A market structure comprises a number of interrelated features or characteristics of a market.

These features include number of buyers and sellers in the market, level and type of competition, degree of differentiation in products, and entry and exit of organizations from the market.

Among all these features, competition is the main characteristic of a market. It acts as a guide for organizations to react and take decisions in a particular situation. Therefore, market structures can be classified on the basis of degree of competition in a market.

Figure-1 shows different types of market structures on the basis of competition:

These different types of market structures (as shown in Figure-1).

1. Purely Competitive Market:

A purely competitive market is one in which there are a large number of independent buyers and sellers dealing in standardized products. In pure competition, the products are standardized because they are either identical to each other or homogenous. Moreover, the price of products is same in the entire market.

Therefore, buyers can purchase products from any seller as there is no difference in the price and quality of products of different sellers. Under pure competition, sellers cannot influence the market price of products. This is because if a seller increases the prices of its products, customers may switch to other sellers for getting products at lower price with the same quality.

On the other hand, if a seller decreases the prices of its products, then customers may become doubtful about the quality of products. Therefore, in pure competition, sellers act as price takers. In addition, in a purely competitive market, there are no legal, technological, financial, or other barriers for the entry and exit for organizations.

ADVERTISEMENTS:

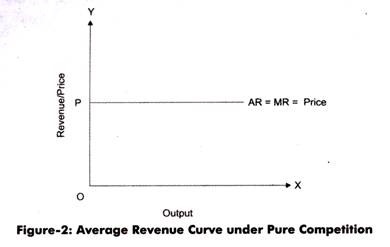

In pure competition, the average revenue curve or demand curve is represented by a horizontal straight line. This implies the homogeneity of products with fixed market price.

Figure-2 shows the average revenue curve under pure competition curve:

In Figure-2, OP is the price level at which a seller can sell any quantity of products at the fixed market price.

2. Perfectly Competitive Market:

In a purely competitive market, there are a large number of buyers and sellers dealing in homogenous products. A perfectly competitive market is a wider term than a purely competitive market. A perfectly competitive market is characterized by a situation when there is perfect competition in the market.

ADVERTISEMENTS:

Some of the definitions of perfect competition given by different economists are as follows:

According to Robinson perfect competition can be defined as, “When the number of firms being large, so that a change in the output of any of them has a negligible effect upon the total output of the commodity, the commodity is perfectly homogeneous in the sense that the buyers are alike in respect of their preferences (or indifference) between one firm and its rivals, then competition is perfect, and its rivals, then competition is perfect, and the elasticity of demand for the individual firm is infinite.”

According to Spencer, “Perfect competition is the name given to an industry or to a market characterized by a large number of buyers and sellers all engaged in the purchase and sale of a homogeneous commodity, with perfect knowledge, of market price and quantities, no discrimination and perfect mobility of resources.”

In the words of Prof. Leftwitch, “Perfect competition is a market in which there are many firms selling identical products with no firm large enough relative to the entire market to be able to influence market price.”

According to Bilas, “The perfect competition is characterized by the presence of many firms. The all sell identical products. The seller is a price taker, not price maker.”

In perfect competition, there are a large number of buyers and sellers in the market. However, these buyers and sellers cannot influence the market price by increasing or decreasing their purchases or output, respectively.

In addition to conditions implied in pure competition, perfect competition also involves certain other conditions, which are as follows:

i. Large Number of Buyers and Sellers:

ADVERTISEMENTS:

Refers to one of the primary conditions of perfect competition. In perfect competition, the number of buyers and sellers is very large. However, level of output produced by a seller or purchases made by a buyer are very less as compared to the total output or total purchase in an economy.

Therefore, under perfect competition, sellers and buyers cannot influence the market price. As a result, the market price remains unchanged, irrespective of any activity of buyers or sellers. Consequently, buyers and sellers are bound to follow the market price.

ii. Homogeneous Products:

Refer to another important characteristic of perfect competition. In perfect competition, all the organizations produce identical products having same quality and features. Therefore, a buyer is free to purchase the product from any seller in the market. Consequently, the sellers are required to keep the same price for the same product.

ADVERTISEMENTS:

iii. Free Entry and Exit:

Constitutes a significant feature of perfect competition. Under perfect competition, there are no legal, social, or technological barriers on the entry or exit of organizations. In the condition of perfect competition, all organizations earn normal profit. If the level of profit increases within a particular industry, then new organizations would be attracted toward the particular industry.

In such a case, the extra profit would be transferred to new organizations. On the contrary, if the total profit in an industry is normal, then some organizations may prefer to exit from the industry. However, if there are restrictions on the entry of new organizations, then the existing organizations may earn supernormal profit. Therefore, organizations would earn normal profits, if there are no restrictions on entry and exit.

iv. Perfect Knowledge:

ADVERTISEMENTS:

Implies that under perfect competition, buyers and sellers have perfect knowledge about the prices of products prevailing in the market. In such a case, when the sellers and buyers are fully aware about the current market price of a product, then none of them would sell or buy at a higher rate. As a result, the same price would prevail in the market.

v. Absence of Transport Cost:

Refers to one of the necessary condition for perfect competition. In perfect competition, the transportation cost is zero, so that the rule of same price can be applied. If transportation cost is present, then the prices of products would vary in different sectors of the market.

vi. Perfect Mobility of Factors of Production:

Helps organizations in regulating their supply with respect to demand, so that equilibrium can be maintained. This implies that the factors of production are free to move from one industry to another.

3. Imperfectly Competitive Market:

In economic terms, imperfect competition is a market situation under which the conditions necessary for perfect competition are not satisfied. In other words, imperfect competition can be defined as a type of market that is free from the stringent rules of perfect competition.

ADVERTISEMENTS:

Unlike perfect competition, imperfect competition is characterized by differentiated products. The concept of imperfect competition was firstly explained by an English economist, Joan Robinson.

In addition, under imperfect competition, buyers and sellers do not have any information related to the market as well as prices of goods and services. In imperfect competition, organizations dealing in products or services can influence the market prices of their output.

There are different forms of imperfect competition, which are shown in Figure-3:

The different forms of imperfect competition (as shown in Figure-3).

Monopoly:

The term monopoly has been derived from a Greek word Monopolian, which signifies a single seller. Monopoly refers to a market structure in which there is a single producer or seller that has a control on the entire market. This single seller deals in the products that have no close substitutes.

ADVERTISEMENTS:

Some of the definitions of monopoly given by different economists are as follows:

According to Prof. Thomas, “Broadly, the term monopoly is used to cover any effective price control, whether of supply or demand of services or goods; narrowly it is used to mean a combination of manufacturers or merchants to control the supply price of commodities or services.”

According to Prof. Chamberlain, “Monopoly refers to the control over supply.”

According to Robert Triffin, “Monopoly is a market situation in which the firm is independent of price changes in the product of each and every other firm.”

From aforementioned definitions, it can be concluded under monopoly the demand, supply, and prices of a product are under the direct control of the seller. In monopoly, the slope of the demand curve is downward to the right.

Following are the main features of the monopoly market structure:

ADVERTISEMENTS:

i. Single Seller:

Refers to the main feature of monopoly.Under monopoly market conditions, there is a single seller or producer of products. In such a case, buyers are not left with any other option; therefore, they are required to purchase from the only seller.

This leads to a full control of the seller on the supply of products in the market. In addition, under monopoly, the seller enjoys the power to decide the price of products. Therefore, in monopoly, there is no distinction between an organization and industry as one organization constitutes the whole industry.

ii. No Substitutes of the Product:

Implies that under monopoly, the seller deals in the product that is unique in nature and does not have close substitutes. The differentiation of products is absent in case of monopoly market.

iii. Barriers to Entry:

ADVERTISEMENTS:

Refers to the main cause of the existence of monopoly market. Under monopoly, there are a number of entry barriers that restrict the entry of new organizations. These barriers include exclusive resource ownership, copyrights, high initial investment, and other restrictions by government.

iv. Restriction on Information:

Implies that under monopoly, information is restricted to the organization and people working within the organization. This information is not available to others and can be transferred only in the form of copyrights and patents.

Monopoly is a condition that prevents the entry of new organizations in the existing market due to various prevailing barriers.

Some of the barriers to entry of new organizations are as follows:

i. Legal Restrictions:

Refer to barriers that are imposed by a government for public welfare. In India, postal, railways, electricity, and state roadways are the best examples of old monopolies. Earlier, in these industries, the entry of new organizations was restricted. However, after economic reforms of 1990s, the Government of India has allowed the entry of private sectors in these industries.

Besides this, the government also forms monopolies in private sectors by providing patents, trademarks, and copyrights to those private organizations that have capability of reducing prices to minimum. Such monopolies are termed as franchise monopolies.

ii. Resource Ownership:

Helps in sustaining the monopoly of an organization. Some of the organizations traditionally have control over the raw materials that are necessary for the production of specific goods, such as aluminum, bauxite, and diamond. Generally, such resources are limited in nature. Therefore, organizations that have acquired these resources attain monopoly in the industry.

For example, Iraq and Iran have monopoly on oil wells and South Africa has monopoly of diamonds. Such monopolies are termed as raw material monopolies. These monopolies can also arise due to specific knowledge about a technique of production. For example, Japan and China have monopoly in electronic goods industry.

iii. Efficiency in Production:

Arises as a result of a long-term experience, innovation capability, financial power, less marketing cost, managerial competence, and market finance accessibility at lower cost. Efficiency in production helps in lowering down the cost of production. Consequently, an organization achieves an edge over its competitors and attains monopoly in the industry. Such organizations also obtain support and protection from the government.

iv. Economies of Scale:

Refers to the technical reason for the existence of monopolies in an imperfect market. In case an organization finds an appropriate production scale at minimum cost in the long-run, then it would prefer to cut the prices of products in the short-run.

This helps an organization to eliminate competitors from the market and attain monopoly. When the organization attains monopoly, then it would be difficult for new organizations to enter and sustain in the industry. Such type of monopolies is termed as natural monopolies. Natural monopolies arise either due to technical situation of efficiency or are formed by a government for social welfare.

Monopolistic Competition:

The term monopolistic competition was given by Prof Edward H. Chamberlin of Harvard University in 1933 in his book Theory of Monopolistic Competition. We have discussed the concepts, perfect competition and monopoly. However, the real market situation is just the middle way between these two extreme market conditions.

The term monopolistic competition represents the combination of monopoly and perfect competition. Monopolistic competition refers to a market situation in which there are a large number of buyers and sellers of products. However, the product of each seller is different in one aspect or the other.

Some of the definitions of monopolistic competition given by different economists are as follows:

According to J.S. Bains, “Monopolistic competition is market structure where there is a large number of small sellers, selling differentiated but close substitute products.”

According to Baumol, “The term monopolistic competition refers to the market structure in which the sellers do have a monopoly (they are the only sellers) of their own product, but they are also subject to substantial competitive pressures from sellers of substitute products.”

Thus, under monopolistic competition, sellers deal in products having close substitutes. In monopolistic competition, the number of sellers is very large; therefore, it resembles perfect competition. On the hand, the products produced by the sellers in monopolistic competition are close, but not perfect substitutes of each other.

Thus, the product of every seller is unique, which is a feature of monopoly market. Therefore, it can be said that monopolistic competition is the integration of perfect competition and monopoly. Therefore, the characteristics of monopolistic competition are also the combination of perfect competition and monopoly.

Some of the characteristics of monopolistic competition are as follows:

i. Large Number of Sellers and Buyers:

Refers to one of the important characteristic of monopolistic competition. Similar to perfect competition, the size of sellers and buyers is also large in monopolistic competition.

ii. Differentiated Products:

Constitute the characteristic feature of monopolistic competition. Under monopolistic competition, the products of sellers are different in many respects, such as difference in brand, shape, color, style, trademarks, durability, and quality. Therefore, buyers can easily differentiate among the available products in more than one way. However, under monopolistic competition, products are close substitutes of each other.

iii. Free Entry and Exit:

Implies that under monopolistic competition there are no restrictions imposed on organizations for their entry and exit from the market. This is the same condition as prevailing under perfect competition.

iv. Restricted Mobility of Factors of Production:

Implies one of the crucial features of monopolistic competition. Under monopolistic competition, the factors of production as well as goods and services are not perfectly mobile. This is because if an organization is willing to move its factors of production or goods and services, it has to pay heavy transportation cost. This leads to difference in the prices of products of organizations.

v. Price Policy:

Affects the market prices of a product. Similar to monopoly, average and marginal revenue curves of an organization also slopes downward in case of monopolistic competition. This implies that an organization can sell more only in case it lowers down the prices of its products. On the other hand, under monopolistic competition, if the prices of products are higher, then the buyers would switch to other sellers due to close substitutability of products. In such a scenario, the organization would not be able to sell more. Therefore, organizations do not enjoy complete control over price in monopolistic competition.

Oligopoly:

The term oligopoly has been derived from two Greek words, oligoi means few and poly means control. Therefore, oligopoly refers to a market form in which there are few sellers dealing either in homogenous or differentiated products. In India, the aviation and telecommunication industries are the perfect example of oligopoly market form.

The aviation industry has only few airlines, such as Kingfisher, Air India, Spice Jet, and Indigo. On the other hand, there are few telecommunication services providers, including Airtel, Vodafone, MTS, Dolphin, and Idea. These sellers are closely interdependent to each other. This is because each seller formulates its own pricing policy by taking into account the pricing policies of other competitors existing in the market.

Some of the popular definitions of oligopoly are as follows:

In the words of Prof. George J. Stigler, “Oligopoly is a market situation in which a firm determines its marketing policies on the basis of expected behavior of close competitors.”

According to Prof. Stoneur and Hague, “Oligopoly is different from monopoly on one hand in which there is a single seller. On the other hand, it differs from perfect competition and monopolistic competition also in which there is a large number of sellers. In other words, while describing the concept of oligopoly, we include the concept of a small group of firms.”

According to Prof. Leftwitch, “Oligopoly is a market situation in which there is a small number of sellers and activities of every seller are important for others.”

In oligopoly market structure, the price and output decided by a seller affects the sales and profit of its competitors. This may either lead to a situation of conflict or cooperation among sellers.

The main characteristics of oligopoly are as follows:

i. Few Sellers and Many Buyers:

Refers to the primary feature of oligopoly. Under oligopoly, few sellers dominate the entire industry. These sellers influence the prices of each other. Moreover, in oligopoly, there are a large number of buyers.

ii. Homogeneous or Differentiated Products:

Implies another important characteristic of oligopoly. In oligopoly, organizations either produce homogenous products (similar to perfect competition) or differentiated products (as in case of monopoly). If organizations produce homogeneous products, such as cement, asphalt, concrete, and bricks, the industry is said to be pure or perfect oligopoly. On the other hand, in case of differentiated products, such as automobile, the industry is known as differentiated or imperfect oligopoly.

iii. Barriers in Entry and Exit:

Prevents the entry of new organizations. The barriers of entry and exit distinguish the oligopoly market from monopolistic competition. In oligopolistic market, new organizations cannot easily enter the market due to various legal, social, and technological barriers. In such a case, existing organizations have a complete control over the market.

iv. Mutual Interdependence:

Refers to one of the important characteristic of the oligopoly market structure. Mutual interdependence implies that organizations are influenced by each other’s decisions. These decisions include pricing and output decisions of organizations.

In monopoly and perfect competition, organizations do not take into consideration the decisions and reactions of other organizations, therefore, the decision of organizations in such types of market structures are independent. However, in oligopoly, an organization is not able to take an independent decision.

For example, in oligopoly, a few numbers of sellers compete with each other. In such a case, the sale of one organization depends on its own price of products as well as the price of competitor’s products. This mutual interdependence differentiates oligopoly from rest of the market structures

v. Lack of Uniformity:

Refers to another important characteristic of oligopoly. In oligopoly, organizations are not uniform in their sizes. Some organizations are very large in size while some of them are very small. For example, in small car segment, Maruti Udyog has the share of 86%, while Tata and Cielo have very low market share.

vi. Existence of Price Rigidity:

Implies that organizations do not prefer to change the prices of their products in oligopoly. This is because the change in price would not be profitable for an organization in oligopoly. In case, an organization reduces its price, its rivals also reduce prices, which adversely affect the profits of the organization. In case, the organization increases prices, it would lose buyers.