Agricultural finance and marketing needs of the farmers can be examined from two different angles:

(i) On the basis of time and

(ii) On the basis of purpose.

On the Basis of Time:

ADVERTISEMENTS:

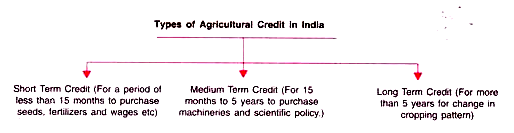

The needs of the farmers can be classified into three categories on the basis of time:

(i) Short term.

(ii) Medium term, and

(iii) Long term.

ADVERTISEMENTS:

Short-term loans are required for the purchase of seeds, fertilizers, pesticides, feeds on fodder of livestock, marketing of agricultural produce, payment of wages of hired labour are classified according to the use and kind of application as insecticides, fungicides, herbicides and other pesticides.

Insecticides account for the major share of pesticides consumption in India that includes both preventive treatments, which are applied before infestation levels are known, a implementation treatments which are based on monitored infestation levels and expected crop damages. The use of pesticides in Indian agriculture was negligible in early 1950s with only 100 tones of pesticides being consumed at the beginning of the first adoption of the new agriculture strategy in mid-1960.

The use of pesticides increased considerably as the new varieties are more prone to attack by pests am insects. The pesticides application in 1970-71 stood at about 24.3 thousand tones. Consumption of pesticides (technical grade material) stood at 41 thousand tones for unproductive purposes.

Period of such loans are up to 15 months. Agencies for granting such loans a the moneylenders and cooperative societies. Medium-term loans are obtained for the purchase of cattle, small agricultural implements, repair and construction of wells etc. The period of such loans extends from 15 months to 5 years. These loans are generally provided by money-lenders, relatives of farmers, cooperative societies and commercial banks.

ADVERTISEMENTS:

Long-term loans are required for effecting] permanent improvement on land, digging tube wells,’ purchase of larger agriculture implements and’ machinery like tractors, harvesters etc. and repayment; of old debts. The period of such loans extends beyond; 5 years. Such loans are normally taken from Primary Cooperative Agricultural and Rural Development Banks (PCARDBS).

On the Basis of Purpose:

Agricultural credit needs of the farmers can be classified on the basis of purpose into the following categories:

(i) Productive:

(ii) Consumption needs and;

(iii) Unproductive.

(i) Under productive needs we can include all credit requirements which directly affect agricultural productivity. Farmers need loans for the purchase of seeds, fertilizers, manures, agricultural implements, livestock, digging and repair of wells and tube wells, payment of wage, effecting permanent improvements on land, marketing of agricultural produce, etc. Repayment of these loans is generally not difficult because the very process of production generally creates the withdrawal for repayments.

(ii) Farmers often require loans for consumption as well. Institutional credit agencies do not provide loan for consumption purpose. Therefore farmers stretch their hand towards the moneylenders.

(iii) Loans are taken for unproductive purposes such as litigation, marriages, social ceremonies on birth and death of a family member, religious functions, festivals etc. Farmers take loans from Mahajans since institutional credit agencies do not give such loans.

ADVERTISEMENTS:

Sources of Agricultural Finance:

This can be divided into two categories:

(i) Non-institutional sources.

(ii) Institutional sources

ADVERTISEMENTS:

(i) Non-Institutional sources are the following:

(a) Moneylenders

(b) Relatives

(c) Traders

ADVERTISEMENTS:

(d) Commission agents

(e) Landlords

(ii) Institutional sources:

(a) Cooperatives

(b) Scheduled Commercial Banks

(c) Regional Rural Banks (RRBs)

ADVERTISEMENTS:

(a) Co operatives:

(i) Primary Agricultural Cooperative Societies (PACSs) provide short and medium term loans.

(ii) PCARDBs provide long term loan for agriculture.

(b) Commercial banks, including RRBs, provide both short and medium term loans for agriculture and allied activities.

The National Bank for Agriculture and Rural Development (NABARD) is the apex institution at the national level for agriculture credit and provides assistance to the agenciesmentioned above. The Reserve Bank of India plays a crucial role in this sphere by giving overall direction to rural credit and financial support to NABARD for its operations.

At the time of Independence the most important source of agricultural credit were the moneylenders. In 1951 (the year when planning was initiated in the country) moneylenders accounted for as much as 71.6 per cent of rural credit. This was because there was no other source or from where the farmers could borrow money.

ADVERTISEMENTS:

Hence the moneylenders exploited the poor farmers. Thus, they used to charge exorbitant interest for their loans. The moneylenders used to manipulate their accounts and force the farmers to sell their produce to them at low price. The government has therefore undertaken various steps to regulate the activities of the moneylenders.

The most important move was to free the agriculturists from the clutches of the money lenders and the expansion of institutional credit to agriculture.

The Government has helped the cooperatives in a number of ways to expand their operations:

I. 14 major commercial banks were nationalised in 1969.

II. 6 more banks were nationalised in 1980.

III. In 1975 an institution was established by the government to meet the requirements of rural credit – Regional Rural Bank (RRBs).

ADVERTISEMENTS:

IV. In July 1982 National Bank for Agriculture and Rural Development (NABARD) was set up.

V. India now has a wide network of rural finance institution (RFI).

As a result of this massive expansion of RFIs their participation in rural credit has increased significantly while that of moneylenders has declined. Non- institutional sources of agriculture credit still remain and they offer credit at high rates of interest specially in case of unproductive purposes.

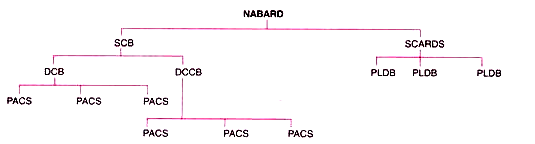

i. NABARD provides re-finance facilities to SCB, SCARDB, PACS, is PLDBs etc.

The flow of fund from NABARD to all of then-shown in the flow chart below:

Cooperative Credit Societies:

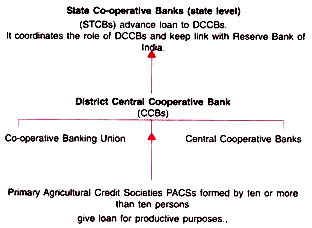

The rural co-operative credit institutions in India have been organised into short-term and long-term structures. The short-term co-operative structure is based on three-tier structures, except the states in the northeast region. At the lowest tier are the Primary Agricultural Credit Societies (PACSs). These are organised at the village level. At the second tier and District Central Cooperative Banks (DCCBs) organised at the district level. At the third and uppermost tier are the State Co-operative Banks (STCBs) organised at the state level state Co-operative Banks (state level).

To cater to long-term loans long-term credit cooperatives have been set up.

These are organised at two levels and categorized into four types:

(i) The unitary structure in which Stat Cooperative Agricultural and Rural Development Banks (SCARDBs) operate at the state level.

(ii) The federal structure in which Primary Cooperative Agricultural and Rural Developments Banks (PCARDBs) operate as independent units at the primary level and federate themselves into SCARDBS at the state level.

(iii) The mixed structure wherein both the unitary and federal types operate in one form or another.

(iv) The integrated structure where no separate Agricultural and rural development banks exist and the long-term credit business is undertaken by the long-term section of the StCBs concerned.

Commercial Banks:

In fact up to 1970 the government policy was to depend entirely on the cooperative banks as a major source of institutional credit in rural areas. Government felt that Cooperative Bank alone cannot meet the growing demand. Therefore Govt, policy changed and a number of institutions were developed to give rural credit. In 1969, 14 major banks were nationalised.

In 1980, six more banks were nationalised. In 2004, the number of total branches had shot up to 67062, of this 32,200 in rural areas. Despite the achievement of the commercial banks in the field of rural creditmentioned above, their performance and operations have invited a lot of criticism.

Regional Rural Banks:

The Working Group on Rural Banks (1975) recommended the establishment of Regional Rural Bank (RRBs) to supplement the efforts of the commercial banks and the cooperatives in extending credit to weaker sections of the rural community, small and marginal farmers, landless labourers, artisan and other rural residents of small means.

The intention in having these new banks was that there should, in the Indian context, be an institutional device which combined the local feel and familiarity with the rural problems which the cooperatives possessed and the degree of business organisation and modernised outlook which the commercial banks had, with a view to reaching the rural poor more extensively.

Consequent upon the recommendations of the Working Group, 5 RRBs were initially set up in 1975. Their number later rose to 196. In 2003-04, RRBs provided Rs. 7,581 crores as credit to the agricultural sector. This was 8.7% of total institutional credit to agriculture in that year.

National Bank for Agriculture and Rural Development (NABARD):

The most important development in the field of rural credit has been the setting up of the National Bank for Agriculture and Rural Development (NABARD) in July 1982. It took over from Reserve Bank of India all the functions that the latter performed in the field of rural credit. NABARD is now the open bank for rural credit.

Functions of NABARD (1982):

The main functions of NABARD are as follows:

(1) It works as an open body to look after the credit requirement of the rural sector.

(2) It has authority to oversee the functioning of ‘the cooperative sector through its Agricultural Credit Department.

(3) It provides short-term credit (up to 18 months) to State Cooperative Banks for seasonal agricultural operation (crop loans), marketing of crops, purchase and distribution of fertilizers and working capital requirements of cooperative sugar factories.

(4) It provides medium-term credit (18 months to 7 years) to State Co-operative Banks and RRBs for agricultural purposes purchase of shares of processing societies and conversion of short- term crop loans into medium term loans in areas affected by natural calamities.

(5) It provides medium and long-term credit (not exceeding 25 years) for investment in agriculture under schematic lending to State Cooperative Banks, Land Development Banks, RRBs and commercial banks.

(6) It provides long-term assistance in the form of loans to state governments (not exceeding 20 years) for contribution to share capital of cooperative credit institutions.

(7) It has been entrusted with the responsibility of inspecting District and State Cooperative Banks and RRBs. The inspection of State Land Development Banks and other Federation Cooperative are undertaken on a voluntary basis.

(8) It maintains a research and development fund to be used to promote research in agriculture and rural development so that projects and programmes can be formulated and designed to suit the requirement of different areas.

NABARD and Rural Credit:

It is an apex institution in the field of rural credit. Therefore it does not deal directly with farmers and other rural people. It grants credit to them through the cooperative banks, commercial banks, RRBs.

(1) NABARD provides two types of refinance. The first is extended to RRBs, and apex institutions, namely StCBs and State governments. The other type of refinance is extended to augment resources for ground level deployment of rural credit.

During 2000-04, the NABARD’s refinance policy on short term SAO (Seasonal Agricultural Operations) for co-operative banks and RRBs laid emphasis on augmentation of the ground level credit flow through adoption of region- specific strategies and rationalisation of lending policies and procedure.

(2) Rural Infrastructure Development Fund (RIDF) was established in 1995-96 with a corpus of Rs 2000 crore with the major objective of providing funds to state governments and state- owned corporations to enable them to complete various types of rural infrastructure projects.

Loans under RIDF are given for various purposes like irrigation projects, watershed management, construction of rural roads and bridges etc.

(3) The access to credit for the poor from conventional banking is often constrained by lack of collaterals, information asymmetry and high transaction cost associated with small borrowed accounts. Micro finance has emerged as a liable alternative to reach the hitherto reached for their social and economic empowerment through social and financial intermediation, it involves provision of thrift, credit and other financial services and products of very small amounts to the poor for enabling them to raise their income levels and thereby improve living standards.

In operational terms, micro credit involves small loans, up to Rs 25,000, extended to the poor without any collateral for undertaking self-employment project. Such loans are provided through Micro Finance Institutions (MFIs). One of the most popular models of MFI has been the Grameen Bank model, developed originally in Bangladesh and replicated in various parts of the world. Under this model, Non-Government Organisations (NGOs) form and develop self- help groups (SHGs) and provide credit to them.

(4) Kissan Credit Scheme was established in 1998- 99 to facilitate short-term credit to farmers.

(5) Credit Monitoring Arrangement is established with a view to providing to operative banks with more freedom and discretion to operate in an increasingly liberalised and competitive banking environment. NABARD, start in consultation with the Reserve Bank, decided to start the Credit Authorisation Scheme (CAS) with the Credit Monitoring Arrangement (CMA) with effect from the year 2000-2001.

(6) Cooperative Development Fund (CDF) was set up in 1993 with the objective of strengthening the cooperative credit institutions in the areas of organisational structure, human resource development, resource mobilisation, recovery position etc. The assistance is provided to StCBs/SCARDBs/ CCBs)/PCARDBs by way of grant or loan or both.

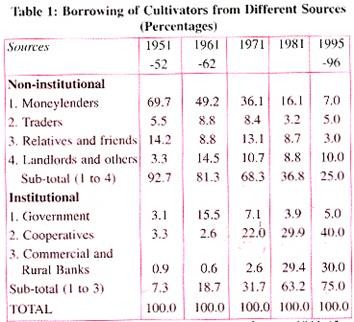

The following Table shows the contribution of these different sources to the total agricultural credit in India since 1951-52 to 1996.

It can be revealed from the above table that among all the different non-institutional sources the contribution of moneylenders was highest and that was to the extent of 69.7%. However, its contribution gradually came down to 49.2% in 1961-62 and then to 7% in 1996. Total contribution of non-institutional source towards agricultural credit has gradually declined from 92.7% in 1951-52 to 25% in 1996.

The share of institutional sources to the total agricultural credit which was 7.3% in 1951-52 gradually increased’ to 18.7% in 1961-62 and then to 75% in 1996. Out of these institutional sources cooperatives contributed 40% and commercial banks contributed 30% of the total farm credit in 1996. Although the share of non- institutional sources in the rural areas decreased but still remained very important in supplying credit to the farmers.

The most important development in the field of rural credit is. the setting up of NABARD in July, 1982. This is an apex bank which coordinates the functioning of different financial institutions working for the expansion of the rural credit. It is run by a Board of Directors headed by a chairman.

So far as the supply of credit to agriculture and to rural industries is concerned, this bank performs all the functions including short, medium and long-term refinancing that were previously performed by the Reserve Bank of India. The paid up capital of NABARD is wholly subscribed by the Central Government and the RBI.

The NABARD played an important role in solving the problem of rural indebtedness in India. This aspect would be clear if we study the functions of NABARD, and the overall impact of all activities on Indian agriculture.