In the long run the cost and revenue curves of the monopolist may shift due to various reasons — product or process innovation, imposition of a tax or provision of subsidy. We may first consider the effect of a change in demand. Change in demand may be of two types: short run and long run.

Changes in demand:

Short-run shifts of demand for the product of the monopolist do not always pay the monopolist to vary the price in response to such shifts. But long-run (permanent) shifts in demand are likely to have some notable consequences.

In our discussion on the absence of a supply curve under monopoly, we noted that a rise in demand need not always cause an increase in a monopolist’s price and output, even in the short run. If, however, there is sufficient change in the elasticity of demand for the product of the monopolist, it is quite possible for a rise in demand to cause a fall either in price or in output.

ADVERTISEMENTS:

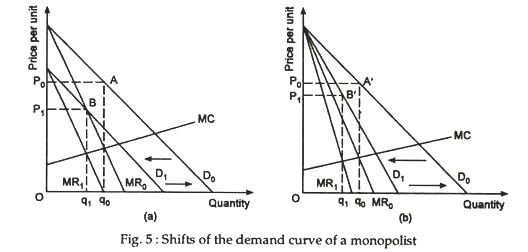

Two possibilities are considered in Fig. 5. In panel (i), there is a parallel rightward (from D1 to D0) or leftward (from D0 to D1) shift of the demand curve, with its slope remaining unchanged. In panel (ii), the demand curve becomes flatter (by rotating anticlockwise from D0 to D1. In both the panels of Fig. 5, we observe one thing clearly: both price and quantity rise when demand rises and both fall when demand falls.

The first case applies when a specific tax is imposed on or subsidy is paid to the buyers of the output of the monopolist. If a tax is imposed the demand curve shifts from D0 to D1. On the other hand, if a subsidy is paid to consumers of the monopolist’s product, the curve shifts from D1 to D0.

If a per-unit tax is imposed the demand curve shifts to the left (downward) exactly by the amount of the tax. So, the amount of the tax is increased by the vertical distance between the two demand curves (as shown by AB) in panel (i). Here, we see a parallel downward shift of the demand curve.

ADVERTISEMENTS:

This is due to the imposition of a specific tax on consumers. Here, every points on the demand curve D0 shifts to the left by the same amount. Exactly the opposite thing will happen if a fixed subsidy of BA is provided to consumers. The second case applies when, for some reason (such as change in the taste of consumers for the product of the monopolist), the total demand for the product of the monopolist increases.

If new customers start buying the product the market will expand. In panel (ii) we show the same percentage change in quantity demanded at each price. In other words, if the number of customers increases by 10%, the quantity demanded also increases by 10% at each price.

Changes in costs:

If there is a fall in marginal cost there will be a fall in price and an increase in the volume of production. This is exactly what happens in a competitive industry in the long run. But in monopoly output does not increase extent to which the monopolist produces more of the existing product by altering the size of the plant. If price falls consumers gain.

ADVERTISEMENTS:

The monopolist also gains because there is no long-run force to drive profits back to the original level (due to the existence of various entry barriers). So, the prediction is that “in monopoly, in both the short run and the long run, the effects of rising or falling costs are shared between the consumers in terms of price and output variations, and the firm, in terms of profit variations”.