Let us make an in-depth study of the meaning and determination of foreign exchange rate.

Meaning:

If a Kashmiri shawlmaker sells his goods to a buyer in Kanyakumari, he will receive in terms of Indian rupee. This suggests that the domestic trade is conducted in terms of domestic currency.

Within the country, transactions are, then, simple and straight-forward. But if the Indian shawlmaker decides to go abroad, he must exchange Indian rupee into Jap yen or dollar or pound or euro. To facilitate this exchange form, banking institutions appear. Indian shawlmaker will then go to a bank for foreign currencies.

The bank will then quote the day’s exchange rate—the rate at which Indian rupee will be exchanged for foreign currencies. Thus, foreign currencies are needed for the conduct of international trade. In a foreign exchange market comprising commercial banks, foreign exchange brokers and authorised dealers and the monetary authority (i.e., the RBI), one currency is converted into another currency.

ADVERTISEMENTS:

A (foreign) exchange rate is the rate at which one currency is exchanged for another. Thus, an exchange rate can be regarded as the price of one currency in terms of another. An exchange rate is a ratio between two monies. If 5 UK pounds or 5 US dollars buy Indian goods worth Rs. 400 and Rs. 250 then pound-rupee or dollar-rupee exchange rate becomes Rs. 80 = £1 or Rs. 50 = $1, respectively. Exchange rate is usually quoted in terms of rupees per unit of foreign currencies. Thus, an exchange rate indicates external purchasing power of money.

A fall in the external purchasing power or external value of rupee (i.e., a fall in the exchange rate, say for Rs. 80 = £1 to Rs. 90 = £1) amounts to depreciation of the Indian rupee. Consequently, an appreciation of the Indian rupee occurs when there occurs an increase in the exchange rate from the existing level to Rs. 78 = £1. In other words, the external value of rupee rises. This indicates strengthening of the Indian rupee. Conversely, the weakening of the Indian rupee occurs if external value of rupee in terms of pound falls.

Remember that each currency has a rate of exchange with every other currency. Not ail exchange rates between about 150 currencies are quoted since no significant foreign exchange market exists for all currencies. That is why exchange rate of these national currencies are quoted usually in terms of the US dollars and euros.

Determination of Exchange Rate:

Now two pertinent questions that usually arise in the foreign exchange market are to be answered now. First, how is the equilibrium exchange rate determined, and secondly, why does exchange rate move up and down?

ADVERTISEMENTS:

There are two methods of foreign exchange rate determination. One method falls under the classical gold standard mechanism and another method falls under the classical paper currency system. Today, gold standard mechanism does not operate since no standard monetary unit is now exchanged for gold. All countries now have paper currencies not convertible to gold.

Under inconvertible paper currency system, there are two methods of exchange rate determination. The first is known as the purchasing power parity theory and the second is known as the demand-supply theory or the balance of payments theory. Since today there is no believer of purchasing power parity theory, we consider only demand-supply approach to foreign exchange rate determination.

Demand-Supply Approach of Foreign Exchange:

Or, BOP Theory of Foreign Exchange Rate Determination:

Since the foreign exchange rate is a price, economists apply supply-demand conditions of price theory in the foreign exchange market. A simple explanation is that the rate of foreign exchange equals its supply. For simplicity, we assume that there are two countries: India and the USA. Let the domestic currency be rupee.

ADVERTISEMENTS:

The US dollar stands for foreign exchange and the value of rupee in terms of dollars (or conversely, the value of dollars in terms of rupee) stands for foreign exchange rate. Now the value of one currency in terms of another currency depends upon the demand for and the supply of foreign exchange.

Demand for Foreign Exchange:

When Indian people and business firms want to make payments to the US nationals for using US goods and services or to make gifts to the US citizens or to buy assets there, the demand for foreign exchange (here dollar) is generated. In other words, Indians demand or buy dollars by paying rupee in the foreign exchange market. A country releases its foreign currency for buying imports. Thus what appears in the debit side of the BOP account are the sources of demand for foreign exchange. Larger the volume of imports, greater is the demand for foreign exchange.

The demand curve for foreign exchange is negative sloping. A fall in the price of foreign exchange or a fall in the price of dollar in terms of rupee (i.e., dollar depreciates) means that foreign goods are now more cheaper. Thus, an Indian could buy more American goods at a low price. Consequently, imports from the USA would increase—resulting in an increase in the demand for foreign exchange, i.e., dollar.

Conversely, if the price of foreign exchange or the price of dollar rises (i.e., dollar appreciates) foreign goods will now be expensive leading to a fall in import demand and, hence, fall in the demand for foreign exchange. Since price of foreign exchange and demand for foreign exchange move in opposite directions, the importing country’s demand curve for foreign exchange is downward sloping from left to right.

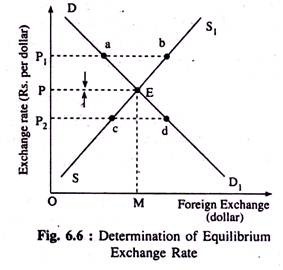

In Fig. 6.6, DD1 is the demand curve for foreign exchange. In this figure, we measure exchange rate expressed in terms of domestic currency that costs 1 unit of foreign currency (i.e., dollar per rupee) on the vertical axis. This makes the demand curve for foreign exchange negative sloping. If the exchange rate is expressed in terms of foreign currency that could be purchased with a 1 unit of domestic currency (i.e., dollar per rupee), the demand curve would exhibit positive slope. Here we have chosen the former one.

Supply of Foreign Exchange:

In a similar fashion, we can determine the supply of foreign exchange. Supply of foreign currency comes from receipts for its exports. If the foreign nationals and firms intend to purchase Indian goods or buy Indian assets or give grants to the Government of India, the supply of foreign exchange is generated. In other words, what the Indian exports (both goods and invisibles) to the rest of the world is the source of foreign exchange. To be more specific, all the transactions that appear on the credit side of the BOP account are the sources of supply of foreign exchange.

A rise in the rupee-per-dollar exchange rate means that Indian goods are cheaper to foreigners in terms of dollars. This will induce India to export more. Foreigners will also find that investment is now more profitable. Thus, a high price or exchange rate ensures larger supply of foreign exchange. Conversely, a low exchange rate causes exchange rate to fall. Thus, the supply curve of foreign exchange, SS1, is positive sloping.

Now we can bring both the demand and supply curves together to determine foreign exchange rate. The equilibrium exchange rate is determined at that point where the demand for foreign exchange equals the supply of foreign exchange. In Fig. 6.6, DD1 and SS, curves intersect at point E. The foreign exchange rate thus determined is OP.

At this rate, quantities of foreign exchange demanded (OM) equals quantity supplied (OM). The market is cleared and there is no incentive on the part of the players to change the rate determined. Note that at the rate OP, (say, Rs. 50 = $1) demand for foreign exchange is matched by the supply of foreign exchange.

ADVERTISEMENTS:

If the current exchange rate OP, (suppose, pc 55 = $ 1) exceeds the equilibrium rate of exchange (OP), there occurs an excess supply of dollar by the amount ‘ab’. Now the bank and other institutions dealing with foreign exchange, wishing to make money by exchanging currency, would lower the exchange rate to reduce excess supply.

Thus, exchange rate will tend to fall until OP is reached. Similarly, an excess demand for foreign exchange by the amount ‘cd’ arises if the exchange rate falls below OP, i.e., OP. Banks would then experience a shortage of dollars to meet the demand. The rate of foreign exchange will rise till demand equals supply.

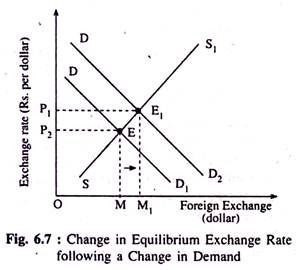

The exchange rate that we have determined is called a floating or ‘flexible exchange’ rate. (Under this exchange rate system, the government does not intervene in the foreign exchange market.) A floating exchange rate, by definition, results in an equilibrium rate of exchange that will move up and down according to a change in demand and supply forces. The process by which currencies float up and down following a change in demand or a change in supply forces is thus illustrated in Fig. 6.7.

ADVERTISEMENTS:

Let us assume that national income rises. This results in an increase in demand for imports of goods and services and, hence, demand for dollar rises. This results in a shift in the demand curve from DD1 to DD2. Consequently, exchange rate rises as determined by the intersection of the new demand curve and supply curve. Note that dollar appreciates while rupee depreciates.

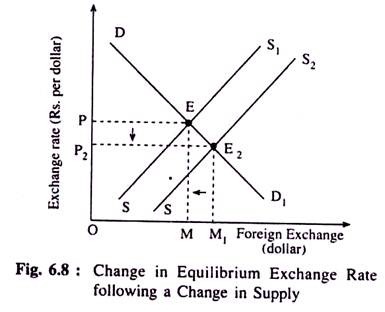

Similarly, if the supply curve shifts from SS1 to SS2 as shown in Fig. 6.8, the new exchange rate thus determined would be OP2. If Indian goods are exported more following an increase in national income of the USA, the supply curve would then shift rightward. Consequently, dollar depreciates and rupee appreciates. New exchange rate is settled at that point where the new supply curve SS2 intersects the demand curve at E2.

ADVERTISEMENTS:

This is the balance of payments theory of exchange rate determination. Wherever government does not intervene in the market, a floating or a flexible exchange rate prevails. Such a system may not necessarily be ideal since frequent changes in demand and supply forces cause frequent as well as violent changes in the exchange rate. Consequently, an air of uncertainty in trade and business would prevail.

Such uncertainty may be damaging for the smooth flow of trade. To prevent this awkward situation, government intervenes in the foreign exchange rate. It may keep the exchange rate fixed. This exchange rate is called a ‘fixed exchange’ rate system where both the demand and supply forces are manipulated or calibrated by the central bank in such a way that the exchange rate is kept pegged at the old level.

Often ‘managed exchange rate’ is suggested. Under this system, exchange rate as usual is determined by the demand for and the supply of foreign exchange. But the central bank intervenes in the foreign exchange market when the situation demands to stabilise or influence the rate of foreign exchange. If rupee depreciates in terms of dollar, the RBI would then sell dollars and buy rupee in order to reduce the downward pressure in the exchange rate.