Here is a term paper on the ‘Information Economics’ for class 9, 10, 11 and 12. Find paragraphs, long and short term papers on the ‘Information Economics’ especially written for school and college students.

Term Paper on Information Economics

Term Paper Contents:

- Term Paper on the Introduction to Information Economics

- Term Paper on the Asymmetric Information Model

- Term Paper on the Principal Agent Model: The Production Game

- Term Paper on the Moral Hazard: Hidden Information

- Term Paper on the Efficiency Wage Hypothesis

- Term Paper on the Adverse Selection

- Term Paper on the Signaling

- Term Paper on Screening

1. Term Paper on the Introduction to Information Economics:

ADVERTISEMENTS:

In production game, there are two players such as principal and agent. Both have different strategies to earn the maximum benefits. The principal chooses the strategies which are of his best interest and knowledge. At the same time, agent wants more benefit out of his efforts. Information is asymmetric, complete and uncertain. There are different contracts are provided by principal to the agent. Now it is depends on both which contract both players have to select or reject. There are economic interests that are involved with each other efforts.

A firm appoints a salesman but efforts of the salesman are important to get maximum benefit. Sometime with pushover effort, there is sale of commodities. But if the efforts do not give the maximum benefit then the company must believe that the agent is telling the truth. The cooperative strategies will work here to get the benefit by both company and salesman. Similarly the signaling is costly action for workers. If the worker has given signal and screened then there is difference between workers with more or less education.

2. Term Paper on the Asymmetric Information Model:

In this term paper, we use the principal agent model to analyze asymmetric information. There are two players in this game. We have taken principal and agent who are usually representative individuals. The principal hires an agent to perform different tasks. The agent acquires an informational advantage about type, actions at some point in the game. Such information may be available from friends, agents, newspapers and employment exchange etc. The principal or uninformed player is the player who has the low caliber information partition. The agent or informed player is the player who has the finer information partition.

ADVERTISEMENTS:

In each model, the principal (P) offers the agent (A) a contract which he accepts or rejects. In some nature (N) makes a move or the agent chooses an effort level. The moral hazard models are games of complete information with uncertainty. In moral hazard with hidden actions, the agent moves before nature and in moral hazard with hidden information. The Agent moves after Nature and conveys a message to the principal about Nature’s move.

Adverse selection models have incomplete information. Therefore nature moves first and picks the types of the agent, generally his ability to perform the task. In the simplest model, the agent simply accepts or rejects the contract.

In the model of signaling, suppose agent sends the signal before the principal offers a contract and screening otherwise. The simple difference between the signal and the message is that a signal is costless statement but a costly action.

Example:

ADVERTISEMENTS:

We are considering of employer (the principal) hiring a worker (the agent). The employer knows the worker’s ability but not his effort level. The problem is moral hazard with hidden actions. At the initial stage, principal do not know the worker’s ability. But after the worker accepts a contract, the principal discovers his ability. Therefore the problem arises of the moral hazard with hidden information.

If the worker knows his ability from the start but the employer does not. Then the problem arises of the adverse selection. Such problem is observed everywhere in labor market. A principal action consists of an incentive scheme that specifies a reward to the agent as a function of some (verifiable) performance measure that is correlated with the agent’s effort. Depending on the application of interest, the reward can be a monetary payment, the transfer of an asset, the choice of a policy or a combination of any of these.

In addition to this, the worker knows his ability from the start but he can acquire education observable by the employer before they make a contract, the problem is signaling. Agent’s utility functions also include intrinsic utility form the action, utility from consuming the public goods, monetary rewards or costs and utility from the esteem of others.

If the worker acquires his education in response to the contract offered by the employer the problem is screening.

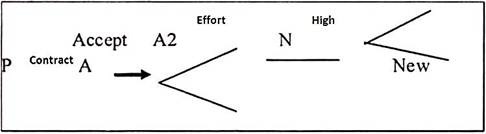

1. Moral Hazard with Hidden Actions:

Moral hazard is defined as the tangible loss producing propensities of the individual assured or as that which “comprehends all of the non-physical hazard risk.”

In the moral hazard with hidden information game, principal signs contract with agent. The contract also gets accepted between the two. The contract is signed for particular efforts by agent. But the efforts are invisible which are recommended in contract.

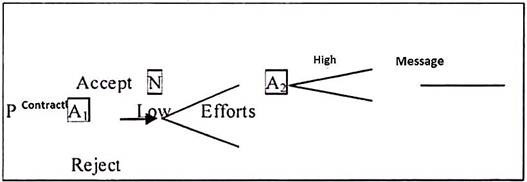

2. Moral Hazard with Hidden Information:

ADVERTISEMENTS:

In this game, principal signs contract with the agent. The contract gets accepted. The agent is expected to work hard. This is because nature shows high efforts. Agent gives the message through work. The efforts are higher in this game. Information is complete because principal observes the effort of the agent.

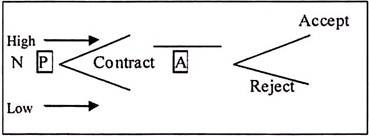

3. Adverse Selection:

Under adverse section model, the principal and agent need to sign the contract. The contract needs to sign for high efforts. Accepting and rejecting contract is depending on the agent and his efforts. But principal allow the agent to sign the contract without observing the efforts. The information is incomplete but it is adverse selection of agent by principal.

ADVERTISEMENTS:

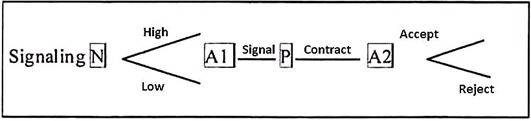

4. Signaling:

In this game, the nature begins the game by choosing different options. The principal is ready to sign the contract with agent. Such contract is signed for high efforts. The agent has to give the signal to sign the contract. Therefore principal sign the contract with agent. Such contract is signed then it is either accepted or rejected by the agent. It is called as signaling. Therefore the information is incomplete. Such game is presented in signaling form.

ADVERTISEMENTS:

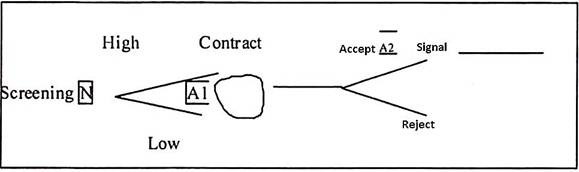

5. Screening:

In this game, the principal need to signs a contract with agent. But he will not sign the contract. He will first screen the agent. He gets the information and screens the agent for high effort. If the agent is willing for high efforts then contract is signed.

3. Term Paper on the Principal Agent Model: The Production Game:

Sometime after hiring an agent, the principal learns the productive capabilities of agent. On the basis of previous experience in the market, the principals have conditional probability assessments over productive capacity given various combinations of signals and indices. At any point of time when confronted with an agent applicant with certain observable attributes.

In the principal agent model, we also assume that the principal is a manager and the agent is worker. The terms are used alternatively at different examples. Under moral hazard, it is easier for the manager to observe the worker’s output than his efforts. Therefore manager offers a contract to pay the worker based on output. Output is depending on the worker’s efforts. We consider one different example of principal agent.

ADVERTISEMENTS:

The principal is the one whose goal is to lay off some of risk with heterogeneous agents. The agents have mean variance preferences. An agent’s degree of risk aversion is private information and hidden to the principal. The principal only knows the distribution of risk aversion coefficients which puts him at an informational disadvantage.

If all the agents were homogeneous, the principal, when offering a structured product to a single agent, could (perhaps) extract the indifference (maximum) price from each trading partner. In the presence of agent heterogeneity this is no longer possible, either because the agents would hide their characteristics from the principal or prefer another asset offered by the principal but designed and priced for another customer.

In a principal-agent situation, the agent chooses an action “on behalf of” the principal. The resulting consequence depends on a random state of the environment as well as on the agent’s action. After observing the consequence, the principal makes a payment to the agent according to a pre-announced reward function, which depends directly only on the observed consequence. This last restriction expresses the fact that the principal cannot directly observe the agent’s action, nor can the principal observe the information on which the agent bases his action.

This situation is one of the simplest examples of decentralized decision-making in which the interests of the decision makers do not co-inside. The monetary value of output by q (e) which is increasing in effort e. At this point, q is quantity produced by worker. The Agent’s utility function U (e, w) is decreasing in effort and increasing in the wage while the Principal’s utility function V(q-w) is decreasing in effort and increasing in the wage. The Principal’s utility function V(q-w) is increasing in the difference between output and the wage.

It is net profit for the principal. In many circumstances a principal may have relevant private information when he/she proposes a contract to an agent. We analyze such a principal agent relationship as a non-co-operative game. The principal proposes a contract which is accepted or rejected by the agent. The contract executed if accepted otherwise the reservation allocation takes effect. This allocation may be determined by a pre-existing contract or it may simply be the non-trade point.

The study assumes that the principal’s information directly affects the agent’s payoff. Before solving the game, we discuss Pareto efficiency with asymmetric information. We define an incentive-compatible allocation to be weakly inter inefficient if there exists no alternative incentive compatible allocation that both parties prefer for all possible beliefs that the agent might have about the principal’s private information.

ADVERTISEMENTS:

A Flat Wage under Certainty:

The principal and the agent are the players in this game. There is asymmetric, complete and certain information.

Actions and events are explained into three types:

1. The Principal offers the worker a wage.

2. The agent decides whether to accept or reject the contract.

3. If the agent accepts the contract then he exerts effort e. Such efforts are unobserved by the principal. Therefore output equals q(e), observed by both player where q’ > 0.

ADVERTISEMENTS:

The payoffs in this game to both players are explained as follows:

1. If the agent rejects the contract, then profit for (π) agent is U̅ and profit for (π) principal is zero.

2. If the agent accepts the contract, then profit for (π) agent is U (e, w) and profit for (ð) principal is V (q-w). Both are depend on each other to achieve profit and wage.

The common assumption to most principal agent models is that either the principal or the agent is perfect competitor. In the background, principal decides to employ the agent then principal’s equilibrium profit equals zero. Many agents compete to work for the principal so the agent’s equilibrium utility equals the reservation utility U̅. The outcome of the above game is simple and inefficient. If the wage is non-negative then the agent accepts the job and exerts zero effort. The principal’s best response is to offer a wage of zero.

An Output Based Wage under Certainty:

The principal and the agent are the players in production game two. The information is again asymetric, complete and certain.

ADVERTISEMENTS:

Actions and events are explained in three forms:

1. The principal offers the worker a wage function w(q).

2. The agent decides whether to work or not to work. If he accepts the work then he exerts effort e, which is unobserved by the principal.

3. Output equals q(e) observed by both players.

The payoffs are explained as follows:

Suppose, the agent rejects the contract, then profit (π) for agent is equal to U̅ and profit (π) for principal is zero. If the agent accepts the contract, then π for agent is u(e,w) and π for principal is V(q-w). Principals must pick the wage as a quantity produced rather than a wage. The principal collects all the gain from trade. He wishes to pick the effort level e* of worker that generates the efficient output level q*.

The contract must provide the agent with utility U̅ in equilibrium. But any U(e,w(q))< U̅ for e*≠ e*. It will make the agent pick e = e*. Such a contract is called as a force contract. It is because it forces the agent to pick a particular effort level.

An Output Based Wage under Uncertainty:

In this game, the players are the principal and agent. The information is asymmetric, complete and uncertain.

The actions are explained in three types:

1. The principal offers the worker a wage function w(q).

2. The agent decides whether to accept or reject the contract. Suppose he accepts the contract then he exerts effort e, which is unobserved by the principal.

3. The efforts are observed by agent but it is unobserved by the principal. The nature chooses the state of the world θ ϵ R.

According to the probability density of (θ), output equals q(e, θ).

The payoffs are as follows:

Suppose the agent rejects the contract, then agent = U̅ and profit for (π) principal is zero. Similarly if the agent accepts the contract, then ∏ for agent is EU (e, w) and π for principal is EV (q-w). The principal cannot just choose an output level and tell the agent to produce it. This is because unlike in production game II, the principal cannot deduce that e = e* just by looking at the output, which is q(e, θ) not just q(e).

The optimal wage contract might specify the highest wage for q*, but not necessarily the outcome because it will usually not specify a zero wage for a slightly lower output. The nature might be to blame if the agent is risk be to blame if the agent is risk averse. The agent’s expected utility equal to U̅. It is more expensive when the agent bears risk and the principal wants to insure the agent by keeping the low risk imposed on him. The tradeoff between incentives and insurance is given as follows.

The modeller may wish to restrict the Principal’s strategy which is set as follows:

In terms of linear equation

It means wage is a function of quantity produced by worker. Wage is directly proportional to workers output.

The source of moral hazard is observable. But the fact is that the contract cannot be conditioned on effort. Effort is non-contractible. Production game III applies even if the principal can see very well that the agent is slacking. But he cannot prove it in court. In principal agent problem, the wage is set without knowing the agents efforts. It is the problem of this model.

4. Term Paper on the Moral Hazard: Hidden Information:

In the moral hazard game, information is complete, but under hidden information the agent sees some move of nature that the principal does not. From the principal’s point of view agents come in several types depending on what they have seen. His chief concern is to discover the type. The agent may exert effort contractibility which is unimportant. When the principal is ignorant then it does not know which effort is appropriate.

Hidden Information:

There are two players such as the principal and the agent in this game. The information is asymmetric -complete and uncertain.

The actions find events as follows:

1. The principal offers the worker a wage contract of the form w (q, m).

2. The agent accepts or rejects the principal’s offer.

3. Nature chooses the state of the world θ according to probability distribution F (θ). The agent observes θ, but the principal does not.

4. If the agent accepts, he exerts effort e and sends a message m, both observed by the principal. The output is q (e, θ).

The payoffs are calculated as follows:

If the agent rejects the contract, then ð for agent is and π for principal is zero. Secondly, if the agent accepts the contract, then π for agent is U (e, w, θ) and π for principal is V (q-w). The principal would like to know θ. He would be delighted to employ an honest agent who always chooses m = θ, but in non-co-operative games the agents words are worthless , the principal must try to design a contract that either provides incentives for truthfulness or takes lying into account.

Pooling and Separating Equilibrium:

In hidden actions models, the principal tries to construct a contract which will induce the agent to take the single appropriate action. In hidden information model, the principal tries to make different actions attractive under different states. Therefore the agent’s choice depends on the hidden state. If all types of agent pick the actions then same strategy is chosen at all points. The equilibrium is pooling otherwise, it is separating.

A single equilibrium ⎯ even a pooling option can include several contracts. It is a pooling equilibrium and the agent always uses the same strategy, regardless of type. If the agent’s equilibrium strategy is mixed, then equilibrium is pooling. The agent always picks the same mixed strategy, even though the messages and efforts would differ across realization of the game.

A separating contract need not be fully separating. If agents who observe θ < 4 then accept contract c, but other agents accept c2, then the equilibrium is separating and it does not separate out every type. We say that the equilibrium is fully revealing if the agent’s choice of contract always conveys his private information to the principal. The pooling and fully revealing equilibrium is synonymously called semi-separating partially separating, partially revealing or partially pooling equilibrium.

The principal problem is to maximize his profit subject to following constraints:

1. Incentive Compatibility:

In this game the agent picks the desired contract and actions. Under hidden information, the incentive compatibility constraint is sometimes called the self-selection constraint because it induces the different types of agents to pick different contracts.

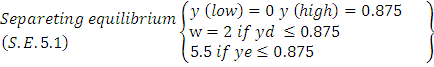

Equilibrium is defined as follows. The principal offers as

W1 = w1 (q = 0) = 3, w1 (q = 10) 3

W2 = w2 (q = 0) = 0 w2 (q = 10) = 4

The agent chooses contract 1 which paying low wage (w1)

Now the agent chooses contract two which is paying high wage (w2)

2. Participation:

In this game, the agent prefers the contract to his reservation utility.

The equilibrium must also satisfy a part of the competition constraints. It is not found in hidden action models: either a non-pooling constraint or a non-separating constraint. If one of the several competing principal’s wishes to construct a pair of separating contracts cl and c2 he must construct than so that not only do agents choose c1 and c2. It is depending on the incentive compatibility. They prefer (c1, c2) a pooling contract then c3 is a non-pooling contract.

5. Term Paper on the Efficiency Wage Hypothesis:

The well-known microeconomics model of efficiency wage is developed by Shapiro and Stiglitz in 1984. In the model they have shown how involuntary unemployment can be explained by a principal agent model. When all workers are employed at the market wage, a worker who is caught shirking and fired can immediately find another job. Therefore firing becomes ineffective at work place.

The economists, Becker and Stigler (1974) have suggested that workers post performance bonds. Suppose the workers are economically poor then it is impractical without bonds are boiling in oil. The workers choose low effort and receive a low wage.

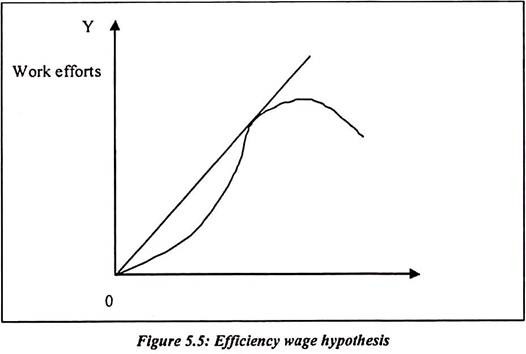

It is presented in the following diagram:

In figure 5.5, income and work efforts are positively co-related. But such positive co-relation is observed up to certain points. Work efforts declined after some time and shirking will take place. To induce a worker not to shirk the firm can offer to pay him a premium over the market clearing wage, which he loses if he caught shirking and fired. If one firm finds it profitable to raise its wage however, so do all firms and one might think that after the wages equalized the incentive not to shirk would disappear.

But when a firm raises its wages, its demand for labor falls, at this point firm need to pay more. When all firms raise their wages, the market demand for labor falls. Such effect would create unemployment. If all firms pay the same wages, a worker has an incentive not to shirk. This is because if worker is fired then he would stay unemployed. If there is a random chance of leaving the unemployment pool, the unemployment rate rises sufficiently high. Therefore workers choose not to risk being caught shirking.

Firm can choose an option to pay a high wages to increases the threat of dismissal. In the theory of Shapiro and Stiglitz, unemployment is generated by these “efficiency wages”. The firms behave paradoxically, they pay workers more than necessary to attract them and outsiders who offer to work for less are turned away. It means “overqualified” jobseekers are unsuccessful and stupid managers are retained by firms.

The trustworthiness matters more than talent in some jobs. Firms are unwilling to hire someone who is talented and intellectual because he could find another job. But at this point there is too much volatility is observed in the market. In the long run technology and knowledge is flexible. Such strategies are true for short term.

6. Term Paper on Adverse Selection:

In the game theory, moral hazard with asymmetric information and adverse selection, the principal tries to sort out agents with different characteristics. The moral hazard with hidden information is structurally similar to adverse selection. The emphasis is given on the agent’s action rather than his choice of contract. The agent accepts the contracts before acquiring information.

Production Game V: Adverse Selection:

In this game, the players are the principal and the agent. The information is asymmetric, incomplete and uncertain.

The actions and the events are played as follows:

1. Nature chooses the agents ability a, which is unobserved by the principal, according to distribution F(a).

2. The principal offers the agent one or more wage contracts w1 (q), w2 (q).

3. The agent accepts one contract or rejects them all.

4. Nature chooses a value for the state of the world e, according to distribution G (θ).

Output is then q = q (a, θ). The payoffs are explained as follows. If the agent rejects all contracts, then the profit of agent is written as agent = and profit of () principal is zero. Suppose the agent accept the contract then profit for agent is Π agent =U(w) and profit for (Π) principal is v(q-w).

Under certainty, the principal would provide a single contract. He simply specifies high wages for high output and low wages for low output. But unlike under moral hazard, either high or low output might be observed in equilibrium. Under adverse selection with uncertainly, multiple contracts may be better than a single contract. The principal might provide a contract with a flat wage to attract the low ability agents and an incentive contract to attract the high ability agents.

Adverse Selection under Uncertainty: Insurance Game III:

The term “Adverse Selection” is similar with “Moral Hazard”. Such terms are often used in insurance sector. Insurance company pays more if there is an accident so it benefits accident prone customers’ more than safe ones. Firm’s customers are adversely selected to be accident prone. Under moral hazard, Harish chooses whether to be careful or careless. Under adverse selection, Harish cannot affect the probability of a theft, which is chosen by nature. Harish is either safe or unsafe and while he cannot affect the probability that his car will be stolen, he does know what the probability is of car stolen.

Insurance Game III:

The players in this game are Harish and two Insurance companies. The information is asymmetric, incomplete and uncertain. The insurance companies are uninformed.

The likely actions and events can take place as follows:

1. Nature chooses Harish to be either safe, with probability 0.6 or unsafe with probability 0.4. Harish knows his types but the insurance companies do not.

2. Each insurance company offers its own contract (x, y) under which Harish pays premium X unconditionally. He receives compensation y if there is any theft.

3. Harish picks a contract and lastly nature chooses whether there is a theft, using probability 0.5 if Harish is safe and 0.75 if he is unsafe.

The likely payoffs in this game as follows. Harish’s payoff depends on her type and the contract (x, y) that he accepts Let U’ > 0 and U” < 0.

The companies payoffs depend on what types of customers accept their contracts.

Company pay-off types of customers

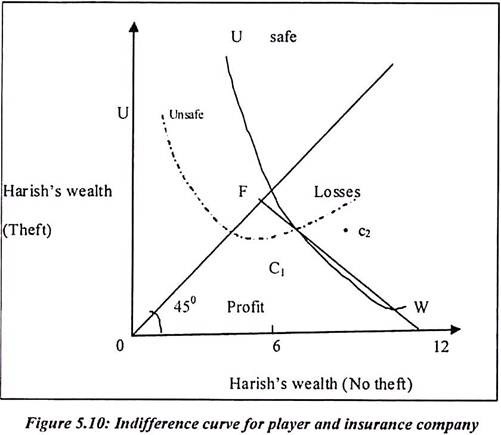

Harish is safe with probability 0.6 and unsafe with probability 0.4. We have assumed these numbers and probability. Without insurance Harish’s rupee wealth is Rs. 12 lakh if there is no theft and 0 if there is theft. His endowment in state space is w = (12, 0). If Harish is safe, a theft occurs with probability 0.5, but if he is unsafe the probability is 0.75.

If an insurance company knew that Harish was safe it could offer him insurance at a premium of Rs. 6 thousand with a payout of Rs. 12 lakh after a theft. Leaving Harish with an allocation of (6, 6). This is the most attractive contract that is profitable because it fully insures Harish. Whatever the state, his allocation is Rs. 6 lakh.

Insurance Game III: Non-Existence of Pooling Equilibrium:

Figure 5.10 shows the indifference curves of Harish and an insurance company. The insurance company is risk neutral. Its indifference curve is the straight line Wf. Suppose Harish is a customer regardless of his type. The insurance company is indifferent between w and c1 at both of which its expected profits are zero. Harish is risk averse and his indifference curves are closest to the origin along the 45 degree line where his wealth in the two states is equal. He has to sets of indifference curves solid if he is safe and dotted if he is unsafe.

To make zero profits, the equilibrium must lie on the line wF. This is easy to think about these problems by imagining an entire population like Harish, whom we will call customers. They pick a contract C1 anywhere on wF. We can draw indifference curves for the unsafe and safe customers that pass through c1. Safe customers are always willing to trade theft wealth for no theft wealth at a higher rate than unsafe customers. At any point, the slope of the solid (safe) indifference curve is steeper than that of the dotted (unsafe) curve.

We can insert another contract c2 between them and just barely to the right of wF. The safe customers prefer contract c2 to c1. But the unsafe customers stay with c1 so c2 is profitable. Since c2 only attract safer. It need not be to the left of wF to avoid losses but then the original contract c1 was not Nash equilibrium. Our argument holds for any pooling contract, no pooling equilibrium exists.

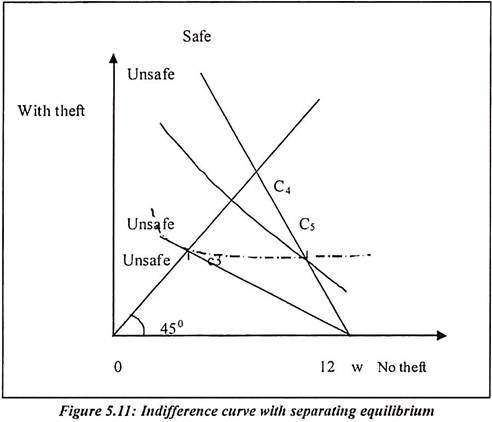

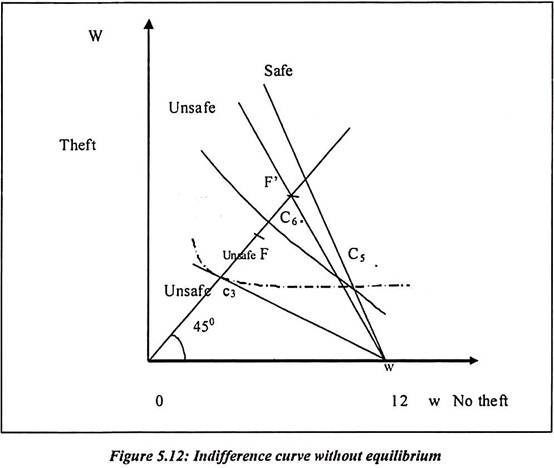

We next consider whether a separating equilibrium exist, using figure 5.11, the zero profit condition requires that the safe customers take contracts on wC4 and the unsafe on wC3.

Insurance game III: A Separating Equilibrium:

The unsafe will be completely insured in any equilibrium, although at a high price. On the zero profit line wC3, the contract they like best is c3. It is the safes and it is not tempted to take. The safes would prefer contract c4 but c4 uniformly dominate c3. It would attract unsafe too and generate losses. The assumption on which the equilibrium is based is that the proportion of safes is 0.6. The zero profit line is for cooling contracts wF and C6 would be unprofitable.

It is assumed that the proportion of safes is higher. The zero-profit line for pooling contracts would be wF’ and C6 lying to its left is profitable. Since neither a separating pair likes (c3, c5) nor a pooling contract like c6 is equilibrium, no equilibrium whatsoever exists.

Insurance Game III: No Equilibrium Exists:

If separating contracts are offered the company is willing to offer a superior pooling contract. But if a pooling contract is offered, the company is willing to offer separating contracts that make it unprofitable. A monopoly would have pure strategy equilibrium, but in a competitive market only a mixed strategy Nash equilibrium exists.

7. Term Paper on Signaling:

Game theory helps players to maximize their utility. Signaling is a way for an agent to communicate his type under adverse selection. The signaling contract specifies a wage that depends on an observable characteristic. The signal which the agent chooses for himself after nature chooses his type. If the agent chooses his signal before the contract is offered. Then he is signaling to the principal. If he chooses the signal afterwards, the principal is screening him. Inducing truthful communication then requires a form of team incentives. A signaling game is an extensive form game between two persons, the sender and the receiver.

Signaling games refer narrowly to a class of two-player games of incomplete information in which one player is informed and the other is not. The informed player’s strategy set consists of signals contingent on information and the uninformed player’s strategy set consists of actions contingent on signals. More generally, a signaling game includes any strategic setting in which players can use the actions of their opponents to make inferences about hidden information.

A signaling game is a two-stage game with incomplete information on one side where the informed party (Player 1, or Sender ) chooses a “message” m from some set M and the uninformed party (Player 2, or Receiver) responds with an action a from some set A. Here I assume, without substantial loss of generality, that the set of feasible messages of the Sender does not depend on his private information and that the set of feasible responses for the Receiver does not depend on the message sent by the Sender.

The Informal Players Moves First: Signaling:

This concept is introduced by the great economist Spence in 1973. He introduced the idea of signaling in the context of education. The series of models are constructed which formalize the notion that education is useless to increase a workers ability. But it is useful to demonstrate that ability to employers. Let half of the workers have the type “high ability” and half “low ability”. Where the ability of worker is a number denoting the rupee value of a worker’s output. Output is assumed to be a non-contractible variable.

Employers do not observe workers ability. They do know the distribution of abilities and they observe the worker’ education, which also takes two levels. Workers choose their education levels before employers choose compensation schemes to attract them. The employer’s strategies are the sets of contracts they offer giving wages as functions of the education level.

Education I:

In this game, the players are a worker and two employers. The information is asymmetric, incomplete and certain.

The likely actions and events can be explained as follows:

1. Nature chooses the worker’s ability aϵ {2,5.5}. It is in the low and high ability workers category, each having probability 0.5. The variable a is observed by the worker, but not by the employers.

2. The worker chooses education level yϵ {0,1}.

3. The employers each offer a wage contract w(y).

4. The worker accepts a contract or rejects both of them.

Therefore the output equals to pay off as follows:

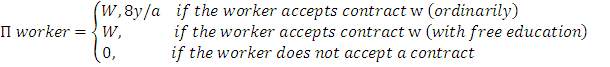

The worker’s payoff is his wage minus his cost of education and the employers pay off is his profit.

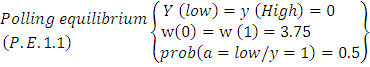

Education is costly if his ability takes a low value. The cost is depending on ability of worker. As in any hidden information game, we must think about both pooling and separating equilibrium. Education I have both pooling and separating equilibrium. In the pooling equilibrium, which we will call PE 1.1 , both types of workers pick zero education and the employers pay the Zero-profit wage that is 3.75 = (2 + 5.5)/2.

It is regardless of the education level of workers. Here, the equilibrium needs to specify the employers belief when he observes y = 1. In PE 1.1, the beliefs are “passive conjectures”. Employers believe that a worker who chooses y ⎯ 1 is low with probability 0.5. Given this belief, both types of workers realize that education is useless. The model reaches the unsurprising outcome that workers do not bother to acquire unproductive education.

Under the belief probability of (a = Low/y = 1) = 0 for example, employers believe that any worker who acquired education has a high, so pooling is not Nash equilibrium. The high workers are tempted deviate and acquire education. This lead to the separating equilibrium from which signaling is best known. The high ability worker acquires education to prove to employers that he really has high ability.

A pair of separating contracts must maximize the utility of the highs and lows subject to the participation constraints that firms can offer the contracts without making losses. The incentive compatibility constraints show that the lows are not attracted to the high contract. The non-pooling constraints show that the highs would not prefer to pool. The participation constraints are that

The incentive compatibility constraints shows that

Since in SE .2, the separating wage of the lows is 8, the separating wage of the highs is 5.5 from (9). The incentive compatibility constraint is satisfied at this point.

For education I, the wage must equal 3.75 in a zero profit pooling contract,

Constraint (10) is satisfied by S.E 1.2.

Given the worker’s strategy and the other employers strategy each employer must pay the worker his full output or loss him to the other employers. Given the employers contracts the low has a choice between the payoff (2 = 2 ⎯ 0) for ignorance and 1.5 = (5.5⎯ 8/2) for education, so he picks ignorance. The high has a choice between the payoff 2 = (2 ⎯ 0) for ignorance and it is 4.05 = (5.5 ⎯ 8/5.5) for education. Therefore worker picks education.

Now we can use the Bayes’s rule to interpret how employers see the problem. Education means the agent has high ability and lack of that means he has low ability. This does not mean that a worker cannot deviate but deviation will not change the employer’s belief. If a high worker deviates by choosing y = 0 and tells the employers he has a high ability who would rather pool than separate it. The employers disbelieve him and offer him the low wage of 2. He is not the pooling wage of 3.75 or the high wage of 5.5.

The low ability worker could never benefit from deviating from PE1.1. Under the passive conjectures specified, the low ability worker gets a payoff of 3.75 in equilibrium versus -0.25 = (3.75 ⎯ 8/2) if he deviates and becomes educated. Under the most favorable belief possible , that a worker who deviates is high with probability 1, the low ability worker would get a wage of 5.5 Suppose the worker deviate from abilities then his payoff from deviating would be 1.5 = (5.5 ⎯ 8/2). A worker who acquires education has high ability and he does not support the pooling equilibrium.

Education II: Modeling Trembles So Nothing is Out of Equilibrium:

Suppose the nature’s move in Education I is replaced then the following actions and events can occur. The nature chooses worker ability aϵ {2, 5.5}. Each worker has ability with probability 0.5. The nature observes a worker with free education.

The payoff is as follows:

With probability 0.001 the worker receives free education. It is regardless of workers ability. If the employer sees a worker with education, he knows that the worker might be one of these rare types, in which case the probability that the worker with low ability is 0.5. Both y = 0 and y = 1 can be observed in any equilibrium.

The separating equilibrium did not depend on belief and remains equilibrium. The pooling equilibrium explains that all workers behave the same way. But the small number with free education may behave differently. The two types of greatest interest are that high and low ability workers are separated from the workers whose education is free. The small amount of separation allows the employers to use Bayes’s rule and eliminates the need for exogenous beliefs.

Education III: No Separating Equilibrium: Two Pooling Equilibrium:

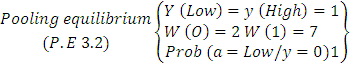

Now we modify education I game by changing the possible worker abilities from {2, 5.5} to {2, 12}. The separating equilibrium vanishes but a new pooling equilibrium emerges. In PE 3.1 and 3.2 both pooling contracts pay the same zero-profit wage of 7 = (2 + 12/2). Both types of agents acquire the same amount of education, but the amount depends on the equilibrium.

Prob (a = Low/y = 1) 0.5 (passive conjectures)

Figure shows that, both types of workers receive the same wage but they incur the education costs anyway. Each type is frightened to do without education. This is because the employers would pay him not the average pooling wage but the wage appropriate to the Low. Although the two types of workers adopt the same strategies. The equilibrium contract offers different wages for different education. The implied threat to pay a low wage to an uneducated worker never needs to be carried out, so the equilibrium is still pooling.

The perfectness does not rule out threats based on beliefs. The model imposes these beliefs on the employer and he would carry out his threats because he believes they are best responses. The employer receives a higher payoff under same beliefs than under other. But he is not free to choose his beliefs. We end up with PE 3.1 because the only rational belief is that if y = 0 is observed, the worker has equal probability of being High or Low. To eliminate PE 3.1 requires less reasonable beliefs. A probability 0.001 that a Low gets free education together with probability zero that a high does.

8. Term Paper on Screening:

The theory of screening is unique in microeconomics. It is also called as the theory of adverse selection or discrimination. It represents a major accomplishment of the economics of information in the last two decades. This theory is often cast in a framework with two parties, a principal and an agent. The principal offers a contract, which the agent decides to accept or reject. The agent has private information about some parameter of his utility function. This parameter determines his “type.”

The parameter affects the principal’s payoff at least indirectly, since the agent’s type establishes the class of contracts that he will accept. The literature has developed this model both in the abstract and as applied to a variety of interesting economic problems, e.g., labor contracts, optimal taxation, price and quality discrimination, insurance contracts, educational screening, auctions, public goods, and regulation of monopoly. An important hypothesis of the usual model is that the principal is not informed, that means it does not possess private information when contracting.

Thus, the asymmetry of information is one-sided. One can think of many circumstances, however, where such an assumption is too restrictive. For example, in the literature on public good mechanisms for a comprehensive bibliography the informational deficiency usually emphasized is the government’s (principal’s) lack of knowledge of consumers’ (agents’) preferences.

But at the time the government institutes a mechanism for eliciting those preferences, it may well know more than consumers about the cost of supplying. If the agent chooses his signal before the contract is offered. He is signaling to the principal. If he chooses the signal afterwards, the principal is screening him. The informed player moves second: screening.

Education IV: Screening with a Discrete Signal Players:

In this game, a worker and the two employers are the players. The information is asymmetric, incomplete and uncertain.

The actions and events are likely as follows:

1. Nature chooses worker ability a ԑ {2, 5.5}, each ability having probability 0.5. Employers do not observe ability, but the worker does.

2. Each employer offers a wage contract w(y).

3. The worker chooses education level y ԑ {0, 1}.

4. The worker accepts a contract. Lastly, the output equals a.

The payoffs are explained as follows:

Education IV has no Nash pooling equilibrium. This is because if one employer tried to offer the zero profit. Pooling contract w (0) = 3.75, the other employer would offer w (1) = 5.5 and draw away all the highs.

The unique equilibrium is:

The uninformed player moves first in the above game. His beliefs after seeing the move of the informed player are irrelevant. The informal player is fully informed. His beliefs are not affected by what he observes. This much like simple adverse selection in which the uninformed player moves first, offering a set of contracts, after which the informed player choosing one of them.

Education V: Screening with a Continuous Signal Players1:

The players in this game are a worker and two employers. Information is asymmetric incomplete and uncertain.

The actions and events are as follows:

1. Nature chooses worker ability aÎ {2, 5.5}. Each workers ability with probability is 0.5. The employers do not observe ability but the worker does.

2. Each employer offers a wage contract w(y).

3. The worker chooses education level yÎ (0, 1).

4. The worker chooses a contract or rejects both of them. Lastly the output is equals a.

The payoff is as follows:

Pooling equilibrium generally does not exist in screening games with continuous signals and separating equilibrium are also sometimes lacking.

Equation V however has a separating Nash equilibrium with a unique equilibrium path.

In any separating contract, the Lows must be paid a wage of 2 for an education at 0. The separating contract for the Highs must maximize their utility subject to the constraints discussed in equation I.

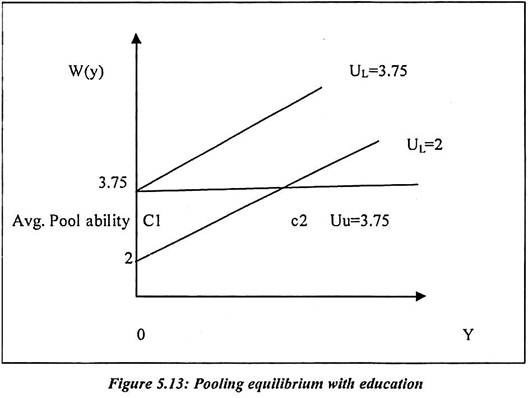

No Pooling Equilibrium in Education V:

Education V is a pooling equilibrium it would require the outcome {y = 0, w (0) = 3.75} which is shown as c1 in figure 5.13. If one employer offered a pooling contract requiring more than zero education (such as in PE3.2), the other employer could make the more attractive offer of the same wage for zero education. The wage is 3.75 to ensure zero profits.

The wage function is equal to the wages for positive education levels. It can take a variety of shapes so long as the wage does not rise so fast with education. The highs are tempted to become educated.

In Nash equilibrium, no exchange can offer a pooling contract. This is because the other employer could always profit by offering a separating contract paying more to educate one. Such separating contract is c2 in figure which pays 4.9 to workers with an educated of y = 0.5 and yields a payoff of 4.17 = [4.9 ⎯ (8*0.3*5.5] to the highs and 2.9 = 4.9 ⎯ 8*0.5/2 to the highs and 2.9 = 4.9 ⎯ 8 ⎯ 0.5/2 to the Lows.

Only Highs prefer c2 to the pooling contract c1. It yields payoffs of 3.75 to both High and Low. It only Highs accept C2. Similarly, it yields positive profits to the employer. Such model is used in different sectors of economy. It is the employers who decide to use the information of workers and pool or separate them on available information.