The following article will guide you about why Bretton Woods System favoured relatively fixed exchange rate.

Until a few years ago, there was fixed exchange rate system introduced during the last year of the Second World War.

This fixed exchange rates system under Bretton Woods System of foreign exchange is known as the Bretton Woods System as a group of economists from the United States and Europe met at the Bretton Woods, a town in New Hampshire to devise this system.

According to the agreement made there, an international organisation, called International Monetary Fund (IMF) was set up to administer the new fixed exchange rates system. According to the rules framed under the agreement, the USA was to fix a parity or par value for its dollar in terms of gold, whereas other countries were required to fix parities for their currencies in terms of dollars. Since US dollar was tied to gold, the currencies of other countries with fixed exchange rate with US dollar automatically got pegged (that is, fixed) with a certain gold value.

ADVERTISEMENTS:

The Government of the USA made a commitment to maintain the convertibility between dollar and gold at a fixed rate, whereas other countries agreed to maintain the convertibility of their currencies with US dollar. The USA fixed $35 per ounce of gold as the convertible rate. The change in these fixed exchange rates (devaluation or revaluation) was to be made with the consent of IMF in case of fundamental disequilibrium in the balance of payments.

The Bretton Woods agreement did not define the fundamental disequilibrium but in practice it came to mean chronic and large deficit in the balance of payments. Therefore, when a country was experiencing a large and persistent deficit in balance of payments it was allowed by IMF to devalue its currency to the extent required to improve the balance of payments position.

Thus, faced with the serious problem of balance of payments India devalued its rupee by 36.5 percent in 1966. Again in July 1991, India devalued its rupee by about 20 per cent to tide over the serious foreign exchange crisis which arose due to deficits in balance of payments.

IMF maintains funds or reserves with itself which are contributed by member countries. IMF was given power to give loans to the member countries when they had short-term or temporary deficit in the balance of payments from its reserves. In case of fundamental disequilibrium its function was to advise the countries to devalue their currency to tide over the problem of deficit in balance of payments. The purpose was to achieve a relatively fixed or stable exchange rate system which was required for promotion of world trade.

ADVERTISEMENTS:

It may be noted that, under Bretton Woods System, to maintain the exchange rate at the specified level, the Governments (or their Central Banks) were to keep with themselves reserves of internationally accepted foreign currencies. Thus gold, which in the previous years served as an international currency was substituted by reserves of foreign currencies that were widely used in international dealings.

The US dollar became the important currency in which the reserves were to be kept by the other countries to maintain the exchange rate of their currency. Pound Sterling’s, German Marks, Japanese Yen were also kept for this purpose.

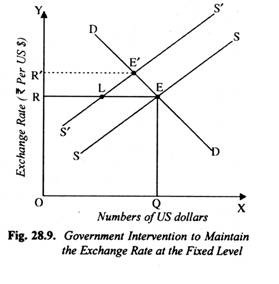

To maintain the fixed exchange rate Bretton Woods System required the intervention by the Governments or their Central Banks. How they maintained the exchange value of their currency by using the reserves of foreign currencies is illustrated in Fig. 28.9 where the demand and supply curves DD and SS of US dollars are drawn. Along the A’-axis the quantity of US dollars and on the y-axis, the exchange rate of rupee in terms of US dollar is measured.

Suppose the Government of India is committed to maintain the exchange rate of its currency at OR level which is also assumed to be the equilibrium rate as determined by demand for and supply of rupees. Now, suppose due to the recessionary conditions the demand of the USA for Indian exports greatly declines.

ADVERTISEMENTS:

This will reduce the supply of US dollars causing a shift to the left of the supply curve of dollars to S”S”. Now, given the demand curve DD of dollars remaining unchanged, at fixed exchange rate OR, the quantity supplied of dollars falls to RL whereas quantity demanded of dollars continues to be RE. As a result, the excess demand for dollars emerges at the fixed exchange rate OR and, if left free to the market forces, the equilibrium exchange rate will rise to OR’ level.

That is, price of US dollar in terms of rupees will appreciate or in other words, the Indian rupee will depreciate. In order to maintain the exchange rate of rupee in terms of dollar, and to prevent it from depreciating, the Government or Reserve Bank of India must sell dollars from its foreign exchange reserves. With the sufficient sale of dollars in the market, the supply curve of dollars will shift to the right to the original position SS which will restore the exchange rate OR. This is how the exchange rates of different countries remained fixed under Bretton Woods system despite the frequent changes in demand for and supply of their currencies.

Collapse of the Bretton Woods System:

Fixed exchange rate system under the Bretton Woods arrangement came under heavy pressure during the sixties and it ultimately collapsed in the early seventies. As seen above, under the Bretton Woods System the US dollar became internationally accepted currency in which reserves of the countries were kept for international transactions. Before the Bretton Woods System gold was accepted as international medium of exchange.

Under the Bretton Woods System, the US dollar also assumed the role of international currency for three reasons. First, after World War II, the United States emerged as the strongest economy. Secondly, the United States had accumulated a large stock of gold.

Thirdly, during 1934 and 1971, the United States had been following the policy of selling and buying gold to other countries at a fixed exchange rate of $35 per ounce. As under the Bretton Woods System, the dollar was converted into gold at a fixed rate (that is, $35 per ounce), it was considered as good as gold.

Since the World’s supply of gold did not increase adequately to meet the requirements of rapidly expanding international trade and finance, the dollar increasingly became the world currency in which international reserves were kept by various countries. But a serious problem arose which caused the demise of Bretton Woods system.

The United States had a large and persistent deficit in balance of payments during the fifties and sixties. To meet these deficits, the US used its gold reserves for making payments to other countries, especially Germany and Japan. Obviously, this could not go on for ever because its gold reserves would have eventually run out.

ADVERTISEMENTS:

In fact, this was the big flaw in the fixed exchange rate system adopted under the Bretton Woods arrangement. Further, as a result of surplus balance of payments with the United States, other countries, especially Germany and Japan, acquired not only gold but also a large quantity of the dollars from the US which were kept as reserves.

With the passage of time reserves of dollars and gold held by other countries increased very much while the reserves of gold with USA declined a great deal, the doubts arose about the ability of the USA to fulfill its commitments of converting dollars into gold at the agreed exchange rate of $35 per ounce. Widespread fears emerged that there would be run on the dollar, that is, countries holding dollars would en masse try to exchange dollars for gold.

If it had actually happened it would have greatly hurt the international trade and finance. Therefore, in view of the large and persistent deficit in balance of payments, it was decided by the US Government to withdraw convertibility of dollar into gold at the rate of $35 per ounce on August 15, 1971.

This brought about the collapse of the. Bretton Woods System which was supported by the US commitment to convert dollar into gold at a fixed rate. With this the link between gold and international value of the dollar ended and consequently the dollar was floated, that is, permitted its exchanged rate with other currencies to be determined by market forces.