Introduction:

Like the money market, capital market in India is dichotomised into organised and unorganised components.

The organised sector of the capital market comprises all the term-lending financial institutions (or development banks or non-banking financial institutions, like 1DB1, ICICI, etc.), banks with their medium-term and their merchant banking divisions or subsidiaries, LIC, GIC, UTI and the stock exchanges (an essential component of the capital market).

The unorganised sector comprises low-lying indigenous bankers and moneylenders in rural and urban areas, chit funds, nidhis, etc.

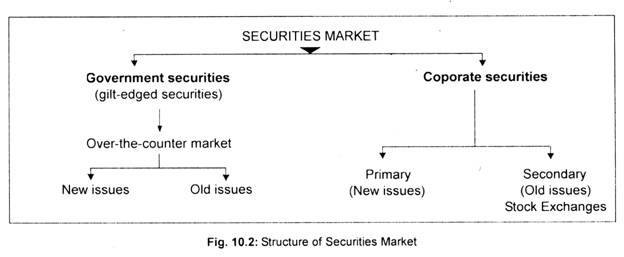

Fig 10.2 describes the structure of the securities market which is divided into government securities and corporate securities. Since former type of securities issued by the government are risk-free, they are called gilt-edged securities. In the gilt-edged securities market, the RBI plays an all-important role. Corporate securities like shares, or equities, bonds and debentures are issued by the corporate firms. It consists of the primary market, called new issues, and the secondary market, called old issues. These are the instruments through which long-term capital funds are collected from the public.

The institution of stock exchange is an important component of the capital market through which both new issues of securities are made and old issues of securities are purchased and sold. The former is called the ‘new issues market’ and the latter is the ‘old issues market’.

The stock exchange is, thus, a specialist market place to facilitate the exchanges of old securities. It is known as a ‘secondary market’ for securities. The stock exchange dealings for ‘listed’ securities are made in an open auction market where buyers and sellers from all over the country meet. There is a well-defined code of bye-laws according to which these dealings take place and complete publicity is given to every transaction.

As far as the primary market or new issues market is concerned, it is the public limited companies instead of stock market that deals in ‘old issues’ that raises funds through the issuance of shares, bonds, debentures, etc. However, to conduct this business, the services of specialised institutions like underwriters and stockbrokers, merchant banks are required.

Since the new issues are not ‘quoted’ or ‘listed’ or ‘approved’ in the register of the stock exchange in the organised stock exchanges, these new securities (of small companies whose prices are determined not through open bidding or auction but through direct negotiation) are dealt in ‘over-the-counter market’ or the ‘auction market’.

ADVERTISEMENTS:

Government securities market for both ‘old’ and ‘new’ issues has been on ‘over-the- counter market’ where securities of the Union Government and State Governments are issued. State Governments’ securities are issued by government undertakings, municipalities and corporations, etc. The gilt-edged market in India is of two types; the treasury bill market and the government bond market.

As the RBI manages entirely the public debt operations of both Central and State Governments, it is responsible for the new issue of loans. Further, in this gilt-edged market, financial institutions like commercial banks, the RBI itself, LIC, GIC, the provident fund organisations are the statutory holders of such government securities. This is what is called the ‘captive market’ for government securities.

Growth of Capital Market in India:

Capital market occupies an important role in shaping resource allocation. In addition, well- developed and well-functioning money and capital markets can cope up as well as prevent (localised) liquidity shocks that may cause serious havoc in the economy. Further, capital market enables financial institutions and non-banking financial companies to access funds on medium and long-term basis.

In fact, India’s organised component of the capital market till independence exhibited backwardness. With the passage of time, India’s capital market has attained a greater degree of maturity as the government took various measures to tone up the capital market.

ADVERTISEMENTS:

The important factors that removed the deficiencies of India’s capital market before 1991 are:

Firstly, to protect the interests of investors, elaborate legislative measures have been taken by the Government from time to time. These are the issues like the Companies Act, 1956, the Capital Issues (Control) Act, 1947, the Securities Contracts (Regulation) Act, 1956.

All these Acts empowered the Government to regulate the activities of the capital market (such as, by the prevention of investment in non-essential activities, listing of securities in a stock exchange). The main objectives of these Acts were to promote a strong and healthy investment market, to protect the interests of genuine investors and to ensure an efficient utilisation of financial resources, etc.

Secondly, immediately after independence, the Government felt the need for establishing a number of financial institutions to cater to the financial needs of the industries. These are: Industrial Finance Corporation of India (1948), State Financial Corporations (1951), Industrial Credit and Investment Corporation of India (1955), Industrial Development Bank of India (1964), Industrial Reconstruction Bank of India (1971), Unit Trust of India (1964), Life Insurance Corporation of India (1956), and many non-banking financial companies (governed by the 1956 Companies Act) like ‘Equipment Leasing Company’, ‘Investment Company’, ‘Loan Company’, ‘Hire-Purchase Finance Company’, ‘Mutual Benefit Financial Company’, ‘Infrastructure Leasing and Financial Services’ (1988), establishment of SEB1 (1988), etc.

Thirdly, the underwriting business has grown substantially over the years—mainly due to the initiative taken by the host of financial institution, including commercial banks, insurance companies and stockbrokers.

In view of these developments (prior to 1991), the base of the capital market has been widened. Large number of people park their savings in corporate securities. However, Indian capital market remained subdued for quite a long time since the 1960s. From the beginning of 1980s, there has been a marked improvement in the health of the market following various innovations all-round revival as a necessity to enable industry to undertake the required investment and achieve the desired growth.

However, the year 1988 saw a boom in the capital market that reflected the growing strength of the Indian economy consequent upon measures taken by the Government to boost the capital market. But, as far as institution-building in the liberalised regime is concerned and the necessary changes thereof in the security market—we had to wait till July-August 1991.

Capital Market in the Reform Era:

(a) Reforms in the Capital Market till 1980:

The capital market reform is an important part of the agenda of financial sector reforms. Though capital market had been doing well till late 1980s, one can see the limited volume of activity of the capital market as it displayed numerous problems.

These are:

ADVERTISEMENTS:

1. Information and transparency in procedures were limited.

2. Market was highly vulnerable to price rigging and insider trading. The prevalent brokerage system of the country’s capital market hampered access to the market for would-be investors. The common malpractices among the brokers are related to the price at which shares are bought and sold.

3. Danger of speculative transactions is largely associated with the stock market.

4. Trading took place by ‘open outcry’ on the trading floor monopolised by 3,000 odd brokers who closed membership to outsiders.

ADVERTISEMENTS:

5. Registration of transactions being time- consuming, one often is led to manipulation. No action against brokers could be taken against such malpractice.

6. Poor communications infrastructures fragmented the equity market.

7. Trading took place with fortnightly settlement. As this kind of settlement is exactly like a ‘futures’ market, this settlement is known as “futures-style settlement”. Indeed, the settlement mechanism in practice, resulted in such settlements beyond fortnight.

8. A peculiar market mechanism called badla caused a mess in the market. Badla allows deferment of settlement obligations into the next settlement period. This practice, thus, involved strong and large ‘counterparty risk’ as settlements could be deferred indefinitely. SEB1 had no power to prevent badla practices.

(b) Reforms in the Capital Market and SEBI since 1991:

ADVERTISEMENTS:

Capital market reforms were initiated in 1992 along the lines recommended by the Narasimham Committee’s recommendations. The reforms affected wholly the equity market.

Equity market reforms took a broad approach:

The Securities Exchanges:

To overcome the deficiencies and to control the capital market, institution-building was thought to be of urgent need. As is known to all that equity trading in India was characterised by floor- based trading, it involved the problems of (i) lack of transparency, and (ii) illiquidity. This kind of trading in the Bombay Stock Exchange—the oldest stock exchange—continued till 1994. One of the landmark developments was the creation of National Stock Exchange by the Government—set up in 1992 but operating since 1994.

The National Stock Exchange started ‘electronic debt trading’ on 30 June 1994, ‘electronic equity trading’ on 3 November 1994 and ‘electronic trading of all stocks’ by the Bombay Stock Exchange since 3 July 1995. Today, all trading is conducted through an electronic order-book system. Indeed, the technology-intensive market infrastructures have ‘transformed the mechanics of trading securities.’

NSE played a pioneering role in respect of (i) national electronic trading, (ii) the clearing operation as a central counterparty, (iii) paperless settlement at the depository, (iv) creation of ‘demutualised structure’ in which brokerage firms do not own the exchange. It is because of the creation of the NSE that financial market participation from all over the country—a situation of nation-wide trading—has become possible.

ADVERTISEMENTS:

The country’s first ‘Independent’ regulatory agency, the Securities and Exchange Board of India (SEBI), was created on 12 April 1988. Following the creation of the SEBI, the requirement of prior government permission for accessing capital markets and prior approval of issue pricing was abolished. From now on, companies were allowed to access capital market subject to the norms governing the behaviour of major market participants (such as brokers, merchant bankers, stock exchanges, mutual funds, etc.) set by the SEBI.

Reforms in the primary market had been undertaken by the SEBI. It has been empowered to inspect the functioning of stock exchanges all-over the country. Registration of intermediates such as stock-brokers and sub- brokers on the basis of eligibility norms of capital advances, infrastructure, etc. for the purpose in securities by the SEBI has been made compulsory.

Not only this, the Government has allowed institutional investors like pension funds, mutual funds, investment trusts, asset or portfolio management companies of foreign origin to invest in the Indian capital market to make it more open, competitive and broad-based in line with the liberalisation of the Indian economy. The Indian capital market is getting integrated more and more with the global market through euro issues.

SEBI has been empowered to direct companies to disclose all facts and the risks involved with their projects regarding issue of capital in the primary market with the objective of removing inadequacies and systematic deficiencies in the issue procedures. To make public issues more transparent, SEBI has introduced an advertisement code that must be fair and free from misleading the investors. Prudential norms have also been laid down for rights issue. In order to inspire confidence among the investors, SEBI has put restrictions on ‘insider trading’.

Merchant banking has been brought statutorily under the regulatory frame of SEBI. Banks must adhere to the stipulated capital adequacy norms and other codes of conduct as set by the SEBl. A set of separate guidelines for ‘development financial institutions’ has been issued by the SEBI.

A set of regulations has been notified for the purpose of governing mutual funds by the SEBI so as to ensure that the mutual funds grow not only on healthy lines but also protect the interests of the investors. Mutual funds are now permitted to underwrite public issues.

ADVERTISEMENTS:

SEBI advises stock exchanges relating to the amendment of listing agreements so that the listed company does not make any fraudulent practices.

Despite these reforms, cases of fraud and market manipulation continued unabated since the reform era began. A prominent scandal on the fixed income and equity markets broke out in April 1992. India’s security market has also been witnessing cases of fraud and market manipulation since 1992. Crises erupted in 1995, 1997, and 1998 and in 2001 when it caused more damages than the earlier years. That is why, to prevent such vulnerability and market manipulation, an extremely important set of reforms were introduced in June 2001. The two notable reforms were: (i) introduction of ‘rolling settlements’, rather than hitherto practised account-period settlements in July 2001 under which settlement has to be made everyday; (ii) commencing of ‘derivative trading in stock index futures’.

The SEBI has introduced a number of measures to reform India’s capital market. In order to give a boost to secondary market in Government-dated securities and public sector bonds, an institution named Securities Trading Corporation of India was set up in June 1994. It deals in short-term money market assets.

It is alleged that promoters hold comfortable volume of shares in a majority of stock exchange listed companies. This means that small investors or non-promoter share holders have very little stakes in these listed companies. All these are made through unfair means.

Alternative Economic Survey, India 2007-08 suggests; “Listing should be related to its main objective of raising resources for investment in a meaningful way and for providity liquidity to those investors. Frivolous listing with low share of public will have all the unwarranted side effects which will become progressively difficult to remedy.”

Conclusion:

As India progresses on in the on new millennium, much has changed, but still it suffers from problems. It is argued that these measures described above, although useful for reducing systemic risks, may prove inadequate against the backdrop of a variety of structural distortions, flawed practices, and ‘soft’ enforcement or intervention.

ADVERTISEMENTS:

The first week of January 2009 saw a biggest ever corporate fraud in India made by the Satyam Computers’ founder-chairman Ramlinga Raju. The scamp showed financial irregularities to the tune of Rs. 7,800 crore over a period of several years by manipulating the balance sheets of the Company in connivance with the Company’s audit firm, the Price water-house Coopers.

It is a tragic that being a regulator of the country’s capital market, SEBI remained a silent spectator over the years even when it came to light that the World Bank had banned the company for adopting unfair practices earlier. It has now come to the light that nearly 94 p.c. of the total shown on Satyam’s books was fake.

This means that further reforms are needed in both the banking and equity sectors to ensure a higher growth rate. Most importantly, the Indian capital market has now been enjoying an international status. But we are afraid that external shocks may spill over the Indian capital market—destabilising the market.