The following points highlight the three main types of fundamental valuation of securities in a company. The types are:- 1. Valuation of Convertible Bonds/Debentures 2. Valuation of ‘Rights’ 3. Valuation of Bonds.

Type # 1. Valuation of Convertible Bonds/Debentures:

Convertibles enjoy the benefits of both debt (initially) and equity (later). The terms of conversion will decide the pricing of these convertibles, which is left to free market forces in India, now. It is the company’s perception what they can sell to investors and at what price?

As per SEBI guidelines, Fully Convertible Debentures (FCDs) and Partly Convertible Bonds (PCBs) have special features and are not governed by guidelines for Non-Convertible Bonds/Debentures (NCDs). Their pricing methods, are different from bonds.

Why Convertible Financing?

ADVERTISEMENTS:

(1) It will delay the issue of equity and hence dilution of earnings per share is delayed.

(2) It will give breathing time for the company for increasing its earnings, when it will be in a position to expand equity base and service them.

(3) Initial bond financing will earn leverage for the company as interest expense on debt is not taxable and the cost of debt financing is lower than that of equity for some companies.

(4) Companies in initial stages of expansion or project financing, or with low credit rating but with the potential for larger earnings in a couple of years prefer convertibles.

ADVERTISEMENTS:

(5) Investors are attracted to convertibles, due to the sweeteners like premium on conversion and dividends and capital appreciation later.

Valuation of Convertibles:

Whether it is FCD or PCD, the pricing of the convertible portion is complicated by the mixture of debt and equity elements. The coupon rate on debt portion will be lower than the market rate of NCD of the same duration, because of the benefits enjoyed on conversion later on.

If conversion is within 18 months, they are as good as equity for purpose of debt-equity ratio and if they are convertible within coming 12 months, they will be eligible to rights after conversion or bonus declared during the preceding 12 months.

ADVERTISEMENTS:

The specification of pricing is difficult, except that the company follows the principles of what “the market can bear.” What is the proportion of convertible portion to the total and the time period of waiting? The terms of offer also depend on the credit rating of the company.

Assume the conversion period is 12 months when the PCD will be converted into equity upto 50% and the rest will be NCD. Then if the expected gain on conversion is say, 2% to 5%, then the debenture will be offered at a coupon rate of 12% to 13% if the normal market rate is 14% to 15%. Coupon rate will be lower, the higher the premium permitted on conversion into equity.

Conversion Ratio:

Conversion ratio is set out as so many equity shares for Rs. 100 of debenture. If the conversion price is set at Rs. 50, then the market price may be already ruling at Rs. 60 or Rs. 70 and one debenture will be converted into two equity shares. Conversion value is the conversion price multiplied by the number of shares given for each debenture. If conversion value is Rs. 50 and market price is say, Rs. 60, the conversion premium is Rs. 10 per share and Rs. 20 is gained by holding a debenture of Rs. 100 for one year. The debenture-holder gets only say 12% as interest. The return on this investment is in fact 12% + 20% = 32%.

Conversion Premium:

The company may offer a lesser premium, for one year and a larger premium for 18 months to 36 months. After 36 months, any conversion offer is subject to call and put options, as per SEBI Guidelines.

A call gives the right to buy from the company the share at the offer price if it is lower than the market price. A put option gives the right to sell the share eligibility to the company (and then buy the shares in the market) when the offer price is higher, than the market price. A call option is exercised if the market price is higher and put option is exercised, if the market price is lower, at the time of conversion.

Type # 2. Valuation of ‘Rights’:

Right issue is a method of selling equity or debt securities to existing shareholders at concessional rates. Rights issues in India are governed by Section 81 (A) of the Companies Act. As these rights will give incentives or discounts on market prices or market rates, they are attractive to investors and they are given to those shareholders who are on the registers of the company at a point of time called the record date fixed by the Board of Directors. But the terms of rights issue, if made open to the public will be different from those when they are offered only to the existing shareholders.

Example of Rights Pricing:

ADVERTISEMENTS:

To illustrate the pricing of rights entitlements, an example is given below:

Existing Paid up Capital (PUC) = Rs. 3 crores; present issue of rights = Rs. 2 crores.

Ratio of rights issue is 3:2. That means if the investor holds 3 shares, he is entitled to 2 rights shares at a discount.

Let the Market Price (MP) = Rs. 40 and rights offer based on their book value is let us say, Rs. 30.

ADVERTISEMENTS:

The market price quoted cum-rights is Rs. 40. If you buy three shares it will be Rs. 120 which when registered with the company will entitle you to 2 shares at a price of Rs. 30 (two shares will cost Rs. 60). The total cost for five shares is 120 + 60 = Rs. 180. The cost of one share is 180/5 = Rs. 36.

The price of one right share thus becomes Rs. 36, while the market price is Rs. 40. The difference is only Rs. 4 per entitlement but this price of Rs. 4 will be available subject to the last date of renunciation of rights by the right-holders. When the quotation becomes ex-rights, then the market price would accordingly adjust to Rs. 36, wiping out the benefit of Rs. 4.

Here the assumption is that company is a well rated company and its shares are in demand which means that there is a market for renunciations. Besides, we have not considered the brokerage costs and other incidentals involved in acquiring the rights and then selling them off. In July 1999 rights issue of ACC, however, the shareholders got rights at a price of Rs. 55 when the market price is around Rs. 170 per share giving a huge premium.

Type # 3. Valuation of Bonds:

Features of a Bond:

ADVERTISEMENTS:

Equity Valuation:

Dividend Capitalisation Approach:

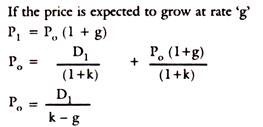

Present Value of the dividends expected + Present value of the resale price expected = Value of an equity share.

Basic Assumption:

1. Dividends are paid annually.

ADVERTISEMENTS:

2. The first dividend is paid one year after the equity share is brought.

Single Period Valuation Model:

Where,

K = Rate of Interest

ADVERTISEMENTS:

P0 = Present Price

P1 = Price in Period 1

D1 = Dividend for Period 1

Tables for PVIF, PVIFA, FVIF, FVIFA etc., are readily available and separately given.

Callable Bonds:

The company sometimes reserves the right to redeem earlier than the stipulated period, if the interest rates are falling. Such bonds are priced lower and discount will be more on the face value. Some bonds are redeemed in instalments, spread over 3 to 5 years. This will also be subject to risk of interest rate changes and are accordingly priced lower. Default prone bonds and junk bonds of companies with poor and falling credit rating will be substantially discounted ranging upto 50% on the face value of even short maturities.

ADVERTISEMENTS:

Detachable and Non-Detachable Warrants and Loyalty Coupons:

These are sweeteners attached to the debt instruments. Keeping the coupon rate at the then prevailing market rate (say, 12.5%) the company can attract investors by giving them a warrant, which will entitle the holder to buy the equity share at a discount over the market price but not lower than the intrinsic value as judged by book value or EPS.

Loyalty coupons or non-detachable warrants require the minimum holding period of say, 3 to 5 years to be eligible to this right of purchasing equity shares at face value or book value, which are much lower than the market price.

Such non-marketable warrants, attached to debt instruments are called latent warrants, which are entitled to conversion at the fixed maturity period of 3 to 5 years, while the debt portion remaining with the investor is sold in the market at a discount. However, the premium gained at conversion into equity is much more than the discount lost in the NCD portion. Some companies provide the safety net of purchasing back through their financial institutions, the NCD portion at the face value after a period of 1 to 3 years, or immediately after allotment depending on the terms.

Mortgage Bonds:

Non-callable and Non-convertible bonds are to be secured by collaterals if they are to be attractive to investors and carry the market interest rates with or without clause of adjustment to floating interest rates. The bond prices in such cases depend on the equity prices and the company’s performance. They are not default prone, if the company is performing well, fundamentals are strong and the share market price will be rising.

ADVERTISEMENTS:

Such bonds are normally near to the market prices. In fact the rates expected on various bonds depend on their ratings by rating agencies, such as Standard and Poor, in USA. In India, compulsory credit rating is necessary for NCDs given by companies and interest/coupon rates are decided accordingly on the basis of credit rating.