they can still alter Y, u and π by adopting appropriate demand management policy such as monetary or fiscal policy. In the short run, for a given expected inflation, policymakers can manipulate aggregate demand to choose the most desirable (optimal) combination of inflation and unemployment on the current Phillips curve, called the short-run Phillips curve.

By moving from N to M along the curve, the policymakers can expand aggregate demand to lower unemployment and raise inflation. Here point N corresponds to the natural rate of unemployment, which is called NAIRU. At any point in time, the policymakers can control aggregate demand in order to choose a combination of inflation and unemployment on the short run Phillips curve.

Thus, the Phillips curve gives two options to policymakers in the short run — low inflation and high unemployment or the converse of it.

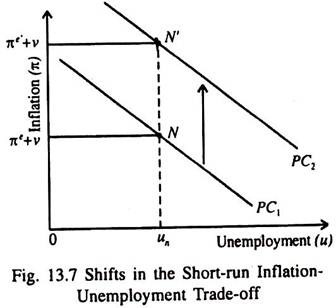

The position of the short run Phillips curve depends on the expected inflation rate. If the rate rises, the curve shifts vertically upward as in Fig. 13.7. Here πe is greater than πe. Since inflation is higher for any level of unemployment the trade-off becomes less favourable the inflation rate rises for any level of unemployment. Compare points N and N’.

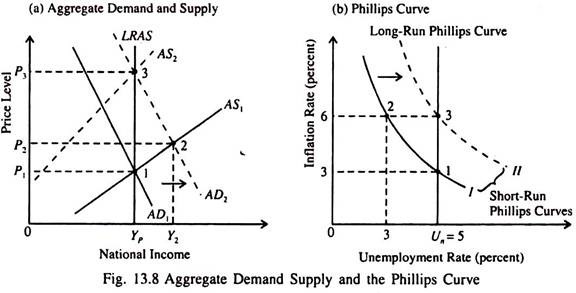

Since people adjust their expectations of inflation over time, there is a trade-off between inflation and unemployment only in the short run. It is not possible for the policymakers to keep the actual rate of inflation above its expected rate (and thus unemployment below its natural rate) over an extended period of time.

ADVERTISEMENTS:

Sooner or later, expectations get adjusted to the policymaker’s target rate of inflation. In the long run, the classical dichotomy holds because money is neutral in its effect on the real sector. There is no trade-off at zero cyclical unemployment because unemployment returns to its natural rate.

So the long-run Phillips curve — called the inflationary expectations-augmented Phillips curve — is vertical. This corresponds to the vertical LRAS curve which corresponds to the classical case — where full employment is the only logical possibility.