We are considering the example of manager and salesman in this article. The manager of a company tells his salesman to investigate a potential customer, who is either a pushover or a windfall. If customers are pushover, the efficient sales effort is low and sales should be moderate. If customers are windfall, the effort and sales should be higher. In the salesman game, the players are manager and salesman. The information is asymmetric, complete and uncertain. The manager is uninformed in this game.

The actions and the events are explained as follows:

1. The manager offers the salesman, a contract of the form w (q, m), where q is sales and m is a message.

2. The salesman decides whether or not to accept the contract.

ADVERTISEMENTS:

3. Nature chooses whether the customer is a windfall or a pushover with probability 0.2 and 0.8. Denote the state variable “customer status” by θ. The salesman observes the state, but the manager does not.

4. If the salesman has accepted the contract he chooses his sales level q, which implies measures his effort. The payoff is explained as, if the salesman rejects the contract, his payoff is = 8 and the manager’s is zero. If he accepts the contract, the ∏ manager = q ⎯ w.

The profit for the salesman 1 explained as follows:

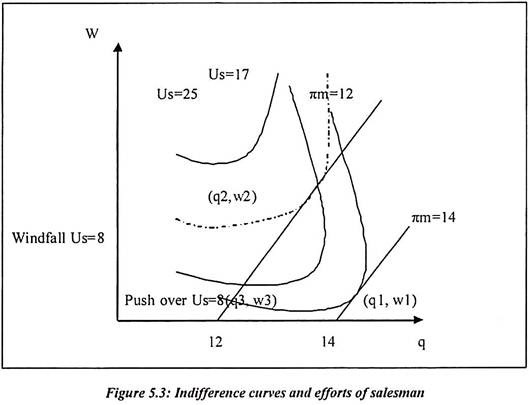

In the following diagram, the manager’s indifference curves are straight lines with slope ⎯1. This is because manager is acting on-behalf of a risk-neutral company. Suppose the wage and the quantities both raise by a rupee, profits are unchanged. The profits do not depend directly on whether θ takes the value pushover or windfall. The salesman’s indifference curves also slope upwards. This is because he must receive a higher wage to compensate for the extra effort. They are convex because the marginal utility of rupee is decreasing and the marginal disutility of effort is increasing.

The salesman has two sets of indifference curves. The solid lines are pushovers and dotted lines are windfall. Because of the participation constraint, the manager must provide the salesman with a contract giving him at least his reservation utility of 8, which is the same in both state.

In windfall, the manager would like to offer a contract that leaves the salesman on the dotted indifference curve U = 8 and the efficient outcome is (q2, w2) the point where the salesman’s indifference curve is tangent to one of the manager’s indifference curves. At that point, if the salesman sells an extra rupee he requires an extra rupee of compensation. If it were common knowledge that the customer was a windfall, the principal could choose w2 so that u (q2, w2, windfall) = 8 and offer the forcing contract.

The salesman would accept the contract and he will choose q ⎯ q2. But if the customer were actually a pushover, the salesman would still choose q = q2, an inefficient outcome that does not maximize profits. At this point, profits would be not maximized because the salesman achieves a utility of it and he would be willing to work for less.

The revelation principal says that in searching for the optimal contract that induce the agent to truthfully reveal what kind of customer that salesman faces. If he required more effort to sell any quantity to the windfall, then the salesman would always want the manager to believe that he faced a windfall to extract the extra pay necessary to achieve a utility of 8. The only optimal truth telling contract is the pooling contract. It pays the intermediate wage of w3 for the intermediate quantity of q3 and zero for any other quantity. The message is not important at this point.

The pooling contract is a second best contract. It is a compromise between the optimum for pushovers and the optimum for windfall. The point (q3, w3) is closer to (q1, w1) than to (q2, w2 ). This is because the probability of a pushover is higher and the contract must satisfy the participation constraints.

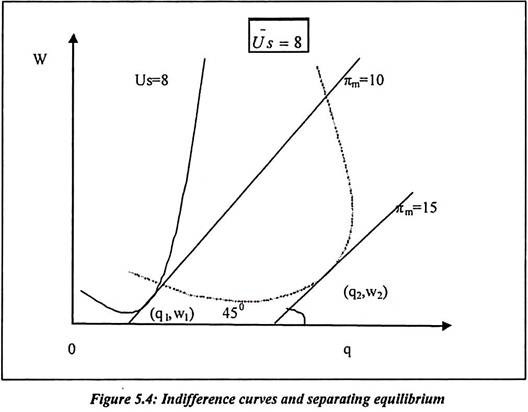

The nature of the equilibrium depends on the shapes of the indifference curves. It is shown in figure below. The equilibrium in this diagram is separating not pooling.

Indifference Curves for a Separating Equilibrium:

Revelation principal that narrow attention to contracts that induce the salesman to tell the truth. In the above diagram, an indifference curve induces the salesman to be truthful. The incentive compatibility constraint is satisfied. Suppose the customer is windfall, but the salesman claims to observe a pushover and chooses q1, salesman’s utility is less than 8. It is because the point (q1, w1) lies below the U̅ = 8 indifference curve.

If the customer is a pushover and the salesman claims to observe a windfall, then although (q2, w2) does yield the salesman a higher wage than (q1, w1) the extra income is not worth the extra efforts, because (q2, w2) is far below the indifference curve U = 8.The salesman game either a pooling or a separating equilibrium. It depends on the utility function of the salesman. The revelation principal can be applied to avoid having to consider contracts. In such contract the manager must interpret the salesman’s lies.