In this article we will discuss about the quantity theory of money. Also learn about its criticisms and merits.

The relation between money supply and the general price level has been of interest even to classical economists. And, in order to show the relation between the two variables David Hume first tried to develop the quantity theory of money.

The theory points out that there is a direct relationship between the money supply and the general price level in an economy. However, the basic identity underlying the quantity theory was first developed by the great American economist Irving Fisher in 1911.

The Fisher equation — known as the quantity equation of exchange — is expressed as:

ADVERTISEMENTS:

MV = PT … (1)

where M is the stock of money in circulation; V is the velocity of circulation of money (i.e., the rate of money turnover or the average number of times each rupee changes hands in financing transactions during a year); P is the general price level; and, T is the number of transactions or the total volume of goods and services sold (or purchased) in the economy for period.

The above relationship given by equation (1) is true by definition because from national income accounting, we know that money expenditure on goods and services (MV) in a period must equal the money value of goods and services produced (FT). So the four terms are defined in such a way that the identity must hold.

However, the identity can be converted into testable equation by assuming that the velocity of circulation (V) and the volume of transactions (T) remain unchanged in the short run. This assumption makes enormous good sense. V depends on people’s spending behaviour.

ADVERTISEMENTS:

In the short run, there is unlikely to be any change in it. Likewise, in the short run gross national product is a constant figure. Thus, the volume of transactions which is equal to GNP by definition is also constant.

Cambridge economists like Alfred Marshall and A.C. Pigou reformulated the traditional quantity theory of money to emphasise the relationship between the stock of money in an economy (M) and national income (y).

The income velocity of circulation in the Cambridge equation is expressed as follows:

V = Y/M … (2)

ADVERTISEMENTS:

Here V is the average number of times the stock of money of an economy changes hands in financing the purchase of goods and services. A simple example-will make the point clear. We denote GNP by Y. Thus, if a country has a GNP of Rs 5,000 crore and an average stock of money (M) over a year is Rs 1,000 crore then V is 5.

Income velocity cannot be observed directly from national income statistics. It has to be calculated by using Y and M figure supplied by government organisations (such as the India’s Central Statistical Organisation or the RBI).

The term V in the Cambridge equation is different from V in Fisher’s traditional quantity theory of money.

The Fisher’s equation MV = PT can be rearranged as:

V = PT/M … (3)

Here T is the number of transactions per period and includes all transactions for real goods and services plus financial transactions. In the Cambridge equation, PT (where P = average price level) is replaced by Y which contains only those transactions which generate final income. This formulation permitted the Cambridge economists to emphasise real income (that is, final goods and services).

The classical economists argued that velocity of circulation was a constant figure. It is so because consumers have relatively constant spending habits and so turnover their money at a steady rate. This argument converts the identity (i.e., the quantity equation of exchange) into a hypothesis (i.e., the quantity theory of money) which expresses a relationship between the supply of money and the general price level. If V and T are constant, we get — P = (V/T) M, dividing both sides of equation (1) by T.

In the long run, real GNP, Y=T equals potential GNP. So if potential GNP and velocity are not influenced by the quantity of may, the relationship between the change in the price level (ΔP) and the change in the quantities of money (ΔM) is:

Δ P = (V/Y) ΔM

ADVERTISEMENTS:

Dividing this equation by the previous one [P = (V/T) M] we get:

Δ P/P = Δ M/M

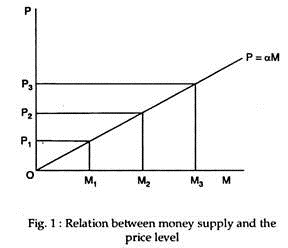

Here AP/P is the percentage increase in the price level and AM/M is the percentage increase in the quantity of money. So this equation is the quantity theory of money. In the long run, the percentage increase in the price level equals the percentage increase in the quality of money, as Fig.1 shows. It shows that P is proportional to M and α is the proportionality factor.

ADVERTISEMENTS:

In fact, the quantity theory of money seeks to establish proportional relationship between M and P at fixed point of time. Thus, ceteris paribus, if domestic money supply increases by 3%, the general price level will also move up by 3%. Thus, according to the quantity theory of money, inflation is always a monetary phenomenon.

Inflation is caused by an increase in money supply, with all other things remaining unchanged. Thus, the quantity theory explains inflation from the demand side. If M rises the aggregate demand for goods and services will also increase. So, too much money will be changing too few goods and the general price level will rise.

With V and T fixed, the price level is determined by the stock of money (M). Any increase in the supply of money immediately leads to an increase in the demand for goods and services (aggregate demand). It therefore follows that if the supply of M and hence aggregate demand increase over time faster than the supply (preservation) capacity of the economy (T), the result will be a rise in the general price level, P (inflation).

Criticisms of the Quantity Theory of Money:

The Quantity Theory of Money has been subjected to many criticisms.

ADVERTISEMENTS:

The important criticisms are stated below:

1. Truism:

Fisher’s Equation is a truism. All that it states is that the means of payment (MV) must equal the total payments actually made (PT).

2. Inactive Balance:

There are always inactive balances in an economy. Under Fisher’s formula, the price level depends upon the total quantity of money. But it is only a part of the total quantity of money which influences prices. There always exist inactive balances (hoards) which exert no pressure at all on the prices of goods and services. This is clearly seen during depression.

3. Unrealistic Assumption:

ADVERTISEMENTS:

The theory is based on unrealistic assumptions. The quantity equation cannot be used for analysing the effects of changes in M, or T, on the price level except on the assumption that, “other things remain constant”.

But in the case of monetary variables such an assumption cannot be made. When M changes, T and V both change. When T changes, M and V change. The net effect on the price level of a change in any of the variables of the quantity equation depends on how the other variables are simultaneously changed.

4. Lack of Dynamism:

The quantity equation does not show the process through which changes in the amount of money affect the price level. Keynes put great emphasis on the objection against the quantity equation. He observed that, “The fundamental problem of monetary theory is not merely to establish identities or statistical relations, but to treat the problem dynamically, analysing the different elements involved in such a manner as to exhibit the causal processes by which the price level is determined and the method of transition from one position of equilibrium to another.”

5. Full Employment:

The theory is based on the assumption of full employment. Increase in the quantity of money does not always increase prices. If there are unemployed resources an increase of money supply creates employment and does not raise prices.

ADVERTISEMENTS:

As Keynes points out the quantity theory is based on the assumption of full employment. He has pointed out that the quantity theory is inapplicable to a country which has unemployed resources (capital and labour not in use).

In such a country creation of more money will lead to more employment and greater production (greater supply of goods) and no change in the price level. Prices will change in proportion to money supply only when there is no scope for increasing production, i.e., when there are no unemployed resources in the economy.

6. Interrelationship among Variables:

Critics argued that all the factors in the equation of exchange are variables and statistical studies have shown that they are interrelated. Moreover, the line of causation is not always from M (money supply) to P (the price level).

It may be from V to P. A change in the rate of spending, all the other factors remaining the same, will result in a change in prices just as surely as would a change in the quantity of money in circulation. Or a change in T, other things remaining the same, will cause a change in prices.

So, it is difficult to accept the unqualified theory that changes in the quantity of money are always the causes of changes in the price level. Studies have shown that the price level cannot be easily and quickly controlled by changing the amount of money and credit available for the purchase of goods and services.

ADVERTISEMENTS:

The value of money determines the quantity of money. According to quantity theory, an increase in the supply of goods or T will cause a fall in the price level P. But under the present monetary and banking practices, an increase in the supply of goods almost always leads to an increase in the supply of money (through creation of credit and otherwise).

Therefore M depends on T; they are not independent variables. If this view is correct, the value of money is not determined by its quantity; on the contrary it is the value of money which determines its quantity.

As Crowther comments, “The modern tendency in economic thinking, in fact, is to discard the old notion of the quantity of money as a causative factor in the state of business and a determinant of the value of money and to regard it as a consequence”.

7. Other Causes of Inflation:

Prices may change and the value of money may vary for reasons entirely unconnected with the quantity of money.

Some examples are given below:

ADVERTISEMENTS:

(i) Changes in the level of efficiency wages may change costs of production and affect prices.

(ii) If increase of output occurs under conditions of diminishing returns, marginal costs will increase and prices will rise. Similarly, prices will fall if production goes on under conditions of increasing returns.

(iii) Increase and decrease of monopoly power will respectively increase and decrease prices.

(iv) Prices are affected by variations in effective demand or expenditure. Consumption expenditure and investment expenditure both vary as also the proportion between them.

8. Misleading Emphasis:

Finally, there is a misleading emphasis in the quantity theory. According to Crowther, the quantity theory puts a misleading emphasis on the importance of the quantity of money as the cause of price changes and pays to o much attention on the level of prices.

In the short run, these principles of the quantity theory are not in accord with facts. In actual life, the price level and volume of production move up and down in a cyclical fashion. There are times when production and prices are at a low level and times when they are at a high level. A period of low prices and low production is called ‘depression’ and a period of high prices and high production is called ‘prosperity’.

Low prices during depression are not caused by shortage of money, because in such times we find unused and unwanted money lying in banks; nor are high prices during prosperity caused by excess of money because we usually find a tightness in the money market in those times. So variations in the quantity of money do not cause short-period price changes, particularly those associated with trade cycles. The quantity theory is not an adequate explanation of these phenomena.

Merits of the Quantity Theory of Money:

From the above discussion it is clear that the quantity theory is inadequate and defective. It has, however, certain merits. Generally, we find that when money supply increases, the price level rises. For example, during 1939-45 in India there was a large increase in the volume of notes and bank advances. Consequently, the price level rose sharply.

Hence there is some relationship between the quantity of money and the value of money. In Samuelson’s view, the Quantity Theory can explain long-term price level trends. It cannot explain short-term price fluctuations.

He has also pointed out that the theory can explain hyper-inflation which occurs during war or emergency. It cannot explain normal peace-time inflation. The quantity theory states the relation not with absolute correctness but only approximately.

Conclusion:

In spite of all these criticisms the quantity theory is not entirely valueless. Economic history shows that periods of rising prices were periods when money supply was large, e.g., inflations after 1918 and during 1939-45. The quantity theory draws pointed attention to one important factor which causes price change, viz., the quantity of money.

It is admitted that the quantity formula, “hides many links in the chain of causation”, but it is undisputed that the formula gives us a rough and ready method of determining the effects of changes in the quantity of money and certain other factors influencing the price level. Robertson, therefore, calls the quantity theory, “a serviceable platitude”.

Prof. Milton Friedman believes that the quantity theory of money is true in its simple form. He believes that there is a proportionality between the quantity of money and the general price level in an economy. As he comments: ‘Inflation is always and everywhere a monetary phenomenon’.