Let us make in-depth study of the performance of capital market and government securities market.

Performance of Capital Market:

The reforms undertaken in the capital market since 1991 have brought about a healthy growth in the capital market, except for a few stock market scams engineered by Harshad Mehata in 1992 and Ketan Parikh in the late nineties.

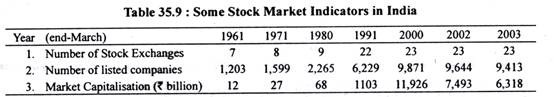

The equity market has registered substantial growth in terms of resource mobilisation, the number of stock exchanges, the number of listed companies, trading volume in the stock exchanges (see Table 35.9).

The significant improvement in efficiency resulting in reduction in transaction costs, the improvement in transparency and safety in transactions in stock exchanges have taken place, thanks to regulation by SEBI. The introduction of rolling settlement system, abolition of Badla system, sophisticated risk management system and trading in derivatives has greatly improved the efficiency of the stock markets.

ADVERTISEMENTS:

The reforms in the capital market have induced the foreign institutional investors to make investment in both equity and debt instruments of the Indian corporate companies. As a result, portfolio investment in India has substantially increased, especially in recent years. “India has emerged as a major recipient of portfolio investment among the emerging market economies. …The stability of portfolio investment towards India is in contrast with large volatility of portfolio flows in most emerging markets.” However these remarks of Rakesh Mohan are not valid in the context of post- crisis period.

From Feb. 2008, there were large outflows of capital from India causing stock market crash and depreciation of rupee. Again from Sept. 2011 there had been large-scale capital flight by FIIs from India causing crash in Indian stock market and a sharp depreciation of rupee. Further, in May-August 2013, there was large-scale capital outflows’ causing a sharp depreciation of rupee. The depreciation of rupee has raised the costs of imports, especially of crude oils and other international commodity prices which have added to the inflationary pressures in the Indian economy.

As a result of the improvement in efficiency and transparency in trading in the Indian stock exchanges the BSE Sensex crossed 12,000 mark in March 2006 and 2000 in January 2008. A large- scale portfolio investment by FII had brought large dollar inflows in India, apart from increasing the capitalization of the Indian companies. At present (October 2013) BSE Sensex has risen above 20500 mark.

Performance of Government Securities Market:

ADVERTISEMENTS:

The reform measures undertaken in respect of government securities market have also yielded good results. Government finances its fiscal deficit mostly by borrowing from the market through sale of its securities. Banks and insurance companies buy these government securities and therefore act as financial intermediaries between the public and government.

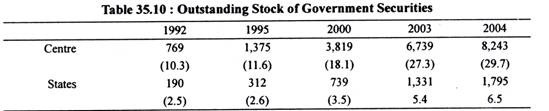

The fiscal deficit of the central government has varied in the range of 6 to 4.6 per cent since 1992. As a result, as will be seen from Table 35.10, the outstanding debt, i.e., stock of central and state government securities has increased by about 10 times in respect of both the Centre and States.

It will also be seen from Table 35.10 that outstanding government debt as a per cent of GDP at current market prices rose from 12.8 per cent in 1992 to 36.2 per cent in 2004. Despite such a large increase in government borrowing to finance its fiscal deficit, the yield and interest rate (i.e., cost of borrowing) has sharply declined. This is due to high liquidity position of banks and also deliberate policy of lower administered interest rates pursued during the major part of the period.

ADVERTISEMENTS:

The yield on primary issues of government securities of the maturity period of 5 to 10 years which ranged between 13.25 and 14.0 per cent during 1995-96 fell to 4.62 to 5.73 per cent in 2003-04. Despite the reduction in yield and interest rate on government securities the turnover (i.e., sale and purchase) of government securities in the market has increased over ten times between 1998-99 and 2003-04. This shows the buoyancy of risk-free and fixed income government securities.