Everything you need to know about application of marginal costing. Marginal costing techniques assist the management in the fixation of the selling price of different products.

Marginal cost of a product is the guiding factor in the fixation of selling price. Generally, the selling price of a product is fixed at a level which not only covers the marginal cost but also contributes something towards fixed costs.

Hence, under normal circumstances for a long period, the fixation of selling price is done on the basis of the total cost of sales (i.e., by adding some margin of profit to the total cost).

Marginal costing helps management to decide whether the firm should itself manufacture a component part or buy it from an outside firm.

ADVERTISEMENTS:

This is particularly so when a component part is available in the market at price below the firm’s own cost. This decision can be arrived at by comparing the supplier’s price with firm’s own marginal cost.

The most useful contribution of marginal costing is that it helps management in vital decision making. Decision making essentially involves a choice between various alternatives and marginal costing assists in choosing the best alternative by furnishing all possible facts.

The information supplied by marginal costing technique is of special importance where information obtained from total absorption costing method is incomplete. Sometimes the information revealed by total costing method is even misleading.

Learn about the applications of marginal costing. They are:-

ADVERTISEMENTS:

1. Profitable Product Mix 2. Problem of Limiting Factors 3. Make or Buy Decision 4. Diversification of Production 5. Fixation of Selling Price 6. Alternative Methods of Manufacturers

7. Operate or Shut Down Decision 8. Maintaining a Desired Level of Profit 9. Alternative Courses of Action 10. Profit Planning 11. Appraisal of Performance.

Application of Marginal Costing: Profitable Product Mix, Make or Buy Decision, Fixation of Selling Price and a Few Others

Application of Marginal Costing – Fixation of Selling Price, Maintaining a Desired Level of Profit, Accepting of Price Less than the Total Cost and a Few Other Applications

We are now explaining the application of the technique of marginal costing in detail in certain important spheres:

Application # 1. Fixation of Selling Price:

Marginal cost of a product represents the minimum price for that product and any sale below the marginal cost would entail a cash loss. The price for the product should be fixed at a level which not only covers the marginal cost but also makes a reasonable contribution towards the common fund to cover fixed overheads. The fixation of such a price for a product would be easier if its marginal cost and overall profitability of the concern is known.

Application # 2. Maintaining a Desired Level of Profit:

ADVERTISEMENTS:

The industry has to cut prices of its products from time to time on account of competition, government regulations and other compelling reasons. The contribution per unit on account of such cutting is reduced while the industry is interested in maintaining a minimum level of its profits. In case the demand for the company’s products is elastic, the minimum level of profits can be maintained by pushing up the sales. The volume of such sales can be found out by the marginal costing technique.

Application # 3. Accepting of Price Less than the Total Cost:

Sometimes prices have to be fixed below the total cost of the product. This becomes necessary to meet the situation arising during trade depression. It will be enough in such periods if the marginal cost is recovered. The selling price may be fixed at a level above this cost though it may not be enough to cover the total cost. This is because in such periods any marginal contribution towards recovery of fixed cost is good enough rather than not to have any contribution at all.

A price less than the total cost but above marginal cost may be acceptable when a specific order has been received and it shall not affect the home market. The additional sales revenue should be compared with the additional costs (which are only marginal costs generally) and if the net revenue is greater, the order should be accepted. In case the market is competitive and there is a fear of adverse impact on existing sales in the long run, the decision should be taken after careful study.

Similar is the situation when order for exports is received by the concerns. Exports at a price above the marginal cost but below the total cost may be made since they don’t interfere in any way the sales in the home market.

Advantages of such practices are:

(i) Idle capacity of plant and machinery can be utilised and prevented from deterioration.

(ii) Services of skilled labour and well trained employees could be secured which will be difficult to obtain later, if discharged.

(iii) It prevents the competitors from securing the business of the firm.

(iv) The business would be ready to take advantage of favourable business environment whenever it arises later.

ADVERTISEMENTS:

Selling at marginal cost or even below the marginal cost may be recommended in extraordinary situations e.g.:

(i) When it is desired to eliminate weak competitors;

(ii) When the production is to be kept continuing because otherwise there is a danger of heavy losses on account of shut down;

(iii) When goods are likely to be perished by the passage of time;

ADVERTISEMENTS:

(iv) When a new product is to be introduced in the market or an existing one is to be made more popular;

(v) When one product can be sold with profit in combination with some other product. The reduction in price of one may enable the business to boost sales of other more profitable products;

(vi) When inventories have been piled up and recessionary trends are there in the market leading to fall in market prices. To save the carrying costs and safeguard against risk and uncertainty, it is advisable to sell even below marginal cost. The risk of obsolescence is there on one hand and uncertainty as to further fall in demand and consequently prices is there on the other.

Application # 4. Decisions Involving Alternative Choices:

CVP analysis helps the management in making decisions involving alternative choices.

ADVERTISEMENTS:

This involves Cost Benefit Analysis as explained below:

Cost Benefit Analysis:

Cost Benefit Analysis (CBA) involves estimating the total benefits and costs of a project in terms of their equivalent money value. It finds, quantifies and adds all the positive factors of a project. These are called as Benefits from the project. Then it identifies, quantifies and subtracts all the Negatives i.e., Total Cost of the project.

The difference between the two indicates whether the planned action is advisable or not. It may please be noted that cost benefit analysis could be used for almost every decision which one undertakes, however, it is most commonly used for taking financial decisions involving alternative choices.

The following are the examples of such decisions:

(i) Should an additional sales person be hired or continue to work with the existing staff by allowing them overtime?

ADVERTISEMENTS:

(ii) Whether manual labour is to be replaced by machinery, wholly or partly?

(iii) Whether free cash funds should be invested into securities or building additional capacity?

There can be many such decisions, as discussed below:

(a) Determination of Product or Sales Mix:

Presuming that fixed costs will remain unaffected, decision regarding sales/ production mix is taken on the basis of the contribution per unit of each product. The product which gives the highest contribution should be given the highest priority and the product, the contribution of which is the least, should be given the least priority. A product giving a negative contribution should be discontinued or given lip, unless there are other reasons to continue its production.

(b) Exploring New Markets:

ADVERTISEMENTS:

Decision regarding selling goods in a new market (whether Indian or foreign) should be taken after considering the following factors:

(i) Whether the firm has surplus capacity to meet the new demand?

(ii) What price is being offered by the new market? In any case, it should be higher than the variable cost of the product plus any additional expenditure to be incurred to meet the specific requirements of the new market.

(iii) Whether the sale of goods in the new market will affect the present market for the goods? It is particularly true in case of sale of goods in a foreign market at a price lower than the domestic market price. Before accepting such an order from a foreign buyer, it must be seen that the goods sold are not dumped in the domestic market itself.

(c) Discontinuance of a Product Line:

The following factors should be considered before taking a decision about the discontinuance of a product line:

ADVERTISEMENTS:

(i) The contribution given by the product – The contribution is different from profit. Profit is arrived at after deducting fixed cost from contribution. Fixed costs are apportioned over different products on some reasonable basis which may not be very much correct. Hence, contribution gives a better idea about the profitability of a product as compared to profit.

(ii) The capacity utilisation, i.e., whether the firm is working to full capacity or below normal capacity. In case a firm is having idle capacity, the production of any product which can contribute towards the recovery of fixed costs can be justified.

(iii) The availability of product to replace the product which the firm wants to discontinue and which is already accounting for a significant proportion of total capacity.

(iv) The long-term prospects in the market for the product.

(v) The effect on sale of other products. In some cases the discontinuance of one product may result in heavy decline in sales of other products affecting the overall profitability of the firm.

(d) Make or Buy Decisions:

ADVERTISEMENTS:

Whether a particular part of the finished product is to be manufactured within the industry or it has to be bought from outside will depend on the consideration of marginal costs. The marginal cost of manufacturing is to be compared with the purchase price of the relevant material and if the marginal cost is more than the purchase price, a decision as to buying it from the market can be taken. However, there are certain non-cost factors also which must be taken into account before making a final decision.

The factors are as under:

1. The part to be bought should be available whenever it is needed and at the same price at which we are considering to buy it at present.

2. If there is difference in quality, specification etc. of the component to be bought, it must be workable.

3. If production is not carried out, labour problems should not crop up. The surplus labour force should be absorbed in other productive work.

(e) Shut-Down or Continue:

Sometimes a business is confronted with the problem of continuing or suspending the business operations. Such suspension of business operations may be of a temporary or a permanent nature. In the former case it may be termed as ‘shut-down’ while in a latter case, it is termed as ‘closing down’ business operations.

Shut-down may be necessary due to some temporary difficulties viz., depression in the market, inadequate availability of raw materials, power, etc. While deciding whether to shut-down or not, a comparison has to be made between the costs e.g., lay off or retrenchment compensation to workers, loss of goodwill, packaging and storing, cost of plant etc., and benefits e.g., saving of fixed costs, avoiding operating losses etc. on account of shut-down. In case the benefits exceed the costs it is advisable to shut-down or vice-versa.

In order to decide whether to continue operations or close down or give up the project altogether, comparison should be made between the revenues from continuing operations and revenues from complete closing down and sale of the plant. In case the revenues from closing down exceed the revenues from continuing operations of the business, it will be advisable to close down the plant.

Application of Marginal Costing – In Making Short Term Decisions: Make or Buy, Acceptance of Special Order, Discontinuing a Product, Shut Down or Continuing

In short-term an organization is required to take many decisions to maximise profit. The best use of existing capacity must be made to do so. In short-term fixed costs remain same and decisions should be made on the basis of contribution. In this situation, marginal costing technique is used extensively.

It may be used for the following types of short-term decisions:

1. Make or Buy,

2. Acceptance of Special Order,

3. Discontinuing a Product,

4. Selection of Product Mix when there is Limiting Factor(s);

5. Shut Down / Continuation.

1. Make or Buy Decisions:

Many organisations buy different items from outside suppliers. For example, in India, all automobile companies are buying different parts or components from different suppliers – car battery from Exide, tyre from MRF, fuel injecting system from MICO, etc. Almost all automobile companies are buying at least 30% of parts and components from outside suppliers.

A company may meet its own needs internally or may buy it from external sources. The decisions on whether to manufacture components in-house or buy them from outside suppliers are called ‘Make or Buy Decisions’.

A detailed analysis of cost and non-cost factors are to be made. Before taking final decision, costs to ‘make’ and costs to “buy’ must be calculated carefully.

Cost to make must be calculated on the basis of identical product specifications, quality standard and quantity to be manufactured. Cost to buy should include all cost to bring the product to the same condition and location as if manufactured in-house. Freight, purchasing costs, handling costs, transportation costs, inspection costs and inventory holding cost are to be taken into consideration.

The following cost and non-cost factors must be taken into consideration in any ‘make’ or ‘buy’ decisions.

i. Cost of materials and its availability at affordable price.

ii. Availability of labour and cost related to labour.

iii. Cost of acquisition of new technology, plant, machinery and equipment.

iv. Cost of operation.

v. Cost of transportation.

vi. Cost of ordering and holding inventory.

vii. Cost to be paid to suppliers.

viii. Cost of stock out.

ix. Cost of construction of production facility.

x. Lease rent of production facility or machinery and equipment.

i. Policy of the organization.

ii. Government’s policy (for example, present US government discourage outsourcing).

iii. Trade union’s resistance.

iv. Reliability of supply.

v. Availability of suppliers with required technology.

vi. Secrecy of company production.

vii. Capability of the supplier to supply required quantity and quality.

viii. Effects on workers’ morale.

ix. Possibility of using idle capacity for other profitable purposes.

Faced with a make or buy decision, the manager can evaluate alternative using marginal costing system. Based on marginal costing, comparison is to be made between cost of buying the product or service and the marginal cost of manufacture. Common fixed costs are excluded from the analysis, as these are to be incurred in any way. However, any specific fixed cost (i.e., related to decision) must be taken into consideration.

Reasons for ‘Making’ vs. Reasons for ‘Buying’:

The following list of reasons are important to arrive at a decision to make or buy:

Reasons for Making in-House:

i. The variable cost of manufacturing is less than the price quoted by the suppliers.

ii. The design of the product or its processing is confidential.

iii. The technology and know-how is available with the organization.

iv. There is no shortage of skilled manpower.

v. The safety factor of the product is very important. If the law of the land is very strict in safety matters, as in USA, then it is better to manufacture in-house rather than buying from vendors. It is important to mention here that in 2009-10 many auto companies had to call back millions of cars for defective parts supplied by vendors. The companies are – Toyota, Maruti, Honda, etc.

vi. It is difficult to transport the parts or products because it is too heavy.

vii. Vendor’s failure to supply in time may upset your production and delivery schedule which may lead to heavy penalty or even loss of future contracts.

viii. Making will facilitate quality control and management of inventory.

ix. There is steady demand for the product.

Reasons for Buying:

i. The buying cost is less than in-house manufacturing cost.

ii. There is no idle capacity to manufacture the products or parts.

iii. The technology and know-how is not available with the company.

iv. The company cannot manufacture it from its own facility because of ‘environmental problem’.

v. The company wants to concentrate in its core area.

vi. The company wants that someone else to face seasonal, cyclical or risky market demands.

vii. The government policy may not allow to manufacture 100% in-house. Some portions must be purchased from small-scale manufacturing enterprises.

Common Mistakes to Avoid in Decision Making:

At the time of making decision, the managers should not overlook the following:

i. Sunk Cost – Sunk costs cannot be changed by any current or future action, so ignore sunk cost for decision making.

ii. Unitised Fixed Cost – Sometimes fixed costs are divided by some activity measure (number of units, number of machine hours or number of labour hours) and charged to each product for product costing purposes. At the time of making decision, the total fixed cost should be taken into consideration rather than as a ‘per unit cost’.

iii. Common Fixed Cost – Common fixed costs are allocated to different departments or product lines. At the time of making decision, common fixed cost should be ignored because these are to be incurred in any situation. It cannot be avoided.

iv. Opportunity Cost – At the time of making decision, due importance should be given to opportunity cost. Many people treat opportunity costs as less important than out of pocket costs. Pay proper attention to identify the opportunity costs and include it in decision making process.

2. Acceptance of Special Order:

A special order is a one-time order that is accepted without disturbing the present production and sales. Generally, this type of order is accepted when there is spare capacity. Sometimes special order can be accepted even sacrificing the present sales. At the time of evaluating a special order, many technical and non-cost factors are to be taken into consideration but cost of executing the special order will be of paramount importance.

The cost of executing the order must be calculated on the basis of marginal cost. Any common fixed costs must be excluded. However, specific fixed cost and tax benefit must be taken into consideration. For special order, usually a lower price is charged than normal price. However, it must be greater than the cost of executing the order.

3. Discounting a Product:

A company may produce several products. For different reasons (e.g., change in taste of the customers, competition etc.,) a product or more than a product may not perform up to the expectation of the management. In such a situation, the management may drop one / two product(s) temporarily from production plan. At the time of dropping a product, marginal costing technique is widely used.

At the time of taking decision, the following points are to be taken into consideration:

i. No product will be discontinued if the contribution is positive.

ii. Total fixed cost (common) for the business as a whole will remain the same or decrease.

iii. Share of fixed cost of discontinued product will have to be borne by the remaining products.

iv. Effect on sale of other products because of discontinuation of a product.

4. Selection of Product Mix when there is Limiting Factor(s):

Resources available to an organisation is not unlimited. Managers are frequently faced with the problem of allocating limited resources for maximising profits. A furniture manufacturing company, for example, has a limited number of direct labour hours and a limited number of machine hours.

In the short run, it may not be possible to recruit more staff or to install new machinery. Because of the limited resources, the company cannot manufacture the required quantity to satisfy the demand fully. This limitation in terms of resources, which restricts the company’s ability to satisfy demand, is called the Limiting Factor.

The limiting factor is also known as the Key Factor or the Principal Budget Factor. It is called the principal budget factor because, the influence of this factor must first be assessed at the time of making functional budgets like production budget, purchase budget, etc.

CIMA, U.K. has defined “limiting factor” as – “The factor which, at a particular time, or even a period, will limit the activities of an undertaking. The limiting factor is usually the level of demand for the products or services of the undertaking but it could be a shortage of one of the productive resources, e.g., skilled labour, raw material or machine capacity.”

The limiting factor may vary from time to time within an organisation. The limiting factor is governed by both internal and external influences. For example, during 2009-10 in sugar industry, the shortage of sugar cane was a limiting factor for all sugar mills. It is an example of external influence. It may happen that in 2010-11, the sugar cane may not be a limiting factor but production capacity may become a limiting factor. It is an example of internal influence.

In practice, many limiting factors are there. An organization may produce different products which consume scarce resources (limiting factors) in different proportions. At the time of allocation of scarce resources, care should be taken so that the overall profit of the organisation is maximised.

In short run, the fixed cost will remain same irrespective of the output. Therefore, the maximisation of total contribution will lead to maximisation of total profits. To maximise total contribution, an organisation should not necessarily sell those products that have the highest contribution per unit.

The organisation should sell those products that have highest contribution per unit of limiting factors. It means ‘higher the contribution per unit of limiting factor, the most profitable the product.’

For example, Tata Motors Ltd. manufactures two types of truck – 6 wheels and 10 wheels.

The selling price, variable costs and contribution are given below:

A glance at contribution per unit data suggests that 10 wheels truck is more profitable than 6 wheels truck. However, in this case, 6 Wheels Truck is more profitable than 10 Wheels Truck because contribution per tyre of 6 wheels truck is Rs. 1,00,000 (Rs.6,00,000 / 6) but in case of 10 wheels truck the contribution per tyre is Rs. 90,000 (Rs. 9,00,000/10).

Contribution per unit is to be taken into consideration only when there is no limiting factor and there is enough demand.

There may be one, two or more than two limiting factors.

Allocation of scarce resources is easy when there is only one limiting factor (for example, either raw material or direct labour hours is a limiting factor). If the number of limiting factors are two or more (for example, both raw material and direct labour hours), the calculation of product mix is complex.

(i) There is only one limiting factor; and

(ii) There are two or more limiting factors.

(i) There is Only One Limiting Factor:

In this case, the priority of production will depend upon the contribution per unit of limiting factors. Product with highest contribution per unit of limiting factor should be given first priority. Similarly, product with lowest contribution per unit of limiting factor should be given last priority.

(ii) There are Two or More than Two Limiting Factors:

Computation of product mix is very complex when there are two or more than two limiting factors / products. In this case, it is not possible to use the approach based on contribution per unit of limiting factors. If the number of limiting factors are limited to two, the simultaneous equation method can be adopted for calculating the optimal product mix.

If the number of limiting factors as well as number of products are several, the use of Linear Programming technique should be adopted to get the optimal solution.

5. Shut Down / Continuation:

Temporary recession in trade or labour problem, etc., may compel the management to take the decision whether the operating activities are to be suspended or to be continued.

The marginal cost technique helps the management to take right decision in this situation. Total shutdown cost is compared with the loss to be incurred if the operation is continued. If the total shut down cost is more than the loss to be incurred if the operation is continued, then the operation should be continued.

If the total shut down cost is less than the loss to be incurred if the operation is continued, then the operation should be suspended.

However, before taking final decision, the following factors should be taken into consideration:

(i) The possibility of losing customers.

(ii) The possibility of losing the skilled labours.

(iii) The reaction of the labour unions and the Government.

(iv) The chance of obsolescence of raw materials in stock.

(v) The agreement with the suppliers.

(vi) The possibility of bad debts due to non-payment by the existing customers.

(vii) The chance of obsolescence / over-depreciation of plant and machinery. For example: In textile industry, the depreciation is more during shut down period than the active period.

The shutdown cost includes the following:

(i) Unavoidable fixed cost;

(ii) Cost of maintenance of the plant and machinery;

(iii) Cost of overhauling the plant at the time of re-opening;

(iv) Cost of training of employees;

(v) Cost of new recruitment, etc.

Application of Marginal Costing – 11 Important Areas: Profitable Product Mix, Make or Buy Decisions, Diversification of Production and a Few Other Applications

One of the basic functions of management is to make decisions. Decision-making process generally involves selecting a course of action from among various alternatives.

Some of the important areas where marginal costing techniques are generally applied, can be given as follows:

Application # 1. Selection of a Profitable Sales Mix or Profitable Product Mix:

In case of a multi-product concern, there may arise a problem of the selection of the suitable or profitable sales mix i.e., the determination of the ratio in which various products are produced and sold.

For the purpose of determining the profitable sales mix, the amount of contribution available under each alternative of sales mix is to be considered and the sales mix giving maximum total contribution will be selected. But the various problems arising out of change in the sales mix e.g., limiting factors etc., must be properly considered.

Application # 2. Problem of Limiting Factors:

Limiting factor (also known as ‘key factor’) is a factor which limits production and/or sales and thus prevents the manufacturing concern from earning unlimited profits. The limiting factors or key factors may be shortage of raw material, shortage of skilled labour and machine capacity, market for sales etc.

In case of the existence of a key factor, a problem may arise as to which product should be pushed more in order to maximise profits. Selection of the profitable product shall be made on the basis of the contribution per unit of limiting factor. The profitability of a product with reference to limiting factor can be assessed as follows –

Profitability = Contribution per unit/Limiting Factor per unit

The higher the contribution per unit of limiting factor, the more profitable is the product and vice versa.

Application # 3. Make or Buy Decisions:

Sometimes a manufacturer has to decide as to whether a certain component or spare part should be manufactured in the factory (having unused installed capacity) or bought from the market. In taking such a ‘make or buy’ decision, the marginal cost of the component or spare part should be compared with the market price. If the marginal cost is lower than the market price, the component or spare part should be manufactured in the factory itself.

However, the manufacturer must take into consideration any increase in fixed costs or any limiting factor which may arise if the production is undertaken in the factory. If the purchase price is lower than the marginal cost and provided regular supply and proper quality of the component are guaranteed by outside supplier, it should be purchased from outside supplier.

Application # 4. Diversification of Production:

Sometimes a manufacturer may intend to add a new product to the existing product or products to utilise the idle capacity, to capture a new market or for some other purpose. In such a case, the manufacturer or management is interested in knowing the profitability of the new product before its production can be undertaken.

It is advisable to undertake the production of the new product if it is capable of contributing something towards fixed costs and profit after meeting out its variable cost of sales. Fixed costs are not to be considered on the assumption that the new product can be manufactured by existing resources without incurring any additional fixed costs.

But if the introduction of a new product involves some specific or identifiable fixed costs (which arise due to the new product), these should be deducted from the contribution of the new product before making any decision.

Application # 5. Fixation of Selling Price:

Marginal costing techniques assist the management in the fixation of the selling price of different products. Marginal cost of a product is the guiding factor in the fixation of selling price. Generally, the selling price of a product is fixed at a level which not only covers the marginal cost but also contributes something towards fixed costs. Hence, under normal circumstances for a long period, the fixation of selling price is done on the basis of the total cost of sales (i.e., by adding some margin of profit to the total cost).

But in times of cut-throat competition, trade depression, in accepting additional orders for utilising unused capacity and in exploring foreign markets, the manufacturer may be ready to sell his products at a price below total cost but not at a price below marginal cost. For fixing the price at a level below total cost of sales, the manufacturer shall take into account the overall profitability or P/V Ratio of the business concern.

Thus, the fixation of selling price becomes easy where marginal cost, overall P/V Ratio and the level of profits expected, are known. In case of exports to foreign markets, the effect of various direct and indirect benefits such as cash compensatory assistance, subsidies, import entitlements and other special favours or benefits from the Government should also be taken into account.

Further, pricing at or below marginal costs may be considered desirable for a shorter period under certain special circumstances given below:

(i) To introduce a new product in the market or to popularise it.

(ii) To drive out weaker competitors from the market.

(iii) To maintain production in order to avoid retrenchment of employees.

(iv) To keep the plant and machinery in gear.

(v) To avoid the loss of future markets.

(vi) To sell the goods of perishable nature.

(vii) To push up the sales of other conjoined profitable products.

Export Market vs. Home Market:

A firm engaged in supplying goods in the home market and having surplus production capacity, may think of utilising it to meet export orders at a price lower than that prevailing in the home market. Such a decision is made only when the local sale is earning a profit i.e., when its fixed costs have already been recovered by the local sales.

In such cases, if the export price is more than the marginal cost, it is advisable to enter the export market. Any reduction in the selling price in the local market to utilise the surplus capacity may adversely affect the normal local sales.

However dumping in the export market at a lower price even below marginal cost in order to capture future market, has no adverse effect on local sales.

Application # 6. Alternative Methods of Manufacture:

Sometimes a manufacturer is faced with the problem of the application of alternative methods of manufacture i.e., whether machine work or hand work, employment of hand-driven machine or power-driven machine or employment of one machine or another machine etc. For the purpose of selecting the method of production to be adopted, a comparison of the amount of contribution available under different methods of manufacture shall be made.

The alternative providing the maximum contribution per unit shall be considered to be more profitable. However, the limiting factor, if any, involved in the method of production, must be given proper consideration.

Application # 7. Operate or Shut Down Decision:

In case of a multi-product concern, it may be found that the production of some of its products is being carried on at a loss. Under such a position, the production of non-profitable products shall have to be discontinued.

But if the choice is out of two or more products, the decision shall be taken with reference to the amount of contribution or P/V Ratio of these products. Production of the product giving the least amount of contribution or least P/V Ratio should be discontinued on the assumption that production capacity thus freed can be used to produce other profitable products.

Application # 8. Maintaining a Desired Level of Profit:

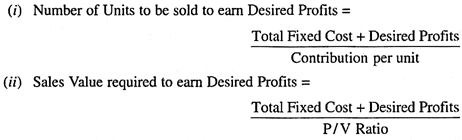

Sometimes the management may be interested in maintaining a desired level of profits under the conditions of a change in the sales price. The volume of sales required to earn a desired level of profits can be ascertained by applying marginal costing techniques. For ascertaining the sales required to earn a desired level of profits, the following formulae are applied –

Application # 9. Alternative Courses of Action:

Sometimes the management has to select a course of action from amongst various alternative courses. Each course of action has its own merits and limitations. The course of action to be selected should ensure maximum profit to the business concern. The appraisal of the various courses of action available is possible through the analysis of contribution. The course of action ensuring highest contribution is generally adopted by the management.

Application # 10. Profit Planning:

Profit planning is one of the important functions of management. It relates to the attainment of maximum profit. Profit planning requires the management to have the proper knowledge of the inter-relationship of selling prices, sales volume, variable costs and fixed costs. Marginal costing helps the management in ascertaining the profit position at the various levels of operation through the technique of cost-volume-profit analysis. Thus, the management can plan its operations at the optimum level where profits are maximum.

Application # 11. Appraisal of Performance:

Cost accounting deals with costs and profits of each department, product, branch etc., of the business separately. Marginal costing being a technique of cost accounting, presents the comparative profitability of each part or segment of the business to the management in an analysed form. Thus, the management can know the efficiency or inefficiency of each segment of the business and can plan in such a way that the profits made by an efficient segment of the business are not eaten away by some inefficient segment.

Application of Marginal Costing – Fixation of Selling Prices, Make or Buy Decisions, Selection of a Suitable Product Mix, Alternative Methods of Production and a Few Others

The most useful contribution of marginal costing is that it helps management in vital decision making. Decision making essentially involves a choice between various alternatives and marginal costing assists in choosing the best alternative by furnishing all possible facts. The information supplied by marginal costing technique is of special importance where information obtained from total absorption costing method is incomplete. Sometimes the information revealed by total costing method is even misleading.

The following are some of the managerial decisions which are taken with the help of marginal costing technique:

1. Fixation of selling prices.

2. Make or buy decisions.

3. Selection of a suitable product mix.

4. Alternative methods of production.

5. Profit planning.

6. Suspending activities, i.e., closing down.

1. Fixation of Selling Price:

Although prices are regulated more by market conditions of demand and supply than by market conditions of demand and supply than by management, yet fixation of selling prices is one of the important functions of management. While fixing prices, the management has to keep in view the level of profits to be earned.

In normal circumstances, the selling price fixed must cover total cost, as otherwise, the profit cannot be earned. But under certain circumstances, products may have to be priced below total cost. This type of situation may arise in trade depression when there is a serious fall in the demand for the products. Prices fixed during depression may be below total cost but it should be equal to or more than marginal cost.

This is because fixed costs will have to be incurred even if production is discontinued for a short period. If the products can be sold at a price above marginal cost, the loss on account of fixed cost can be reduced to that extent. In other words, any contribution towards the recovery of fixed costs will reduce the losses which will be incurred if production is stopped. As a word of caution, fixation of prices below total cost should be made only on a short-term basis because no firm can afford losses on a long-term basis.

However, under the following circumstances, selling prices may have to be fixed even below the marginal cost:

i. When competitors are to be eliminated from the market.

ii. When a new product is introduced in the market and it has to be made popular.

iii. When goods are of perishable nature and there is a stock of such goods.

iv. When depression seems temporary and closure of business may mean breaking of business connections that can be re-established only at a heavy expenditure.

v. When plant and machinery have to be kept in gear as idle machines are liable to deteriorate.

Marginal costing presents information in such a way so as to enable management to know the price limits within which it can operate.

2. Make or Buy Decisions:

Marginal costing helps management to decide whether the firm should itself manufacture a component part or buy it from an outside firm. This is particularly so when a component part is available in the market at price below the firm’s own cost. This decision can be arrived at by comparing the supplier’s price with firm’s own marginal cost. For example, if total cost of making a component part is Rs. 18, consisting of Rs. 15 as variable cost and Rs. 3 as fixed cost.

Suppose, the same component part is available in the market at Rs. 17. The prima facie conclusion is that it is cheaper to buy the component part from outside. But a study of cost analysis shows that each unit produced also contributes Rs. 3 towards the fixed cost. If purchased from outside, it will cost Rs. 20, i.e., Rs. 17 + 3 (fixed cost). This fixed cost has to be incurred whether to make or buy. Thus, this component should not be purchased from outside unless it is available at below Rs. 15, which is its marginal (variable) cost.

However, while arriving at a final decision in this regard, it should also be considered that the production facilities (plant capacity) released by the non-manufacture of a component may be put to some alternative use. In such a case, the above argument does not hold good. Moreover there should be an assurance of continued supply of the component by the outside firm.

3. Selection of a Suitable Product Mix:

When a concern manufactures more than one product, the management has to decide the proportion in which these products should be manufactured. This is known as product mix or sales mix. The production and sales of those products should be pushed up which give the maximum profits and production of comparatively less profitable products should be reduced. Marginal costing helps management in deciding the best product mix so that profits can be maximised. The best product mix is one that yields the maximum contribution.

4. Alternative Methods of Production:

When management is faced with the problem of choosing from amongst alternative methods of production, marginal costing helps by furnishing relevant cost information for taking a right decision. For example, management may be faced with the problem of using an automatic machinery or manufacturing entirely by manual labour. The method of manufacture which yields the greatest contribution should be selected, of course, keeping in view certain other factors.

5. Profit Planning:

The aim of each business is to maximise profits. Marginal costing with the help of break-even analysis guides management about the profit position at various levels of output so that management can operate the business at optimum level where profit is maximum. Thus it is helpful in profit planning.

6. Closure of Business:

The management, under certain circumstances, may be faced with the problem of suspending the activities, i.e., closing down the business. This type of situation usually arises when sufficient volume of business cannot be secured.

The closure of business may take one of the two forms:

i. Temporary closure.

ii. Permanent closure.

i. Temporary Closure:

Temporary closure of business is a short-term concept. The object is usually to stop operations until trade depression has passed. But if products are making a contribution towards fixed cost, then generally speaking, production should continue. In other words, if prices exceed marginal (variable) cost, losses will tend to be minimised by continuing production.

ii. Permanent Closure:

Permanent closure of business is decided when in the long run business is not earning sufficient profits to cover the risk involved.

Applications of Marginal Costing – In Various Fields to Aid Management in Arriving at Important Policy Decisions

Marginal costing techniques may be applied in various fields to aid management in arriving at many important policy decisions.

These can be stated thus:

Application # 1. Profit Planning:

There are four important ways to improve the profit performance of a business – (i) by increasing volume, (ii) by increasing selling price, (iii) by decreasing variable costs, and (iv) by decreasing fixed costs.

Profit planning is the planning of future operations so as to attain maximum profit. The contribution ratio shows the relative profitability of various sectors of the business whenever there is a change in selling price, variable costs or product mix.

Application # 2. Introduction of a New Product:

Sometime, a product may be added to the existing lines of products with a view to utilise idle facilities to capture a new market or for any other purpose. The profitability of this new product has to be found out initially. Usually, the new product will be manufactured if it is capable of contributing something towards fixed cost and profit after meeting its variable costs.

Application # 3. Level of Activity Planning:

Marginal costing is of great help while planning the level of activity. Maximum contribution at a particular level of activity will show the position of maximum profitability.

Application # 4. Key Factor:

A concern would produce and sell only those products which offer maximum profit. This is based on the assumption that it is possible to produce any quantity without any difficulty and sell likewise. However, an actual practice, this seems to be unrealistic as several constraints come in the way of manufacturing as well as selling.

Such constraints that come in the way of management’s efforts to produce and selling unlimited quantities are called ‘key factors’ or ‘limiting factors’. The limiting factors may be materials, labour, plant capacity, or demand. Management must ascertain the extent of the influence of the key factor for ensuring maximisation of profit.

Normally, when contribution and key factors are known, the relative profitability of different products or processes can be measured with the help of the following formula –

Application # 5. Make or Buy Decisions:

A company might be having unused capacity which may be utilized for making component parts or similar items instead of buying them from the market. In arriving at such a ‘make or buy’ decision, the cost of manufacturing component parts should be compared with price quoted in the market.

If the variable costs are lower than the purchase price, the component parts should be manufactured in the factory itself. Fixed costs are excluded on the assumption that they have been already incurred, and the manufacturing of components involves only variable cost. However, if there is an increase in fixed costs and any limiting factor is operating while producing components etc. that should also be taken into account.

Application # 6. Suitable Product Mix:

Normally, a business concern will select the product mix which gives the maximum profit. Product mix is the ratio in which various products are produced and sold. The marginal costing technique helps management in taking appropriate decisions regarding the product mix, i.e., in changing the ratio of product mix so as to maximise profits.

The technique not only helps in-dropping unprofitable products from the mix but also helps in dropping unprofitable departments, activities etc.