Let us make an in-depth study of Demand for a Commodity:-

1. Meaning of Demand 2. Definition of Demand 3. Elements 4. Direct Demand and Individual and Market Demand 5. Kinds 6. Demand Schedule 7. Demand Curve and Its Nature.

Meaning of Demand:

Ordinarily by the word ‘demand’ we mean a desire or want for something. In economics, demand means much more than this.

Economists give a social meaning of the concept of demand which is as follows:

ADVERTISEMENTS:

“Demand means effective desire or want for a commodity, which is backed by the ability (i.e., money or purchasing power) and willingness to pay for it.”

That is one should have the desire and capacity to buy a commodity and should be willing to pay its price to constitute effective demand for that commodity. For example—A pauper’s wish for a motor car will not constitute its potential market demand, as he has no ability to pay for it.

Similarly, a miser’s desire for the same, however rich he may be will not become an effective demand since he would not be willing to spend the money for the satisfaction of that desire.

Demand in economics, means effective demand for a commodity.

ADVERTISEMENTS:

It requires three conditions on the part of a consumer:

(i) Desire for a commodity

(ii) Capacity to buy it i.e., ability to pay, and

(iii) Willingness to pay its price.

ADVERTISEMENTS:

In Short:

Demand = Desire + Ability to pay (i.e., money or purchasing power) + will to spend.

Demand is not an absolute term. It is a relative concept. Demand for a commodity should always have a reference to price and time. For instance—An economists would say that the demand for apples by a household, at a price of Rs. 30 per kg. is 10 kg per week. Thus, economists always mention the amount of demand or a commodity with reference to a particular price and at a specified time period, such as per day, per week, per month or per year.

Thus, we can say that demand is a function of price (P), income (Y), prices of related goods (pr) and tastes (t) and is expressed as D = f (P, Y, pr, t). When income, prices of related goods and tastes are given, the demand function is D = f (P). It shows the quantities of a commodity, purchased at given prices as per Marshallian analysis, the other determinants of demand are taken as given and constant.

Definition of Demand:

1. According to Penson – “Demand implies three things—(i) Desire to possess a thing, (ii) Means of purchasing it; and (iii) Willingness to use those means for purchasing it.”

2. Benham has said – “Demand means always demand at a price, the term has no significance unless a price is stated.

3. In the words of Prof. J. S. Mill – “We mean by the word demand the quantity demanded and remember, that it is not a fixed quantity but in general varies according to values.”

4. According to Prof. Waugh – “The demand for a commodity is the relationship between the price and the quantity that will be purchased at the price.”

5. As Bober has said – “By demand we mean the various quantities of a given commodity or service which consumers would buy in one market in a given period of time at various prices or at various incomes or at various prices of related goods.”

Elements of Demand:

There are five elements of demand:

ADVERTISEMENTS:

(i) Desire for a commodity.

(ii) There must be means or ability to purchase it.

(iii) There should be willingness to purchase the commodity.

ADVERTISEMENTS:

(iv) The commodity be purchased at a given price.

(v) And under a given time.

Direct or Derived Demand and Individual and Market Demand:

The demand for a commodity refers to the amount of it which will be bought per unit of time at a particular price. Demand for a commodity may be viewed as ex-ante; i.e., intended demand or ex-post i.e., what is already purchased. The former states The Potential Demand’ while the latter refers to the actual amount purchased.

In a broad sense, the concept of demand has two aspects:

ADVERTISEMENTS:

(i) Direct Demand, and

(ii) Derived Demand.

Consumer’s demand is a direct demand as it directly gives satisfaction to the consumer. Consumption goods have direct demand. Producer’s demand for factor-inputs is a derived demand as it is derived from the demand for the final output. All capital goods have derived demand. For instance—The demand for a house for dwelling purpose is a direct demand, while the demands for bricks, cement or wood, mason, carpenter, architect etc. that are required to build the house are derived demands.

Further, consumer demand for a product may be viewed at two levels:

1. Individual demand, and

2. Market demand.

Individual demand:

ADVERTISEMENTS:

Refers to the demand for a commodity from an individual. That quality of a commodity a consumer would buy at a given price during a given period of time is his individual demand for that particular commodity.

Market demand:

For a product on the other-hand refers to the total demand of all the individual buyers taken together. How much in quantity the consumers in general would buy at a given price during a given period of time constitutes the total market demand for the product.

Market demand is the sum of individual demands. It is derived by aggregating all individual buyers’ demands in the market. This demand is more important from the seller’s point of view. Sales depend on the market demand. Business policy and planning are based on the market demand. Prices are determined on the basis of market and not of just an individual demand for the product.

Kinds of Demand:

There are three kinds of demand:

1. Price demand,

2. Income demand, and

ADVERTISEMENTS:

3. Cross demand.

1. Price Demand:

Price demand is that demand which refers to the various quantities of a commodity or service that a consumer would purchase at a given time in a market at various hypothetical prices. In this it is always assumed that other things such as consumer’s income, his tastes and prices of related goods remain unchanged.

This type of demand has been classified under three heads:

(a) Individual Demand:

Individual demand is the demand of an individual consumer.

(b) Industry Demand:

ADVERTISEMENTS:

It is the aggregate demand of all the consumers combined for the commodity.

(c) Firm’s Demand or Individual Seller’s Demand:

This is the total demand for the product of an individual firm at various prices.

2. Income Demand:

This demand refers to the various quantities of goods which will be purchased by the consumer at various levels of income. In this, we start with this assumption that the price of the commodity as well as the price of related goods and the tastes and desire of the consumers do not change. The demand brings out the relationship between income and quantities demanded. This is helpful in preparing demand schedule.

3. Cross Demand:

In this demand the quantities of goods which will be purchased with reference to changes in the price not of this goods but of other related goods. These goods are either substitutes or complementary goods. For example—A change in the price of tea will affect demands for coffee. Similarly, if the price of horses will become cheap demand for carriages may increase.

Demand Schedule:

The demand schedule for a commodity is a list of amounts that a buyer is willing to buy at different prices at a particular time. It represents a functional relationship between price and quantity demanded. It assumes that other determinants—consumer’s income, his preferences and the price of other related goods are held as constant.

ADVERTISEMENTS:

According to Prof. Benham:

“In any market at different prices and at a given time, if the total sale of a commodity is expressed in the form of a schedule, it is called demand schedule.”

It can be expressed in two forms:

1. Individual Demand Schedule.

2. Market Demand Schedule.

1. Individual Demand Schedule:

It main-fests a functional relationship between the demand for a particular commodity or service by an individual at various price levels. In other-words, it is a schedule showing the quantities of a commodity that will be purchased by an individual at various prices in a given period of time (say per day, per week, per month or per annum) is referred to an individual demand schedule.

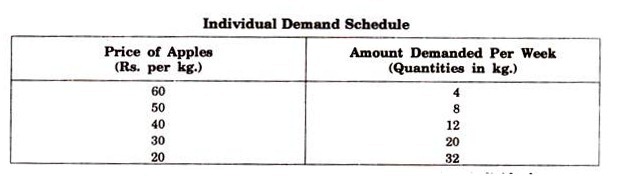

This table illustrates a purely imaginary demand schedule of an individual consumer Mr. X for apples.

Characteristics of Demand Schedule:

The important characteristics of demand schedule are as follows:

(i) The demand schedule does not indicate any change in demand by the individual concerned but merely expresses his present behaviour in purchasing the commodity at alternative prices.

(ii) It shows only the variation in demand at varying prices.

(iii) It seeks to illustrate the principle that more of a commodity is demanded at a lower price than at a higher one. In fact, most of the demand schedules, show an inverse relationship between price and quantity demanded.

2. Market Demand Schedule:

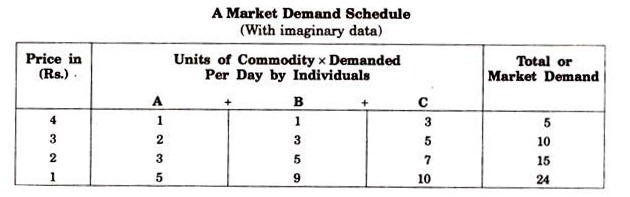

Market demand schedule depicts the various amounts of commodity or service which the group of consumers taken together will buy at different level of prices. It is a tabular statement narrating the quantities of a commodity demanded in aggregate by all the buyers in the market at different prices in a given period of time.

A market demand schedule thus represents the total market demand at various prices. Theoretically, the demand schedule of all individual consumers of a commodity can be compiled and combined to form a composite demand schedule representing the total demand for the commodity at various alternative prices.

Apparently, it is constructed by the horizontal additions of quantities at various prices shown by the individual demand schedules. It follows that like an individual demand schedule, the market demand schedule also depicts an inverse relationship between price and quantity demanded.

Points to be Kept in Mind While Preparing Demand Schedule:

In preparing the demand schedules some points given below must be kept in mind.

They are:

(1) This is an imaginary demand schedule which explains the condition of only one consumer or one market.

(2) In its preparation imagine the taste and income of a consumer, prices of other complementary and substitution goods are constant. We should suppose a particular demand of a commodity which is affected by changes in its price only.

(3) Individual demand schedule is unsystematic and odd. Market demand schedule is continuous and smooth. It is because in market demand schedule, differences are often equal and smooth.

(4) Individual demand schedule and market demand schedule are prepared at a definite time. But change of time brings a change in them also.

(5) Both individual and market demand schedules depend upon each other and so affect each other.

Demand Curve and Its Nature:

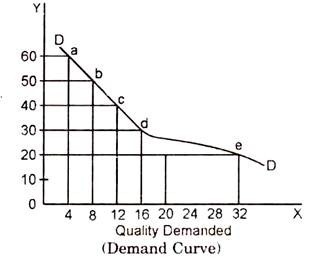

Demand schedule expresses the price quantity relationship arithmetically and when the same is expressed in the form of a diagram it is called as demand curve. It has been defined as—”a Locus of points each of these points shows the maximum quantity of a commodity will be purchased per unit of time at a particular price.”

According to Prof. Milton Friedman—”Demand curve is a snapshot at a moment in time and represents, the maximum quantity that would be purchased at alternate prices.”

Along the horizontal axis (X-axis) the units of commodity Y demanded are measured, where as the price of a commodity is represented along with vertical axis (Y-axis) corresponding to the price quantity relations given in the demand schedule, various points like— a, b, c, d and e are obtained on the graph. These points are joined and a smooth curve DD is drawn, which is called the demand curve.

Individual Demand Curve:

DD is the demand curve. It slopes downwards. It shows that variation in demand is inversely related to the variation in price.

The demand curve has a negative slope. It slopes downwards from left to right, representing an inverse relationship between price and demand.

Quantity of X Demanded:

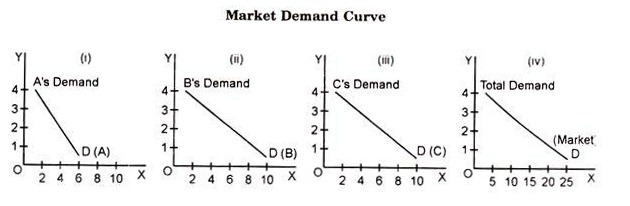

Market demand curve is derived by the horizontal summation of individual demand curve for a given commodity.

Market demand curve drawn above as in the panel (iv) is derived by the horizontal summation of individual demand curve in panel (i), (ii) and (iii).

Thus, D (Market) = D (A) + D (B) + D (C)

By seeing the curve we can draw this conclusion that the slope of the market demand curve is an average of the slopes of individual demand curve. Essentially, the market demand curve too has a downward slope indicating an inverse price quantity relationship i.e., demand rises when the price falls and vice-versa.

Both the above demand curves show a downward slope from left to right hand side. This negative slope of the demand curve is the outcome of the operation of the law of diminishing marginal utility. Since, the marginal utility diminishes with an increase in the stock of a particular commodity; the consumer will purchase more units of the same commodity only at a lower price.