In this article we will discuss about the net barter terms of trade with its criticisms.

In the contemporary world, the concept of net barter terms of trade was introduced by F.W. Taussig. This concept was called as commodity terms of trade by Jacob Viner.

It is defined as ratio of export prices to import prices. It can be expressed as:

TC = PX/PM

ADVERTISEMENTS:

Here TC = commodity terms of trade or net barter terms of trade, PX = export price, PM = import price.

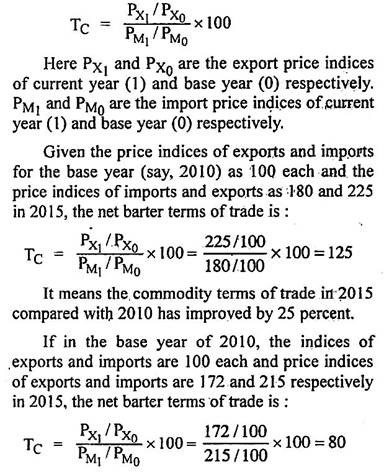

If the net barter terms of trade are to be applied to more than one export and import commodities and the changes in terms of trade over a given period are to be computed, the index numbers of export and import prices rather than prices of individual commodities are taken into account.

In such situations, the net barter terms of trade can be measured as below:

It means there is deterioration in country’s terms of trade by 20 percent between 2010 and 2015.

ADVERTISEMENTS:

It is generally believed that an improvement in the commodity terms of trade increases the economic welfare of a country. The sale of home produced goods at higher export prices and the purchase of foreign produced goods at lower prices is expected to increase welfare. From this a conclusion is sometime derived that maximisation of net barter terms of trade will mean the maximisation of welfare. But that is not necessarily true. If the export function of a country is more elastic, a rise in export price will cause considerable reduction in the quantity of export and bring about a significant fall in the export earnings.

Similarly, if the import function is more elastic, a fall in import price will cause a very substantial increase in quantity imported and also an increase in the spending on import. A fall in export earning coupled with an increase in import spending will mean a decline in welfare, even though the commodity terms of trade are favourable.

It is because of this reason that Haberler suggested that a country should try to optimise the terms of trade rather than maximize the terms of trade. The terms of trade get optimised at such levels of export and import prices where the export earning is maximum, while the import spending is the least possible. The optimum terms of trade, in his opinion, are fully consistent with the maximisation of welfare.

ADVERTISEMENTS:

Criticisms:

Even though the concept of net barter terms of trade has been widely accepted as a useful measure of short-term changes in the trade position of a country, yet it suffers from certain limitations because of which it has been subjected to criticism.

The main objections against it are as follows:

(i) Problems in the Construction of Index Numbers:

This concept involves the use of index numbers of export and import prices. The construction of index numbers is beset with several problems related to the choice of commodities, obtaining of price quotations, choice of base year, use of appropriate weights and the method for computing index numbers.

(ii) Neglect of Qualitative Changes:

The net barter terms of trade are based on indices of export and import prices. These can measure the relative changes in prices between the current and base period. If there are qualitative changes in output in the two trading countries during a given period, they remain neglected. In such a situation, net barter terms of trade cannot measured exactly the changes in welfare due to foreign trade in general and terms of trade in particular.

(iii) Misleading:

If the export price index of a country falls, the import price index remaining the same, there is worsening of the net barter terms of trade. As export prices are lower than the import prices, the country will be able to get a smaller quantity of import in exchange of the goods exported. The conclusion may be derived that the economic position of the country has deteriorated. It is possible that the fall in export prices has resulted from a fall in costs of producing export goods.

ADVERTISEMENTS:

If the productivity in export sector increases at a greater rate than the worsening of net barter terms of trade, the country actually does not suffer due to trade, it rather gains. From this it follows that the net barter terms of trade can sometimes result in misleading conclusions.

(iv) Inappropriate for Explaining Distribution of Gains from Trade:

The concept of net barter terms of trade is an inappropriate criterion for explaining the distribution of gains from trade between two countries one of which is advanced and the other is less developed. Suppose the import price index has risen relatively less than the export price index in the latter. It signifies an improvement in the terms of trade and the conclusion is derived that the less developed country gains from trade.

However, if the profits from foreign investments rise large enough to off-set the increase in export prices, the LDC may not derive any gain from trade. Similarly, if the export prices fall but there is also an equivalent fall in the profits of foreign investments, the position of the country is not worse off even though the net barter terms of trade are unfavourable. It is, therefore, evident that the distribution of gains from trade cannot be rightly decided on the basis of changes just in the net barter terms of trade.

ADVERTISEMENTS:

(v) Faulty Index of Gain from Trade:

It is often claimed that the net barter terms of trade provide an index of gains from trade for a country. In this connection, Taussig pointed out that the net barter terms of trade could be an appropriate measure of gains from trade, if the balance of payments of the country included only the receipts and payments on account of exchange of goods and services.

However, if balance of payments includes also the capital transactions and unilateral transfers, the gain from trade cannot be determined through the ratio of export and import prices.

(vi) Period of Time:

ADVERTISEMENTS:

The net barter terms of trade are based upon the relative changes in export and import prices over some period between the base year and the current year. If this time interval is too short, there may not be any significant change in the terms of trade. On the contrary, if this duration is too long, there is the possibility of some major changes in the structure of production and demand in the countries such that comparisons on the basis of export and import prices are rendered irrelevant.

(vii) Neglect of Factors Affecting Prices:

The net barter terms of trade concentrate only upon the indices of export and import prices. There is absolute neglect of the factors, which cause variation in these prices. The export and import prices are affected by changes in productivity, costs, wages, general business conditions and reciprocal demand in the trading countries. Any conclusion concerning the economic position of a country exclusively on the basis of commodity terms of trade cannot be valid.

(viii) Capacity to Import:

The improvement or worsening of the commodity terms of trade cannot give any definite conclusion about the capacity of a country to import. An appropriate measure of the capacity to import can be the income terms of trade rather than the net barter terms of trade. In order to overcome the deficiencies of the net barter terms of trade, Taussig introduced the concept of gross barter terms of trade.