Marginal costing is a technique/system of presentation of sales and cost data with a view to guide the managers for taking short term decisions like sales mix selection, make or buy, acceptance of special order, etc. It is also used by the managers for cost control, budgeting and profit planning purposes.

Marginal costing is concerned with marginal cost only. Under marginal costing technique, cost of production comprises of variable costs only. As such the valuation of the finished goods and work-in-progress is made on the basis of variable costs only.

Contents

- Introduction to Marginal Costing

- Meaning and Definition of Marginal Cost

- Meaning and Definitions of Marginal Costing

- Features of Marginal Costing

- Characteristics of Marginal Costing

- Uses of Marginal Costing

- Vital Areas Which Helps the Management in Decision-Making

- Techniques of Marginal Costing

- Equation of Marginal Costing

- Marginal Cost Statement

- Cost-Volume-Profit (CVP) Analysis

- Differences between Marginal Costing and Absorption Costing

- Cost Concepts Used in Decision Making

- Splitting Semi-Variable Costs into Fixed and Variable Elements

- Break-Even Chart

- Profit Statement under Marginal Costing and Absorption Costing

- Direct Costing

- Difference between Marginal Costing and Variable Costing

- Marginal Costing and Differential Costing

- Margin of Safety

- Assumptions of Marginal Costing

- Advantages of Marginal Costing

- Limitations of Marginal Costing

Marginal Costing: Meaning, Definitions, Pricing, Opportunity Cost, Characteristics, Areas, Techniques, CVP, Differences, Margin of Safety, Advantages, Limitations and Examples…

Marginal Costing – Introduction

Marginal costing system is not a method of costing like job or batch costing or process costing or contract costing or operating costing which are used for the purpose of calculating the cost of products or services.

ADVERTISEMENTS:

Marginal costing is a technique/system of presentation of sales and cost data with a view to guide the managers for taking short term decisions like sales mix selection, make or buy, acceptance of special order, etc. It is also used by the managers for cost control, budgeting and profit planning purposes.

Different costs behave differently with the increase or decrease in the volume of production. Some costs change proportionately with the change in volume of production; they are called the variable cost. Some costs are fixed, irrespective of the volume of production. They are called the fixed cost.

In the marginal costing system, only variable cost of production is included in the unit cost. Fixed cost is treated as period cost and charged to the Profit and Loss Account in full.

Under marginal costing system, fixed costs are excluded from unit cost mainly for two reasons:

ADVERTISEMENTS:

(i) There are many costs which are not affected by the number of units produced during a period. For example, rent and taxes, insurance, lease rent of the machinery, etc., are not dependent upon the units produced. Same amount is payable if production is zero unit or 10,000 units or 15,000 units or more.

(ii) Fixed cost per unit will be more if number of units produced is less. Similarly, fixed cost per unit will be less if number of units produced are more. The variation in fixed cost per unit may distort the cost calculation for decision making in the short run.

Therefore, it is better not to consider fixed cost for cost calculation.

Marginal costing system seeks to remove any potential difficulty.

ADVERTISEMENTS:

In a marginal costing system, all variable costs (direct, indirect, production related or otherwise) are included in the cost of sales calculation.

The difference between sales and cost of sales is treated as contribution. This contribution is used first to recover fixed cost for the period. If there is any surplus, it is treated as profit.

Meaning and Definition of Marginal Cost

Marginal cost is the increase or decrease in total cost which occurs with small variation in output (such as a unit). It generally excludes any element of fixed cost.

The Chartered Institute of Management Accountants, (CIMA) London defines marginal cost as -“The cost of one unit of product or service which would be avoided if that unit were not produced or provided.”

Earlier the marginal cost was defined as -“The amount at any given volume of output by which aggregate costs are changed if the volume of output is increased or decreased by one unit. In practice, this is measured by the total variable cost attributable to one unit.Note – In this context, a unit may be a single article, an order, a stage of production capacity, a process or department. It relates to changes in output in particular circumstances under consideration.”

Whenever there is any change in production volume, the total cost of production will also change. This change within a given capacity range, will be in variable cost only.

In other words, the amount of change in total cost when related to per unit within a given range of production capacity, is generally equal to variable cost.

Hence, for all practical purposes, in cost accounting variable cost means marginal cost. It may be noted that though we generally talk of marginal cost per unit, the term unit represents the normal scale by which an activity changes. For example, in the case of cars, a unit may represent only one car but in case of a component, a unit may represent 1,000 components due to the application of batch costing.

According to economists, marginal cost of production refers to the cost of producing one additional unit of output. This cost may include an element of fixed cost also. The economist’s concept of marginal cost per unit does not remain uniform due to the operation of the law of diminishing (or increasing) return.

ADVERTISEMENTS:

According to accountants, when production is increased within the given capacity range the change in the aggregate cost is due to the incurrence of only variable cost of producing additional output. This change (increase) in the aggregate cost is termed as marginal cost. Thus, according to an accountant’s concept, marginal cost is variable cost only.

Marginal Costing – Meaning and Definitions

Marginal costing is used for managerial decision-making. It can be used in conjunction with any method of costing, such as job costing or process costing. It can also be used with other techniques of costing like standard costing and budgetary control. In this, only variable cost are considered.

The term ‘marginal costing’ has been defined by the Chartered Institute of Management Accountants (CIMA), London, as -“The accounting system in which variable costs are charged to cost units and fixed costs of the period are written off in full against the aggregate contribution. Its special value is in decision-making.”

Earlier the term was defined as -“Ascertainment of marginal costs and of the effect on profit of change in volume or type of output by differentiating between fixed costs and variable costs. Note – In this method of costing, only variable costs are charged to operations, processes or products while fixed costs are written-off against profits in the period in which they arise. The system of marginal costing, therefore, is a technique of cost accounting which differentiates between fixed costs and variable costs and shows the effect on profit of changes in the volume of output”.

ADVERTISEMENTS:

One additional-unit of production is known as marginal unit and the change in total cost on account of adding or subtracting one unit is known as marginal cost.

Definitions:

“Marginal costing is that technique which studies the increase or decrease in total cost as a result of increase or decrease of one unit of production.”

“Marginal costing is the ascertainment by differentiating between fixed and variable costs.” – (I.C.M.A. London)

ADVERTISEMENTS:

“Marginal cost may be defined as segregation of production cost between fixed and variable cost.”

Its deals with the principle of treating the cost of producing marginal units. It segregates fixed and variable cost. Thus marginal cost is the change in total cost on account of increase or decrease by one unit in production volume. Marginal cost is synonymous with the variable cost. In decision making, marginal costs are related to change in cost due to charge of one unit in production.

Marginal Costing – 5 Main Features

Marginal costing technique has the following main features:

1. Marginal costing is not a method of costing like process costing, job costing, operating costing etc., but a technique dealing with the effects of changes in the cost, volume, price, sales mix on the profits.

2. Marginal costing is concerned with marginal cost only. Under marginal costing technique, cost of production comprises of variable costs only. As such the valuation of the finished goods and work-in-progress is made on the basis of variable costs only.

3. Fixed costs do not form part of cost of production for the purposes of marginal costing. They are treated separately and may be charged wholly to the Profit and Loss Account for the accounting period.

ADVERTISEMENTS:

4. The profitability of a product or department is ascertained in terms of ‘Contribution’ or ‘Contribution Margin’. Contribution represents the difference between sales value and marginal cost of sales. The aggregate of contribution for all products is called ‘fund’.

5. For marginal costing techniques prices of the various products are fixed by the manufacturing concerns on the basis of marginal cost and marginal contribution.

Marginal Costing – Top 8 Characteristics

Following are the characteristics of a Marginal Costing System:

(1) In marginal costing system, only variable costs are taken into consideration for calculating unit cost.

(2) Fixed costs are treated as period cost and written off during the period in full.

(3) Closing stock, work-in-progress are valued at variable cost of production only.

ADVERTISEMENTS:

(4) It is not suitable for external reporting purposes. AS – 2 “Inventories” do not accept this method of valuation of stock.

(5) It is used extensively for short term (less than one year) decision making.

(6) Under marginal costing system, cost data is presented on the basis of behavior of the cost.

(7) Cost of sales are calculated after taking all variable costs (e.g., direct materials, direct labour, direct expenses, variable production, selling and administrative overheads).

(8) The difference between sales revenue and cost of sales is called contribution. Fixed costs are adjusted against contribution.

Marginal Costing – 7 Uses

Following are the uses of marginal costing:

ADVERTISEMENTS:

1. Determine the selling price, which will give desired profit.

2. Fixing sales volume to cover a given return on investment employed.

3. Forecasting cost and profits as a result of change in volume.

4. Determine cost and revenue at various levels of output.

5. Suggestions for shift in sales mix.

6. Inter firm comparison of profitability.

ADVERTISEMENTS:

7. Impact of increase or decrease in fixed and variable cost on profits.

Marginal Costing – Vital Areas Which Helps the Management in Decision-Making

Marginal Costing is an extremely valuable technique with the management. The cost- volume-profit relationship has served as a key to locked storehouse of solutions to many situations.

It enables the management to tackle many problems which are faced in the practical business. “All the introduction of marginal cost principles does is to give the management a fresh, and perhaps a refreshing, insight into the progress of their business”.

Now we explain the application of the techniques of marginal costing in certain important spheres-

Marginal Costing helps the management in decision-making in respect of the following vital areas:

1. Cost Control

2. Fixation of Selling Price

3. Closure of a Department or Discontinuing a Product

4. Selection of a Profitable Product Mix

5. Profit Planning

6. Decision to make or buy

7. Decision to accept a bulk order

8. Introduction of a new product

9. Choice of technique

10. Evaluation of performance

11. Decision making

12. Maintaining a desired level of profit

13. Level of activity planning

14. Alternative methods of production, and

15. Introduction of product line.

Area # 1. Cost Control:

The two types of costs—variable and fixed—are controllable and non-controllable respectively. The variable cost is controlled by production department and the fixed cost is controlled by the management.

Area # 2. Fixation of Selling Price:

Product pricing is a very important function of management. One of the purposes of cost accounting is the ascertainment of cost for fixation of selling price. Marginal cost of a product represents the minimum price for that product and any sale below the marginal cost would entail a loss of cash. There are cyclic periods in business—boom, depression, recession etc.

During normal circumstances, price is based on full cost. The theory is that only those products should be produced or sold which make the largest contribution towards the recovery of fixed costs. The selling price fixation is also done under different circumstances.

Some important circumstances are as follows:

(i) Fixing Selling Price

(ii) Reducing Selling Price

(iii) Selling at or Below Marginal Cost – When we sell a commodity at marginal cost, only variable cost is recovered. Generally, the price of a product is fixed to cover variable cost as well as fixed cost, in addition to a desired profit. Fixing the selling price below the marginal cost, invites loss of some of variable cost.

The products may be sold below the marginal cost in the following cases, when:

a. A competitor is to be driven out of market.

b. To popularise the product.

c. Labour engaged cannot be retrenched.

d. The goods are of perishable nature.

e. To keep the plant in running condition.

f. There is a cut throat competition.

g. To use the materials, which is about to perish.

h. The product is used as a loss leader for the sale of another product.

i. Not to close down the firm.

j. Fear of market which may go out of hand.

k. To prevent the loss of future orders.

l. To capture the foreign market.

Area # 3. Closure of a Department or Discontinuing a Product:

Marginal costing technique shows the contribution of each product to fixed costs and profit. If a department or a product contributes the least amount, then the department can be closed or its production can be discontinued.

It means the product which gives a higher amount of contribution may be chosen and the rest should be discontinued.

Area # 4. Selection of a Profitable Product Mix:

In a multiproduct concern, a problem is faced by the management as to which product mix or sales mix will give the maximum profit. The product mix which gives the maximum profit must be selected. Product mix is the ratio in which various products are produced and sold.

The marginal costing technique helps the management in taking decisions regarding changing the ratio of product mix which gives maximum contribution or in dropping unprofitable product line. The product which has comparatively less contribution may be reduced or discontinued.

Area # 5. Profit Planning:

Profit planning is a plan for future operation or planning budget to attain the given objective or to attain the maximum profit.

Area # 6. Decision to make or buy:

A firm may make some products, parts or tools or sometimes it may buy the same thing from outside. The management must decide which is more profitable to the firm. If the marginal cost of the product is lower than the price of buying from outside, then the firm can make the product.

Area # 7. Decision to Accept a Bulk Order or Foreign Market Order:

Large scale purchasers may demand products at less than the market price. A decision has to be taken now whether to accept the order or to reject it. By reducing the normal price, the volume of output and the sales can be increased. If the price is below the total cost, rejection of the order is aimed at.

In marginal costing, the offer may be accepted, if the quoted price is above marginal cost, because of the reason that existing business contribution can recover the fixed costs and the margin of profits.

In such cases, the contribution made by foreign market or bulk orders will be an addition to the profit. But the price should not be less than the marginal cost. However, it should not affect the normal market price.

Area # 8. Introduction of a New Product:

A producing firm may add additional products with the available facility. The new product is sold in the market at a reasonable price, in order to sell it in large quantities. It may become popular. If favourable, the sales can be increased; thus the total cost comes down and contributes some amount towards fixed costs and profits.

Area # 9. Choice of Technique:

Every management wishes to manufacture the products at the most economical way. For this, the managerial costing is a good guide as to the products at different stages of production, that is to say whether the management has to adopt hand operated system or semi-automatic system or complete automatic system.

When operations are done by hand, fixed cost will be lower than the fixed cost incurred by machines and in complete automatic system fixed costs are more than variable cost.

Area #10. Evaluation of Performance:

Marginal costing helps the management in measuring the performance efficiencies of a department or a product line or sales division. The department or the product or division which gives the highest P/V ratio will be the most profitable one or that is having the highest performance efficiency.

Area # 11. Decision Making:

Price must not be less than total cost under normal conditions. Marginal costing acts as a price fixer and a high margin will contribute to the fixed cost and profit. But this principle cannot be followed at all times. Prices should be equal to marginal cost plus a reasonable amount, which depends upon demand and supply, competition, policy of pricing etc.

If the price is equal to marginal cost, then there is a loss equal to fixed costs. Sometimes, the businessman has to face loss when, –

(a) there is cut-throat competition,

(b) there is the fear of future market,

(c) the goods are of perishable nature,

(d) the employees cannot be removed,

(e) a new product is introduced in the market,

(f) competitors cannot be driven out etc.

Area # 12. Maintaining a Desired Level of Profit:

An industry has to cut prices of its products from time to time on account of competition, government regulations and other compelling reasons. The contribution per unit on account of such cutting is reduced while the industry is interested in maintaining a minimum level of its profits.Marginal costing technique can ascertain how many units have to be sold to maintain the same level of profits.

Charles points out “when desired profits are agreed upon, their attainability may be quickly appraised by computing the number of units that must be sold to secure the wanted profits. The computation is easily made by dividing the fixed costs plus desired profits by the contribution margin per unit”.

Area # 13. Level of Activity Planning:

Where different levels of production and/or selling activities are being considered and the management has to decide the optimum level of activity, the marginal costing technique helps the management. What level of activity is optimum for a business to adopt is an important problem faced by businesses.

Area # 14. Alternative Methods of Production:

Marginal costing techniques are also used in comparing the alternative methods of manufacture i.e. machine work or hand work, whether one machine is to be employed instead of another etc.

Many a time, management has to choose a course of action from among so many alternatives, the changes in the marginal contribution under each of the proposed methods are worked out and the method which gives the greatest contribution is obviously adopted keeping in view the limiting factor if any.

Area # 15. Introduction of New Product or Product Line:

The technique to assess the profitability of line extension products is the incremental contribution estimates. The same technique of contribution analysis would be followed in assessing the profitability of a new product line. Sales forecast would result from a market survey and market research.

Techniques of Marginal Costing

The technique of marginal costing involves:

1. Differentiation between fixed costs and variable costs;

2. Ascertainment of marginal costs; and

3. Ascertaining the effect on profit due to changes in volume or type of output i.e., the determination of cost-volume-profit relationship.

Technique # 1. Differentiation between Fixed Costs and Variable Costs:

Marginal costing technique involves the segregation of all costs into fixed costs and variable costs. Costs may be divided into fixed costs, variable costs and semi-fixed or semi-variable costs.

Fixed cost may be defined as a cost which tends to remain unaffected in aggregate by changes in the volume of output. Fixed costs are generally referred to as period costs as they are incurred on the basis of time and do not vary directly with volume or rate of output such as rent, rates, insurance premium etc.

Variable cost may be defined as a cost which tends to change in aggregate in direct proportion to changes in output. Variable costs mainly depend on output and are sometimes referred to as direct costs. Examples of variable costs are direct material cost, direct wages, direct expenses etc.

Semi-variable cost or semi-fixed cost is a cost which is partly fixed and partly variable. It tends to change in aggregate with changes in volume of output but not directly in proportion to such changes. Examples of semi-variable costs are repairs and maintenance, cost of supervision etc.

Technique # 2. Determination of Marginal Cost:

Under the marginal costing technique only variable costs are applied to products. The cost of production is the marginal cost of production and the cost of sales is the marginal cost of sales. Marginal cost refers to the aggregate of prime cost and all variable overheads.

Prime cost is the aggregate of direct material cost, direct wages and direct or chargeable expenses. ‘All variable overheads’ means variable overheads plus the variable portion of semi-variable overheads.

Semi- variable overheads are partly fixed and partly variable, and require segregation into fixed and variable elements. The variable portion is added to variable overheads thus forming part of marginal cost whereas the fixed portion is added to fixed overheads and the total fixed overheads are treated as separate costs. These separate costs are related to time and hence known as ‘period costs.’

The main problem to a cost accountant is to segregate the semi-variable overhead into fixed and variable elements. Segregation or separation of semi- variable overhead into fixed and variable elements can be done by adopting various methods such as Comparison Method, High and Low Points Method, Equation Method, Averages Method, Graphical Method or Least Squares Method.

Technique # 3. Cost-Volume-Profit Relationship:

At this stage, we know that variable or marginal costs vary directly with production while fixed costs remain unchanged without any regard to the quantity of output. If this cost behaviour is related to sales revenue, it will show the cost-volume-profit relationship.

This cost-volume-profit relationship actually represents the net effect of changes in cost, volume and price on the profits of the firm. Cost-volume-profit analysis is a device which is used to determine the usefulness of the profit planning process of the firm.

Analysis of the cost-volume-profit relationship provides answers to questions such as:

(a) What should be the minimum level of sales to avoid losses?

(b) What should be the sales level to earn desired profits?

(c) What will be the effect of changes in costs, prices and volume on profits?

(d) What will be the effect of changes in sales-mix on profits?

(e) What will be the revised break-even point in case there is a change in costs, prices, volume or sales-mix?

(f) Which product is most profitable and which one is the least profitable?

(g) Should the sale of a product be discontinued? and so on.

Marginal Costing – Equation

In marginal costing, for determining profit, contribution is first worked out. Contribution is the excess of sales price over variable cost. At each level of output, one can calculate the total amount of contribution by multiplying the contribution per unit by the number of units produced. When fixed costs are deducted from the total contribution, we get the profit figure.

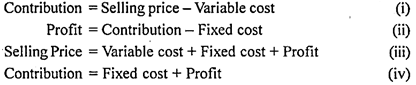

In an equation form these may be written as under:

The above equations are called marginal costing equations. These equations help in calculating the break-even point, profit planning and finding out an unknown variable.

Marginal Cost Statement

In marginal costing, a statement of marginal cost and contribution is prepared to ascertain

contribution and profit. In this statement contributions are separately calculated for each of the product or department.

These contributions are totaled up to arrive at the total contribution. Fixed cost is deducted from the total contribution to arrive at the profit figure. No attempt is made to apportion fixed cost to various products or departments.

Marginal Costing – Cost-Volume-Profit (CVP) Analysis: Meaning, Assumptions and Techniques

CVP analysis is an important tool that provides management with useful information for managerial planning and decision making. Profits of a business are the result of interaction of many factors such as selling price, volume of sales, variable cost, total fixed cost and sales mix.

To do an effective job in planning and decision making, management must analyze correct predictions of how profits will be affected by change in one of these factors.

Management also needs an understanding of how revenues, cost and volumes interact in providing profits. All these information are provided by the CVP analysis. CVP analysis is a systematic method of examining the relationships between selling price, total sales revenue, and volume of production, expenses and profit. This analysis simplifies the real world conditions that a business enterprise is likely to face.

CVP analysis provides management with information regarding financial results if a specified level of activity or volume fluctuates, information on profitability and probable effects of changes in selling price and other variables.

Such information can help management improve the relationship between these variables. Similarly CVP analysis may be used in setting selling prices, selecting the products mix to sell, level of sales to earn desired profit, choosing among alternatives and the effects of cost increase or decrease on the profitability.

In CVP analysis, all expenses are classified into fixed and variable. Semi variable expenses have to be divided into their fixed and variable elements. These are important prerequisites to any CVP analysis for proper understanding and essential for reliable conclusions.

Based upon the knowledge of fixed and variable cost elements and CVP analysis, it is possible to determine Break-even sales volume, to compute the sales needed to generate desired profits and to supply answers to questions that arise in the course of management planning and decision making.

Following are the assumptions, which will limit the precision and reliability of CVP analysis:

1. All costs can be divided into fixed and variable elements.

2. Total fixed cost remains the same over the relevant volume range of the CVP analysis.

3. Total variable costs are directly proportional to volume over the relevant range.

4. Selling prices are to be unchanged.

5. Prices of the factors of production like material, wage rates etc. remain unchanged.

6. Efficiency and productivity are to be unchanged.

7. The analysis either covers a single product or assumes that a given sales mix will be maintained as total volume changes.

8. It is assumed that the units produced are sold. Revenue and costs are being compared on a single activity base.

9. It is assumed that volume is the only relevant factor affecting cost. There are other factors that affect cost and sales. Ordinary cost-volume- profit analysis is a crude over-simplification when these factors are unjustifiably ignored.

Economists do not assume the linearity in CVP analysis. They assume that sales price reduction may be needed to spur sales volume. Managers and accountants take comfort in knowing that most decisions are made within relevant range of volume, where the linearity assumptions regarding sales and costs are likely to be good enough.

Techniques of CVP Analysis:

CVP analysis uses the following techniques for planning and decision making:

1. Contribution margin concept.

2. Profit-Volume (P/V) analysis.

3. Break-Even analysis.

Technique # 1. Contribution Margin Concept:

Contribution margin concept indicates the profits potential of a business enterprise and also highlights the relationship between cost, sales and profit. It is highly useful technique for planning and decision making. Contribution margin is the excess of sales revenue over the variable cost and expenses.

From the contribution margin, fixed costs and expenses are deducted giving finally operating income or loss. It is thus used to recover fixed cost and once the fixed costs are recovered, any remaining contribution margin adds directly to operating income of the firm.

Contribution = sales – variable cost

Contribution = fixed cost + profit

Contribution – fixed cost = profit or loss

The percentage of contribution to sales will change under different levels of sales if there is any change in variable cost per unit, fixed cost or selling price per unit.

Technique # 2. Profit Volume (P/V) Ratio:

The contribution margin can also be expressed as a percentage. This ratio is also known as contribution to sales ratio. This ratio denotes the percentage of each sales rupee available to cover the fixed cost and provide operating income to a firm.

Example sales of a company are Rs.100000, variable cost is Rs.60000 and fixed cost is Rs.30000, the profit will be Rs.10000.

The contribution ratio will be –

Contribution = (sales – variable cost) / sales (i.e. Rs.100000 – Rs.60000) / Rs.100000 = 40%.

The p/v ratio helps in knowing the effect on income of a firm due to increase or decrease in sales volume. Suppose if the sales are increased to Rs.140000, then the profit will be –

Rs.26000 at a p/v ratio of 40%. This p/v ratio is useful to management in deciding whether to increase sales volume. If the p/v ratio is large and if the enterprise is operating at less than 100% capacity, it will be advantageous for the firm to go for increase in sales volume as net income will go up because of higher sales volume.

On the other hand, a firm with small p/v ratio will not be profitable to have increase in sales volume much profitable. The firm with low p/v ratio should aim at reducing cost and expenses before thinking of increasing the sales volume.

P/v ratio is most useful when the increase or decrease in sales volume is measured in terms of rupees, the unit contribution is useful when increase or decrease in sales volume is measured in sales units.

If business is able to cover fixed cost, the net income of the firm will increase by unit contribution margin multiplied by additional sales units.

P/v ratio = Contribution / sales Or

(sales – variable cost) / sales Or

(FC + profit) / sales

Technique # 3. Break-Even Analysis:

A break-even analysis is performed to identify the level of operations at which the entity has covered all costs but has not yet earned any profit. In other words the total revenues and total expenses are equal i.e. there is neither profit nor loss.

This is an important point to management because it represents a minimum acceptable level of operations and it indicates that profitable operations can only result when the level of activity exceeds the break-even point.

There are three methods of calculating break-even point: the equation method, the contribution margin method and graphic method.

Consider the following example:

Mr. X plans to sell plastic tricolor flags on Independence Day. He purchased these flags at 50 paise each. The rental charges are Rs.200 payable in advance. He sells the flags at 90 paise each. How many flags must be sold to break even?

i. Equation Method:

Sales – variable expenses – fixed expenses = net income

Or,

Unit sale price – unit variable expenses – fixed expenses = net income

.90 -.50 – Rs.200 = 0

.40x = Rs.200 x = Rs.200 / .40 = 500 units

ii. Contribution Margin Method:

BEP = fixed expenses / contribution per unit

= Rs.200 / .40 = 500 units.

The contribution margin method is merely a restatement of the equation method in a different form. Use of either technique is a matter of personal preference.

BEP = fixed cost / p/v ratio; or

iii. Graphic approach – The relationships in this example can be graphed by using three building blocks.

Advantages of Break-Even Analysis:

i. Total cost, variable cost and fixed cost can be determined.

ii. Cost, volume and profit relationship can be studied and are very useful to the managerial decision making.

iii. Inter-firm comparison is possible.

iv. It is useful for forecasting plans and profits.

v. The best product mix can be selected.

vi. It is helpful for cost control.

vii. Total profits can be calculated.

Difference between Marginal Costing and Absorption Costing

Marginal costing differs from absorption costing which is also known as conventional costing.

The following are the main differences.

1. In marginal costing only variable costs (marginal costs) are charged to products, processes or operations. Fixed costs are charged as period costs to the profit statement of the same period in which they are incurred.

Absorption costing is a total cost technique. In this all costs, both variable and fixed, are charged to products, processes or operations.

2. Under marginal costing, the cost of production does not include fixed factory overheads and, therefore, the value of the closing stock comprises only variable costs. No part of fixed expenses is included in the value of closing stock and carried over to the next period in its value.

Under absorption costing, fixed factory overheads are absorbed by the production units on the basis of a pre-determined fixed factory overhead recovery rate based on normal capacity. Under/over-absorbed overheads are adjusted before arriving at the figure of profit for a particular period.

The inclusion of fixed factory overheads (in some cases office and administrative expenses also) in the cost of production results in the closing stock being valued at a higher value and carrying over a certain part of fixed overhead to the next period.

3. In marginal costing, since fixed overheads are not included in the cost of production, under or over recovery of overheads does not arise.

In absorption costing, in spite of best possible forecast and equitable basis of apportionment/allocation of fixed costs, under or over recovery of fixed overheads generally arises.

4. In marginal costing decisions are taken on the basis of contribution, i.e., excess of sales price over variable costs, which results in optimum profit.

In absorption costing, managerial decisions are based on profit, i.e., excess of sales value over total costs, which may at times lead to erroneous decisions.

Marginal Costing – Important Cost Concepts Used in Decision Making

Costs for Decision Making:

The following are the important cost concepts used in decision-making:

Concept # 1. Relevant Costs:

These are the costs, which are affected by a decision. Relevance means pertinent to the decision in hand. The important features of relevant cost are that a cost to be relevant must satisfy two conditions –

(i) it must be a future cost, and

(ii) it must be a cost that differs. The same conditions apply to revenue aspect for being relevant to decision in hand. Examples of relevant costs are –

(a) variable costs (marginal costs), if they differ,

(b) fixed costs, which differ for various options under consideration for decision,

(c) in case of replacement decision, disposal value of old machine. Out of profit cost, opportunity cost and imputed cost are also relevant costs.

Concept # 2. Irrelevant Costs:

These are the costs, which are not affected by a decision in hand. Examples are- past costs, historical costs or sunk costs, fixed costs, variable costs, which will remain unchanged under various alternatives, future fixed costs if remain unchanged under various alternatives, and book values of old machine.

Concept # 3. Marginal Cost:

The amount of change in total cost when related to per unit within a given range of production capacity represents marginal cost. In cost accounting, for all practical purposes, variable costs are marginal costs. For example- direct material costs, direct labour costs, direct variable expenses which vary in the same proportion in which the volume of output or activity changes are marginal costs.

Concept # 4. Direct Costs:

These are costs (fixed or variable) which are directly identifiable with a particular product, service, job or activity. Beside the cost of direct material and direct labour, all direct expenses, such as hire charges of a special machine commissioned for a specific job, which can be identified with a given product, service, job or activity also form part of direct costs. These are also called traceable costs.

Concept # 5. Differential Cost (Incremental and Decremental Costs):

It represents the change (increase or decrease) in total cost (variable as well as fixed) or in specific elements of cost that occurs due to change in activity level, technology, process or method of production, etc.

For example, if any change is proposed in the existing level or in the existing method of production, the increase or decrease in total cost or in specific element of cost as a result of this decision will be known as incremental cost or decremental cost.

The profitability of the new proposal is assessed after matching the differential revenues. Incremental cost also refers to added value of a new product.

Concept # 6. Opportunity Cost:

This cost represents the value of sacrifice made or benefit of opportunity foregone in accepting an alternative course of action. For example, a firm accepts an expansion plan and for its financing, withdraws money from its bank deposits. Then, the loss of interest on the bank deposits is the opportunity cost for carrying out the expansion plan. Opportunity costs play an important role in decision making.

Concept # 7. Imputed / Implicit Costs:

These are notional costs, similar to opportunity costs, and do not involve any cash outlay. These costs are computed and considered only for decision-making purposes. Interest on capital, rent of premises, payment for which is not actually made are examples of imputed costs.

Concept # 8. Sunk Cost:

This is historical cost incurred in the past. It plays no role in decision making in the current period. For example, in the case of a decision relating to the replacement of a machine, the written down value of the existing machine is a sunk cost and therefore not considered.

Concept # 9. Full Cost / Total Cost / Absorption Cost:

This is total of all costs, variable costs and fixed costs assignable to a product, service or activity. In short-run, full cost is not relevant for a decision.

Concept # 10. Out of Pocket Cost / Explicit Costs:

This is that portion of total cost which involves cash outlay as against those costs which do not require any cash outlay, such as depreciation. This cost concept is a short run concept and is used in decisions relating to fixation of selling price in recession, make or buy, etc. Out of pocket cost can be avoided or saved if a particular proposal under consideration is not accepted.

Marginal Costing – Splitting Semi-Variable Costs into Fixed and Variable Elements (With Methods)

The technique of marginal costing requires a clear distinction between fixed costs and variable costs. Semi-variable costs are those which vary with the change in the activity level but not in direct proportion.

This indicates that semi-variable costs contain both types of costs—fixed as well as variable. Most expenses in an organisation are generally of a semi-variable type. All indirect expenses which are neither fixed nor variable can be included in this category.

For example, costs of machine repairs, maintenance, depreciation, telephone charges, etc., are of semi-variable nature.

In applying the marginal costing technique, semi-variable expenses have to be split into fixed and variable elements. The fixed portion is added to other fixed costs and variable portion is added to other variable costs thus arriving at total fixed and variable costs.

There are several methods of splitting semi-variable costs into fixed and variable elements.

These are:

(1) Comparison by period or level of activity method.

(2) High and low points method.

(3) Analytical method.

(4) Least squares method.

(5) Graphic method.

Marginal Costing – Break-Even Chart: Assumptions, Constructions, Cash Break-Even Chart and Profit Volume Graph

The break-even point can also be shown graphically through the breakeven chart. The break-even chart “shows the profitability or otherwise of an undertaking at various levels of activity and as a result indicate the point at which neither profit nor loss is made”.

It shows the relationship, through a graph, between cost, volume and profit. The break-even point lies at the point of intersection between the total cost line and the total sales line in the chart.

In order to construct the break-even chart, the following assumptions are made:

Assumptions of Break-Even Chart:

1. Fixed costs will remain constant and do not change with the level of activity.

2. Costs are bifurcated into fixed, and variable costs. Variable costs change according to the volume of production.

3. Prices of variable cost factors (wages rates, price of materials, supplies etc.) will remain unchanged so that variable costs are truly variable.

4. Product specifications and methods of manufacturing and selling will not undergo a change.

5. Operating efficiency will not increase or decrease.

6. Selling price remains the same at different levels of activity.

7. Product mix will remain unchanged.

8. The number of units of sales will coincide with the units produced, and hence, there is no closing or opening stock.

Construction of Break-Even Chart:

The following steps are required to be taken while constructing the break-even charts:

1. Sales volume is plotted on the X-axis. Sales volume can be shown in the form of rupees, units, or as a percentage of capacity. A horizontal line is drawn spacing equal distances showing sales at various activity levels.

2. Y axis represents revenues and fixed and variable costs. A vertical line is also spaced in equal parts.

3. Draw the sales line from point 0 onwards. Cost lines may be drawn in two ways.

(i) Fixed Cost Line is drawn parallel to X axis and above it variable Cost Line is drawn from zero point of fixed cost line. This line is called the Total Cost Line.

(ii) In the second method the Variable Cost Line is drawn from point 0 and above this, fixed cost line is depicted running parallel to the variable cost line. This line may be called Total Cost Line.

4. The point at which the Total Cost Line cuts across the sales line is the break-even point and volume at this point is break-even volume.

5. The Angle of Incidence is the angle between sales and the Total Cost Line. It is formed at the intersection of the sales and the total cost line, indicating the profit earning capacity of a firm. The wider the angle the greater is the profit and vice versa.

Usually, the angle of incidence and the margin of safety are considered together to show that a wider angle of incidence coupled with a high margin of safety would indicate the most suitable conditions.

Cash Break-Even Chart:

This chart is prepared to show the cash needs of a concern. Fixed expenses are to be classified as those involving cash payments and those not involving cash payments like depreciation.

As the cash break-even chart is designed to include only actual payments and not expenses incurred, any time lag in the payment of items included under variable costs must be taken into account.

Equal care must be shown on the period of credit allowed to the debtor for the purpose of

calculating the amount of cash to be received from them, during a particular period.

Profit Volume Graph:

This graph (called profit graph) gives a pictorial representation of cost-volume-profit relationship. In this graph, X axis represents sales. However, the sales line bisects the graph horizontally to form two areas. The ordinate above the zero sales line shows the profit area, and the ordinate below the zero sales line indicates the loss or the fixed cost area.

The profit-volume-ratio line is drawn from the fixed cost point through the break-even point to the point of maximum profit. In order to construct this graph, therefore, data on profit at a given level of activity, the break-even point and the fixed costs are required.

Profit Statement under Marginal Costing and Absorption Costing

The difference in the treatment of fixed overhead affects the profit computation under two costing systems, particularly when a part of the production remains unsold. Profit, under marginal costing will be less than under absorption costing, since no part of fixed expenses has been carried over to the next period in the value of closing stock.

Absorption costing will tend to produce a more stable profit profile when production is constant but sales are subject to seasonal fluctuations. Reverse will be the case when sales are constant but production volume fluctuates from period to period.

Marginal Costing – Direct Costing

Marginal or variable costing is, sometimes, designated as direct costing. This term, which is very popular in the United States, is defined as “the practice of charging all direct costs to operations, processes or products, leaving all indirect costs to be written off against profits in the period in which they arise.”

According to this definition, direct costs, i.e., those that can be identified with a product, process or a department are to be charged to the product, process or department. For instance, material cost and labour cost which can be identified with a cost unit become direct costs to be charged to cost unit as product cost.

However, direct labour may not, in certain situations, vary in the short term with changes in output. If that is so, although direct labour can be identified with the product, it cannot be considered to be an item of variable cost.

Similarly, manufacturing overhead is indirect cost since the same cannot be identified with the cost unit. But yet, variable manufacturing overhead is included in product cost under the direct costing technique. Consequently, the concept of direct costing is not the same as marginal or variable costing.

In spite of the peculiarity of direct costing, those who prefer the designation variable costing also bring direct costing within the purview of variable costing.

Difference between Marginal Costing and Variable Costing

Both marginal costing and variable costing are the techniques of product costing. In the case of both these techniques, a clear distinction is drawn between variable costs and fixed costs. In both these techniques, variable cost of manufacture is charged to cost unit and fixed cost is charged to profit and loss account as period cost.

This is because of the fact that both the techniques treat variable cost as related to output and fixed cost as related to the period.

In the case of both these techniques, there is no need to allocate and apportion fixed costs to cost units, products, processes or departments. There is also no need to compute departmental absorption rates for recovery of fixed costs. This is mainly because of the fact that fixed costs are not treated as product costs.

It is also of interest to note, in this context, that both the techniques show stocks of work-in-progress and finished goods at variable cost which is equal to prime cost plus variable overheads. No part of fixed cost is included in stocks for valuation purpose and carried forward to the next accounting period.

Excess of sales revenue over variable cost of sales is treated as ‘contribution margin’ in the case of both these techniques. This contribution margin is called so as it initially contributes towards recovery of fixed costs and subsequently, towards profit. Accordingly, contribution minus fixed cost is profit or fixed cost plus profit is equal to contribution.

In the light of what is stated above, we may end up by drawing the conclusion that both marginal costing and variable costing are similar to each other and, variable costing is another name for marginal costing. Confusion may arise if we take the views of the accountant and economist with regard to their conception of the term ‘marginal cost’.

While marginal cost is, from the point of view of the accountant, average variable cost which falls in the beginning and later rises due to diseconomies as output increases, it is the additional cost of the additional or one extra unit produced from the economist’s point of view.

According to the latter, marginal cost does not remain constant but falls in the beginning as output increases and then it slopes upwards as further additions are made to the output. It is, for this reason that the trend in modern times is to avoid the usage of the term marginal cost but stick to the term variable costing.

In spite of the differing views of the accountants and economists with regard to the concept of marginal costing, the CIMA Official Terminology uses only the term ‘marginal costing’ and not ‘variable costing’.

However, while defining this term, it makes it clear that in this accounting system only variable costs are charged to cost units and fixed costs of the period are written off in full against the aggregate contribution. As such, we may conclude by equating marginal costing with variable costing, and use the terms as synonyms.

Marginal Costing and Differential Costing

It is necessary to state, at the outset, that marginal costing is not the same as differential costing, although both are the techniques of cost analysis and presentation of cost data to management.

Differential costing comes close to the economist’s concept of marginal cost, since the former is defined by the CIMA Official Terminology as “the difference in total cost between alternatives”.

According to the definition of the term ‘differential costing’, the technique calculated to assist decision-making includes not merely variable cost but fixed costs also. As such, the scope of differential costing is much wider than that of marginal costing. Further, differential costs are presented to management for decision-making both under absorption costing and marginal costing techniques.

This feature of differential costing should lead us to the conclusion that differential costing is not an alternative method of cost ascertainment. Hence, marginal costing is not the same as differential costing.

Marginal Costing – Margin of Safety

It is the difference between the actual sales and the sales at break-even point. One of the assumptions of marginal costing is that output will coincide sales, so margin of safety is also the excess of production over break even point’s output.

It can also be expressed as a percentage. It is the sales above break-even point. All fixed costs are recovered at break-even point, so fixed expenses have been excluded from the formula of margin of safety which gives profit after meeting fixed costs.

The margin of safety will be nil at break-even point, because the actual sales are just equal here. If the margin of safety is large, it is an indicator of strength of business because with a substantial reduction in sales or production, profit shall be made.

On the other hand if it is small, a small reduction in sales or production will be a serious matter and will lead to loss.

Efforts should be made by the management to increase the margin of safety so that more profit may be earned. It can be increased by increasing level of production, increasing the selling price and output, reducing fixed or variable cost and substituting existing products with more profitable products.

Marginal Costing – Assumptions

The following assumptions of the marginal costing are made which are as follows:

1. Total cost can be separated into fixed and variable cost.

2. Fixed cost remains constant at all the levels of output.

3. Variable cost fluctuates in direct proportion to volume of output.

4. Selling price remains constant.

5. Productivity per worker will also remain unchanged.

6. There will be no change in general price level.

7. Production and sales will be synchronized. That means whatever produced is sold.

Marginal Costing – Important Advantages

The following are important advantages of the marginal costing technique:

Advantage # 1. Simplicity –

It is simple to understand and easy to operate. It can be operated along with standard costing and budgetary control.

Advantage # 2. True valuation of closing stock –

Under marginal costing, closing stock is valued at marginal cost only. It, thus, prevents the illogical carry-forward of fixed costs (period costs) of one period to the next one as part of the value of closing stock.

Advantage # 3. No under/over recovery of overheads –

Since fixed overheads are charged against the contribution, there is no problem of computing fixed overheads recovery rates and their under or over recovery.

Advantage # 4. Profit a function of sale –

Marginal costing establishes that profit is the function of sale and not of production since profits depend on sale volume and not on production volume. This can be seen by preparing a profit statement under marginal costing and absorption costing.

Advantage # 5. Helps in decision making –

The effect of the change in production and sales policies can be better appreciated under marginal costing. It enables the management to take correct decisions resulting in optimum profits. In a multi-product firm, the contribution approach helps in deciding the most profitable mix.

Advantage # 6. Facilitates control –

It facilitates control over costs, particularly variable costs, by avoiding arbitrary apportionment or allocation of fixed costs. Since fixed costs are more or less uncontrollable, the management can concentrate on variable costs which are generally controllable.

Advantage # 7. Helps in profit planning –

It helps in short-term profit planning, cost control and taking correct decisions, keeping in view the exigencies of the situation. It better serves the needs of the management.

Marginal Costing – Limitations

Marginal costing however, suffers from a few limitations.

These are:

1. Assumes that all costs can be classified into fixed and variable –

It assumes that all costs can be classified into fixed and variable, but there may be certain costs which are neither fixed nor variable but the result of the management’s discretion and policy. For example, various amenities to workers may have no relation either to volume of production or time factor.

2. Ignores time factor and investment –

It ignores time factor and investment. For example, the marginal cost of two jobs may be the same but the time taken in their completion and the cost of machines used may differ. The true cost of a job which takes longer time or uses costlier machine should be higher. This is not disclosed by marginal costing.

3. No show of profit before work completed –

The application of marginal costing in certain industries such as ship building, construction, etc., may show no profit or loss during the year work is in progress, but huge profit in the year the work is completed. This is due to the non-inclusion of overheads in the value of closing work-in-progress.

4. Selling price based on variable cost not true selling price –

In the long run, true selling price should be based on total cost, i.e., inclusive of fixed cost also. In the short run or in special situations when a product is sold below the total cost, customers may insist on the continuation of reduced prices forever and this may not be possible in all cases.