An exchange rate is the price at which one currency is converted into or exchanged for another currency.

Exchange rate connects the price system of two countries since this (special) price shows the relationship between all domestic prices and all foreign prices.

Any change in the exchange rate between rupee and dollar will cause a change in the prices of all American goods for Indians and the prices of all Indian goods for Americans. In the process, equilibrium in BOP accounts will be restored.

Every government has to make international decisions of what type of exchange rate it wants to adopt. This means that government will have to decide how its own currency should be related to other currencies of the world.

ADVERTISEMENTS:

For instance, it may choose to fix the value of its currency to other currencies of the world so as to adjust its BOP difficulties or it: may choose to allow its currency to move freely against other currencies of the world so as to adjust its BOP difficulties. This means that there are two important exchange rate systems the fixed (or pegged) exchange rate and the flexible (or fluctuating or floating) exchange rate.

These two exchange rates have been tried and tested in the past. Fixed exchange rate system had been tried by the IMF during 1947- 1971 when this system was abandoned. After 1971, the world’s exchange rate became a flexible one or a floating one. Truly speaking, the exchange rate that is being followed by the IMF now is known as ‘managed floating system, or ‘managed flexibility’.

Fixed and Flexible Exchange Rate Management:

(A) Fixed Exchange Rate:

A fixed exchange rate is an exchange rate that does not fluctuate or that changes within a pre-deter- mined rate at infrequent intervals. Government or the central monetary authority intervenes in the foreign exchange market so that exchange rates are kept fixed at a stable rate. The rate at which the currency is fixed is called par value. This par value is allowed to move in a narrow range or ‘band’ of ± 1 per cent.

If the sum of current and capital account is negative, there occurs an excess supply of domestic currency in world markets. The government then intervenes using official foreign exchange reserves to purchase domestic currency.

ADVERTISEMENTS:

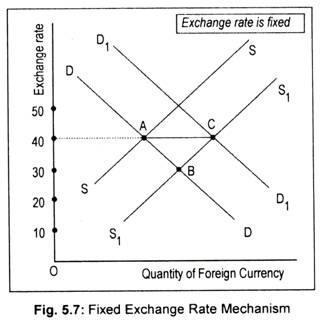

The fixed or pegged exchange rate can be explained graphically. Let us suppose that India’s demand for US goods rises. This increased demand for imports causes an increase in the supply of domestic currency, rupee, in the exchange market to obtain US dollars. Let DD and SS be the demand and supply curves of dollar in Fig. 5.7. These two curves intersect at point A and the corresponding exchange rate is Rs. 40 = $1. Consequently, the supply curve shifts to S1S1 and cuts the demand curve DD at point B. This means a fall in the exchange rate.

To prevent this exchange rate from falling, the Reserve Bank of India will now demand more rupee in exchange for the US dollars. This will restrict the excess supply of rupee and there will be an upward pressure in exchange rate. Demand curve will now shift to DD1. The end result is the restoration of the old exchange rate at point C.

Thus, it is clear that the maintenance of fixed exchange rate system requires that foreign exchange reserves are sufficiently available. Whenever a country experiences inadequate foreign currency reserves it won’t be able to purchase domestic currency in sufficient quantities. Under the circumstance, the country will devalue its currency. Thus, devaluation means an official reduction in the value of one currency in terms of another currency.

(B) Flexible Exchange Rate:

ADVERTISEMENTS:

Under the flexible or floating exchange rate, the exchange rate is allowed to vary to international foreign exchange market influences. Thus, government does not intervene. Rather, it is the market forces that determine the exchange rate. In fact, automatic variations in exchange rates consequent upon a change in market forces are the essence of freely fluctuating exchange rates.

A deficit in the BOP account means an excess supply of the domestic currency in the world markets. As price declines, imbalances are removed. In other words, excess supply of domestic currency will automatically cause a fall in the exchange rate and BOP balance will be restored.

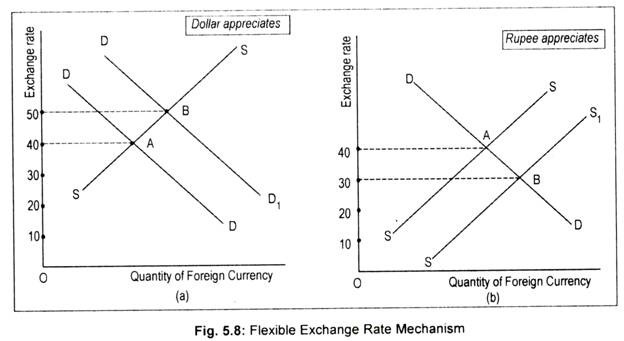

Flexible exchange rate mechanism has been explained in Fig. 5.8 where DD and SS are demand and supply curves. When Indians buy US goods, there arises supply of dollar and when US people buy Indian goods there occurs demand for rupee. Initial exchange rate—Rs. 40 = $1—is determined by the intersection of DD and SS curves in both the Figs. 5.8(a) and 5.8(b).

An increase in demand for India’s exportables means an increase in the demand for Indian rupee. Consequently, demand curve shifts to DD1 and the new exchange rate rises to Rs. 50 = $1. At this new exchange rate, dollar appreciates while rupee depreciates in value [Fig. 5.8(a)].

Fig. 5.8(b) shows that the initial exchange rate is Rs. 40 = $1. Supply curve shifts to SS1 in response to an increase in demand for US goods. SS1 curve intersects the demand curve DD at point B and exchange rate drops to Rs. 30 = $1. This means that dollar depreciates while Indian rupee appreciates.

(C) Managed Exchange Rate:

Under the managed exchange rate, floating exchange rates are ‘managed’ partially. That is to say, exchange rates are determined in the main by market forces, but central bank intervenes to stabilise fluctuations in exchange rates so as to bring ‘orderly’ conditions in the market or to maintain the desired exchange rate values.