A central bank plays an important role in monetary and banking system of a country.

It is responsible for maintaining financial sovereignty and economic stability of a country, especially in underdeveloped countries.

“A Central Bank is the bank in any country to which has been entrusted the duty of regulating the volume of currency and credit in that country”-Bank of International Settlement.

It issues currency, regulates money supply, and controls different interest rates in a country. Apart from this, the central bank controls and regulates the activities of all commercial banks in a country.

ADVERTISEMENTS:

Some of the management experts have defined central bank in different ways, which are as follows:

According to Samuelson, “Every Central Bank has one function. It operates to control economy, supply of money and credit.”

According to Vera Smith, “The primary definition of Central Bank is the banking system in which a single bank has either a complete or residuary monopoly of note issue.”

According to Kent, “Central Bank may be defined as an institution which is charged with the responsibility of managing the expansion and contraction of the volume of money in the interest of general public welfare.”

ADVERTISEMENTS:

According to Bank of International Settlement, “A Central Bank is the bank in any country to which has been entrusted the duty of regulating the volume of currency and credit in that country.”

Bank of England was the world’s first effective central bank that was established in 1694. As per the resolution passed in Brussels Financial Conference, 1920, all the countries should establish a central bank for interest of world cooperation. Thus, since 1920, central banks are formed in almost every country of the world. In India, RBI operates as a central bank.

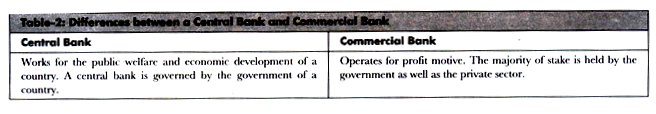

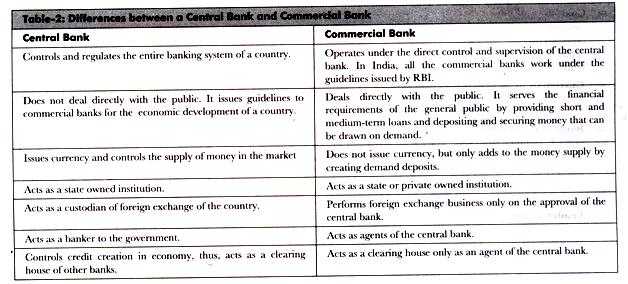

Central banks differ from the commercial banks in various ways, which are shown in Table-2:

Functions of Central Bank:

The central bank does not deal with the general public directly. It performs its functions with the help of commercial banks. The central bank is accountable for protecting the financial stability and economic development of a country.

Apart from this, the central bank also plays a significant part in avoiding the cyclical fluctuations by controlling money supply in the market. As per the view of Hawtrey, a central bank should primarily be the “lender of last resort.”

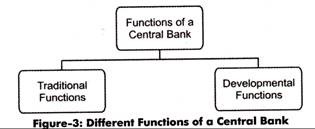

On the other hand, Kisch and Elkins believed that “the maintenance of the stability of the monetary standard” as the essential function of central bank. The functions of central bank are broadly divided into two parts, namely, traditional functions and developmental functions.

These functions are shown in Figure-4:

The different functions of a central bank (as discussed in Figure-4) are explained as follows:

(a) Traditional Functions:

Refer to functions that are common to all central banks in the world.

ADVERTISEMENTS:

The traditional functions of the central bank include the following:

(i) Bank of issue:

Possesses an exclusive right to issue notes (currency) in every country of the world. In the initial years of banking, every bank enjoyed the right of issuing notes. However, this led to a number of problems, such as notes were over-issued and the currency system became disorganized. Therefore, the governments of different countries authorized central banks to issue notes. The issue of notes by one bank has led to uniformity in note circulation and balance in money supply.

(ii) Government’s banker, agent, and advisor:

ADVERTISEMENTS:

Implies that a central bank performs different functions for the government. As a banker, the central bank performs banking functions for the government as commercial banks performs for the public by accepting the government deposits and granting loans to the government. As an agent, the central bank manages the public debt, undertakes the payment of interest on this debt, and provides all other services related to the debt.

As an advisor, the central bank gives advice to the government regarding economic policy matters, money market, capital market, and government loans. Apart from this, the central bank formulates and implements fiscal and monetary policies to regulate the supply of money in the market and control inflation.

(iii) Custodian of cash reserves of commercial banks:

Implies that the central bank takes care of the cash reserves of commercial banks. Commercial banks are required to keep certain amount of public deposits as cash reserve, with the central bank, and other part is kept with commercial banks themselves.

ADVERTISEMENTS:

The percentage of cash reserves is deeded by the central bank! A certain part of these reserves is kept with the central bank for the purpose of granting loans to commercial banks Therefore, the central bank is also called banker’s bank.

(iv) Custodian of international currency:

Implies that the central bank maintains a minimum reserve of international currency. The main aim of this reserve is to meet emergency requirements of foreign exchange and overcome adverse requirements of deficit in balance of payments.

(v) Bank of rediscount:

Serve the cash requirements of individuals and businesses by rediscounting the bills of exchange through commercial banks. This is an indirect way of lending money to commercial banks by the central bank. Discounting a bill of exchange implies acquiring the bill by purchasing it for the sum less than its face value.

Rediscounting implies discounting a bill of exchange that was previously discounted. When owners of bill of exchange are in need of cash they approach the commercial bank to discount these bills. If commercial banks are themselves in need of cash they approach the central bank to rediscount the bills.

ADVERTISEMENTS:

(vi) Lender of last resort:

Refer to the most crucial function of the central bank. The central bank also lends money to commercial banks. Instead of rediscounting of bills, the central bank provides loans against treasury bills, government securities, and bills of exchange.

(vii) Bank of central clearance, settlement, and transfer:

Implies that the central bank helps in settling mutual indebtness between commercial banks. Depositors of banks give checks and demand drafts drawn on other banks. In such a case, it is not possible for banks to approach each other for clearance, settlement, or transfer of deposits.

The central bank makes this process easy by setting a clearing house under it. The clearing house acts as an institution where mutual indebtness between banks is settled. The representatives of different banks meet in the clearing house to settle inter-bank payments. This helps the central bank to know the liquidity state of the commercial banks.

(viii) Controller of Credit:

ADVERTISEMENTS:

Implies that the central bank has power to regulate the credit creation by commercial banks. The credit creation depends upon the amount of deposits, cash reserves, and rate of interest given by commercial banks. All these are directly or indirectly controlled by the central bank. For instance, the central bank can influence the deposits of commercial banks by performing open market operations and making changes in CRR to control various economic conditions.

(b) Developmental Functions:

Refer to the functions that are related to the promotion of banking system and economic development of the country. These are not compulsory functions of the central bank.

These are discussed as follows:

(i) Developing specialized financial institutions:

Refer to the primary functions of the central bank for the economic development of a country. The central bank establishes institutions that serve credit requirements of the agriculture sector and other rural businesses.

ADVERTISEMENTS:

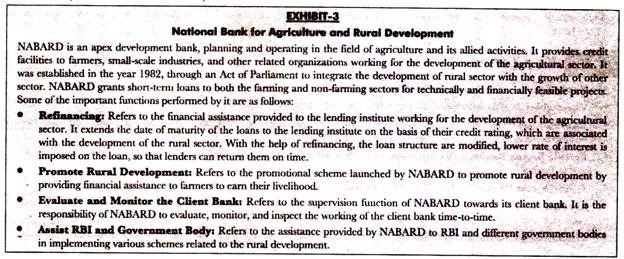

Some of these financial institutions include Industrial Development Bank of India (IDBI) and National Bank for Agriculture and Rural Development (NABARD). These are called specialized institutions as they serve the specific sectors of the economy.

(ii) Influencing money market and capital market:

Implies that central bank helps in controlling the financial markets Money market deals in short term credit and capital market deals in long term credit. The central bank maintains the country’s economic growth by controlling the activities of these markets.

(iii) Collecting statistical data:

Gathers and analyzes data related to banking, currency, and foreign exchange position of a country. The data is quite helpful for researchers, policymakers, and economists. For instance, the Reserve Bank of India publishes a magazine called Reserve Bank of India Bulletin, whose data is useful for formulating different policies and making macro-level decisions.