Let us make in-depth study of the determination, change and analysis of concepts of exchange rate.

Determination of Exchange Rate:

We are now in a position to explain how in a flexible exchange rate system the exchange of a currency is determined by demand for and supply of foreign exchange.

We assume that there are two countries, India and USA, the exchange rate of their currencies (namely, rupee and dollar) is to be determined. Thus, we explain below how the value of a dollar in terms of rupees (which will conversely indicate the value of a rupee in terms of dollars) is determined.

At present in both USA and India there is floating or flexible exchange regime. Therefore, the value of currency of each country in terms of the other depends upon the demand for and supply of their currencies. It is in the foreign exchange market that the exchange rate among different currencies is determined. The foreign exchange market is the market in which the currencies of various countries are converted into each other or exchanged for each other.

ADVERTISEMENTS:

In our case of the determination of exchange rate between US dollar and Indian rupee, the Indians sell rupees to buy US dollars (which is a foreign currency) and the Americans or others holding US dollars will sell dollars in exchange for rupees. It is the demand for and supply of a foreign currency or exchange that will determine the exchange rate between the two.

Demand for Foreign Exchange (US Dollars):

The demand for US dollars comes from the Indian people and firms who need US dollars to pay for the goods and services they want to import from the USA. The greater the imports of goods and services from the USA, the greater the demand for the US dollars by the Indians.

Further, the demand for dollars also arises from Indian individuals and firms wanting to purchase assets in the USA, that is, desire to invest in US bonds and equity shares of the American companies or build factories, sales facilities or houses in the USA.

The demand for dollars also arises from those who want to give loans or send gifts to some people in the USA. Thus, for whatever reasons the Indian residents need dollars they have to buy them in the foreign exchange market and pay for them with the Indian currency, the rupees. All of these constitute demand for dollars, the foreign exchange.

ADVERTISEMENTS:

To sum up, the demand for dollars by the Indians arises due to the following factors:

1. The Indian individuals, firms or Government who import goods from the USA into India.

2. The Indians travelling and studying in the USA would require dollars to meet their travelling and education expenses.

3. The Indians who want to invest in equity shares and bonds of the US companies and other financial instruments.

ADVERTISEMENTS:

4. The Indian firms who want to invest directly in building factories, sales facilities, shops in the USA.

An important thing to understand is how the demand curve for a foreign exchange would look like. When there is a fall in the price of dollar in terms of rupees, that is, when the dollar depreciates, fewer rupees than before would be required to get a dollar. With this, therefore, a dollar’s worth of US goods could be purchased with fewer rupees, that is, the US goods would become cheaper in terms of rupees for Indians.

This will induce the Indian individuals and firms to import more from the USA resulting in the increase in quantity demanded of dollars by the Indians. On the other hand, if the price of US dollar rises, (that is US dollar appreciates) a dollar’s worth of US goods would now cost more in terms of rupees making American goods relatively expensive than before. This will discourage the imports of US goods to India causing a decrease in quantity demanded of dollars for imports.

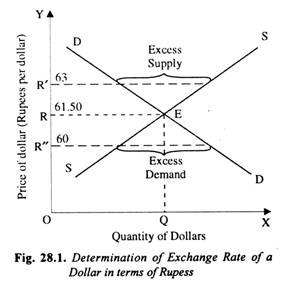

It therefore follows from above that at a lower price of dollars, the greater quantity of dollars is demanded for imports from the USA and at a higher price of dollar, the smaller quantity of dollars is demanded for imports from the USA by the Indians. This makes the demand curve for dollars downward sloping as shown by the DD curve in Fig. 28.1.

Supply of US Dollars (i.e., Foreign Exchange):

What determines the supply of dollars in the foreign exchange market. The individual firms and Government which export Indian goods to the USA will earn dollars from the American residents who would buy the Indian goods imported into the USA and pay their price in dollars. Further, the Americans who travel in India and use the services of Indian transport, hotels etc., will also supply dollars to be converted into rupees for meeting these expenses.

Besides, the American firms and individuals who want to buy assets in India, such as bonds and equity shares of Indian companies or wish to make loans to the Indian individuals and firms will also supply dollars. There are Indians who are working in the USA and send their earnings in dollars to their relatives and friends.

The supply of these dollars by the Indians working in the USA popularly called remittances from the USA also adds to the supply of dollars. Those holding dollars who have earned them from exports to the USA and the foreign firms and individuals who want to invest in India or those who want to make loans to Indians or the American tourists travelling in India, and remittances from USA by the Indians working there will supply dollars in the foreign exchange market.

The supply curve of dollars plotted against the price of dollar in terms of rupees is positively sloping as shown in Fig. 28.1. What accounts for the upward sloping nature of the supply curve of the dollars. At a higher price of dollar in terms of rupees (or, in other words, lower value of the Indian rupee in terms of dollar), 100 rupees worth of Indian goods would be relatively cheaper in terms of dollars.

ADVERTISEMENTS:

This will tend to boost exports of the Indian goods to the USA at a higher price of dollar and thus ensure more supply of dollars in the foreign exchange markets. On the other hand, if the price of US dollar in terms of rupees falls (i.e. its exchange rate for Indian rupee declines) the 100 rupees worth of Indian goods would become relatively expensive in terms of dollars. This will discourage the exports of Indian goods to the USA and reduce the quantity supplied of dollars in the foreign exchange market.

The Equilibrium Exchange Rate:

It will be seen from Figure 28.1 that the equilibrium exchange rate, that is, the equilibrium price of dollar in terms of rupees is equal to OR or 61.50 per dollar at which demand for and supply curve of dollars intersect and therefore the market for dollars is cleared at this rate. At a higher price of dollars OR’ or Rs.63, the quantity supplied of dollars exceeds the quantity demanded.

With the emergence of excess supply of dollars, its price, that is, the exchange rate will again fall to OR or Rs. 61.50. On the other hand, if the rate of exchange is lower than OR, say it is OR” or Rs. 60 to a dollar, there will emerge the excess demand for dollars. This excess demand of dollars would push up the price of dollars to the level of OR or Rs. 61.50 per dollar.

Changes in Exchange Rate:

In our analysis of determination of exchange rate through demand and supply of foreign exchange we have assumed that the underlying forces which determine demand for and supply of foreign exchange remain constant. In our foregoing analysis it is only changes in the exchange rate that cause the quantity supplied and demanded of foreign exchange to change and bring about the equilibrium between demand for and supply of foreign exchange.

ADVERTISEMENTS:

The equilibrium in the foreign exchange market will be disturbed if some changes occur in the underlying factors that determine the demand for and supply of foreign exchange. For example, if there is increase in incomes of the American people due to the boom conditions in the US economy, it will affect the equilibrium rate of exchange.

The increase in incomes of the people of USA will lead to the increase in demand for imported goods including those of India. Now, with this increase in demand for imported Indian goods, they will spend more dollars on the Indian goods.

This will increase the supply of dollars to buy Indian goods in the foreign exchange market causing a right- ward shift in the supply curve from SS to S’S’, as shown in Fig. 28.2. This increase in the supply of dollars in foreign exchange market will lower the price of dollar in terms of rupees from OR 61.50 to a dollar) to OR’ (Rs. 60 to a dollar).

ADVERTISEMENTS:

This implies that increase in imports by USA from India leading to more exports from India will cause the dollar to depreciate and the Indian rupee to appreciate. It will be seen from Figure 28.2 that with the increase in India’s exports to the USA and as a result increase in supply of dollars, supply curve of US dollars shifts to the right to S’S’ position.

With this, at the original price OR (or Rs. 61.50 to a dollar) there is excess supply of dollars by EN amount which will result in lowering the price of dollar to the level of OR’ or Rs. 60 to a dollar. This means increase in supply of dollars has led to the appreciation of rupee from Rs. 61.50 to a dollar to Rs. 60 to a dollar and depreciation of US dollar.

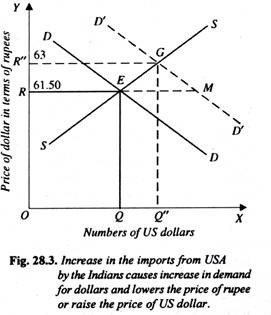

On the other hand, if due to the increase in incomes of the Indian people causing a rise in demand for American consumer goods or there is pick up of industrial activity in India requiring more imports of materials, machines, equipment’s and other capital goods from the USA the Indian imports from USA will increase.

The increase in imports from USA by India will have to be paid in dollars causing the demand for dollars to increase and as a result demand curve for dollar shifts to the right from DD curve to D’D’ curve (see Fig. 28.3). This will upset the initial equilibrium at price OR (Rs. 61.50 to a dollar) as with the increase in demand for dollars following the increase in imports from USA there will emerge excess demand for dollars which will push up the price of dollar to OR” (Rs. 63 to a dollar) so as to bring balance between demand for and supply of dollars (i.e., foreign exchange). Note that rise in price of dollar in terms of rupees implies depreciation of the value of rupee from Rs. 61.50 to Rs. 63 to a dollar.

It will be observed in Fig. 28.3 that as a result of adjustments following the increase in demand for dollars, the price of dollar has risen to OR” (Rs. 63 to a dollar) and the amount of dollars spent by Indians on imports from the USA increases to Q”

Analysis of Some Exchange Rate Concepts:

ADVERTISEMENTS:

As the Indian economy gets more integrated with the world economy (that is, has extensive trade and capital flows with the rest of the world), exchange rate of rupee with foreign currencies will play a very important role as it will determine competitiveness of Indian goods and services in the international markets.

The rupee has different exchange rates with foreign currencies of its various trade partners. A bilateral exchange rate with a foreign currency, say the US dollar, in nominal terms is not a good exchange rate with which to measure the competitiveness of the rupee.

Further, the exchange rate of rupee with a single currency in nominal terms would not measure the differences in changes in prices and costs in the domestic economy as compared to the changes in prices in all the trade partners. To deal with this issue the effective exchange rate (EER) concept is used.

Nominal Exchange Rate (NER):

Foreign exchange rate is generally quoted as the number of units of a domestic currency required to purchase one unit of a foreign currency. For example, rupees 40 per US dollar refers to foreign exchange rate of the Indian rupee in terms of US dollar and means that Rs. 40 can buy one US dollar in foreign exchange market. Likewise, there is foreign exchange rate between rupee and the pound sterling, between rupee and the Yen, between rupee and Mark and so on. This exchange rate of rupees per US dollar, or per pound sterling is called nominal exchange rate (NER).

Nominal Effective Exchange Rate (NEER):

ADVERTISEMENTS:

In addition to the nominal exchange rate, the economists often use the concept of nominal effective exchange rate. The nominal effective exchange rate is the weighted average of nominal exchange rates where the weights used are the shares of the trading partners in the foreign trade of a country. Suppose the US accounts for 60 per cent of total trade with India, and the United Kingdom accounts for 40 per cent of trade with India, then the nominal effective exchange rate is given by

Nominal Effective exchange rate (NEER) = (NERUS WUS) + (NERUK × WUK)

where NERUS and NERUK are the nominal exchange rates of the US and UK respectively for the India rupee and W and W are trade shares of the US and UK respectively with India. Suppose the US accounts for 60 per cent in India’s trade and NER of the Indian rupee with the US dollar is Rs.44 while UK accounts for 40 per cent in India’s trade and nominal exchange rate of rupee with pound sterling is Rs.85, the nominal effective exchange rate is

NEER = 44 x 0.6 + 85 × 0.4

= 26.4 + 34.0 = 60.4

Real Exchange Rate:

ADVERTISEMENTS:

Real exchange rate measures the relative price of the two currencies after adjusting for price levels prevailing within two countries. For example, real exchange rate between rupee and US dollar is defined as the rupee price of a basket of goods in India relative to a

RER = NER (PUS/PIn)

where NER is the nominal exchange rate between the two currencies and PUS is the price level in the USA and PIn is the price level in India. While the nominal exchange rate measures the rate at which currencies of the two countries are exchanged, real exchange rate measures the rate at which domestic goods can be exchanged for foreign goods.

An example will clarify the meaning of real exchange rate. Suppose Rs. 44 are required to buy one US dollar, that is t 44 per US dollar is the nominal exchange rate (NER) between the Indian rupee and the US dollar. If a basket of goods costs 200 in India and the same basket of goods costs 20 dollars, then real exchange rate (RER) will be:

RER = (NER)PUS/PIn = 44 × 20/200 = 4.4

Thus 4.4 is the real exchange rate of the Indian rupee. This means 4.4 units of Indian goods are needed to buy one unit of US goods. Real exchange rate is used as a measure of international competitiveness. A rise in real exchange rate indicates foreign goods (in our example the US goods) have become more expensive relative to domestic goods of a country. This means competitiveness of our goods has increased relative to that of the USA.

ADVERTISEMENTS:

Real Effective Exchange Rate (REER):

Real effective exchange rate is the weighted average of real exchange rates with all its trade partners, the shares of different countries in its total trade are used as weights. Thus, in India 5 countries real effective exchange rate (REER) is prepared and the shares of major trade partners such as the USA, UK, other European countries, Japan with India are used as weights for calculating real effective exchange rate.

Changes in India’s Nominal Effective Exchange Rate (NEER) and Real Effective Exchange Rate (REER):

India’s NEER (base 2000 = 100) which is composed of 5 foreign currencies namely, US dollar, Euro, Pound sterling and Japanese Yen. This India’s NEER depreciated on a yearly basis till 2004-05 to reach a level of 90.75. With a bout of appreciation during April – June 2005, it depreciated thereafter but it again rose during Jan. to Feb. 2006 to 94.06. In 2006-07 it depreciated steadily till Aug. 2006 when it reached a low of 88.05. It once again rose to 91.31 in Nov. 2006. This shows there has been quite a large changes in NEER causing uncertainty about what exchange rate will prevail in future.

As regards the real effective exchange rate (REER), it appreciated to 106.79 in 2005-06. After depreciating to 100.6 in Aug. 2006, it rose to 109.0 in Nov. 2006.

Devaluation and Depreciation of Exchange Rate:

An important issue in regard to foreign exchange rate has been at what level it should be fixed or stabilized. Even under Bretton Woods system 1 per cent change in fixed exchange rate on either side the parity value was allowed to be varied. For more than one per cent change in the exchange rate the permission of IMF was necessary to restore equilibrium in the balance of payments. A proposal was mooted to increase this permissible band for variation or adjustment to be raised to 10 per cent from the parity value to correct disequilibrium in the balance of payments.

However, in 1973 Bretton Woods system of fixed exchange rate collapsed. The US dollar and Pound Sterling were floated, that is, allowed to be determined freely by demand for and supply of these currencies. However, India continued with the fixed exchange rate system. But instead of based on parity value in terms of gold or the US dollar it determined exchange rate of rupee on the basis of exchange rate movements of a basket of foreign currencies, namely, the pound sterling, US dollar, Yen and Mark.

In 1991 India faced a serious balance of payments crisis with stagnant exports and rising imports, especially of petroleum oil. On the advice of IMF India devalued its rupee in July 1991 to solve the balance of payments problem. It was about 25 per cent devaluation against the currencies of our major trading partners. As a result of this devaluation India’s exports increased substantially and also black market in foreign exchange that prevailed before came to end.

In addition to devaluation, a dual exchange rate system was introduced in 1992.

Under the dual exchange rate system there were two rates:

(1) The official exchange rate that was controlled and

(2) The market rate of exchange which was free to change according to demand and supply conditions.

Under this dual exchange rate system 40 per cent of earnings from the exports of goods and services were to be surrendered to RBI through authorized dealers at officially fixed exchange rate. The foreign exchange reserves received in this way was used by RBI for financing preferred imports. The remaining 60 per cent of export earnings in foreign exchange were converted into rupees by the exporters at the market determined exchange rate.

However, in the year 1993-94 the policy of dual exchange rates was dropped and rupee was allowed to float. With this a unified market determined exchange rate came to prevail which can change as a result of changes in demand and supply of foreign currencies.

Managed Float System and Implications of RBI Intervention:

It is important to note that even with the present flexible exchange rate system in India there is a managed float system because RBI intervenes in foreign exchange market to influence the exchange rate of rupee and keep fluctuations in it within reasonable limits.

Thus when rupee in the free market depreciates much and RBI does not want much depreciation, it will sell foreign exchange from its reserves in the foreign exchange market to prevent it from depreciating. On the other hand, when rupee appreciates much against foreign currencies RBI intervenes and buys foreign exchange. This move of RBI prevents rupee from appreciating.

Note that appreciation of rupee as compared to other currencies makes the Indian exports expensive and therefore discourages them. Although RBI does not follow any fixed exchange rate target through sale and purchase of foreign exchange, it aims at preventing large volatility in foreign exchange rate of rupee.

However through sale and purchase of foreign exchange by RBI has implications for maintaining price stability. This is because when RBI buys foreign exchange from the market it issues new money (i.e. rupee currency) to pay for it. This new money comes into circulation in the Indian economy and thus leads to the expansion in money supply.

If aggregate supply of goods remains the same or does not increase much, this expansion in money will cause rise in general price level (i.e. inflation) in the economy. To check inflation, RBI can sterilize the impact of increase in foreign exchange inflows by selling government securities to the banks.

The banks will give cash to RBI against the purchase of these securities. In this way RBI mops up excess liquidity (i.e. cash reserves) of the banks caused by the inflows of foreign exchange. The proceeds of the government securities sold to the banks can be kept by RBI in a separate account which cannot be used by the Government and therefore cannot affect prices. However, there is limit to which the sterilization can take place.

From Aug. 2006 the Indian rupee started appreciating and its exchange rate with US dollar rose to eight year high of Rs. 43 per US on March 28, 2007 and further to f 41.57 on April 23, 2007. In the last four months (Jan-April 2007) RBI did not intervene much to buy foreign exchange from the market and as a result continued inflows of dollars in India resulted in the exchange rate of rupee to appreciate.

On Nov. 12, 2007, the exchange rate of rupee per US $ rose to Rs. 39.4. The RBI did not intervene to a large extent in the foreign exchange market and let the rupee appreciate in order to check inflation in the Indian economy.

If RBI intervenes in the foreign exchange market to mop up excess US dollars from the market it leads to the increase in money supply in the economy and this causes inflation. Further, appreciation of rupee makes imports cheaper which encourages imports. The increase in imports leads to the rise in aggregate supply of goods which helps in checking inflation.

Changes and Volatility in Foreign Exchange Rate of Rupee:

As a result of the above developments, rupee depreciated a good deal from 1991-92 to 2000-03. From Rs. 21 per US dollar in 1990-91 average annual exchange rate was reduced to Rs. 27 in 1991 -92 (i’. e., about 25 per cent fall in value as a result of devaluation made in July 1991), and it then gradually fell to Rs. 36 in 1997-98 and to Rs. 48 in 2001 -02.

With effect from 2002-03 under pressure of capital inflows, rupee started appreciating and rose to t 47 per US dollar in 2002-03, to Rs. 44.27 in 2005-06. In 2006-07 and 2007-08, there was large inflows of capital through portfolio investment which led to further appreciation of rupee which rose to 39.4 to a dollar on Nov. 12, 2007 which was ten years high level. In the year 2007 alone there was net capital inflows of 17 billion US dollars through F1I which pushed up the value of rupee to a dollar.

Then there was a sub-prime housing loan crisis in the United States which created liquidity crisis in America. To meet the requirements of liquidity at home, FIIs started selling shares in the Indian market and as a result capital outflows occurred during 2008 which gathered momentum in the months of September and October 2008 when rupee depreciated rapidly and its value fell to Rs. 48.53 to a US dollar on Oct. 10, 2008 and to Rs. 49.5 for a US dollar in Nov. 2008 (For some days it fell to Rs. 50 for a US dollar).

The capital outflows by FIIs not only caused depreciation of rupee but also stock market crash in Oct. 2008 and Nov. 2008 and liquidity crunch in the Indian banking system. To ensure credit needs of industries for investment the RBI intervened in the economy by reducing cash reserve ratio (CRR) form 9 per cent to 6.5% and thereby infused liquidity in the economy to the extent of Rs. 1, 40,000 crores and promised to do more if needed.

In the later half of 2011 from September to December 2011, due to uncertainty caused by Eurozone Crisis there has been capital outflows by FIIs from India which caused a sharp depreciation of rupee. Despite some limited intervention by RBI, the value of rupee fell to Rs. 53 to US$ in Mid-December 2011 against Rs. 44 in August 2011, that is Rs. 18 per cent fall in the value of rupee in four months.

This is a matter of serious concern as it has raised the costs of imports of crude oil and other commodities and therefore will not only raise inflation in the economy but will also adversely affect of our balance payments. Besides, the weak rupee will discourage foreign investment in India as investors will suffer losses due to the fall in exchange value of the Indian rupee.