Some of the important economics tools which are used widely in managerial economics are as follows:

1. Opportunity Cost Principle:

This principle is of immense use in decision-making. It can be stated as; the cost involved in any decision consists of the sacrifices of alternatives required by that decision. If there are no sacrifices there are no costs.

The opportunity costs are measured by the sacrifices in terms of goods and services involved in the decision. The opportunity cost of the funds employed in one’s own business is the amount of interest income which could be earned had that been employed in other ventures.

The opportunity cost of using a machine to produce one product is measured as the income which could have been obtained by renting it out to somebody else. If a machine has only one use, its opportunity cost is zero. In the same way, the opportunity cost of the time which an entrepreneur devotes to his business is the salary he could earn by working with some other firm of which he has knowledge. Thus, opportunity costs are the only relevant principle for decision making.

2. Incremental Principle:

The economists make a use of the incremental principle in the theories of consumption, production pricing and distribution. In price-determination, this principle states that a firm would maximise its profits if it equates its marginal costs to its marginal revenue. In this way, this principle guides a business manager that he should expand his business in each direction only so long as the incremental benefit to his firm is more than the incremental costs.

ADVERTISEMENTS:

The moment the incremental benefit (marginal revenue) is equated to the incremental cost (marginal cost); it is the point where the activity has to be limited. This principle focuses on the changes in prices, products, procedures, investments or whatever may be at stake in a business decision.

3. Principle of Time Perspective:

Another principle that is the principle of time perspective is useful in decision-making in output, prices, advertising and expansion of business. Economists distinguish between the short run and the long run in discussing the determination of price in a given market because in the long run a firm must cover its full cost.

On the contrary, in the short-run it can afford to ignore some of its (fixed) costs. Modern economists have started making use of an “intermediate run” between the short run and the long run in order to explain pricing and output behaviour under what is called oligopoly.

ADVERTISEMENTS:

The principle of time perspective can be stated as under:

A decision should take into account both the short run and the long run effects on revenues and costs and maintain a right balance between the long run and the short run perspectives.

4. Discounting Principle:

Generally people consider a rupee tomorrow to be worth less than a rupee today. This is also implied by the common saying that a bird in hand is worth two in the bush. Anybody will prefer Rs. 100 today to Rs. 100 next year.

There are two main reasons for this:

ADVERTISEMENTS:

(1) The future is uncertain and it is preferable to get Rs.100 today rather than a year after;

(2) Even if one is sure to receive Rs. 100 next year, one would do well to receive Rs. 100 now and invest it for a year and earn a rate of interest on Rs. 100 for one year.

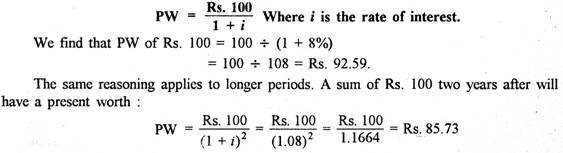

What is the present worth (PW) of Rs. 100 obtainable after one year?

The relevant formula for finding this out is:

The principle of economics used in the calculations given above is called the discounting principle. It can be explained as “If a decision affects costs and revenues at future dates, it is necessary to discount those costs and revenues to obtain the present values of both before a valid comparison of alternatives can be made”.

5. The Equi-Marginal Principle:

This principle states that an input should be allocated in such a way that the value added by the last unit of the input is the same in all its uses. This generalized law is known as the equi-marginal principle.

Example:

Let us suppose that a firm has got two workers to employ in three activities, say production of bottled milk, butter, and cheese. The firm must allocate these workers in such a way that the marginal productivity of the last worker employed in each of these activities is the same.

ADVERTISEMENTS:

To put it in more clear way, if the marginal worker given the duty of producing bottled milk, adds output worth Rs. 20. Then the marginal worker employed on butter and cheese production must also earn neither more nor less than Rs. 20 for the milk plant.

Otherwise the firm will not be making the best use of the employed labour. The Rs. 20 worth of additional output produced by the marginal worker is called ‘value -of marginal product or VMP.’

According to the law of equi-marginal principle in short, it can be written as follows:

VMPA = VMPB = VMP8C

ADVERTISEMENTS:

Where A, B and C indicate the activities A, B and C.

This is the equi-marginal principle is a very simple form. It needs to be corrected further for practical use.

Firstly:

We must find the net value of the marginal products before we compare these. This is because adding a worker to an activity also necessitates adding other inputs like machine, time, electricity etc. And to find out the worker’s net marginal value product, we must deduct from his VMP the value of the additional materials used in the process. Suppose the value of these additional materials is Rs. 5, then the net VMP of the worker will be Rs. 20 – Rs. 5 = Rs. 15.

ADVERTISEMENTS:

Secondly:

Correction is needed with regard to the price of the output produced by the additional worker. When more bottles of milk are produced these may have to be offered to consumers at lower prices which means that the revenue earned by the firm from additional bottles of milk would be less than that of the earlier bottles. If we subtract the reduction in revenue from the VMP of the worker, we get the net marginal revenue product of the worker.

Thirdly:

Equi-marginal principle is to discount the revenues made available to the firm from the sale of the additional production in the future. Labour has to be paid today while the output of labour has to be sold in future. If a year’s period is necessary for the sale of output we have to discount the net product for one year before comparing the net products of labour in each activity.

We must remember that the equi-marginal principle is workable only under only ideal conditions. A business enterprise may also work under some non-economic pressures and pulls. For example, an activity may be carried on simply because of inertia on the part of management arising from well-set routines even though activities add less to the revenues of a firm than others which have to be started for the first time. Other activities may be just continued because the managers have a sentimental attachment to them.

To conclude the discussion, we can say that economic laws are significant in business economics although these have to considerably refined and modified to suit the nature of the business enterprise. But, there are definite gaps between the theory of the firm and managerial economics.

ADVERTISEMENTS:

Economic theory deals for generalized study and application to economic models while managerial economics is downright practical science. Most of the assumptions of the economic theory of the firm are abstract in nature, For example, the entrepreneur of a firm is assumed to be a thoroughly calculating man who strives to maximize profit by equating its marginal cost with marginal revenue.

But, now it has been observed that under imperfect competition firms has no compulsion to maximize profit. Rather the firms tend to have nonprofit goals of a long-run nature such as stability and liquidity of the firm which considerably modify their decision-making processes and policy planning.