The concept of double factoral terms of trade, formulated by Jacob Viner takes into account the change in factor productivity both in the domestic export industries and export industries of the foreign countries.

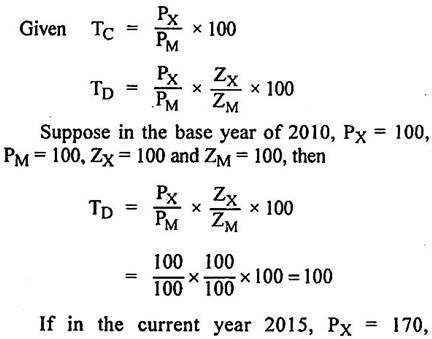

This concept can be expressed as:

TD = TC . (ZX/ZM)

Here TD is the double factoral terms of trade, TC is the commodity terms of trade, ZX is the productivity index in domestic export sector and ZM is the productivity index in the export sector of the foreign countries or it is import productivity index.

Thus the double factoral terms of trade show an improvement by 37-50 percent over the given period. In this illustration, the commodity terms of trade indicate an improvement by only 6.25 percent [TC = (PX/PM) × 100 (170/160) × 100 = 106.25]. The single factoral terms of trade show a much substantial improvement in terms of trade by 87 percent [TS = (PX/PM) . ZX = (170/160) × 176 = 187].

A relatively smaller improvement in the double factoral terms of trade by 37.5 percent is on account of the fact that the increase in import productivity index has some neutralizing impact. If the import productivity index were greater (say, ZM = 204) than the export productivity index, the double factoral terms of trade could even become unfavourable (84.62 percent) despite favourable commodity and single factoral terms of trade.

Criticisms:

ADVERTISEMENTS:

The concept of double factoral terms of trade has met with criticism on the following main grounds:

(i) Measurement of Productivity:

Like single factoral terms of trade, this concept too has a limitation related to exact measurement of productivity of the factors and changes therein both in the export sectors of home country and the foreign country. Although E. Devons attempted to compute single factoral terms of trade in Britain for 1948-53 periods, yet no significant headway could be made in the computation of double factoral terms of trade.

(ii) Misplaced Emphasis:

ADVERTISEMENTS:

The double factoral terms of trade emphasises upon the relative productivity indices in the two trading countries. Such an emphasis seems to be misplaced. The matter which is of greater concern for any country is the quantities of commodities that can be imported with a given quantity of its exports rather than the quantity of productive factors required in a foreign country to produce the goods imported by the home country. This line of argument suggests that even gross barter terms of trade are better than the double factoral terms of trade.

(iii) Faulty Concept:

This concept attempts to establish a relation between the productivity of the factors in two trading countries. Kindleberger has objected to it and has regarded this concept as faulty. He even treats single factoral terms of trade as a better concept than the double factoral terms of trade. In his words, “The single factoral term of trade is a much more relevant concept than the double factoral terms of trade. We are interested in what our factors can earn in goods, not what our factor services can command in services of foreign factor.”

(iv) Difficulty in the Determination of Gains from Trade:

It is difficult to measure the gains from trade for a country with the help of this concept of terms of trade. The relative changes in factor productivity in two trading countries can affect the quantities of exported and imported goods and their respective prices in such a way that the conclusion about the gains from trade cannot be easily derived.

(v) Neglect of Real Costs:

When the two trading countries make efforts to increase the production of export goods, there is diversion of productive resources including some additional real cost. The concept ignores the real cost as a factor influencing the terms as well as the gains from trade. This deficiency was, however, removed through the concept of real cost terms of trade.

Despite the above deficiencies, the concept of terms of trade is regarded as a logical and scientific concept to interpret the historical changes in the terms of a country.