The following points highlight the top five contributions of Paul A. Samuelson to Economics to Economics. The contributions are: 1. Theory of Revealed Preference 2. Business Cycles 3. Social Welfare Function 4. Samuelson’s Utility Possibility Approach 5. Inflation.

Contribution # 1. Theory of Revealed Preference:

In revealed preference theory, the consumer is supposed to reveal his preferences. When a consumer selects a combination out of various alternative combinations open to him, he reveals his preference over all other alternative combinations. Thus ‘Choice reveals preference’.

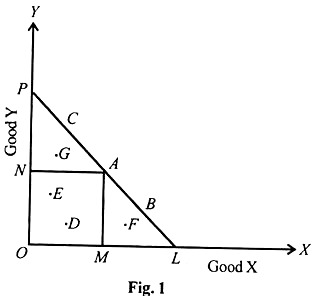

Revealed preference hypothesis can be shown graphically in the following figure 1:

Give the price of two commodities and income of the consumer, the price line PL is drawn. Given the price income line PL the consumer can choose any combination within or on the triangle OPL. The combinations A,B,C lying on the line PL and D,E,F,G lying below the PL line are alternative combinations available to the consumer. If the consumer selects the combination A, it means he reveals his preference for A over-all other combinations. At A, the consumer is buying OM of commodity X and ON Quantity of commodity Y.

Assumptions:

ADVERTISEMENTS:

The revealed preference hypothesis is based on the following assumptions:

(1) The consumer is rational aiming at maximum satisfaction.

(2) It assumes consistency of consumer behaviour. If A is preferred to B in one situation, B cannot be preferred to A in other situation.

ADVERTISEMENTS:

(3) The theory is based on the assumption of transitivity. If A is preferred to B and B to C, then the consumer must prefer A to C.

(4) The consumer prefers a combination of more goods to less in any situation.

(5) The tastes of the consumer do not change.

(6) Revealed preference theory assumes that the income elasticity of demand is positive, i.e., as income increases, demand for the commodity must also increase.

ADVERTISEMENTS:

(7) Revealed preference theory is based on strong ordering. By choosing one combination and rejecting others, the consumer reveals his definite preference.

Merits:

Revealed preference theory is an improvement over the Marshallian utility analysis and Hicks – Allen indifference curve technique.

(1) Revealed preference theory is more realistic and scientific. It studies the actual behaviour of a consumer and not an imaginary consumer.

(2) Samuelson’s revealed preference theory does not assume continuity.

(3) Samuelson uses the consistency principle to derive the demand theorem and drops the utility maximisation principle.

Demerits:

Revealed preference theory is not free from defects.

(1) The Revealed theory preference is based on strong ordering and neglects indifference. Sometimes, the consumer is faced with alternatives which are equally desirable and therefore he is hesitant to choose among them.

(2) The Revealed preference theory is based on the positive income elasticity of demand. It cannot explain Giffen’s paradox in which the income effect is negative.

(3) The assumption of choice reveals preference has also been criticised. Choice always does not reveal preference. Choice requires rational consumer behaviour. Since a consumer does not act rationally at all times, his choice may not reveal his preference.

ADVERTISEMENTS:

(4) The revealed preference approach is applicable only to an individual consumer. Individual demand curve can be drawn for each consumer. But market demand schedule cannot be drawn with the help of this approach.

(5) Since the revealed preference theory is based upon the actual behaviour of the consumer it is not possible to distinguish between income effect and substitution effect.

Therefore Samuelson’s theory gives only a partial explanation of a change in demand as a result of a change in price. Revealed preference theory is superior to other demand-theories as it is scientific and behaviouristic.

Contribution # 2. Business Cycles:

Prof. Samuelson has developed a model of multiplier-accelerator interaction to explain the process of income propagation and also the different types of cyclical fluctuations.

ADVERTISEMENTS:

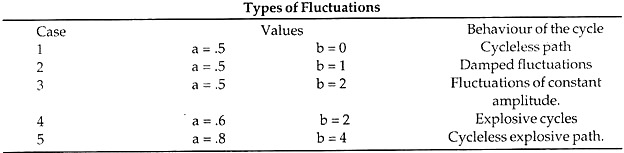

Samuelson shows five types of cyclical fluctuation in the following figure 2:

Figure A (case 1) shows cycle-less path. Income moves upward or downward at a diminishing rate. As accelerator is zero, there is no cycle. It is based only on multiplier. Figure B shows damped oscillations (case 2), i.e., they will become weaker and weaker and slowly disappear.

ADVERTISEMENTS:

Figure C depicts (case 4) explosive fluctuations. The cycles will become stronger and stronger. Figure D (case 3) illustrates cycles of constant amplitude. This type of cycle is a regular one. Figure E (case 5) relates to a cycle-less explosive path. Income moves in an upward path. Prof. Samuelson has shown that for different combinations of values of multiplier and accelerator, it is possible to get cycles of various types.

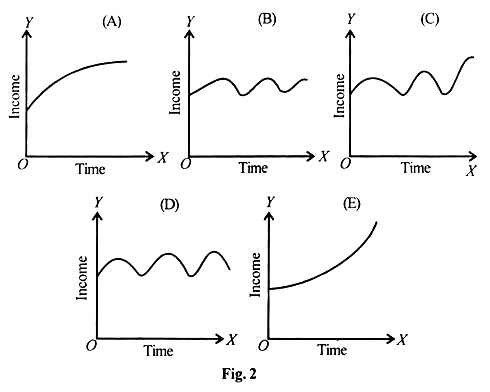

In the figure 3 the combinations of multiplier and accelerator which fall in region B will produce damped oscillations. Similarly, those combinations of multiplier and accelerator that fall in regions A, C and D will produce either explosive cycles or cycle-less path. Multiplier and accelerator combinations that fall along the line E produce cycles of constant amplitude.

In case 1 the economic system moves to a new equilibrium without any fluctuation. There is no cycle here. Case 5 produces explosive movement without cycles. Only other three cases are cyclical in nature. Of the three, case 3 illustrates cycles of constant amplitude which has not been experienced. Case 2 shows damped oscillations and this has taken place in the last century. They are the result of exogenous factors such as war, inventions, changes in crops etc. Case 4 represents explosive cycles but this type of fluctuations is absent due to endogenous economic factors.

Limitations:

Samuelson’s theory has got certain limitations.

ADVERTISEMENTS:

(1) Samuelson did not explain the length of each period in different cycles.

(2) He assumes a constant marginal propensity to consume and a constant accelerator. But in reality, consumption changes change with the level of income.

(3) He assumes a stationary state but this is unrealistic as the economy is always in a process of growth.

Uses:

Samuelson’s study has paved the way for a more accurate analysis of nature of cyclical fluctuations. It also serves as a useful tool for understanding the process of income generation. It also helps in formulating a stabilisation policy. Prof. Kurihara points out, ‘It is in conjunction with the multiplier analysis that the acceleration principle serves as a useful tool of business cycle analysis based on the concept of the marginal propensity to consume and a helpful guide to stabilisation policy.”

Contribution # 3. Social Welfare Function:

Samuelson makes use of his social welfare function which describes the factors on which the welfare of all individuals in a society depends. It makes welfare of the society depend upon economic as well as non-economic factors – the amount of each and every kind of goods consumed and services performed, the amount of capital investment undertaken and so on.

The social welfare functions possess some special properties which give it an edge of superiority over the earlier ones.

ADVERTISEMENTS:

1. It introduces value judgements into the welfare analysis and does not in any way feel shy of them. Thus the function involves inter-personal comparisons and hence value judgements.

2. It is a general welfare function. Any set of assumptions of compounding individual utility functions into the social welfare function can be fed into the Bergson social welfare function.

3. The ethical norms on which the Social Welfare Function is built, are assumed to be ordinal in nature. So the assumption of additivity of individual utilities is not there.

4. The Social Welfare Function does not have any element of indeterminacy in it. It deals with distribution of welfare as much as production and exchange condition of welfare.

Assumptions:

1. It assumes that social welfare depends on wealth and income.

ADVERTISEMENTS:

2. It assumes the presence of external economies and diseconomies.

3. It is based on ordinal utility.

4. Inter – personal comparisons are possible.

A social welfare function is simply a set of social indifference curves where an increase in one individual’s welfare, all other individual’s welfare remaining the same, increases social welfare. Hence the social welfare function is an ordinal index of society’s welfare and is also a function of the level of satisfaction of all individuals. Economists have developed two equivalent ways of finding the point of maximum welfare.

Contribution # 4. Samuelson’s Utility Possibility Approach:

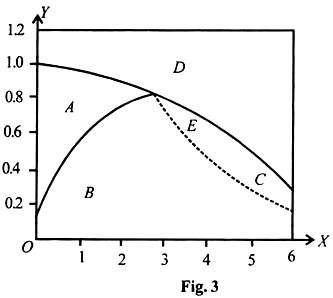

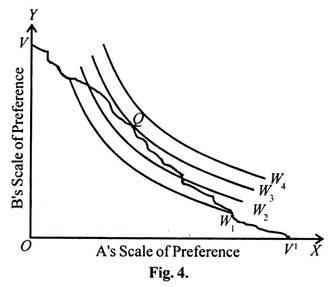

It was given by Samuelson. It consists of representing the social welfare function by a family of social indifference curves. A family of curves is shown in the figure by, W1, W2, W3, W4 VV1 is the utility possibility frontier.

It shows all possible combinations of utility to A and B, given the resource base, production functions and individual preference orderings. The social indifference curves show utility combinations that result in equal levels of social welfare. The higher the curve, the greater is the aggregate social welfare.

Maximum social welfare is attained at Q where a social indifference curve is just tangent to the utility possibility frontier. The unique equilibrium Q is called the point of “Constrain bliss” because it represents the unique organisation of production, exchange and distribution that leads to the maximum attainable social welfare.

The society, of course, would be more blissful, on W4. But a state on this higher curve is not attainable. The resource endowment and technology constraint the society to a point on VV1. In view of the constraint, society reaches its point of constrained bliss at Q.

Contribution # 5. Inflation:

Samuelson has emphasized the problem of inflation. Inflation occurred whenever the sum of consumption, investment and Government expenditures exceed the full employment capacity of production. Samuelson regards the Phillips Curve as an important concept in the formulation of modern policy. He advocated a system of rationing to fight scarcity of resources.

He gave a welfare interpretation of the concept of national income. He has suggested a Leontief- type Input-Output structure. He has written an important theorem in the pure theory of normative growth in his “Linear programming and Economic Analysis”.

He emphasized that mixed economy idea is coming up in many countries. Samuelson has a great public image not only in U.S.A. but in the entire world. Through his works and articles, he has impressed the world much more than any other economist of the day.