The upcoming discussion will update you about the relationship between saving and investment.

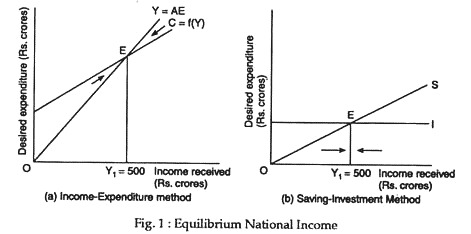

Incomes are generated by production and the economic system is said to be in equilibrium when all the incomes earned are returned to the income flow through spending. Keynes’ income-expenditure analysis focuses on the relationship between aggregate expenditures and income.

In a two-sector model, equilibrium occurs when income received equals aggregated desired expenditures (i.e., Y = C + I). An alternative way of describing how national income is determined is to focus on saving and investment. Here, we consider a simple situation in which all income is disposable income.

This happens when we assume that taxes are zero and all of a firm’s profits are paid out as dividends. And in a simple 2-sector economy, with no government or foreign trade, we assume that there are no government savings or dis-savings, or flow of funds from abroad.

ADVERTISEMENTS:

This simple model system is affected by the existence of two complicating factors — saving and investment. Saving is that part of income which is not consumed and therefore not passed on in the income flow. Investment is the process of capital formation plus addition to stocks and therefore is an addition to the income flow.

The main reason for the apparent paradox in the above two statements is that both terms, savings and investment, are defined differently in each statement.

When Keynes stated that saving was always equal to investment he was referred to actual or realised saving and actual or realised investment.

The income obtained from the production of the national output is distributed to the various factors of production employed in the production process and so national income and national output are always and necessarily equal. They are merely the same thing looked at in two different ways.

ADVERTISEMENTS:

The output produced will be either for current use or will be added to the country’s stock of investment goods. The income earned will either be used for consumption purposes or saved. As aggregate output and income are always equal and consumption is identical in both places, the rest of the equation must also be equal or Y = C + I and Q = GNP = C + S and if Y = Q, C + S = C + I or S = I.

So, in Keynes’ simple 2-sector demand-determined model individuals can either spend their income today or save it, either to consume later or to leave as a bequest to their children.

This is true by definition:

income = consumption + saving . . . (1)

ADVERTISEMENTS:

With no government purchases or net exports, the components of aggregate expenditures that firms can produce only two kinds of goods: consumer goods and investment goods.

Thus, output Y can be broken into two components:

Y = consumption + investment . . . (2)

These two identities can be combined to form a new one. Since the value of national output equals national income

Y = income . . . (3)

We can use tire right-hand side of (1) and (2) to get:

Consumption + savings = Consumption + investment . . . (4)

By subtracting consumption from both sides of the equation, we get:

Saving = investment . . . (5)

ADVERTISEMENTS:

In short, saving must equal investment. This is a simple matter of definition and is known as saving-investment equality (identity).

The simplest way to understand this identity is to think of firms as producing a certain amount of goods, the value of which is just equal to the income received by all individuals in the economy (here the entire sales revenue of firms is paid out as income to factor-suppliers). That portion of national income which is not spend on consumption goods is saved. On the output side, firms either sell the goods they produce or put them into inventory, for future sale.

Some of the inventories business firms hold is planned (desired), because businesses require inventories to survive (i.e., because production and sales do not coincide). Some of it is unplanned (undesired) — business may be surprised by a brief recession that spoils their sales forecasts. Both intended and unintended inventory build ups are considered investment.

The goods that are not demanded by consumers are, by definition, demanded by business firms, i.e., are invested. (In fact, investment is the demand for capital goods). After all, inventory accumulation consists of goods that are produced not for current consumption but presumably for future consumption.

ADVERTISEMENTS:

The above identity (5) can now be transformed into an equation determining national income, once we recognise that in equilibrium firms will cut back production if there is unintended inventory accumulation.

Since firms will reduce output, in equilibrium the amount companies invest in the amount they wish to invest (including inventories), given current market conditions. (That is, in equilibrium, firms do not suffer unpleasant surprises). The equilibrium condition theory is that

investment = desired investment . . . (6)

Now, let us switch over to the savings side of the identity (5). The Keynesian short-run consumption function tells us how much people will wish to consume at each level of income. But since saving is a residue (i.e., what is not consumed is automatically saved), the consumption function can easily be transformed into a saving function, given the level of saving at each level of income.

ADVERTISEMENTS:

Saving is just income minus consumption:

saving = income (Y) – consumption (c) . . . (7)

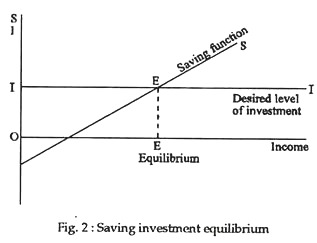

Fig. 1 shows the saving function. The slope of this curve, the amount by which saving increases as income rises, is the MPS which is 1 – MPC.

Since saving must equal investment, and in equilibrium investment must equal desired investment, then in equilibrium

saving = desired investment . . . (8)

ADVERTISEMENTS:

The Fig. 2 shows a fixed level of desired investment (7). The desired investment function is horizontal because in Keynes’ model all investment is autonomous, i.e., is assumed to be independent of national income. National income equilibrium occurs at point E where the desired saving function intersects the desired investment function.

Thus, in the words of Samuelson, “investment calls the tune and consumption dances to the music. Investment determines output, while saving responds precisely to income changes. Output rises or falls until planned saving has adjusted to the level of planned investment”.

Therefore, we observe that actual (ex-post) saving is always equal to actual (ex-post) investment. But planned or desired (ex-ante) saving is equal to planned or desired (ex-ante) investment only when national income is in equilibrium.

When we talk of saving and investment being equal, we are referring to the observed behaviour of an economy; a study of what has actually happened or what has been realised. But the Keynesian analysis of income determination revolves around the intended nature of such variables as saving and investment. These plans to save and invest lead to changes in the income flow, with different equilibrium levels being reached.

Decisions to save and invest are constantly being made by different groups of people at different times and for different reasons. So there is very little chance of these plans being equal to each other within the same time period.

ADVERTISEMENTS:

When any discrepancy between the plans to save and invest occurs a change in the level of income brings about a state of disequilibrium, and as income continues to change so do these plans get readjusted until a level of income is reached where planned saving and investment are once more equal to each other.

It is only then that equilibrium has been attained where there is no tendency for the level of income and employment to alter. This process is facilitated by a multiplied change in income which operates both in an upward and in a downward direction.

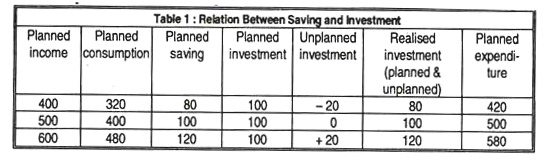

A simple numerical example may clarify the above:

The table gives a consumption function, from which saving plans can be obtained. Assuming that planned investment is autonomous and that all household plans are realised, an equilibrium level of income can be calculated.

When income is 500 the consumption schedule indicates that 400 will be consumed, leaving the remainder (100) to be saved. At this level of income autonomous planned investment is 100, thereby bringing total planned expenditure (consumption + investment) equal to the level of output (or income). With planned saving and investment being equal, the economy is in a state of equilibrium — there are no forces at work changing the level of output or income.

ADVERTISEMENTS:

However, at the higher level of income (600) planned saving exceeds planned investment resulting in planned expenditure failing below planned income. As the rate of production exceeds the rate of sales by 20 the level of stock will rise thereby resulting in a rise in unplanned investment.

Any stock changes are regarded as changes in investment. At this stage, realised investment, made up of planned and unplanned investment, will still be equal to realised saving, but the discrepancy between the intentions of savers and investors will result in the level of income falling back until it reaches the equilibrium level of 500.

An exactly opposite process will work itself out if actual income falls below its equilibrium value. If income were 400 the consumption schedule would indicate that 320 would be consumed and 80 saved. With planned investment exceeding planned saving, planned expenditure would exceed planned income resulting in a fall in the value of stocks (inventories). The fall in stocks can be regarded as unplanned disinvestment, giving a realised investment figure of (100 – 20) = 80 (which is the same as realised savings).