Marshall has divided the pricing of products into four time periods: market period, short period, long period, and secular period.

Period # 1. Market Period Price:

Market period is a very short period in which supply being fixed, price is determined by demand. The time period is of a few days or weeks in which the supply of a commodity can be increased out of a given stock to match the demand. This is possible for durable goods.

The time period for perishable commodities is only a day. For instance, if the demand for a vegetable increases, its supply cannot be increased on the same day. Therefore, the supply of vegetable being fixed, its price is determined by demand on that day.

The price prevailing in the market is called the market price which changes with the nature of the commodity many times within a day or a week or a month. Marshall explained the market price thus: “The market value… is often influenced by passing events and causes whose action is fitful and short-lived than by those which work persistently.”

ADVERTISEMENTS:

In reality, market price is that price which is determined by the forces of demand and supply in the market at a point of time. The determination of market price is explained separately for perishable and durable commodities.

Perishable Commodities:

The price of a perishable commodity like milk, vegetables, fish, etc., is primarily influenced by its demand. Supply has no influence on price because it is fixed. Therefore, the price of a perishable commodity rises with the increase in its demand, and falls with the decrease in its demand.

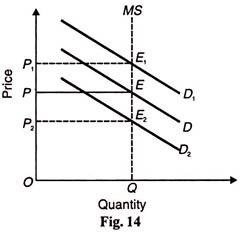

Figure 14 depicts the price E determination of a perishable commodity, fish. MS is the market supply curve which reflects the fixed quantity OQ of fish in the market period. D is the initial demand curve which intersects the supply curve MS at E and the market price OP is determined.

ADVERTISEMENTS:

If the demand for fish rises from D to D1 the new equilibrium is established at E1 and the price increases to OP1. On the other hand, with the fall in demand from D to price also falls from OP to OP2.

Thus the market price is determined by demand alone while the supply (OQ) is fixed. We also find in reality that the prices of perishable commodities like vegetables, milk, fish, etc. rise or fall many times a day in summer with the rise or fall in the demand for them.

Durable Commodities:

ADVERTISEMENTS:

Most commodities are durable which can be kept in stock. When the price of a durable commodity increases with the increase in its demand, its supply can be increased out of the given stock. Such commodities are cloth, wheat, tea, etc.

They have two price levels. First, a minimum price below which a seller will not sell his commodity. This is also known as the reserve price. Second, a minimum price at which the seller will be prepared to sell the entire quantity of his commodity.

While fixing the reserve price for his commodity, any seller would take into consideration the following factors:

(i) Durability of the Commodity:

The reserve price depends on the durability of the commodity. The more durable a commodity is, the higher will be its reserve price.

(ii) Prices in Future:

The reserve price depends on future changes in price. If the seller expects prices to increase in future, he will fix a high reserve price, and vice versa.

(iii) Future Cost of Production:

The reserve price also depends on the future cost of production of the commodity. If the sellers expect cost to rise in future, they will fix a high reserve price, and vice versa.

ADVERTISEMENTS:

(iv) Expenses on Storage:

The reserve price also depends on the time and expense involved in the storage of the commodity. The greater the time and expense in storing the commodity, the lower will be the reserve price because the seller would like to dispose of his commodity at the earliest so as to avoid the expenses of storage, and vice versa.

(v) Liquidity Preference:

The reserve price depends on the liquidity preference of the sellers. The higher the liquidity preference, the lower will be the reserve because the seller would try to sell his commodity at the earliest in order to have cash in hand. On the contrary, if the liquidity preference is low the reserve price will be high.

ADVERTISEMENTS:

(vi) Demand in Future:

The reserve price also depends on the future demand. If the seller expects the demand to rise in future, he will fix a high reserve price, and vice versa.

Thus there being two price levels, the seller will not sell any quantity of his commodity at the reserve price, whereas he would be prepared to sell the entire quantity at the maximum price.

As the price of the commodity increases with the rise in its demand, the seller will continue to sell larger quantity of his commodity till the demand rises to the level of the maximum price where he will dispose of his entire stock of the product. After this, it is not possible to increase the supply to match any increase in demand. This also explains the vertical shape of the supply curve for a durable commodity.

ADVERTISEMENTS:

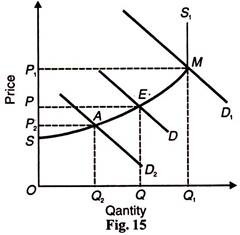

SMS1 is the supply curve during the market period in Figure 15. OQ1 is the total supply of the commodity. OS is the minimum or reserve price at which the seller does not sell his commodity. When the demand curve D intersects the supply curve SMS1 at E, OP price is determined at which he sells OQ quantity of his commodity and keeps OQ1 in stock.

If the demand is D2 the prices is OP2 at which he sells OQ2 quantity and keeps Q2Q1 in stock. It is only when the demand increases to D1 that the seller would be prepared to sell the entire stock of his commodity at the maximum price of OP1. If the demand rises beyond D1 it will only raise the price above OP1 because in the market period not more than OQ1 quantity can be sold.

Thus in the market period demand has a greater influence than supply in price determination because the seller does not consider production costs.

Period # 2. Short Period Price:

The short period relates to a few months in which supply can be changed in accordance with demand. This is possible by changing the variable factors. For instance, if the firm wants to increase the supply of its product it can do so by working the fixed factors like existing plants, machines, etc., more fully.

This can be done by starting two or three shifts and by employing more labour, raw materials, etc. In the short period, it is not possible to change the fixed factors, the scale of production and organisation. Therefore, supply can be increased or decreased to match the increase or decrease in demand by changing the variable factors.

ADVERTISEMENTS:

In the short period, price is determined by the forces of demand and supply. The short-run supply curve slopes upward from left to right like the ordinary supply curve. It establishes the short-run equilibrium price when it is intersected by the demand curve. The short-run price is also known as the short-run normal price.

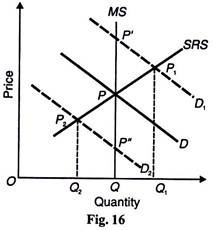

Its determination is shown in Figure. 16. D is the original demand curve and MS is the market period supply curve. Both intersect at P and establish PQ price and OQ quantity. Suppose the demand for cloth rises which is reflected in the D1 curve. The immediate effect will be for the market price to increase from PQ to P1Q.

Since supply is fixed in the market period, it is not possible to increase it beyond OQ. But it is possible to increase it with the help of existing plants and machines by employing extra labour and raw materials, etc. Thus by increasing the variable factors, the supply will be increased along the SRS curve.

The SRS curve intersects the new demand curve D1 at P1. In this way, the short-run normal price P1Q1 is determined at which OQ1 quantity of the commodity is bought and sold. This short-run price P1Q1 is higher than the original market price PQ but is lower than the market price P1Q which prevailed after the increased demand.

Now suppose that the demand for cloth falls. The demand curve shifts from D1 to D2. The market price immediately falls from PQ to P”Q. All the firms in the industry will try to reduce the supply by reducing the amount of variable factors like labour and raw materials, etc. As a result, the new equilibrium is established at P2 where the curves SRS and D2 intersect.

Now OQ2 quantity is bought and sold at P2Q2 price. This short-run price is less than the original market price PQ but is higher than the price P”Q established after the fall in demand. Thus supply is more important than demand in the short period because supply can be increased or decreased to match the rise or fall in demand by changing the variable factors.

Period # 3. Long Period Price or Normal Price:

The long period is of many years in which supply can be fully adjusted to demand. This is done by changing the fixed factors. During this period, the old machines, equipment and plants can be replaced by the new. New firms can enter the industry and old firms can organisation and management can also be changed. Thus supply can be adjusted to demand in every possible way in the long- run.

Long period price is also known as the normal price. Normal price is that price which is likely to prevail in the long- run. In the words of Marshall: “Normal or natural value is that which economic forces would tend to bring about in the long-run.”

Long period or normal price is determined by the equilibrium of demand and supply. For the equilibrium of firms and industry in the long-run, it is essential that normal price should equal the long-run marginal cost and average cost. If the price is above the minimum long-run average cost, all the firms would be earning super-normal profits. These extra profits would attract new firms into the industry.

As a result, supply would increase and price would come down to the level of the minimum long-run average cost. On the contrary, if the price falls below the minimum long-run average cost, firms would incur losses. Some of the firms that cannot sustain losses would leave the industry, supply would be reduced and price would rise to the level of the minimum long-run average cost.

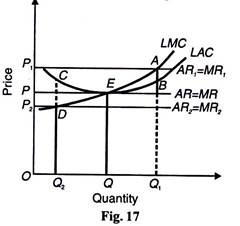

Thus the long period or normal price is always equal to the minimum long-run average cost. This is depicted in Figure 17 where LAC and LMC are the long-run average and marginal cost curves respectively. The long-run equilibrium point is E, where LMC=MR=AR=LAC at its minimum point.

It sets OP price at which OQ quantity of the commodity is sold. This is the normal price which has the tendency to prevail in the long-run. If the price increases from OP to OP1, the firms would sell QQ1 additional quantity and earn AB extra profits per unit of the commodity.

The extra profits would attract new firms into the industry, the supply would increase further and ultimately bring down the price to the OP level where the long-run equilibrium would be re-established at point E. On the contrary, with the fall in price from OP to OP2, the firms would reduce the supply to OQ2, and thereby incur CD losses per unit of the commodity.

Unable to sustain these losses, some of the firms would leave the industry. Consequently, the supply would decrease further, price would start rising and ultimately reach the OP level where the long-run equilibrium would be re-established at point E.

Period # 4. Secular Period:

The secular period is very long. According to Marshall, it is a period of more than ten years in which changes in demand fully adjust themselves to supply. Since it is not possible to estimate the changes in demand due to changes in techniques of production, population, raw materials, etc. over a very long period, Marshall did not analyse pricing under the secular period.

Conclusion:

The above analysis shows the importance of time element in price theory. It points out that of the two forces, demand and supply, which force is more important in the price determination depends on the time period. Generally, the shorter the time period, the greater will be the influence of demand on pricing; and the longer the time period, the greater will be the influence of supply on the determination of prices of commodities.