The following procedure is observed in India for the determination of Exchange Rate:-

In theory terms exchange rate determination is explained by two main models: 1. Flexible/floating exchange rate model 2. Fixed/pegged exchange model

1. Flexible Exchange Rate Model:

When we treat exchange as a price of any foreign currency, then we can use the tools of demand and supply to determine this ‘price’.

Foreign exchange is treated as a ‘good’ with its own demand and supply curves as we learnt in Microeconomics course. Any shifts in each or both of these curves will determine the changes in price of foreign exchange.

ADVERTISEMENTS:

Demand for Foreign Exchange:

Any transaction that leads to outflow of foreign exchange from India will create a demand for it.

Foreign exchange is demanded when residents of India (in terms of individuals or private companies) and government want to spend in terms of foreign currency, instead of Rupees. If a non-resident provides any service, she must be paid dollars by the Indian employer, which adds to demand for dollars.

This may happen in the following ways:

ADVERTISEMENTS:

(i) Indian importers who want to buy German machines must pay the machine manufacturers in dollars.

(ii) Non-residents who provide services in India must be paid in dollars. For example, if a US consultant conducts a workshop for engineers of Maruti Ltd. he will have to be paid in dollars.

(iii) Foreign companies that set up production in India will send profits to home country in dollar terms. This is also called profit repatriation.

(iv) If an Indian mother wants to send money to her daughter studying in the US, she needs dollars.

ADVERTISEMENTS:

(v) A loan taken in US by an Indian citizen (who went on a 2 year training exercise to US) will have to be repaid in dollar terms only, even though the Indian may come back to India and earn in rupees.

(vi) NRIs have a facility to open accounts in India under special schemes which allow them to withdraw money in terms of foreign currency. For example Ravi opens an account with $100 in such a special account. When he needs to withdraw $25 it creates demand for $25.

(vii) If an Indian resident wants to buy shares of a US company she will have to pay in dollar terms, creating a demand for dollars. This kind of investment is also possible in US mutual funds, stock markets and other financial instruments. This financial investment generates demand for dollars.

Supply of Foreign Exchange:

Any transaction that leads to an inflow of foreign exchange will generate supply of it.

Foreign exchange is supplied when non-residents (in terms of individuals or private companies) and government want to spend in terms of Indian rupees. For this they provide supply foreign currency to banks and receive Indian rupees. Also if any services activity is done by a resident in India for a non-resident (like a foreign company) he must be paid in rupees, which generates supply of foreign exchange that is converted into rupees.

This may happen in the following ways:

(i) Indian exporters, who want to sell in Germany, must be paid in rupees. The German buyer supplies Euros which are converted into Rupees. These Euros become supply of Euros for India.

(ii) Residents of India who provide services to foreign companies are paid in non rupee currency. When they want to spend in India they convert their income into Indian rupees, providing India with supply of foreign exchange. For example, Ravi is a consultant works in Mumbai for a foreign consultancy firm based in USA. He supplies the income he earns in dollars to Indian banks when he wants rupees to spend in India.

ADVERTISEMENTS:

(iii) Indian companies that set up production outside India will send profits to India in dollar terms, which is part of supply of dollars.

(iv) If a mother in Nepal wants to send money to her daughter studying in India, she will supply foreign exchange to Indian banks and take rupees in return to give to her daughter.

(v) A loan taken in India by a non-Indian (who came and worked in India on a 2 year training exercise) will have to be repaid in rupee terms only, even though this person is paid his salary in dollars.

(vi) If a foreigner or (from USA) wants to buy shares of an Indian company she will have to pay in rupee terms, creating a supply of dollars. This kind of investment is also possible in Indian mutual funds, stock markets and other financial instruments. This financial investment by non-residents of India generates a supply of dollars.

ADVERTISEMENTS:

Based on the above demand and supply sources we can draw the familiar demand-supply diagram to show the exchange in equilibrium.

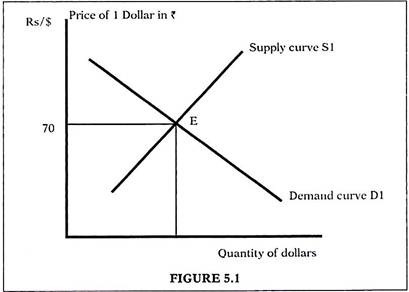

In figure 5.1, on the X axis we have quantity of foreign exchange (or Dollars, as we treat it as the foreign currency as compared to domestic currency Rupee). The Y axis denotes the price of 1 dollar in Rs. terms. The commodity depicted here is ‘foreign exchange’ (dollars in this case).

As shown we have a downward sloping demand curve for dollars. This implies that as the price of a dollar in Rs. terms falls the demand for dollars will rise. This is the same logic that we use for any other good. The law of demand gives us an inverse relation between price and quantity of any good, represented as a down sloping demand curve.

The supply curve is upward sloping, implying that as price of $ 1 rises its supply will increase. Equilibrium is found at the point where demand= supply. At E, $ 1 = Rs.70 and this is the market determined equilibrium Exchange Rate for dollars.

ADVERTISEMENTS:

A model as shown in figure 5.1 lies at the core of flexible exchange rate model.

As the name suggests, in this model the exchange rate is flexible, as it changes in response to changes in demand and supply of foreign currency. Any factor that directly or indirectly affects demand/supply will cause exchange rate to change.

There is no government intervention in this model.

Buyers and sellers are ‘free’ to buy and sell any quantity of foreign exchange – there is no limit on this quantity.

Also there is no limit on the exchange rate, in terms of how low or high it can be.

The flexible exchange rate is dictated purely by demand and supply considerations. Economic and financial factors can affect exchange rate only through demand and supply forces.

ADVERTISEMENTS:

We must now understand two common words used with reference to foreign exchange.

Depreciation of domestic currency refers to an increase in the domestic price of foreign exchange.

Appreciation of domestic currency refers to a fall in the domestic price of foreign exchange.

EXAMPLE:

Let’s compare two rates to understand appreciation and depreciation in common sensual way. Start at a point where $ 1 = Rs.70. Consider another rate where $ 1 = Rs.75 now, so that we can compare the two points. This means that every dollar now gets you Rs.5 more. Does this mean that Rupee has improved its value or has the Rupee value diminished? The answer lies in understanding that for every Re now we get fewer dollars. Earlier we got 1/70 = 0.014286 dollars per Re. In the new equilibrium we end up with 1/75 = 0.01333 dollars per Rupee. Since we end up with lesser dollars this is depreciation of the Rupee.

ADVERTISEMENTS:

In the same way an appreciation of rupee will mean that we get more dollars per Rupee. Consider another equilibrium rate of Rs.60 now. This gets us 1/60 = 0.0666 dollars for each Rupee, as compared to 0.01333 dollars when rate was Rs.70. As we get more dollars with Rs.60 as the rate, we say that Rupee has appreciated.

The exchange rate is also called the value of the currency, which is something we often see as newspaper headlines. When the value of Rupee rises we say it has appreciated, while depreciation means its value has fallen. The rise and fall in value of any currency is thus, correlated with the exchange rate.

The change in the value of a currency comes from the change in exchange rate. This change in exchange rate is driven by changes in demand and supply that affect equilibrium exchange rate. This flexibility can be seen through many cases that outline movements in demand and supply separately as well as in a joint manner.

We now consider some such changes, using dollars as the foreign currency:

A. Increase in Demand for Dollars:

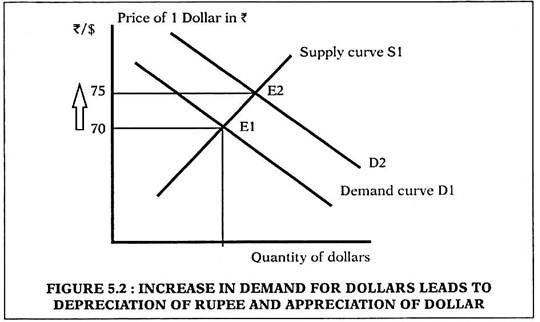

Let us start at equilibrium at point E1 where demand = supply of foreign exchange and equilibrium exchange rate is 1 $ = Rs.70 in figure 5.2. A rise in demand for dollars is shown as a rightward shift of demand curve from D1 to D2. The new equilibrium is now at E2, where exchange rate is Rs.75 for $ 1. This may happen when imports rise and importers need dollars to pay for goods bought from abroad. This change is also called depreciation of the Rupee.

B. Increase in Supply of Dollars:

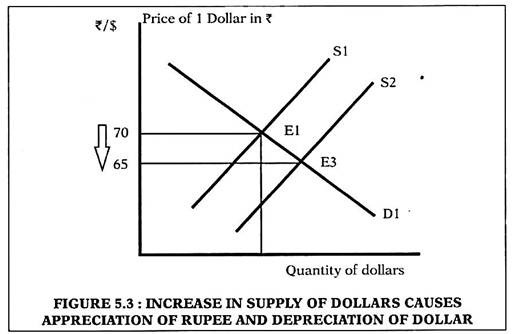

Let us start again at equilibrium at point E1 where demand = supply of foreign exchange and equilibrium exchange rate is 1 $ = Rs.70 in figure 5.3. An increase in supply of dollars is shown as a rightward shift of supply curve from SI to S2. The new equilibrium is now at E3, where exchange rate is Rs.65 for $1.

This may happen when exports rise and sellers from abroad need to pay Indian exporters in Rupee terms. To do so they must supply more foreign exchange to Indian banks in return for Rupees. This change from Rs.70 to Rs.65 is also called appreciation of the Rupee.

C. Simultaneous Increase in Demand and Supply of Dollars:

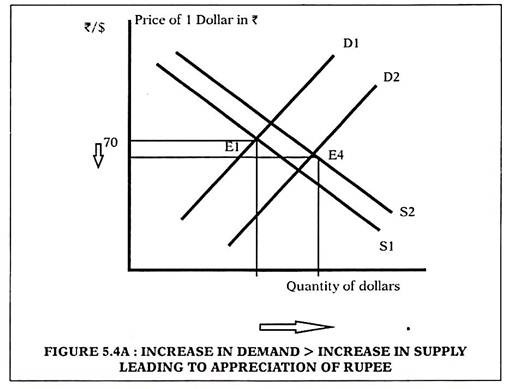

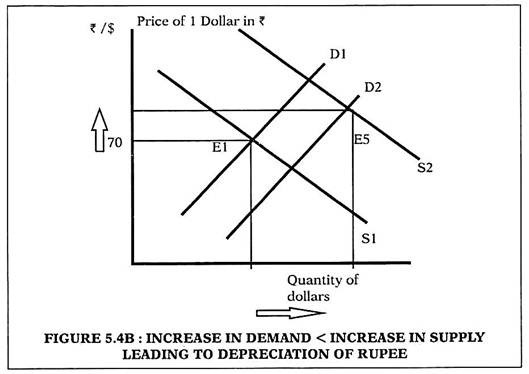

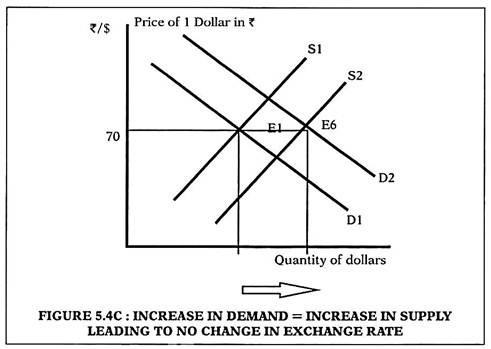

Let us start at equilibrium at point E1 where demand = supply of foreign exchange and equilibrium exchange rate is 1 $ = Rs.70 in figures 5.4A, 5.4B and 5.4B. We now allow both demand and supply to change. This is shown by a simultaneous move from D1 to D2 (depicting increase in demand for foreign exchange) and from S1 to S2 (depicting increase in supply for foreign exchange).

ADVERTISEMENTS:

Now there can be three possible cases as shown below:

Figure 5.4A- A move from E1 to E4, causing an appreciation of the Rupee. This happens if increase in demand is more than the increase in supply. This is clearly shown as the amount of shift of D1 exceeds the shift of S1

Figure 5.4B- A move from E1 to E5, causing depreciation of the Rupee. This happen if increase in supply is more than the increase in demand.

Figure 5.4C- This is the last case where we have equal increase in demand and supply of dollars. This causes a move from E1 to E6 in equilibrium position, causing no change in the foreign exchange rate. This is happening as increase in demand is matched exactly by the increase in supply. The only effect is that quantity of dollars traded in the market increases as shown by the arrow under X axis.

Thus we can see that the effect on exchange rate in a flexible exchange rate model depends on the relative change in demand and supply for dollars. Similar effects can also be seen for other simultaneous changes in demand and supply.

Who Benefits/Loses From Depreciation:

Let’s look at our jewellery exporter again. For every $ 1000 worth of jewellery sold he got 70 x 1000= Rs.70000 in the beginning. Now of the Re depreciates, he will end up with 1000 x 75= Rs.75000. This makes him happier as he realized more revenues without any change in goods sold. So exporters benefit from depreciation.

By the opposite logic, importers will lose. Let Shalini be an importer of designer bags from Italy. Assume that she bought bags worth $ 1000 from An Italian designer. She will pay 1000 x 70 = Rs.70000 to an Indian bank in order to get $ 1000 and pay the designer. If the Rupee depreciates, she will have to pay 75 x 1000= Rs.75000 to the bank now. She still receives bags worth $ 1000 but her cost in rupee terms rises. Importers lose out if rupee depreciates.

This explains why nations that fixed exchange rate like to fix rates at a level that exceeds the rate determined in the market. Export earnings are higher in such a scenario. China did this for many years, until recently when it shifted to a flexible rate regime.

2. Fixed Exchange Rate Model:

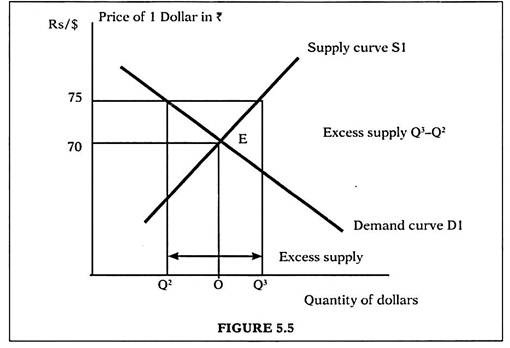

In this model, exchange rate is not allowed to vary and change in response to market conditions and economic performances or economic indicators. The government or the central bank of a country may decide to ‘fix’ the rate at some level that suits the economy. For example the government may decide to ‘fix’ exchange rate at Rs.75, while the real conditions in the economy and foreign exchange market may put the rate at Rs.70 only.

In this case the supply of foreign exchange for conversion of dollars to Rupees will be higher than demand for dollars from Indians who want to convert Rupees to dollars. This is because the dollar will fetch Rs.75, though its actual value is only Rs.70. This will encourage more people to convert dollars to rupees, leading to higher supply of dollars as compared to its demand. This is a situation of excess supply- a situation where supply of foreign currency exceeds the demand.

Why is this fixing done? Such fixing is often done to support exporters who can earn more at fixed rates. In this case an exporter who sells goods worth $ 1000, will end up with Rs.75 x 1000 = Rs.75000 in fixed scenario. In a free market he would realize only Rs.70000. (see figure 5.5)

While most nations remain on flexible exchange rate system, Africa is the continent which has maximum number of nations on fixed exchange rate system. Most nations ‘fix’ their exchange rate with respect to the dollar, as US is considered a very strong economy (probably the strongest economy in the world). China was on this system for many years in the past. It shifted to flexible exchange rates only recently. Bahrain, Cuba, Eritrea Hong Kong, Jordan, Lebanon, Oman, Panama, Qatar, and Saudi Arabia are some nations that are still on fixed rate regime.

Merits and Demerits of Fixed Exchange Rate Model:

Merits of Fixed Exchange Rates:

1. Smaller and newer nations often fix exchange rates to induce discipline in their foreign exchange transactions and economy. It allows the central bank time to set appropriate systems in place for smooth functioning of the economy.

2. A fixed exchange rate regime leads to lesser volatility and fluctuations in prices of commodities in any nation. This is more relevant when the nation depends heavily on exports and imports.

3. International trade and investment flows between countries are more certain when exchange rates are fixed. Capital controls are better if fixed exchange rate is followed.

4. Inflation is better controlled with fixed exchange rate. When a central bank is unable to streamline its monetary policy to rein in inflation, it is best to shift to fixed regime.

Demerits of Fixed Exchange Rates:

1. Often the ‘fixed’ exchange rate does not coincide with the free market exchange rate. This causes a ‘black’ market to emerge for foreign exchange, as demand does not meet supply of foreign exchange. The announced exchange rate may not coincide with the market equilibrium exchange rate, thus leading to excess demand or excess supply of foreign exchange.

2. ‘Wrong’ exchange rates can lead to loss of exports if the fixed rate is lower than free market rate of exchange.

3. The central bank is required to hold stocks of both foreign and domestic currencies at all times, adding to its responsibilities.

4. Management of exchange rate is the responsibility of the central bank. To maintain the fixed rate the bank needs to continuously sell foreign exchange reserves to buy its own currency. A change in rate of interest is also necessitated to attract enough investments funds, which adds to the targets assigned to central bank.

Merits and Demerits of Flexible Exchange Rate Model:

Merits of Flexible Exchange Rates:

1. Flexible exchange rate system allows the central bank to pursue an independent monetary policy.

2. Flexible exchange rates work as an automatic policy to maintain equilibrium in balance of payments. For example, if there is a deficit in BOP, there is an excess supply of home currency. This leads to fall in exchange rate as supply curve shifts to the right. The depreciation of domestic currency will increase exports and decrease imports, leading to a self-correction in BOP deficit levels.

3. Since a flexible exchange rate does not need any active management it is relatively freer from any government interference, leading to more transparency in international transactions. The flow of capital is easier and trade is boosted under flexible exchange rates.

4. The system of flexible exchange rates minimizes the requirement of maintaining official foreign exchange reserves by the central bank. This allows greater liquidity in currencies across the world.

5. Since the flexible exchange rate system allows market forces to work, there is greater allocative efficiency. The market clears automatically, with minimal scope of imbalances in demand and supply that could lead to scarcity or surplus of foreign exchange.

Demerits of Flexible Exchange Rates:

1. Due to its very nature, a flexible exchange rate system is more uncertain and instable as compared to fixed regime. For example if an Indian exporter agrees to sell goods worth $100 to a French buyer and deliver after 30 days, he is unsure of the actual amount he will receive after 1 month. This is because there is no surety of the exchange rate on the 30th day. This uncertainty can reduce the volume of international trade and foreign investment. Long-term foreign investments are also subject to fluctuations and higher risks.

2. The system of flexible exchange rates has widest impact on BOP of a nation. Fluctuating exchange rates lead to changes in the price of imports and exports goods which affect BOP systematically. This can lead to trade deficits that are unsustainable in the long run.

3. Capital inflows and outflows of a nation depend on exchange rates and other factors like interest rates. Changes in rates of exchange can cause large-scale capital outflows and inflows which can potentially impair an economy and cause financial instability- Such movements have far reaching effects on the structure of the economy itself. These effects include high liquidity preference, currency hoarding, black money generation and illegal transactions in foreign exchange.

4. Flexible exchange rate system is associated with greater fluctuations in prices, especially when imports are high. These inflationary pressures further depreciate the value of the domestic currency, exaggerating BOP problems.

5. To protect themselves from fluctuations in currency rate changes, foreign exchange traders, exporters and importers indulge in speculation, and hedging to protect themselves from uncertainty. The development of a forward market in foreign exchange is a result of speculation. In affixed regime there is no scope for such activities.