A central bank is the primary source of money supply in an economy through circulation of currency.

It ensures the availability of currency for meeting the transaction needs of an economy and facilitating various economic activities, such as production, distribution, and consumption.

However, for this purpose, the central bank needs to depend upon the reserves of commercial banks. These reserves of commercial banks are the secondary source of money supply in an economy. The most important function of a commercial bank is the creation of credit.

Therefore, money supplied by commercial banks is called credit money. Commercial banks create credit by advancing loans and purchasing securities. They lend money to individuals and businesses out of deposits accepted from the public. However, commercial banks cannot use the entire amount of public deposits for lending purposes. They are required to keep a certain amount as reserve with the central bank for serving the cash requirements of depositors. After keeping the required amount of reserves, commercial banks can lend the remaining portion of public deposits.

ADVERTISEMENTS:

According to Benham’s, “a bank may receive interest simply by permitting customers to overdraw their accounts or by purchasing securities and paying for them with its own cheques, thus increasing the total bank deposits.”

Let us learn the process of credit creation by commercial banks with the help of an example.

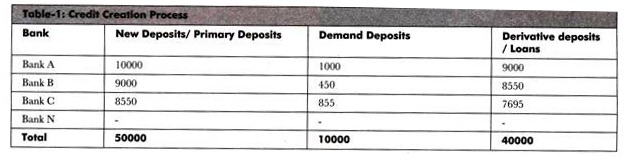

Suppose you deposit Rs. 10,000 in a bank A, which is the primary deposit of the bank. The cash reserve requirement of the central bank is 10%. In such a case, bank A would keep Rs. 1000 as reserve with the central bank and would use remaining Rs. 9000 for lending purposes.

The bank lends Rs. 9000 to Mr. X by opening an account in his name, known as demand deposit account. However, this is not actually paid out to Mr. X. The bank has issued a check-book to Mr. X to withdraw money. Now, Mr. X writes a check of Rs. 9000 in favor of Mr. Y to settle his earlier debts.

ADVERTISEMENTS:

The check is now deposited by Mr. Y in bank B. Suppose the cash reserve requirement of the central bank for bank B is 5%. Thus, Rs. 450 (5% of 9000) will be kept as reserve and the remaining balance, which is Rs. 8550, would be used for lending purposes by bank B.

Thus, this process of deposits and credit creation continues till the reserves with commercial banks reduce to zero.

This process is shown in the Table-1:

From Table-1, it can be seen that deposit of Rs. 10,000 leads to a creation of total deposit of Rs. 50,000 without the involvement of cash.

ADVERTISEMENTS:

The process of credit creation can also be learned with the help of following formulae:

Total Credit Creation = Original Deposit * Credit Multiplier Coefficient

Credit multiplier coefficient= 1 / r where r = cash reserve requirement also called as Cash Reserve Ratio (CRR)

Credit multiplier co-efficient = 1/10% = 1/ (10/100) = 10

Total credit created = 10,000 *10 = 100000

If CRR changes to 5%,

Credit multiplier co-efficient = 1/5% = 1/ (5/100) = 20

Total credit creation = 10000 * 20 = 200000

ADVERTISEMENTS:

Thus, it can be inferred that lower the CRR, the higher will be the credit creation, whereas higher the CRR, lesser will be the credit creation. With the help of credit creation process, money multiplies in an economy. However, the credit creation process of commercial banks is not free from limitations.

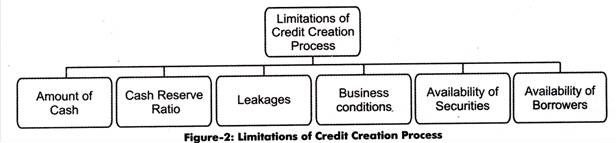

Some of the limitations of credit creation by commercial banks are shown in Figure-3:

The limitations of credit creation process (as shown in Figure-3) are explained as follows:

ADVERTISEMENTS:

(a) Amount of Cash:

Affects the creation of credit by commercial banks. Higher the cash of commercial banks in the form of public deposits, more will be the credit creation. However, the amount of cash to be held by commercial banks is controlled by the central bank.

The central bank may expand or contract cash in commercial banks by purchasing or selling government securities. Moreover, the credit creation capacity depends on the rate of increase or decrease in CRR by the central bank.

(b) CRR:

ADVERTISEMENTS:

Refers to reserve ratio of cash that need to be kept with the central bank by commercial banks. The main purpose of keeping this reserve is to fulfill the transactions needs of depositors and to ensure safety and liquidity of commercial banks. In case the ratio falls, the credit creation would be more and vice versa.

(c) Leakages:

Imply the outflow of cash. The credit creation process may suffer from leakages of cash.

The different types of leakages are discussed as follows:

(i) Excess Reserves:

Takes place generally when the economy is moving towards recession. In such a case, banks may decide to maintain reserves instead of utilizing funds for lending. Therefore, in such situations, credit created by commercial banks would be small as a large amount of cash is resented.

ADVERTISEMENTS:

(ii) Currency Drains:

Imply that the public does not deposit all the cash with it. The customers may hold the cash with them which affects the credit creation by banks. Thus, the capacity of banks to create credit reduces.

(d) Availability of Borrowers:

Affects the credit creation by banks. The credit is created by lending money in form of loans to the borrowers. There will be no credit creation if there are no borrowers.

(e) Availability of Securities:

Refers to securities against which banks grant loan. Thus, availability of securities is necessary for granting loan otherwise credit creation will not occur. According to Crowther, “the bank does not create money out of thin air; it transmutes other forms of wealth into money.”

ADVERTISEMENTS:

(f) Business Conditions:

Imply that credit creation is influenced by cyclical nature of an economy. For example, credit creation would be small when the economy enters into the depression phase. This is because in depression phase, businessmen do not prefer to invest in new projects. In the other hand, in prosperity phase, businessmen approach banks for loans, which lead to credit creation.

In spite of its limitations, we can conclude that credit creation by commercial banks is a significant source for generating income.

The essential conditions for creation of credit are as follows:

a. Accepting the fresh deposits from public

b. Willingness of banks to lend money

ADVERTISEMENTS:

c. Willingness of borrowers to borrow.