Let us make an in-depth study of the meaning, classification, price determination of demand and supply, and major classes of markets.

The Market:

Market is the key concept of this article. Moreover, it is perhaps the most important concept of microeconomics.

The term ‘market’ refers to “any kind of institutional arrangement whereby buyers and sellers communicate with each other to buy or sell a commodity.”

Perhaps the most important factor which influence a firm’s production decisions relate to characteristics of the market in which it operates.

ADVERTISEMENTS:

Economists find it useful to distinguish among market situations according to their competitiveness and the extent to which an individual firm has power to control the price at which it sells its product. This power depends on various factors, such as, the number of firms in the industry and their size relative to total consumer demand for the product, how far each firm sells a product which is individualistic (described as differentiated from those of its competitors) and whether there are any barriers to the entry of new firms into the industry.

A market consists of a group of buyers and sellers in sufficiently close contact with one another for exchange to take place among them. For some commodities, as for example, sugarcane, there are numerous more or less isolated markets. Buyers are in contact only with local producers, since transportation costs are so high relative to selling prices that the commodity cannot be shipped any substantial distance.

Thus, price and output are determined in a number of small markets, and total production of sugarcane is the sum of the amounts of output determined separately in each of the markets. In other industries, markets are nationwide; automobile manufacturers, for example, sell to dealers throughout the country and determine price and output on the basis of considerations relating to the entire economy.

Classification of Markets:

Market situations differ from one another primarily on the basis of the extent to which individual buyers and sellers can, by independent action, influence price. The extent of such influence, in turn, depends primarily upon four considerations the homogeneity of the product, the number of sellers, the number of buyers, and the extent of cooperative action or interdependence among the various buyers and sellers.

ADVERTISEMENTS:

We classify markets in different categories in terms of:

(i) the number of sellers,

(ii) number of buyers,

(iii) nature of the product,

ADVERTISEMENTS:

(iv) level of information and

(v) mobility.

On the basis of these criteria markets are classified into three broad categories:

(1) perfectly competitive markets,

(2) monopolistic markets and

(3) imperfectly competitive markets.

Imperfectly competitive markets may be subdivided into:

(a) monopolistically competitive markets and

(b) oligopolistic markets.

ADVERTISEMENTS:

Homogeneity—the extent to which buyers regard the products of all sellers as being identical, and the extent to which sellers have no preferences as to the buyers to whom they sell—is of primary importance in controlling the degree of freedom which firms enjoy to act independently of rival producers.

The increase in the degree of product differentiation—that is, of preferences on the part of buyers and sellers for particular varieties of product and for dealing with particular firms— increases the freedom of firms to act independently and thus increases the control which they have over their own prices. The greater the differentiation, the less easily will customers shift from one firm to another in response to price changes.

The number of buyers and sellers determine the extent to which each is aware of the effects of his own policies on those of his competitors and thus the extent to which each expects his action to affect the prices and outputs of his competitors. If sellers are numerous, for example, they will not expect their own policies to have much effect upon their competitors to affect their policies. If the number is small, each firm will expect competitors to react to its policies.

Price Determination by Demand and Supply:

There are two groups of people in a market, buyers and sellers. They are like two sets of players of a game. The players on the demand side are consumers, who want to buy goods. Their objective is utility maximisation, viz., maximisation of satisfactions from their purchases (or consumption).

ADVERTISEMENTS:

On the supply side the players are producers who supply goods for sale with a view to maximising their profits. We generally assume that the both groups act as price-takers in the sense that no buyer or seller can individually affect the market price of a commodity (by buying or selling a little more or a little less of the commodity).

Ceteris Paribus:

Here we make the ceteris paribus assumption. We assume that all the variables affecting the quantity demanded or supplied of a commodity remain constant. Only the price of the commodity is allowed to vary.

Major Classes of Markets:

The number of possible types of market situations is very great, because of the large number of possible degrees of differentiation of products and of variations in numbers of buyers, sellers, and relationships among them. For the purpose of analysis, however, markets are divided into two broad classes purely competitive and non-purely competitive markets. In the first, neither individual buyers nor sellers have any direct control over market prices. In the second, individual buyers, or sellers, or both, do exercise such control.

ADVERTISEMENTS:

The purely competitive model is useful for purposes of analysis, although actual conditions approximate it in only a small segment of the economy. It is a simple, clear-cut case, the analysis of which will serve to clarify basic theoretical relationships more easily than would analysis of more complex structures.

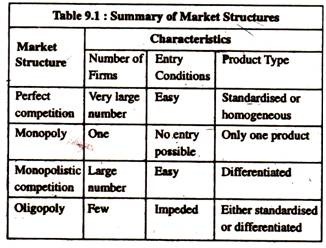

Table 9.1 summarises the characteristics of the four major market structures. It is commonly assumed that consumers and firms have perfect information about prices and other decisions made by a firm. This means that consumers and firms know the prices; locations and products of all firms in the market in each type of market.

Perfect Competition:

Perfect competition refers to a market situation in which there are very large number of firms, so large that whatever any one firm does has no effect on the market; firms that produce an identical (standardised or non-differentiated) product; and easy entry. For instance, wheat from one farm is no different than wheat from another farm. Because of easy entry, no one firm can earn more than a normal profit (zero economic profit).

A perfectly competitive market exists when the following criteria are met:

1. Many buyers and sellers:

ADVERTISEMENTS:

The market has so many buyers and sellers that each can have very little, if any, influence on price, and each particular acts independently of one another.

2. A homogeneous (or standard) product:

Each firm’s product is neither superior nor inferior to the products made by other firms. The products are identical (such as wheat or cotton).

3. Perfect knowledge and information:

All firms have access to the same types of technology, and prospective buyers are familiar with prevailing prices.

4. Mobility:

ADVERTISEMENTS:

Entry is free. Exit is also free. Any firm that believes it can earn higher profits by moving from one industry to another is free to do so. This means that there is complete mobility of factors of production (or productive resources).

Monopoly:

Monopoly refers to a market situation characterised by existence of just one firm and entry by other firms is not possible. Because there is only one firm, consumers have only one place to buy the good, and there are no close substitutes. Because entry is impossible, even if the firm earns above-normal returns, no new firms compete for those returns. As a result, the firm in a monopoly can earn positive (above-normal) economic profit over a long period of time.

Imperfect Competition:

Monopoly and perfect competition represent the extremes of market situations—one firm versus an infinite number of firms; entry achievable by only one firm versus free and easy entry by all. Between these two models lie oligopoly and monopolistic competition.

Monopolistic Competition:

A monopolistically competitive market structure is characterised by a large number of firms, easy entry, and differentiated products. Many agricultural products provide good examples of non-differentiated products—milk is milk and oats are oats. But beer, detergents, cereals, and soft drinks provide examples of differentiated products. Coca-Cola is not Pepsi. Each brand is to some degree different from the others.

Product differentiation distinguishes a perfectly competitive market from a monopolistically competitive market (entry in each is easy, and a large number of firms exist in each). When a new firm enters a perfectly competitive market, it produces an identical product — more wheat, for example. When a new firm enters a monopolistically competitive market, it produces a slightly different product.

Oligopoly:

In an oligopoly, there are few firms—more than one but few enough so that each firm alone can affect the market. Auto producers and steel markets are examples. Entry into an oligopoly is more difficult than entry into a perfectly competitive or monopolistically competitive market. The difficulty of entry enables the firms in the oligopoly to earn profit for a longer period of time than can perfectly competitive or monopolistically competitive firms.

ADVERTISEMENTS:

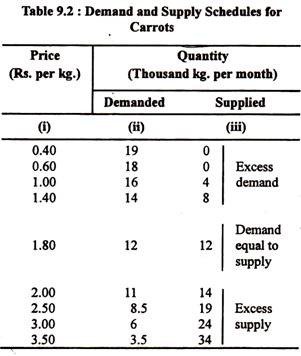

In Table 9.2, we present hypothetical data for market demand and market supply for carrots. In this market we assume the existence of thousands of buyers and numerous sellers. But each one is so small a part of the market he (she) cannot exert any influence on the market price through his (her) own action or behaviour.

We see that if carrots cost only 40 p per kg, consumers would purchase 19,000 kg each month. As the price of carrots rises, the quantity that people want to buy falls continuously.

On the supply side we observe that no farmer will offer any carrot for sale until the price is at least Re. 1 per kg. As the price rises above Re. 1 per kg., larger and larger quantities are offered for sale.

Equilibrium Price:

In fact, there is one price at which suppliers are willing to supply exactly what consumers are willing to buy. There is no unsatisfied buyer or no unsatisfied seller. At this price the desires of buyers and sellers are simultaneously fulfilled. In Table 9.2, we observe that when the market price of carrots is Rs. 1.80 per kg the quantity demanded is 12,000 kg per month and the quantity supplied is also the same. At no other price this is so.

This price is called the equilibrium price and the quantity purchased and sold at this price, 12,000 kg per month is called the equilibrium quantity.

ADVERTISEMENTS:

Equilibrium refers to a situation of rest or balance. It occurs when there is a balance between supply and demand, i.e., when the quantity the suppliers are willing to sell is exactly equal to the quantity the buyers want to purchase. At this price the market is cleared because there is no unsatisfied buyers (excess demand) or seller (excess supply).

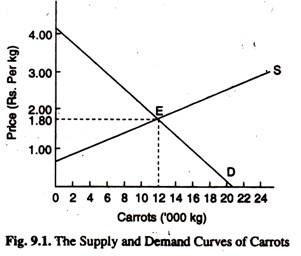

The information contained in Table 9.2 is represented graphically in Fig. 9.1. On the basis of columns (i) and (ii) we draw the demand curve. These two columns show how much is demanded at each of the prices shown in the table. On the basis of columns (i) and (ii) we draw the supply curve. These two columns show how much is offered for sale at each of the prices.

The two curves interact at point E which is called for the equilibrium point. This point gives us both equilibrium price (Rs. 1.80 per kg) and equilibrium quantity (12,000 kg). At this point the quantity demanded of carrots is exactly equal to the quantity supplied of carrots. Thus, in terms of our diagram, the equilibrium price is the one at which the demand and supply curves meet or intersect. When the market (actual) price is the same as the equilibrium price there is no unsatisfied seller or unsatisfied buyer in the market.