Concept of Paradox of Thrift (with Diagram)!

Paradox of thrift refers to contrasting implications of savings to households and to economy as a whole.

Saving is treated as a virtue by households as they provide a protective umbrella against bad spells but same is treated as a vice by the economy as it retards the process of income generation.

Since start of human civilisation, it was considered a virtue to keep consumption level at the minimum but the lasting effects and chain reactions of keeping consumption in check were not realised. People were taught that thrift or savings are good because a penny saved today will bring increased income.

ADVERTISEMENTS:

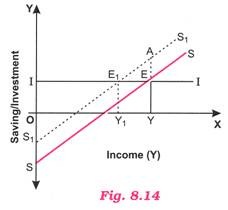

In this connection, Keynes pointed out ‘paradox of thrift’ and showed that as people become thriftier, they end up saving less or same as before. If all the people of an economy increase the proportion of income which is saved (i.e., MPS), the value of savings in the economy will not increase, rather it will decline or remain unchanged. Let us understand this statement with the help of the fig. 8.14.

In Fig. 8.14, initial saving curve is SS and investment curve is II. Economy attains equilibrium (Saving = Investment) at E and equilibrium level of income is OY. Now, suppose the society decides to become thrifty by reducing consumption expenditure and Increases saving by, say, AE. As a result, saving curve shifts upward to S1S1 intersecting Investment curve II at E1.

Unplanned inventories will increase and firms will cut down production and employment and move to new equilibrium E1. The figure shows that in the end, planned saving has fallen from AY to E1Y1. Notice at new point of equilibrium E1, investment level and also realised saving remain the same (E1Y1) but level of income has fallen from OY to OY1. The decline in equilibrium level of income shows the paradox of thrift as the reverse process of multiplier has worked on reducing consumption expenditure. In fact Increased saving is virtually a withdrawal from circular flow of income.