Keynes’s main attack against the postulates of the classical economists centres around the relationship between price flexibility and full employment. Keynes challenged the classical belief that price flexibility can be relied upon to generate automatic full employment. The defenders of the classical school, on the other hand, still insist upon this automaticity as a fundamental tenet.

Wage Flexibility:

The importance of wage flexibility arises from the fact that, in most macroeconomic models, we find an inverse relationship between wages and employment. Unemployment is thus associated with wages in excess of full-employment level and the persistence of unemployment then depends on how quickly wages adjust in the face of unemployment.

It is often argued that if wages were very (if not completely) flexible, unemployment would be eliminated quickly and automatically by wage cuts, and that, consequently, any persistence of unemployment must be attributable to wage rigidity.

No doubt wage inflexibility plays a crucial role in explaining unemployment in both classical and Keynesian models. But the mechanism through which it does so is quite different in the two cases. Classical unemployment occurs when the real wage exceeds the marginal product of labour at full employment. So, it is not profitable for firms to employ the whole labour force.

ADVERTISEMENTS:

It can only be reduced by cuts in real wages, which makes it profitable for firms to employ some more workers at the margin. Keynesian unemployment is caused by a deficiency of aggregate demand. But aggregate demand is largely determined in nominal terms so that a cut in money wages, and, hence, in prices, tends to raise real aggregate demand.

Thus, it is the inflexibility, or downward rigidity, of money wages which is the crucial assumption in explaining why unemployment persists in the Keynesian system (even when the economy is in equilibrium, i.e., a situation of underemployment equilibrium in Keynesian terminology).

The effectiveness of money wage flexibility in reducing unemployment depends on the interaction of wage-setting and price-setting behaviour. As Keynes stressed in the General Theory (1936), if a change in money wages leads to an equi-proportionate change in prices, as the behaviour of competitive market might lead one to expect, it will leave the real wage unchanged.

Thus, in the Keynesian system, the wage bargaining (which is generally conducted in money terms) has no direct effect on the real wage. If the price level is fixed, a fall in money wages will reduce real wages but, because there is no fall in prices, there is no stimulus to aggregate demand, and, hence, a fall in money wages will not help remove Keynesian unemployment. We may now discuss in detail the relation between the price flexibility and full employment in the classical and Keynesian models against this backdrop.

Essentially a Static Analysis:

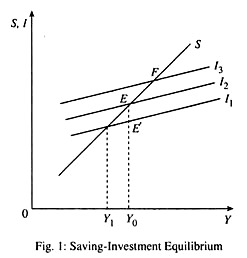

The static Keynesian model rules out the possibility of automatic full employment. There is no guarantee that the desired savings will automatically be equal to investment. This point is illustrated in Fig. 1. Here, desired real savings (S) and investment (I) are assumed to depend only on the level of real income (Y). There are three possible investment schedules—I1, I2, I3. Here, Y0 is the full employment level of income. If the investment desires of the businesses are represented by the curve I1, desired savings at full employment exceed desired investment by EE’.

This will lead to unemployment, in which case the level of income will fall to Y1 at which desired savings are equal to desired investment. Conversely, if I3 is the investment schedule, a situation of overfull employment or demand-pull inflation will arise. Businesses desire to invest more at full-employment than is possible with the current level of savings.

Only if the investment schedule happened to be I2, the economy would reach full employment level, with desired investment equal to desired savings. Since, in Keynes’s model, investment decisions are independent of savings decisions, there is no reason to expect the investment schedule to coincide with I2. Hence there is assurance that automatic full employment will result.

While defending the classicists, Don Patinkin argues that desired savings and investment depend on the rate of interest as well as the level of income; and that, granted flexibility, variations in the interest rate serve as an automatic mechanism for ensuring full employment.

The Classical Theme:

Patinkin’s defence of the classicists can be interpreted as- the savings and investment functions (representing what households and businesses desire to) are written as:

ADVERTISEMENTS:

S = f (r, Y)

I = g (r, Y)

where r is the rate of interest.

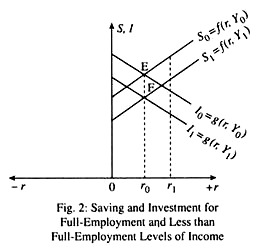

In Fig. 2, we have drawn a whole family of curves relating savings and investment to the rate of interest—one pair for each level—and real income. In Fig. 2, these pairs of curves are drawn for full-employment income, Y0, as also for less than full-employment income Y1.

Since it is assumed that for a given rate of interest people will save and invest more at a higher level of income, the investment curve corresponding to Y = Y0 lies above that corresponding to Y = Y1. The same is true for the two saving curves. These are also consistent with the assumption that, at a certain level of real income, people desire to save more and invest less when the rate of interest increases. This is essentially a classical argument.

We now consider the pair of curves, which correspond to the full employment income Y0. If in Fig. 2, the rate of interest were r1, then households would be desirous of saving more at full employment than businesses would plan to invest. If the interest rate continued to fall, savings would fall and investment would increase. The process would continue until finally desired full employment savings and investment would be equated at the level S0 = I0.

In a like manner, if, at full employment desired investment exceeds desired savings, a rise in the interest rate will prevent inflation. This is why variations in the rate of interest serve automatically to prevent any discrepancy between desired full-employment investment and savings, and, thus, to ensure full employment.

ADVERTISEMENTS:

This point may also be illustrated in terms of Fig. 1. Let us assume, for analytical convenience, that desired investment depends on the rate of interest as well as the level of real income, while desired savings depend only on the latter. Then a fall in the rate of interest will raise the investment curve from, say, I1 to I2.

That is, at any level of income, businesses can be encouraged to invest more by a reduction in the rate of interest. In a like manner, a rise in the rate of interest will shift the investment curve downward from, say, I3 to I2. Thus, at full employment, desired savings will be equal to desired investment.

Keynes’s Answer:

Keynes challenged this classical argument on the basis that it greatly exaggerates the importance of the interest rate. Empirical studies give ample support to the hypothesis that variations in the rate of interest have little effect on the amount of desired investment. (Even the classical economists accept the hypothesis that savings are insensitive to the interest rate.) Oscar Lange has interpreted this insensitivity as a reflection of the presence of widespread uncertainty.

In Fig. 3, we show the possible effect of this insensitivity on the ability of the system automatically to generate full employment. Although the savings functions are the same as in Fig. 2, the investment functions are now represented in Fig. 3 as being much less interest-sensitive than those in Fig. 2.

ADVERTISEMENTS:

In such a situation, interest rate changes could never ensure full employment. For, in an economy in which there are virtually no costs of storing money, the interest rate can never be negative. But from Fig. 3 we see that the only way the interest rate can equate desired full employment savings and investment is by assuming the negative value r2.

Hence, the possibility of the existence of full employment national income Y0 is ruled out. For whatever (positive) rate of interest may prevail, the amount people want to save at full employment exceeds what businesses want to invest. Instead, there will exist some less than full employment income (say) Y1 for which desired savings and investment can be brought into equality at a positive rate of interest, say, r3 in Fig. 3.

Once again we find that automatic full employment is not the only logical possibility. As Don Patinkin has rightly commented: whether the system will generate full employment depends on whether the full employment savings and investment functions intersect at a positive rate of interest. But there is no automatic mechanism to assure that the savings and investment functions will have the proper slopes and positions to bring about such an intersection.

Importance of Real Balances:

ADVERTISEMENTS:

G. Haberler and A.C. Pigou have introduced a new variable the real value of cash balances held by individuals in the economy.

Thus, Pigou’s saving function is:

S = h(r, Y, M1/P)

where M1 is a fixed amount of money in the economy, and P is the wholesale price level.

Pigou’s argument is simple and straightforward: If people refused to save anything at negative or zero rates of interest, then the desired savings schedule would intersect the desired investment schedule at a positive rate of interest whatever may be the level of income, i.e., whether it is high or low (see Fig. 3). The extent to which an individual wishes to save out of current income for reasons other than the desire of future income is inversely related to the real value of his cash balances.

At this point the only reason he will continue to save out of current income is anticipated future interest payments. This implies that, if the real value of cash balances is sufficiently large, the savings function becomes zero at positive rate of interest, regardless of the income level.

ADVERTISEMENTS:

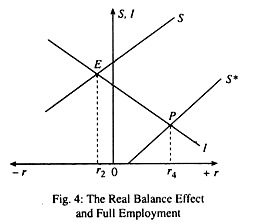

This argument is presented in Fig. 4. Pigou argues by increasing the real value of cash balances, the full employment savings curve shifts to the right until it is in such a position that no savings are desired except at possible interest rates. This is shown by the savings curve S*, which intersects the horizontal axis at a positive rate of interest. This means that even if the rate of interest is positive, saving is zero.

The full employment savings curve S* intersects the full employment investment curve I at the positive rate of interest r4. Thus, by changing the real value of cash balances, it is always possible to equate desired full employment savings with investment at a positive rate of interest.

Pigou’s assumption of flexible wage and price levels, and a constant stock of money in circulation ensure that real cash balances automatically change in the most desirable way. If, for instance, full employment saving exceeds investment, national income begins to fall and there is unemployment. If workers react to this by accepting lower money wages, then the price level will also start falling.

Consequently, the real value of the constant stock of money increases correspondingly. Thus, with a fall in price level, the full employment saving function continuously shifts to the right until it intersects the full employment investment function at a positive rate of interest.

This is the automatic mechanism on which Haberler and Pigou rely to ensure full employment This mechanism will operate regardless of the interest-elasticities of the savings and investment functions—provided they are not both identically zero.

ADVERTISEMENTS:

The Haberler-Pigou analysis makes the following prediction:

‘There always exists a sufficiently low price level such that, if expected to continue indefinitely, it will generate full employment.’

Concluding Comments:

The Keynesian position differs from its classical counterpart on three points:

1. Even if there were no problem of uncertainty and adverse anticipations, a policy of price flexibility would still not assure the generation of full employment.

2. In a static model, price flexibility would always ensure full employment. But in a dynamic world of uncertainty and adverse anticipations, even if we were to allow an infinite adjustment period, there is no certainty that full employment will always be attained. That is, the economy may remain indefinitely in a position of underemployment disequilibrium.

3. This is the Keynesian position, closest to the ‘classicists’, which states that, even with uncertainty, full employment would ultimately be ensured by a policy of price flexibility. But the long time period that might be necessary for the adjustment makes the policy impractical.