In this article we will discuss about the relationship between output and compensation in a company.

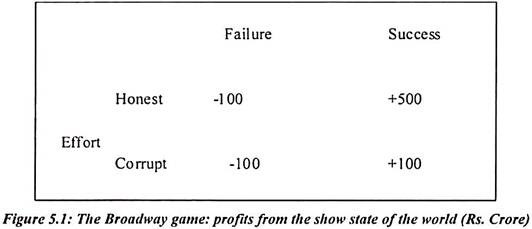

Investor advance funds to a producer to produce a broad way show which may succeed or fail. The producer has a choice to appoint between corrupt and not corrupt manager. The funds advanced with a direct gain to him of so if he is corrupt. If the company is correct in decision making then the revenue is Rs. 500 crore and the Manager did not corrupt and Rs. 100 crore if he did.

If the company is fail to recruit honest manager then revenue is Rs. 100 crore in either case; extra expenditure on a fundamentally flowed show is useless. The Broadway game, there are players such as the company and the investors. The information is asymmetric, complete and uncertain.

There are three possible actions and events:

ADVERTISEMENTS:

1. The investors offer a wage contract w (q) as a function of revenue q.

2. The producer accepts or rejects the contract.

3. The producer chooses to corrupt or be honest.

Nature picks the state of the world to be success or failure with equal probability. Payoffs are calculated to both as follows. The company’s payoff is U, if he rejects the contract, where U > 0 and U” < 0, and the investors’ payoff is 0, otherwise. The profit of the manager is U (w (q) + 50) if he corrupt. Suppose he is not corrupt then profit is U (w (q)).Such probabilities have effect on the profit of company. In other words, if the manager is corrupt then he will get some wages and Rs. 50 lakhs. But it has reflection on investors and the company.

ADVERTISEMENTS:

The profit for the investor will affect, it is

The broad way game illustrate that option contracts do not always pass higher wages for better performance. An optimal contract here is the boiling ⎯in-oil contract. Investors are risk neutral and the company is risk averse. The company should bear as little risk as is consonant with providing his incentives. The boiling ⎯in-oil contract is an application of the sufficient statistics condition. It states that if the manager’s utility function is separable in effort and money. The wages should be on whatever evidence which indicates effort and only incidentally on output.

ADVERTISEMENTS:

In the spirit of the three step procedure, what the principal wants is to induce the agents to cause the appropriate effort. Suppose both the company and the investor are risk adverse then risk sharing would change the part of the contract that applies in equilibrium. The optimal contract would then provide w (-100) < w(+ 500) to share risk. The company would have a lower marginal utility of wealth when output was + 500. Therefore company would be better able to pay an extra rupee of wage in that state than when output was-100. Suppose the producer is paid enough when output is-100 or + 500.

Managers expected utility equals his reservation, expected utility U̅ and if he is boiled in oil point that is forced down to an arbitrarily low level of utility. Suppose the output is + 100 then he refrains from corruption. The set of possible outcomes under optimal effort is different from under any other effort. Certain output show without any doubt that the manager refrain from corruption. The heavy punishments imposed only for those output achieve the first best because a non-corrupt manager has nothing to fear.

If the manager shirks instead of working then certain low outputs becomes possible and certain high outputs become impossible. In this case, when the support of the output shifts when behavior changes boiling ⎯in-oil contracts are useful.

The conditions favoring boiling oil contracts are into four points:

1. The agent is not very risk averse.

2. There are outcomes with high probability under shirking that have low probability under optimal effort.

3. The manager can be severely punished.

4. It is credible that the company will carry out the severe punishment.

Selling the Store:

ADVERTISEMENTS:

It is becoming the residual claimant since manager keeps even additional rupees of output that his extra effort produces. This is equivalent to fully incurring the company. Selling the store takes the form of the company paying the investors 200 = 0.5 (⎯100) + 0.5(500) and keeping all the profits for himself.

The Drawbacks are:

1. The company not be able to afford to pay the investors the flat price of Rs. 200 crore.

2. The company might not be risk averse and incur a heavy utility cost in bearing the entire risk.

ADVERTISEMENTS:

More public information through newspaper and media may hurt the company and the manager.

Under the optimal contract:

ADVERTISEMENTS:

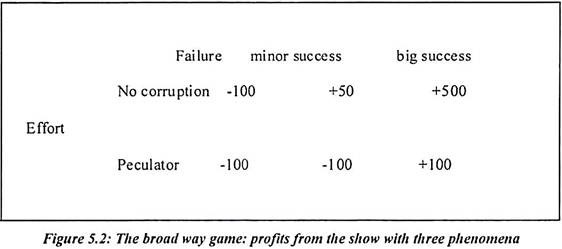

Because only the datum q = + 100 is proof that the manager is corrupted when the information set is refined. Therefore before the agent takes his action both he and the principal can tell whether the show will be a big success or not. If the company would find the investment profitable even if he knew in advance that the show would not be a big success, the refinement does not help him. It changes the behavior of the manager, however, because on observing {failure, minor success} manager is free to corrupt without four of the boiling-in-oil output of + 100.

He would still refrain from corrupting, if he observed {big success} but contract can make the manager not corrupt if he observes {failure, minor success}. If the parameters were such that the company needs the returns from minor successes to cross the break-even point. Therefore company would not make the investment in the first place were the information sets refined and the gains from trade would be lost.