The following points highlight the nine grounds on which Keynes criticized the Classical Theory of Employment. The Grounds are: 1. Keynes Rejected the Fundamental Classical Assumption of Normal, Automatic Full Employment Equilibrium in the Economy 2. Keynes Refuted the Say’s Law of Markets with the help of his Theory of Effective Demand 3. No Automatic Working of the Price Mechanism and Others.

Ground # 1. Keynes Rejected the Fundamental Classical Assumption of Normal, Automatic Full Employment Equilibrium in the Economy:

He considered it as unrealistic. He regarded full employment as a special situation.

He observed that the general situation in a capitalist economy is one of underemployment.

This is because the capitalist society does not function according to Say’s law especially during depression when aggregate supply exceeds its demand.

ADVERTISEMENTS:

We find during depression that millions of workers are prepared to work at the current wage rate, and even below it, but they do not find work. Thus the existence of involuntary unemployment in capitalist economics (entirely ruled out by the classicists) proves that underemployment equilibrium is a normal situation and full employment equilibrium is just a chance.

Ground # 2. Keynes Refuted the Say’s Law of Markets with the help of his Theory of Effective Demand:

He maintained that all income earned by the factor-owners would not be spent in buying products which they help to produce. A part of the earned income is saved and is not automatically invested because saving and investment are done by two entirely different groups of people.

So when all income is not spent on consumption goods and a portion of it is saved and not invested their results a deficiency of aggregate demand. This leads to general overproduction because all that is produced is not sold. This, in turn, leads to general unemployment. Thus Keynes invalidated Say’s Law by invoking the principle that all saving is not automatically invested.

Ground # 3. No Automatic Working of the Price Mechanism:

Keynes did not agree with the classical view that the laissez faire policy was essential for an automatic and self-adjusting process of achieving full employment equilibrium. He pointed out that the free market capitalist system was not automatic and self-adjusting because of the way some capitalist institutions function on profit-motive alone.

ADVERTISEMENTS:

There are two principal classes, the rich and the poor. The rich possess much wealth but they do not spend the whole of it on consumption. The poor do not have money to purchase consumption goods. In times of prosperity, the incomes of the rich rise much more than the incomes of the poor.

Thus there is general deficiency of aggregate demand in relation to aggregate supply which leads to overproduction and unemployment in the economy.

This, among other reasons, led to the Great Depression. Had the capitalist system been automatic and self-adjusting this depression would not have occurred. Keynes, therefore, advocated state intervention for adjusting aggregate supply and demand in the economy through fiscal and monetary measures.

Ground # 4. Investment is Equated to Saving by Changes in Income:

The classicists believed that saving and investment were equal at the full employment level and in case of any divergence, equilibrium was brought about by changes of the rate of interest. Keynes held that the level of saving depended upon the level of income and not on the rate of interest. Similarly investment is determined not so much by rate of interest as by the marginal efficiency of capital.

ADVERTISEMENTS:

A low rate of interest cannot increase investment if profit expectations are low. If saving exceeds investment, it means people are spending less on consumption. As a result, demand declines. There is overproduction and the failure to sell goods results in fall in investment, income, and output.

It leads to reduction in saving to the level at which investment falls. Thus it is variations in income rather than changes in interest rate that brings about equality between saving and investment.

Ground # 5. Inadequate Analysis of the Demand for Money:

The classical economists believed that money was demanded only for transactions and precautionary purposes. They did not recognise the speculative demand for money because they thought it irrational as money held for speculative purposes related to idle balances. But Keynes did not agree with this view. He emphasised the rationality of speculative demand for money.

He pointed out that the cost of assets meant for transactions and precautionary purposes may be very small at a low rate of interest and therefore the demand for active balances may be low. But the speculative demand for money would be infinitely large at a low rate of interest.

Thus the rate of interest will not be allowed to fall below a certain minimum level, where the speculative demand, for money would become perfectly interest- elastic. This is Keynes’s ‘liquidity trap’ situation which Keynes considered as the real situation in the depths of the Great Depression.

Keynes pointed out that it was possible for saving to exceed investment while the rate of interest was positive. The liquidity trap prevents the rate of interest from falling below certain minimum level. This may prevent the equality of saving and investment at full employment.

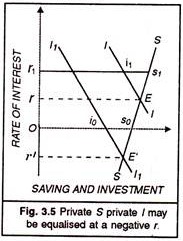

This is illustrated in Figure 3.5 where SS is the saving curve and II the investment curve. If the liquidity trap occurs at Or1 rate of interest, it would prevent the interest rate from falling to Or level and the equality between saving and investment will not be brought about at point E.

At the liquidity trap level of the rate of interest Or1 saving exceeds investment by i1S1. So the economy will not achieve equilibrium at the full employment level shown at the point E where saving and investment are equal but at underemployment equilibrium level of the rate of interest Or, where saving exceeds investment.

Keynes’s argument has been further developed by Patinkin who maintains that even if the rate of interest were to fall to zero; there would still be an excess of saving over investment. This is because even when there is deep depression people save for security reasons and hold idle balances when the general price level falls. This is also explained in Figure 3.5 where the curve II has shifted to the extreme left as I 1I 1 – showing the decrease in investment.

ADVERTISEMENTS:

Such a possibility exists under a depression. At zero interest rate saving exceeds investment by i0s0. Patinkin says that under depression conditions, it may be that full employment is obtained at a negative rate of interest. In the figure, the classical saving and investment curves intersect at point E’ where the rate of interest Or’ is negative. This is an impossible policy proposition for a depressed economy because the rate of interest can never be negative in practice.

Ground # 6. Money Influences Output and Employment:

The classical economists regarded money as neutral. Therefore they had separated the theory of output, employment and interest rate from the monetary theory. According to them, the level of output and employment, and the equilibrium rate of interest were determined by real forces.

Keynes criticized the classical view that the monetary theory should be treated as separate from the value theory. He tried to integrate monetary theory with value theory, and brought the theory of interest within the domain of monetary theory (by regarding the interest rate as a monetary phenomenon).

ADVERTISEMENTS:

This lie attempted by forging a link between the quantity of money and the price level via the rate of interest. We state Keynes’s argument briefly: when the quantity of money increases, the rate of interest falls, investment increases, income and output increases, demand increases, factor costs and wages increase, relative prices increase, and ultimately the general price level rises.

Ground # 7. Keynes refuted Professor Pigou’s Contention that a Cut in Money wage could Achieve Full Employment in the Capitalist Economy:

The greatest fallacy in Pigou’s analysis, Keynes pointed out, was that he extended the argument to the economy which was only applicable to an individual industry. Reduction in wage rate can increase employment in an industry by reducing costs and increasing demand.

But the adoption of such a policy for the economy as a whole leads to a reduction in employment. When there is a general wage-cut, the income of the workers as a class is reduced. As a result, aggregate demand falls leading to a decline in employment.

From the practical policy viewpoint also Keynes never favoured a wage-cut policy. Since workers have formed strong trade unions, which resist a cut in money wage, they would resort to gherao, go-slow tactics and even strikes. The consequent unrest in the economy would bring a decline in output and income.

ADVERTISEMENTS:

Keynes also did not accept the classical assumption that there was a direct proportionate relationship between money wages and real wages. According to him, for the economy as a whole there is an inverse relation between the two. When money wages fall, real wages rise and vice versa.

Therefore, a reduction in the money supply would not reduce the real wage and reduce more employment simply because effective demand would not improve through wage cutting.

Keynes, however, believed that employment could be increased more easily through monetary and fiscal measures rather than by reduction in money wage. Moreover, institutional resistances to wage and price reductions are so strong that it is not possible to implement such a policy politically.

Ground # 8. State Intervention is Necessary for Economic Stability:

Keynes did not agree with Pigou that “frictional maladjustments alone account for failure to utilise fully our productive power.” The capitalist system is such that left to itself it is incapable of using its productive powerfully.

Therefore, state intervention is necessary both for efficiency and stability. The government has many options. The state may directly invest to raise the level of economic activity or to supplement deficient private investment. It may pass legislation recognising trade unions, fixing minimum wages and providing relief to workers through social security measures. We are now living in welfare states. “Therefore”, as observed by Dillard, “it is bad politics even if it should be considered good economics to object to labour unions and to liberal labour legislation.”

Ground # 9. Importance of the Short-run Problems:

The classicists believed in the automatic establishment of long-run full. Employment equilibrium through a self- adjusting process. Keynes maintained that society had no patience to wait for the long period, for the common man believes that “In the long-run we are all dead. As pointed by Schumpeter. “His philosophy of life was essentially a short-term philosophy.” His analysis is confined to short-run phenomena.

ADVERTISEMENTS:

Politicians making policy choices attach more importance to short-run problems. Classical policy proposals were not acceptable to them as these would take a long time to work out their way. The classical macro model might have been quite logical on its assumptions and policy prescriptions. But it was unfit for short-term macro analysis and policymaking. Keynes had good reasons to reject classicism.

In conclusion it may be pointed out the classical model had an inconsistency. It tried to separate the real sector from the monetary sector. The pricing process in the real (goods) sector was separated from that in the monetary sector through the assumption of neutrality of money.

This separation was invalid as it did not have a link between the goods market and the money market. This link was provided by Keynes through his theory of the rate of interest.