Everything you need to know about the methods of costing. The method of costing refers to a system of cost ascertainment and cost accounting.

Industries differ in their nature, in the products they produce and the services they offer. Hence, different methods of costing are used by different industries.

For example, the method of costing employed by a building contractor is different from that of a transport company.

The methods to be used for cost ascertainment depend on nature of industry. Costs of production or service rendered differ from industry to industry.

ADVERTISEMENTS:

Job costing and process costing are the two basic methods of costing. Job costing is suitable to industries which manufacture or execute the work according to the specifications of the customers.

Process costing is suitable to industries where production is continuous and the units produced are identical. All other methods are combinations, extensions or improvements of these basic methods.

Some of the methods of costing are:- 1. Unit Costing 2. Job Costing 3. Contract Costing 4. Process Costing 5. Service Costing 6. Composite Costing 7. Batch Costing 8. Operation Costing 9. Formula

Methods of Costing: Unit Costing, Job Costing, Contract Costing, Process Costing, Service Costing and Composite Costing

Methods of Costing – 8 Important Methods of Costing: Unit Costing, Job Costing, Contract Costing, Process Costing, Service Costing, Composite Costing and Batch Costing

Various methods of costing are as under:

ADVERTISEMENTS:

1. Unit Costing – If production is made in different grades, costs are ascertained grade wise. Per unit cost is calculated on the basis of units produced. This method is applicable to steel production bricks, mines and flour mills etc.

2. Job Costing – This method is applicable where work is undertaken to customers. This method is used in repair shops printing press and interior decoration etc.

3. Contract Costing – Unit cost in a contract is of a long duration and it may continue for more than a year. It is most suitable in roads, bridge, shop building etc.

4. Process Costing – The method is used in mass production industries. The raw material passes through a number of processes up to a completion stage. The finished product of one process passed through a number of process for the next process. This method is used in chemical works, sugar mills etc.

ADVERTISEMENTS:

5. Service Costing – This method is used where services are provided such as hotels, cinemas, hospitals, transport, electricity companies etc.

6. Composite Costing – This method is used where a number of components are manufactured separately and then assembled in a final product such as in Scooters, Cars, Air Conditioners etc.

7. Batch Costing – The cost of a batch is ascertained and each batch is a cost unit. This method is used in readymade garments, shoes, tyres and tubes etc.

8. Operation Costing – This system is followed where number of operations are involved. It provides minute analysis of costs and ensures greater accuracy and better control.

Methods of Costing – In Manufacturing Organisations: Specific Order Costing and Operations Costing

In manufacturing organisations, the principles of cost accumulation and their identification with products are more clear and visible and therefore the principles used by a manufacturing enterprise is often used by other organisations also for accumulating costs.

In manufacturing concerns, costs are accumulated and assigned to products on the basis of the following cost accounting methods viz.-

1) Specific Order Costing, and

2) Operations Costing.

But according to Mr. Batty, “Many costing systems do not fall neatly into the category of either job or process costing. Often, systems use some features of both the main costing systems”. It is, for this reason, that he uses the term “hybrid costing systems” for all those methods that combine the features of the basic costing methods.

1) Specific Order Costing:

ADVERTISEMENTS:

The terminology of I.C.M.A. defines Specific Order Costing as – “the category of basic costing methods applicable where the work consists of separate contracts, jobs or batches each of which is authorised by a special order or contract”.

This method is adopted in made-to-order type of products which depends entirely on the specification of customers. As such there is no standardisation in the production process for want of uniformity.

The following are the different methods of costing which fall under the category of specific order costing:

i) Job Costing:

ADVERTISEMENTS:

The terminology of I.C.M.A. defines Job Costing as – “that form of specific order costing which applies where work is undertaken to customers’ “special requirements”.

Under this method, costs are collected and accumulated for each job, work order or project separately. Each job can be separately identified, so it becomes essential to analyse the cost according to each job. A Job Card is prepared for each job for cost accumulation. This method is applicable to printers, machine tool manufacturers, foundries and general engineering workshops, interior decorator, painters, repair shops etc.

ii) Batch Costing:

The terminology of I.C.M.A. defines Batch Costing as – “that form of specific order costing which applies where similar articles are manufactured in batches either for sale or use within the undertaking”.

ADVERTISEMENTS:

This method is a variation of Job Costing. In this method, the cost of a batch or group of identical products is ascertained and, therefore, each batch of products is a unit of cost for which costs are accumulated. This method is used in biscuit factories, bakeries, ready-made garments, hardwares like nuts, bolts, screws, shoes, toys, drugs and pharmaceuticals etc.

iii) Contract or Terminal Costing:

The terminology of I.C.M.A. defines Contract Costing as – “that form of specific order costing which applies where work is undertaken to customers’ special requirements and each order is of long duration”.

The cost unit here is a contract which is of a long duration and may continue over more than one financial year. A separate account is kept for each contract. This method is used by builders, civil engineering contractors, constructional and mechanical engineering firms etc.

iv) Multiple or Composite Costing:

It is an application of more than one method of cost ascertainment in respect of the same product. This method is used in industries where a number of components are separately manufactured and then assembled into a final product. In such industries each component differs from the others as to price, material used and process of manufacture undergone.

ADVERTISEMENTS:

So it will be necessary to ascertain the cost of each component for this purpose, process costing may be applied. To ascertain the cost of the final product, batch costing may be applied. This method is used in factories manufacturing cycles, automobiles, engines, radios, TVs, typewriters, aeroplanes etc. This method has been completely dropped out from the latest I.C.M.A. Terminology.

v) Class Cost Method:

It is the method of Job Costing where the costing of goods is done by classes instead of the unit or a piece. Instead of the cost being separately accumulated for each article or piece, the cost will cover a group of orders of the same class of product.

2) Operations Costing:

The terminology of I.CM.A. defines Operations Costing as – “the category of basic costing methods applicable where standardised goods or services result from a sequence of repetitive and more or less continuous operations or process to which costs are charged before being averaged over the units produced during the period”.

The following are the different methods of costing which fall under the category of operations costing:

i) Process Costing:

ADVERTISEMENTS:

The terminology of I.C.M.A. defines Process Costing as – “that form of operation costing which applies where the standardised goods are produced”.

It is a method of costing where cost is ascertained at the stage of every process and also after completing the finished production. It is used in concerns where production follows a series or sequential process. Process types of industries do not manufacture individual items to the specific requirements of customers.

As such, production is not intermittent but continuous. Each process represents a distinct stage of manufacture and the output of one process becomes the input of the following process. The unit cost is arrived at by averaging the cost over the units produced, and cost per unit of each process is ascertained.

This method is used in a variety of industries such as – chemicals, oil refining, paper making, flour milling, cement manufacturing, sugar, rubber, textiles, soap, glass, food processing etc.

ii) Operating or Service Costing:

The terminology of I.C.M.A. defines Service Costing as – “that form of Operation Costing which applies where – standardised services are provided either by an undertaking or by a service cost centre within an undertaking”.

ADVERTISEMENTS:

This method of costing is used by those undertakings which render service as against manufacturing and supply of tangible products. It is an essential method of costing where only the services are rendered. It ascertains the cost of one unit of service rendered. This method is applicable to transport undertakings, electricity supply undertakings, hospitals, hotels, canteen, water works, gas companies, educational institutions etc.

The cost unit depends upon the service provided. Usually, in service undertakings a composite cost unit is used e.g., tonne kilo-metre passenger kilo-metre, patient per day or bed per day, KWH (kilo-watt-hours), meal served, student hours etc.

iii) Unit or Single or Output Costing:

It is a method of costing by the unit of production, where manufacturing is continuous and the units are identical. In some cases the units may be differ in terms of size, shape, quality etc. This method is also called as Single Costing because only one type of product alone is manufactured.

Examples of industries where this method is applicable are collieries, quarries, flour-mills, paper mills, textile mills, brick-making, radio, cameras, pencils, slates, dairy products etc. No separate set of books is generally required and costing information is presented in the form of a statement known as Cost Sheet.

iv) Departmental Costing:

ADVERTISEMENTS:

A factory may be divided into a number of departments and sometimes good results are obtained by allocating expenditure first to different departments and then to different products manufactured in that department. Under this method, the cost incurred in maintaining a particular department is ascertained. There are two objectives for using this method viz., to control the cost of department and to charge the cost of a department or to the finished product.

v) Operation Costing:

It is a special type of Process Costing. It refers to the determination of cost of operations; the cost unit is the ‘operation’ instead of the process. The per unit cost is arrived at by dividing the cost of an operation by the number of units completed in the operation centre. For large undertakings it is frequently necessary to ascertain the cost of various operations. Cost control can be exercised more effectively with operation costing.

Methods of Costing – Job Costing and Batch Costing (With Features, Advantages, Disadvantages and Formula)

1. Job Costing:

Job costing means ascertaining costs of an individual job, work order or project separately. It is used by manufacturing as well as non-manufacturing undertakings which manufacture goods against specific orders. Manufacturing concerns adopting this method are – printing presses, machine-tool manufacturing concerns.

Non-manufacturing concerns following this method are auto repairing units and general engineering workshops.

Main Features:

i. Production is undertaken against customer’s order.

ii. Each job is clearly distinguishable from the other, and hence requires a special treatment.

iii. The cost is ascertained for each job, since there is no uniformity in the flow of production from department to department.

iv. A separate cost sheet is maintained for each job. Each job is given a certain number by which it is identified. The cost sheet provides information regarding details of costs incurred, the data of commencement, completion of the job etc.

Advantages:

i. It helps in identifying profitable and unprofitable jobs.

ii. It helps in the preparation of estimates will submitting quotations for similar jobs.

iii. Cost data under job costing enable management in preparing budgets for future.

iv. It enables management to control operational efficiency by comparing actual costs with estimated ones.

v. Spoilage and defective work can be identified with a specific job and responsibility for the same can be fixed on individuals easily.

Limitations:

i. It involves too much of clerical work (in estimating cost of material, labour and overheads chargeable to each job). As such it is expensive and laborious.

ii. Being historical in nature, it has all the disadvantages of the historical costing. Hence, it cannot be used as a means of cost control unless it is used with techniques like standard costing.

Procedure of Job Costing:

The procedure involved in job costing may be summarised as under:

i. Job Order Number:

When an order for a job is received from a customer that order is given a specific number by which it will be known through its course in the factory.

ii. Production Order:

When an order is received, the Production Planning Department allots a production order number. A production order is a written order issued to the manufacturing department to take up the job. It serves as an authority to start the work. It contains the information concerning job order number, date, customer’s name, quantity and description of the job, operations to be carried out etc.

iii. Bill of Materials:

A bill of material provides a list of materials and stores needed to complete a job. A copy of this is being sent by the Production Planning Department to the foreman along with production. This enables the foreman to collect materials from the stores.

iv. Job Cost Card:

For every job a job card is maintained, recording all expenses regarding materials labour and overheads from cost records. Actually it is a cost sheet of a specific job.

The basis of collection of casts would follow the following pattern:

(a) Materials— Materials Requisition, Bill of Materials or Materials Issue Analysis Sheet.

(b) Wages— Operation Schedule, Job Card or Wages Analysis Sheet.

(c) Direct expenses— Direct expenses vouchers.

(d) Overheads—Standing Order Numbers or Cost Account Numbers.

It should be kept in mind that for convenience in collection of costs, all the basic documents will contain cross reference to respective production order numbers.

After completion of the job, the actual cost, as recorded in the Job Cost Sheet, is compared with the estimated cost so as to reveal efficiency or inefficiency in operation. This serves as a guide to future course of action.

It is possible to prepare a job account and debit the same with all expenses incurred on the job and credit the same with the price of the job.

The difference between the two sides would give us profit made on the job.

Work-in-Progress:

This account shows the job under production and may be kept in any of the following two ways:

i. A composite work-in-progress account for the entire factory.

ii. A composite work-in-progress account for every department.

The work-in-progress account is periodically debited with all cost direct and indirect incurred in the execution of the jobs and credited with the cost of completed jobs. The balance in this account at any time represents the cost of jobs not yet completed.

2. Batch Costing:

Batch costing is a type of job costing. It is used where articles are manufactured in definite batches. (The term batch refers to the lot in which articles are to be manufactured). In job costing production is undertaken against specific orders, whereas in batch costing items manufactured and held for stock and sold on demand. Batch costing is followed in drug industries, readymade garment concerns, toy manufacturing concerns bakeries, biscuit factories, television sets, watches etc.

In pencil manufacturing units it will be costly to produce one pencil of a particular design at a time. However, production of 30 or 40 thousand penalise at a time would be more economical. The finished stock can be held in stock where there is no demand and offered for sale whenever there is demand for the items.

In batch costing, each batch is given a specific number. The method of cost collection is similar to what has been explained in respect in job costing. The cost of production per unit is ascertained by dividing he total costs by the total batch quantity.

Economic Batch Quantity:

It is necessary to determine economic lot size in batch costing.

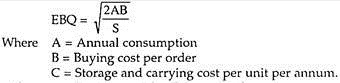

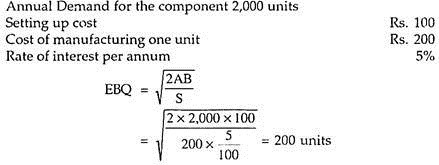

Such an economic size could be determined using the following formula:

Where A = Annual consumption B = Buying cost per order

Compute the economic batch quantity for a company using batch costing with the following information:

Methods of Costing – Job Costing, Contract Costing, Batch Costing, Process Costing, Unit Costing, Operating Costing, Operation Costing and Multiple Costing

The method of costing refers to a system of cost ascertainment and cost accounting. Industries differ in their nature, in the products they produce and the services they offer. Hence, different methods of costing are used by different industries. For example, the method of costing employed by a building contractor is different from that of a transport company.

Job costing and process costing are the two basic methods of costing. Job costing is suitable to industries which manufacture or execute the work according to the specifications of the customers. Process costing is suitable to industries where production is continuous and the units produced are identical. All other methods are combinations, extensions or improvements of these basic methods.

The methods of costing are explained in detail:

Method # 1. Job Costing:

It is also called specific order costing. It is adopted by industries where there is no standard product and each job or work order is different from the others. The job is done strictly according to the specifications given by the customer and usually the job takes only a short time for completion. The purpose of job costing is to ascertain the cost of each job separately. Job costing is used by printing presses, motor repair shops, automobile garages, film studios, engineering industries etc.

Method # 2. Contract Costing:

It is also known as terminal costing. Basically, this method is similar to job costing. However, it is used where the job is big and spread over a long period of time. The work is done according to the specifications of the customer.

The purpose of contract costing is to ascertain the cost incurred on each contract separately. Hence a separate account is prepared for each contract. This method is used by firms engaged in ship building, construction of buildings, bridges, dams and roads.

Method # 3. Batch Costing:

It is an extension of job costing. A batch is a group of identical products. All the units in a particular batch are uniform in nature and size. Hence each batch is treated as a cost unit and costed separately. The total cost of a batch is ascertained and it is divided by the number of units in the batch to determine the cost per unit. Batch costing is adopted by manufacturers of biscuits, ready-made garments, spare parts medicines etc.

Method # 4. Process Costing:

It is called continuous costing. In certain industries, the raw material passes through different processes before it takes the shape of a final product. In other words, the finished product of one process becomes the raw material for the subsequent process. Process costing is used in such industries.

A separate account is opened for each process to find out the total cost as well as cost per unit at the end of each process. Process costing is applied to continuous process industries such as chemicals, textiles, paper, soap, lather etc.

Method # 5. Unit Costing:

This method is also known as single or output costing. It is suitable to industries where production is continuous and units are identical. The objective of this method is to ascertain the total cost as well as the cost per unit. A cost sheet is prepared taking into account the cost of material, labour and overheads, Unit costing is applicable in the case of mines, oil drilling units, cement works, brick works and units manufacturing cycles, radios, washing machines etc.

Method # 6. Operating Costing:

This method is followed by industries which render services. To ascertain the cost of such services, composite units like passenger kilometers and tone kilometers are used for ascertaining costs. For example, in the case of a bus company, operating costing indicates the cost of carrying a passenger per kilometer. Operating costing is adopted by airways railways, road transport companies (goods as well as passengers) hotels, cinema halls, power houses etc.

Method # 7. Operation Costing:

This is a more detailed application of process costing. It involves costing by every operation. This method is used where there is mass production of repetitive nature involving a number of operations. The main purpose of this method is to ascertain the cost of each operation.

For instance, the manufacture of handles for bicycles involves a number of operations such as cutting steel sheets into proper strips, moulding, machining and finally polishing. The cost of these operations may be found out separately. Operation costing provides a minute analysis of costs to achieve accuracy and it is applied in industries such as spare parts, toy making and engineering.

Method # 8. Multiple Costing:

It is also known as composite costing. It refers to a combination of two or more of the above methods of costing. It is adopted in industries where several parts are produced separately and assembled to a single product.

Methods of Costing – Job Costing, Contract Costing, Batch Costing, Process Costing, Operating Costing, Operation Costing, Unit or Output Costing and Activity Based Costing

The methods to be used for cost ascertainment depend on nature of industry. Costs of production or service rendered differ from industry to industry. As per I.C.M.A.

Terminology costing methods can be grouped into two categories, viz.:

(i) Specific order costing (or Job/Terminal Costing), and

(ii) Operation Costing (or Process or Period Costing).

(i) Specific Order Costing (or Job/Terminal Costing):

This method of costing is applicable where the work consists of specific orders or Jobs batches or contracts. Job costing, Batch costing and Contract costing come under this category.

(ii) Operation Costing (or Process or Period Costing):

This method of costing is applicable where standardised goods or services result from a sequence of continuous operations. Process costing, unit costing, operating costing, operation costing fall under this category.

Various methods of costing are discussed below briefly:

1. Job Costing:

It is applicable in industries where goods are made against individual orders from customers. It is defined by the terminology of the definitions committee, I.C.M.A., London as, “that form of specific order costing, where work is undertaken to customers’ specific requirements”. In job costing direct costs are traced for specific jobs or orders. Each of the jobs involves different operations. Basic object of costing is to ascertain the cost of each job separately and any profit or loss thereon.

2. Contract Costing:

It is applied in concerns involved in construction work, like laying of roads, bridges and buildings, etc. For each of the contracts a separate account is opened and the total cost incurred is identified with it. The contracts may take a long time for completion. It is also known as terminal costing.

3. Batch Costing:

It is applied where orders for identical products are placed in convenient lots or batches. I.C.M.A. defines it as “that form of specific order costing which applies where similar articles are produced in batches either for sale or for use within an undertaking. In most cases, the costing is similar to job costing”. Cost per unit is ascertained by dividing the total cost of the batch by number of units of the batch.

4. Process Costing:

This method of cost ascertainment is used where the input is processed through several distinct processes to be converted into a finished product. The processes are carried out in a continuous sequence where the raw material is introduced in the first process and the finished product of each process becomes raw material for the subsequent process until the last process where from the finished product is transferred to finished stock account. In process costing a separate account is maintained for each process.

5. Operating Costing:

This method is applicable to service industries where no product is produced but some service is rendered. Examples- Transport, Lodging, Houses, Cinema theatres, Hospitals, etc.

6. Operation Costing:

This method is applicable where there is mass production and several processes are involved with different operations to be carried out to complete the process of production. It is similar to process costing but cost details are maintained for every minute operation and costs are more accurate.

7. Unit or Output Costing:

This method is applicable where output is uniform in all respects and production is continuous. Under this method cost per unit is ascertained by dividing the cost by number of units produced.

8. Multiple Costing:

This is a system where two or more methods of costing like job costing unit costing and operation costing are applied to find the cost of production. It is the application of combination of two or more methods to ascertain the cost of the work done. It is applied in industries where different parts are produced separately and assembled into a final product.

9. Activity Based Costing:

ABC is an accounting methodology that assigns costs to activities rather than products and services.

Costs are initially assigned to activities based on their resources. Then the costs are absorbed by products and services based on their use of activities.

CIMA defines ABC as “Cost attribution to cost units on the basis of benefit derived from indirect activities e.g., ordering, setting up, assuring quality”.

According to Horngren, Foster and Datar, “ABC is not an alternative costing system to Job costing or process costing; rather ABC is an approach to developing the cost numbers used in job or process costing systems. The distinctive feature of ABC is its focus on activities as the fundamental cost objects. The ABC approach is more expensive than traditional approach. ABC has the potential however, to provide managers with information they find more useful for costing purposes.”

Kaplan and Cooper of Harward Business school who have developed ABC approach to ascertain product costs, have classified the costs as ‘short term variable costs’ and ‘long term variable costs’. The approach relates overhead costs to the forces behind them which are named as ‘cost drivers’. Thus ‘cost drives’ are those activities or transactions which are significant determinants of costs.

ABC system is based on the belief that activities caused costs and a link should therefore be made between activities and products by assigning costs of activities to products based on individual product’s demand for each activity.

Methods of Costing – 3 Important Methods of Costing: Job Costing, Process Costing and Other Methods of Costing or Multiple Costing

Industries can broadly be classified into two categories as Jobbing industries and Processing (or mass production) industries. Job industrial enterprises undertake the production of goods and services according to the customer’s specifications. Since the customer’s specifications about the goods and services usually differ from one (customer) to another, there is no standard product and the costs are ascertained for each job separately.

Construction, Ship-building, Heavy Machinery, Contractor’s Works, etc., fall into job industries. On the other hand, in the case of mass production industries, industrial enterprises undertake production of identical units on a continuous basis. The manufacturing activities are grouped into a number of processes and the costs are accumulated for each process separately. Paper, Sugar, Textiles, etc., are examples to process industries.

This basic difference that exists in the nature of industrial activities and production methods necessitates the use of different methods of Costing. The methods used to ascertain the costs are called methods of costing or costing methods. Selection of a specific method of Costing depends, therefore, upon the nature of production and type of industry. Since there are two types of industries viz., job industries and process industries, Costing Methods can broadly be classified into two as Job Costing and Process Costing.

Depending upon the special features that vary from one industry to another within jobbing or processing industries, a number of methods of Costing based on the principle of Job Costing or Process Costing can be found.

Method # 1. Job Costing:

Under this method, costs are collected, accumulated and ascertained for each job separately. Because, each job normally differs from others as the works are undertaken strictly in accordance with the customers’ specifications. It is, therefore, necessary to ascertain the costs for each job separately.

This Costing method is suitable to the industries like Printing, Shipbuilding, Machine Tools, Repair Shops, Job Foundries, Locomotives, etc. The other methods of Costing which are based on the principles of Job Costing are Contract Costing and Batch Costing.

Though these methods are based on the same Job Costing principles, they are referred to by different names as they differ due to their special features:

i. Contract Costing:

A big job is normally termed as a contract. Further, contracts differ from jobs in the sense that the contract is usually carried out outside the factory whereas a job is manufactured internally in the company itself. However, Contract Costing which is also known as – Terminal Costing aims at collecting, accumulating and ascertaining the cost of each contract separately. This method of Costing is used in constructional type of industries such as -Buildings, Dams, Roads, Bridges, etc.

ii. Batch Costing:

In this case, a batch comprising of a number of identical units of a product is reckoned as job. The job is a batch and the batch is the cost unit. The reason as to why all the units of a batch are reckoned as a cost unit is two fold – all the units in a batch are identical and the amount of cost attributable to each unit in the batch is trivial. Under Batch Costing, costs are collected, analysed, accumulated and ascertained for each batch separately.

If necessary, cost per unit or average cost may be computed by dividing the total cost of the batch by the number of units in the batch. Batch Costing is suitable for industries like Pharmaceutical Industry (where medicines, injections, etc., are prepared in batches), Ready-made Garments, Spare Parts and Components, Confectionery, Toys, Patent Food, etc.

Method # 2. Process Costing:

This method is suitable to industries where production is undertaken on mass scale and on continuous basis. Further, raw materials pass through two or more processes before being converted into finished products. Raw materials introduced into the first process are transferred, after processing in the first process, to the second process for further processing.

After the processing of materials in the second process, they are transferred to next process for further processing and this process continues till processing in the final process to obtain finished product. Hence, the output of the first process becomes the input for the second process and the output of the second process is the input for the third process.

Under this method, costs are collected, analysed, accumulated and ascertained for each process or department. To arrive at the cost per unit, total process costs are divided by the output of the process. This method is suitable for industries like Chemical, Paper, Sugar, Cement, Refineries, etc. There are three more methods which are also based on the principles of Process Costing but varying slightly due to their special features.

The methods are:

i. Operation Costing,

ii. Single or Output Costing, and

iii. Operating Costing.

i. Operation Costing:

This method is a refinement over Process Costing as a manufacturing process consists of a number of distinct operations. It (i.e., Operation Costing) is, therefore, called detailed application of Process Costing. Under this method, costs are collected, accumulated and ascertained for each of the operations in the manufacturing process separately. This method is suitable for industries like Engineering, Toy-making, etc.

ii. Single or Output Costing:

When a company produces only one product (or two or more similar types of products but varying only in size, shape, etc.,) and when the units are identical and are of standard ones, and the entire manufacturing cycle is treated as a process, this method is adopted.

Under this method, costs are collected, accumulated and ascertained for the whole manufacturing process. The total cost is divided by the number of units of output to arrive at the cost per unit of output. This method is suitable for industries such as – Mines, Quarries, Steel Works, Breweries, Brick Works, etc.

iii. Operating Costing:

This method is applied to the organisations which are engaged in rendering services such as – Transport – Railways, Road, Airways; Hospitals; Power House; Canteens; etc. This method, therefore, aims at ascertaining the cost of services rendered. Total cost is divided by the total number of cost units [i.e., service such as number of passenger-kilometres (Passenger Transport), number of tonne-kilometres; number of patient-days (Hospitals); number of employees or meals (Hotel or Canteen); etc.,] to arrive at the cost per unit of service.

Method # 3. Other Methods of Costing – Multiple Costing:

In order to ascertain the cost of a product, application of more than one Costing method may be necessary. Hence, it is called Multiple Costing which is also called Composite Costing. For instance, up to a particular stage of production, Process Costing may be applied and for the rest of the production stage, Job Costing may have to be used. Manufacture of Motor-car, Aeroplane, Television, Video, etc., provide good examples wherein Multiple Costing is used.

As far as System of Costing is concerned, Batty is of the opinion that a system of Costing implies that there is a planned and co-ordinated arrangement of all matters relating to Costing. This lays emphasis on evolving systematic procedure for collection, classification, accumulation and ascertainment of costs. Costs can be collected and computed either after or before they are incurred.

If the costs are ascertained after their incurrence, it is called Historical Costing. CIMA, London has, therefore, defined Historical Costing as the ascertainment of costs after they have been incurred. It is of not much use for the management for cost control which is one of the important objectives of Cost Accounting. Because, a sound Cost Accounting system must aim at not only ascertaining costs but also control of costs.

Therefore, the procedure of ascertaining the costs before they are incurred (called, Standard Costs) has been in vogue in the corporate sector. CIMA, London has defined standard cost as a predetermined cost which is calculated from management’s standards of efficient operation and the relevant necessary expenditure. It can be used as a basis for price fixing and for cost control through variance analysis.

Further, CIMA, London has defined Standard Costing as the preparation and use of standard costs, their comparison with actual costs and analysis of variances to their causes and points of incident. By establishing standards for each element of costs, comparing actuals with the standards, finding out variances, if any and the reasons for the variances, and recommending to the management to take necessary remedial measures, Standard Costing helps to exercise control over the costs.

Therefore, Standard Costing can rightly be called a System of Costing. Further, it may be noted that the work of Costing methods is normally based on Historical Costing system. But the work of Costing Methods in the post-1980 is based on Standard Costing system and therefore, it is contributing heavily to the control of costs.