In this article we will discuss about the fluctuations in the income of farmers.

Short-Term Fluctuations in Prices and Incomes:

The production of many farm products is subject to quite large variations due to factors completely beyond human control i.e. lack of rainfall, floods invasion of pests, and other natural causes are capable of reducing produce to a level well below that planned by farmers, while exceptionally favourable conditions can cause produce to be well above the planned level.

We may now ask what our price theory predicts about the effects of these unplanned fluctuations on the price of farm goods and on the incomes earned by farmers from the sale of their crops. A supply curve is meant to show desired output and sales at each market price.

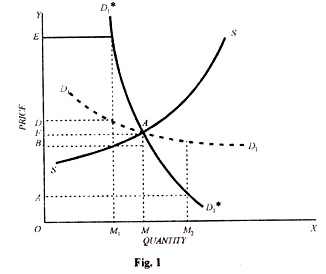

If there are unplanned variations in output then actual produce and sales will diverge from their planned level. The supply curve drawn in Figure 1, shows the total quantity farmers desire to produce and offer for sale at various prices. If the price were OP, then planned produce would be OM, but actual produce would vary, round this planned amount, owing to causes beyond the farmers’ control.

ADVERTISEMENTS:

Two demand curves are drawn in Figure 1; one is relatively elastic and the other is relatively inelastic over the price range from OE to OF. In a world in which plans were always fulfilled, price would settle at the equilibrium level of OP with output OM. But unplanned fluctuations in output will cause the actual price to fluctuate.

If the crop is poor so that the actual produce is OM1, then a shortage will develop; price will rise to OE in the case of demand curve Di, and OG in the case of curve De. In each case the quantity demanded will be reduced to a point at which it equals available supply.

If, on the other hand, conditions as are particularly favourable, actual produce will exceed planed produce, a surplus will occur and price will fall. For example, when produce is OM2 price falls to OF in the case of curve Di and to OH in the case of curve De. In each case the fall in price increases the quantity demanded sufficiently to absorb the extra unplanned supply but the fall in price is larger when the demand curve is Dt than when it is De.

We now get the following conclusion:

ADVERTISEMENTS:

Unplanned fluctuations in supply will cause price variations in the opposite direction to the supply changes (the bigger the supply the lower the price) and for given supply fluctuations, the prices fluctuations will be larger the lower is the elasticity of demand for the product.

Now we shall consider the effects on the revenues received by farmers from the sale of their crops. If the product in question has an elasticity of demand greater than unity, then unplanned increases in supply raise farmers revenues while unplanned decreases lower them. If, on the other hand, the product has an inelastic demand, consumers total expenditure on the product, and thus farmers revenue will rise when price goes up and fall when price comes down.

Thus, good harvests will bring reductions in total farm revenues while bad harvests will bring increases in farm revenues. If the demand elasticity happened to be unity then farmer’s revenues would vary as output and prices varied because every change in production would be met by an exactly compensating change in price so that total expenditure would remain the same.

ADVERTISEMENTS:

We now get the following conclusions:

(1) Unplanned fluctuations in output can cause every conceivable- type of fluctuation in farmers’ revenue.

(2) Farm revenue and farm output will vary in the same direction whenever demand for the product is elastic.

(3) Farm revenue and output will vary in the opposite directions whenever demand for the product is inelastic.

(4) The fluctuations in revenue will be larger the further does the elasticity of demand for the product diverge from unity in either direction.

Unplanned fluctuations in supply do occur frequently in agriculture. Where the prices of farm goods are left to be determined by the free market, large price fluctuations do take place. In the case of many farm goods, the demand is quite inelastic.

In these cases we find very large price fluctuations together with the peculiar situation that when nature is unexpectedly kind and produces a bumper crop, farmers see their incomes dwindling while when nature is moderately unkind so that supplies fall unexpectedly, farmers’ incomes rise. The self-interests of the farmer and of the consumer appear to be exactly opposed in such cases.

Cyclical Fluctuations in Prices and Incomes:

Agricultural markets are subject not only to short-run instabilities due to uncontrolled supply changes, but also to cyclical instability due to shifts in demand. In prosperity, full employment prevails, incomes are high, and demands for all goods are high. In depressed business activity, there is substantial unemployment, total incomes earned decline, and the demand for most goods fall.

As the pulse of business prosperity ebbs and flows, we thus find demand curves for all goods rising and falling. What effect will this have on prices? Industrial products typically have, rather elastic supply curves, so that demand shifts cause fairly large changes in outputs but only small changes in prices.

ADVERTISEMENTS:

Farm products often tend to have rather inelastic supplies. Thus when demand falls due to a recession in general business activity prices tend to fall drastically in agriculture but to remain fairly stable in the industrial sector.

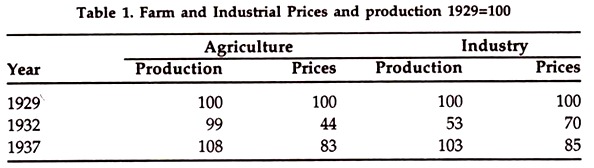

This phenomenon is illustrated in table below with ‘data for the United States, where agriculture still accounts for a major-proportion of total production employment. The data allow a comparison of the experience of agriculture and industries during the largest cyclical decline in demand that Western economics have suffered in modern times.

The price and quantity data in the table confirm the hypothesis that farm products tend to have very inelastic supplies, while industrial goods tend to have much more elastic supplies. To the public, the relatively large fall in farm prices is likely to signify that the farmer has fared relatively poorly compared to the typical manufacturer. But of course, it is revenues, not prices, that matter in dealing how badly various sectors have fared relative to each other.

ADVERTISEMENTS:

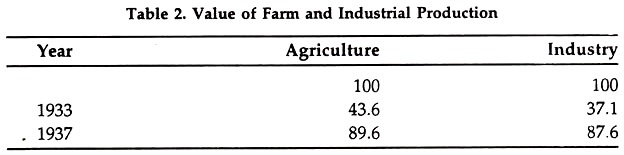

A very different picture emerges if we look at gross-receipts rather than at prices alone. Table 2 shows the gross receipt position of the two sectors. Agriculture fared better in revenue than industry relative to 1929. Since we do not have cost figures, we cannot reach a final conclusion about incomes.

But from the point of view of fluctuations in total receipts caused by cyclical fluctuations in demand, it is just as much a curse to have a very elastic supply as it is to have a very inelastic one.