The traditional theory laid down diversification as a technique of selection of securities in a portfolio. This is called “Random diversification” or “Simple diversification,” on the basis of straight rule of “two is a better than one.” Simple diversification on Random basis was found to be more remunerative by researchers and the number of scrips in a portfolio of individuals is to be around 10-15 securities.

Rational basis of why diversification and how to achieve optimal diversification were studied by later researchers, of which Markowitz is reputed to be the pioneer. “Naive diversification” or “Superfluous diversification” may result from indiscriminate selection of securities, which does not lead to any reduction of risk. Thus, cycle and tubes are related industries and one invests in those two types of industries which are highly correlated in a positive manner, the risk will be increased by diversification rather than reducing. Naive diversification thus means that diversification in name only which does not reduce the risk.

Thus, an investor may have 10 scrips in steel, mini steel and ferrous metals, which will only increase risk. But an investor having 10 scrips spread in cycles, electronics, sugar, steel, auto, etc., will have less risk as these industries are not auto correlated and their risks are independent of each other or even negatively related.

It is thus left to Markowitz and later researchers to show that diversification is a tool to reduce unsystematic risk and how it can be reduced by a study of variances and covariances of securities return, as against the market returns.

Need for Diversification:

ADVERTISEMENTS:

It is never prudent to put all ones’ eggs in one basket, as it may lead to total ruin if the basket itself is broken or lost. The human behaviour is normally risk averse which means that for psychological reasons, he distributes his assets in a variety of risk classes, some in cash, some in bank deposits, insurance, provident fund, pension fund etc. These are all examples of the normal human behaviour of diversifying the asset holdings to reduce risk, provide for contingency and take all precautions against total loss.

(a) Thus, the average investor never puts all his savings in one form or in one security for self-protection and for psychological reasons.

(b) Money kept idle or in some investments which do not give adequate return will be a loss to investor, as he loses the value of money over time. By logic of common sense, investors try to satisfy most of their objectives of savings by putting money in various avenues and that means diversification. The various objectives are income, capital appreciation, safety, marketability, contingency, liquidity and hedge against inflation and for future provision of larger incomes. His choice of investments will cater to these requirements which lead to diversification of investments.

Even without the theoretical basis of covering or reducing the unsystematic diversifiable risk, the investor in the traditional Theory used to adopt some methods of Diversification.

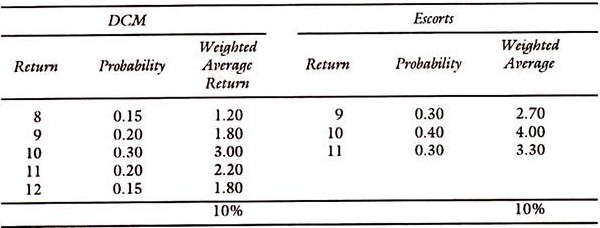

Example on Measurement of Risk:

ADVERTISEMENTS:

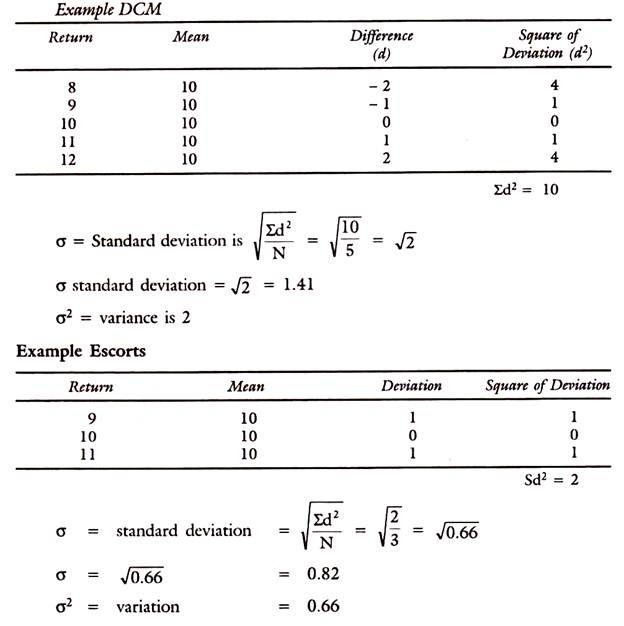

Calculation of Standard Deviation and Variance:

As diversification is meant for reduction of risk, its measurement is relevant here.

Average return is the same in both cases but risk is different. DCM has a range of variation from 8% to 12% while the escorts have a variation from 9 to 11.

ADVERTISEMENTS:

Calculation of Standard Deviation:

Risk on the Escorts is lower in the above example, referred to above.

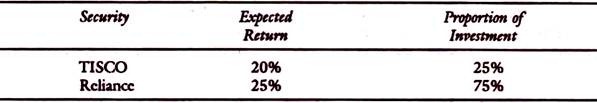

Example of Simple Diversification:

Take two securities of TISCO and Reliance

The return on the portfolio by combining them would be Rp = W1R1 + W2R2 (Rs. are returns) where W1 and W2 are weights of two investments.

Rp = 0.20 (.25) + 0.25 (0.75)

5% + 18.75% = 23.75%

ADVERTISEMENTS:

Here no consideration is given for risk and covariance of risk among the securities, invested in the portfolio. This can be demonstrated by taking an example of Markowitz diversification.

Markowitz Diversification:

Before discussing the Markowitz diversification, what the researches of investors and investment analysts have found has to be set out briefly. Firstly, they found that putting all eggs in one basket is bad and most risky. Secondly, there should be adequate diversification of investment into various securities as that will spread the risk and reduce it; if the number of them say 10 to 15 is adequate to enjoy the economies of time, scale of operations and expertise utilised by the investor in their analysis.

Reference was already made to have diversification, which is a spread of investments into many securities but will not reduce the risk, like buying ten securities all in the shipping industry, which is risky industry in itself. Besides some researchers have found that there is an optimisation process for diversification to reduce the unsystematic or company related risk by choosing such companies which are not closely related or not owned by the same family group in the same industry group. This optimisation process also leads to an investment in 10-15 companies well chosen for differences in their characteristics, nature of the product market, pattern of production etc.

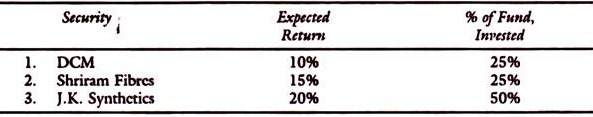

Example:

ADVERTISEMENTS:

What is the expected return of a portfolio, comprising of the following securities:

Rp = W1R1 + W2 R2 + W, R,

Rs are expected returns and Ws are weights

ADVERTISEMENTS:

Rp = (10 x 0.25) + 15 (0.25) + 20 (0.50)

= 2.5 + 3.75 + 10.0 = 16.25%