The following article will guide you about how will an advertising firm determine how much to spend for advertising.

The purpose of advertising or selling cost is to shift the demand curve to the right, to increase demand for the product. In monopolistic competition the firm’s profits are not only a function of the level of output, but depend largely on the extent to which the firm succeeds in differentiating its product from those of its rivals. Thus advertising helps a firm to differentiate its product from those of its rivals. Hence advertising plays a role of great importance.

The Theory:

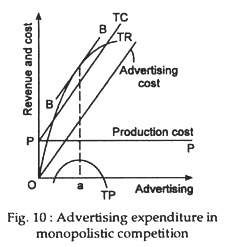

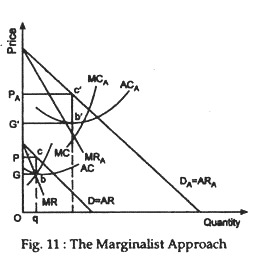

The theoretical approval to advertising is illustrated in Figure 10 and 11.

ADVERTISEMENTS:

In Fig.10 revenue and costs are shown on the vertical axis and advertising expenditure on the horizontal axis. Advertising expenditure is shown on the 45°– line. Production costs are shown on the line pp and are independent of advertising outlay.

Total cost is the sum-total of production cost and advertising expenditure. At the level of advertising where the distance between the total cost curve and the total revenue curve is largest, profits of the firm are maximised. This happens at the level of advertising Oa, where the slope of BB, the line tangent to the TR curve at point T, is the same as that of total cost curve. At this level advertising expenditure, the total profits will be maximum.

Alternatively we can examine the effect of selling costs on price and output of the firm in Fig.11. The average and marginal revenue curves of the firm, without any selling cost are AR and MR. Equilibrium output is Oq at price P. With selling costs including advertising, the demand curve shifts to DA and marginal revenue curve to MRa.

Selling cost is represented in the higher average and marginal cost curves. The point of intersection of MCA with MRA will give an increased level of output qA at a much higher price PA. Profits have jumped up from the size of the rectangle abcp to a’b’c’p’A. The firm will continue adding to its selling cost as long as addition to cost is less than addition to revenue.

It is clear that firms pay for increased costs of advertising by charging consumers a higher price. The consumer is worse off as a result of the increased selling costs, which are merely designed to create product differentiation regardless of any real differences in the products themselves.

The Practical Approach:

Joel Dean has identified five possible ways in which advertising budgets are determined:

ADVERTISEMENTS:

(1) The Percentage of Sales Approach:

It bases advertising budget on a fixed percentage of sales, either past or expected future sales. But in reality past or present sale volumes have nothing to do with the cost or worth of expanding sales further. It confuses cause and effect since promotional activities cause sales and are not the result of them.

(2) The ‘All-You-Can-Afford’:

It apparently implies that the more profitable and more liquid the financial position of the business, the more advertising should be undertaken. But present profitability and a high degree of liquidity arc not necessarily related to potential benefits likely to be achieved uses both within the firm and outside it, they yield the highest return.

(3) The Return on Investment Approach:

It acknowledges that advertising increases immediate sales and at the same time, contributes to the goodwill of the business by increasing future earning power. But there is the difficulty of identifying which part of a business’s cash flows is attributable to advertising.

(4) The ‘Objective and Task’ Approach:

It operates on the principle of: first, defining advertising objectives; second, outlining specific tasks necessary to attain the objectives and third, determining the cost of attainment. The method has some logical basis.

(5) The Competitive Parity Approach:

ADVERTISEMENTS:

It bases the firm’s advertising outlay on what other firms in the industry are spending, e.g., the proportion of total industry advertising expenditure incurred by a particular firm will depend on its share of the total market.

In oligopolistic markets, where rivalry is intense, such method may also be adopted to stabilise market shares and provides no criterion by which the costs and benefits of additional advertising may be evaluated. What rivals spend need not be relevant to the size of advertising outlay a particular firm should make.