Accounting plays an important role in smooth functioning of business organisation through systematic recording of business transactions. It also provides various information to business and its stakeholders such as – creditors, bankers, tax authorities, shareholders, suppliers etc., through systematic maintenance of books of accounts and access to these accounts as and when required.

Accounting is basically an Information System. Because, it is designed primarily to serve the different stakeholders in their decision-making process by providing them necessary, timely and relevant information.

Accounting is the science of recording and classifying business transactions and events, primarily of a financial character, and the art of making significant summaries, analyses and interpretations of those transactions and events and communicating the results to the persons who must take decisions or form judgement.

Contents

- Introduction to Accounting

- Meaning and Definition of Accounting

- Important Aspects of Accounting

- Types of Accounting

- Accounting Information

- Important Uses of Accounting Information

- Users of Accounting Information

What is the Meaning Of Accounting? – Meaning, Definition, Aspects, Types, Accounting Information, Uses and Users…

Meaning of Accounting – Introduction

Accounting plays an important role in smooth functioning of business organisation through systematic recording of business transactions. It also provides various information to business and its stakeholders such as – creditors, bankers, tax authorities, shareholders, suppliers etc., through systematic maintenance of books of accounts and access to these accounts as and when required.

ADVERTISEMENTS:

Thus, we cannot think of any business organisation without use of accounting in the modern world.

Meaning of Accounting – Meaning and Definition

Accounting is basically an Information System. Because, it is designed primarily to serve the different stakeholders in their decision-making process by providing them necessary, timely and relevant information.

As Michael Porter opined, the Accounting System is the dominant source of business information since no other system of a business entity has the ability to combine the performance of all functions of a business into one set of measures which led accounting to be known as language of business.

ADVERTISEMENTS:

As an Information System, Accounting is involved in the process of converting inputs into outputs. It processes business transactions (inputs) to produce the desired result in the form of reports, statements, etc., (outputs).

The reports, statements, etc., are meant for submission to different stakeholders (both internal and external parties/stakeholders) to help them in their decision-making process. Because, as pointed out by Ashok Chandek, the major objective of financial statements is to provide information which is useful to the present and prospective investors, creditors and other user groups to make rational investments, credit and other pertinent economic decision making.

And it may be noted here that the accounting information contained in the reports, statements, etc., help the decision-makers in their decisions.

Accounting is a discipline which records, classifies, summaries and interprets business transactions. Accounting is essential for the success of any business. Robert Anthony has pointed out — Accounting is the language of business.

ADVERTISEMENTS:

Accounting is the science of recording and classifying business transactions and events, primarily of a financial character, and the art of making significant summaries, analyses and interpretations of those transactions and events and communicating the results to the persons who must take decisions or form judgement. — Smith and Ashburne.

Earlier the objective of accounting was to ascertain the profit or loss and financial position of business. Thus it was useful for the owner of the business. But in modern times, accounting provides useful information to the various stakeholders. It is also an important source of Management information system. Accordingly its subject matter has increased to serve the needs of different people and different branches of accounting have been developed.

American Institute of Certified Public Accountants (AICPA) has defined Accounting as the art of recording, classifying and summarizing in a significant manner and in terms of money, transactions and events which are, in part at least, of financial character and interpreting the results thereof.

American Accounting Association defines Accounting (in 1966) as the process of identifying, measuring and communicating economic information to permit informed judgments and decisions by the users of the information.

In the opinion of Kenneth S. Most, Accounting is a service activity. Its function is to provide quantitative information, primarily in nature, about economic entities that is intended to be useful in making economic decisions, in making reasoned choices among alternative courses of action. Accounting includes several branches, for example, Financial Accounting, Managerial Accounting and Government Accounting.

Another opinion reads as, essentially Accounting is an information system. More precisely, it is an application of general theory of information to the problem of efficient economic operation. It also makes up a large part of the general information expressed in quantitative terms. In this context, Accounting is both a part of general information system of an operating entity and a part of the basic field bounded by the concepts of information.

Meaning of Accounting – Important Aspects of Accounting

The important aspects of accounting are as follows:

1. One of the essential and primary functions of Accounting is recording the voluminous and heterogeneous business transactions that have taken place during an accounting period. This recording activity has rightly been called Book-Keeping.

Prof. R. N. Carter has defined Book-Keeping as the science and art of correctly recording, in the books of accounts, all those business transactions that result in the transfer of money or money’s worth.

ADVERTISEMENTS:

Similarly, L. C. Cropper defined Book-Keeping as the science of recording transactions in money or money’s worth in such a manner that, at any subsequent date, their nature and effect may be clearly understood and, when required, a combined statement of their result may be prepared.

According to A. J. Favell, Book-Keeping is the recording of the financial transactions of a business in a methodical manner so that information on any point in relation to them may be quickly obtained.

J. R. Batliboi defines Book-Keeping as the science as well as the art of recording business transactions under appropriate accounts.

A. H. Rosenkamptt also defined Book-Keeping as the art of recording business transactions in a systematic manner.

ADVERTISEMENTS:

From the above, it is obvious that Book-Keeping is the language in which the business transactions are recorded in the books of accounts. Though Book-Keeping serves as the base for Accounting, it is not synonymous with Accounting. Because, the scope of Book-Keeping is confined to recording of business transactions which results in the accumulation of data relating to business activities.

And it is the Accounting which processes, analyzes and interprets the data for the purpose of meeting the informational requirements of different categories of users of accounting information.

The function of Accounting is to provide quantitative information, primarily of financial nature, about economic entities, that is needed to be used in making economic decisions. Book-Keeping, therefore, represents only a part (pertaining to the recording of business transactions) of the Total Accounting System.

2. The phrases in terms of money and of financial character used by AICPA while defining Accounting, as quoted above, are somewhat ambiguous in nature. Because, the organizations record the money equivalents of their business transactions. For instance, assume that P Company purchased 1,000 units of material S at Rs.10 per unit.

ADVERTISEMENTS:

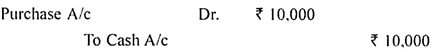

This transaction is recorded in the books of accounts by passing the following entry:

It may be noted here that the purchase of 1,000 units of S is recorded in the books of accounts in terms of money as this transaction is of financial nature. It may also be noted here that Rs.10,000 represents the monetary value of the materials purchased. But the monetary value itself (of materials purchased) is not money. Hence, there is a wide scope for influencing the monetary value of business transactions.

3. The use of the phrase in part at least in the definition also introduces an element of subjectivity and difficulty. The difficulty is with respect to the identification of the transactions which form the subject matter of Accounting. Hence, there is a scope for subjectivity,

4. One may also note the use of the phrase transactions and events which restrict the scope of Accounting by excluding the items such as depreciation expense, accrual of interest payable, bad-debts written-off, etc. However, it is not so in practice as Accounting considers all those which are normally considered by the accountants to denote transactions and events. It may be noted here that transaction is used to mean a business, performance of an act, an agreement, etc.

Purchase of raw materials, sales of goods and services, payment of wages salaries, etc., are examples to transactions. On the other hand, event is used to mean a happening, as a consequence of transactions, a result, etc. Earning profit as a result of production and sales activities carried out, closing stock left with the company after the sales out of goods available for sales, etc., are examples to events, and

ADVERTISEMENTS:

5. Since Accounting furnishes information to the needy, it may be considered as a part of the Total Information System. It consists of many branches. Financial Accounting, Cost Accounting and Management Accounting are three important branches of the Total Accounting System.

Meaning of Accounting – Types: Financial Accounting, Cost Accounting and Management Accounting

Accounting is the ‘recording and reporting of transactions’. It records the day-to-day events relating to business, in terms of money in various books of account. Additionally, it communicates the results of business operations to management, shareholders, creditors, banks, financial institutions etc. As a language of business, accounting serves an important means of communication between the business and its constituent parts.

The principal objective of accounting is to provide information to the users to make relevant decisions and form judgements.

Functions of Accounting:

Accounting, basically, performs three important functions – First, it identifies and gathers relevant data. This involves recording and analysis of economic events. These records furnish details regarding events which have already occurred.

Second, accounting tries to measure economic events by assigning monetary values to them. Where quantification is not possible, some economic events are estimated.

ADVERTISEMENTS:

Third, the information collected and measured is communicated through statements and reports to users.

Broadly speaking, there are three types of accounting – financial accounting, cost accounting and management accounting:

Type # 1. Financial Accounting:

According to Kohler, financial accounting is ‘the accounting for revenues, expenses, assets and liabilities that is commonly carried on in the general offices of a business’. It is the recording of business transactions in the books of account for the purpose of presenting results to Board of Directors, Shareholders etc.

The basic objective of financial accounting is to provide useful financial information for the benefit of investors, creditors and other external groups.

The results are essentially revealed through three statements at the end of an accounting period:

ADVERTISEMENTS:

i. Profit and loss account

Revealing the net profit or loss during the year

ii. Balance sheet

Highlighting the financial health of the firm

iii. Statement of sources and application of funds

Showing the flow of funds arising from business activities during a period.

ADVERTISEMENTS:

Functions:

The basic functions of Financial Accounting may be summarized thus:

i. Recording

All monetary transactions are recorded in the day book called ‘journal’ in a scrupulous manner.

ii. Classifying

Transactions which are similar in nature are then grouped at one place through another book called ‘ledger’.

iii. Summarizing

The classified data is presented in an understandable form through accounting statements, i.e., trial balance, income statement and balance sheet, for the benefit of internal and external groups

iv. Interpreting

The financial data is interpreted in a meaningful way now so that various groups can arrive at decisions regarding the overall profitability of a business, its financial health and its future earnings potential etc.

Limitations of Financial Accounting:

Financial accounting served the interests of small business owners for a long time. However, when businesses grew in size, it failed to answer certain crucial questions such as profitability of a specific job or operation, detailed analysis of items of expenditure, controllable items of cost, data for price quotations etc.

According to Blocker and Weltmer, ‘in spite of new accounting devices, improved techniques and elaborate subsidiary records, financial accounting is so limited and inadequate in regard to the information which can be supplied to management that, during the past 30 years, businessmen have been eager to adopt supplementary accounting methods known as Cost Accounting’.

Let’s examine the limitations of financial accounting, which have contributed, to the emergence of cost accounting in a big way:

i. Historical Data:

Financial data, presented at the end of an accounting period, is historical in nature, and prompt cost information on a day-today basis is not available. In the absence of up to date information, managers fail to initiate corrective steps at a right time.

ii. Unclassified Cost Data:

Cost data for each segment of business such as division, department, job, product, process or operation is also not available. Financial accounting treats figures as simple, single and silent items. Such raw data is of little help in interpreting figures meaningfully and decide about the price of product, evaluation of a project, feasibility of an operation etc.

iii. Looks at the Jungle, Rather than the Trees:

Financial accounting shows only the overall performance. It discloses the net trading result of the business as a whole. It does not show profit or loss of different products, jobs, departments etc.

iv. Incomplete Analysis:

Financial accounting does not fully analyse the losses arising out of substandard material, inefficient labour, idle plant capacity etc. It does not also reveal cost variations between active and slack periods of business.

In the absence of useful cost data, management cannot take appropriate decisions like replacement of labour by machines, make or buy, identify a suitable product mix, launch new products etc. By providing a back seat to decision making data, financial accounting fails to meet the growing needs of a modern business organisation

v. Improper Classification of Expenses:

Expenses are not classified into direct and indirect, fixed and variable, controllable and uncontrollable. There is no clear-cut focus on controllable items of cost. Hence, it is not possible to improve operational efficiency from time to time.

vi. Cost Comparisons not Easy:

Financial accounting does not provide data for comparison of costs of different periods, different departments, products or jobs.

vii. Price Fixation Difficult:

It is not easy to fix the price of an individual job, product, or department in absence of classified cost information. Estimates also cannot be prepared.

viii. There is no Control over Materials and Supplies:

This may result in losses in the form of wages, labour and overheads, misappropriation obsolescence, deterioration, scrap and defective work etc. Likewise, labour cost is not recorded by jobs, processes or departments and, hence, it is virtually impossible to evaluate jobs or departments over a period of time.

There is no system of incentives to compensate bright workers. Since workers are paid by the time spent on the job, the losses arising out of idle time, loitering go unchecked.

ix. No Scope for Performance Appraisal:

In financial accounting, proper norms for efficient use of material, labour and costs are missing. As a result, there is no way to find out whether everything is progressing as planned or not.

x. Not Amenable for Introduction of Modern Techniques:

Financial accounting does not offer any room for the introduction of sophisticated techniques such etc., which are important for cost ascertainment and cost control

Type # 2. Nature of Costing and Cost Accounting:

Costing:

It is the technique and process of ascertaining costs'(ICMA, London). It expresses faithfully the actual cost of any particular unit of production and also discloses how such total cost is constituted. According to Wheldon, it is ‘the classifying, recording and appropriate allocation of expenditure for the determination of the costs of products or services; the relation of these costs to sales volumes and the ascertainment of profitability’.

Cost Accounting Activities:

Cost accounting provides management with detailed records of the cost relating to products, departments, operations or functions. It involves classification, analysis and interpretation of costs to meet the requirements of internal and external groups.

It includes:

i. Cost finding

This is concerned with finding the cost of a specific product or activity.

ii. Cost recording

It is concerned with recording of costs in the cost journal and the subsequent posting to the ledger.

iii. Cost analysis

This step involves the careful evaluation of cost data so as to assist management in planning, controlling business activities.

iv. Cost presentation

It is a system of reporting cost data in a meaningful form to various levels of management for making right decisions at the right time.

v. Cost control

Cost control is the guidance and regulation by executive action of costs of an undertaking. It aims at guiding the actuals towards the targets and regulates the actuals if they vary from the targets and this is done through executive action. Cost control is exercised through techniques such as standard costing, budgetary controls etc.

Cost Accountancy:

The Institute of Cost and Management Accountants, London has defined Cost Accountancy as the ‘application of costing and cost accounting principles, methods and techniques to the science, art and practice of cost control and ascertainment of profitability as well as presentation of information for the purpose of managerial decision making’.

According to this definition cost accounting includes several things:

i. The technique and process of ascertaining costs

ii. Accumulation, analysis and interpretation of cost data for internal use— for planning, control and decision making

iii. The function of keeping costs within prescribed limits, using techniques such as standard costing, budgetary control

iv. The function of ensuring a real and permanent reduction in the unit cost of goods produced or services rendered by employing techniques such as standardization, forecasting, value analysis etc.

v. It is the verification of cost accounts and a check on the adherence to the cost accounting plan. It has two aspects; to verify that the cost accounts have been properly maintained and to check that the principles laid down have been scrupulously adhered to

Cost Accounting – Science, Art and Practice?

Cost accounting is often described as the science, art and practice of a cost accountant on account of the following reasons:

Science:

Cost accounting is a science. It has a systematic body of knowledge which can be applied by the cost accountant in various situations. Certain techniques and principles (in the form of standard costing, marginal costing, budgetary control etc.) have developed over the years to aid the decision making capabilities of accountants. These can be pressed into service by anyone interested in improving profitability of business operations, cutting down costs and achieving overall efficiency.

Art:

Cost accounting sharpens the skills of an accountant while applying the above mentioned techniques. It demands analytical and judgmental skills on the part of an accountant. Mere knowledge of principles may prove to be useless for a cost accountant unless he looks into the requirements of each business closely and critically.

Practice:

A cost accountant must offer valuable data for decision making usually at the top levels of management. He must present data in an amenable form, offer valuable suggestions and aid decision making process in a significant manner.

This requires sustained efforts on the part of an accountant to apply the knowledge in a skilful manner, and give the best to the organisation. He must be able to translate the techniques, methods and practices in the service of an undertaking, yielding concrete results.

Type # 3. Management Accounting:

Management accounting presents accounting information in such a way as to assist management in the creation of policy and in the day-to-day operations of an undertaking. According to Kohler, management accounting is ‘that portion of accounting which attempts to supply management with quantitative information as the basis for decisions’.

The purpose of management accounting is not to make decisions, rather, it facilitates the process of decision making. By using specialized techniques such as budgetary control, standard costing, management accounting tries to initiate remedial actions whenever actual performance deviates from the budgeted performance. Management accounting is used by management

First, to understand business transactions and economic environments and their impact on the organisation; second, to evaluate the impact of past and future events; and, third, to ensure proper control over performance.

Functions of Management Accounting:

i. Provides selective and pertinent, quantifiable data to management

ii. Analyses and interprets data for effective planning and decision making

iii. Communicates relevant financial information to management and other internal and external users

iv. Facilitates accomplishment of goals through budgets and standards

v. Collects other important qualitative information (through surveys, records, statistical compilations) for improving managerial performance.

Meaning of Accounting – Accounting Information: As a Language of Communication, Users of Accounting Information, External and Internal Reporting

Accounting as a Language of Communication:

People, who have financial stake in an economic organisation such as a business entity, are naturally interested in its welfare. Since all such persons cannot directly participate in the decision making process pertaining to its activities, they are inclined to fall back upon the information supplied to them by the accounting mechanism.

The main function of accounting is the provision of business information to people who have an interest in the organisation. Accounting may, therefore, be considered as a language through which useful economic information relating to an organisation, whether business or otherwise, is communicated to the users. Accounting has had its origin mainly to perform what was called the ‘stewardship’ function of reporting to the owners the financial position and profitability of their business.

In modern times, however, accounting information is not restricted to a business organisation only. The utility of accounting information has been felt by non-profit organisations also. In fact, every organisation of human beings, regardless of the purpose of such an organisation, has felt the need for accounting information.

Users of Accounting Information:

Users of accounting information are decision makers. Their decision centers round the problem of allocation of scarce resources with them amongst competing alternative uses. In other words, their main interest is the choice of the most profitable channel of investment. However, accounting information is needed by persons interested in making non-financial decisions also. This is so, as we have already seen that accounting information is needed by persons interested in all types of human organisations.

There are, therefore, different classes of persons interested in accounting information. For instance, shareholders, creditors, debenture holders, bankers, employees, potential investors, Government, trade unions, trade associations, chambers of commerce, brokers and underwriters, etc., need accounting information consistent with their own decision requirements.

Besides, these classes of users, there are also the managerial personnel who function within an organisation. Though their information needs are different, they too are interested in accounting information for their own decisions.

The users of accounting information may thus be classified into two broad groups, viz., those external to an organisation and those within the organisation.

External and Internal Reporting:

Provision of accounting information is known as ‘reporting’. Accordingly, we distinguish between external reporting and internal reporting. This distinction is purely on the basis of the class to which the user of accounting information belongs.

Historically, accounting was evolved to supply business information to those who had invested their wealth in business. During the days prior to the Industrial Revolution, business units were small in size.

The owner or owners, depending on whether the business was of a sole trader’s or partnership type, procured the information required by direct observation and personal contact with their business and its activities. The need for a medium of communication was not felt. As such, there was nothing like external or internal reporting.

The Industrial Revolution introduced far reaching economic changes in some of the Western countries. Large-scale business units run by agent-managers came into existence. Divorce between ownership and management was one of the dominant reasons for placing reliance on business information. Reporting was mainly external.

The financial statements were made use of for conveying as much business information as was possible. The information needs of those external to business and also of those who were interested in the welfare of a business unit were satisfied.

With the growth of business concerns, the problem of internal control necessitated internal reporting to managerial personnel. Accounting was geared to the needs of management. Accounting became a tool in the hands of management. It served the information needs of those internal to business. Thus, was drawn the distinction between external and internal reporting.

Meaning of Accounting – Important Uses of Accounting Information: Managerial Decisions, Managerial Planning, Managerial Control, Evaluation of Performance and Assistance to External Parties

Accounting information is used by different parties for different purposes. It is used by both the internal and the external parties, and by both the shareholders, employees, managerial personnel, governments, etc. However, the purpose for which the accounting information is used by different parties differs from one party to another.

Anyhow, the important uses of accounting information are presented below:

1. Managerial Decisions:

Management is expected to take various decisions – both short-run and long-run decisions, both tactical and strategic decisions, etc. However, what is common with all these decisions is their future implications. The decisions taken today followed by their implementation influence the future performance of the organization, and the future performance depends upon the quality of the decisions taken today and the way in which they are implemented.

Any lapse at the stage of taking decisions affects the future performance of the organization adversely. Decisions pertaining to the revision of prices of goods and services, new product pricing, make or buy an intermittent product, whether to discontinue the production and sale of a particular product either on temporary basis or on permanent basis, product diversification, etc., are some of the decisions that the managerial personnel are expected to take.

Since they influence the future results of the organization, it is necessary for the management to take the decision after evaluating the pros and cons of different alternatives. To evaluate the different alternatives and to take a final decision, management needs relevant accounting information. Hence, the accounting information is useful for taking various decisions by the managerial personnel of business organizations.

2. Managerial Planning:

Another important aspect of management is the Planning for the future in the form of defining the goals for the future organizational performance, and deciding about the tasks and optimal use of available resources to accomplish those goals. It may be noted at this stage that every planning has a purpose or a set of purposes in the form of achieving goals or targets by allocating and utilizing available resources and time optimally.

Further, the allocation and utilization of resources require proper planning. To accomplish the goals by utilizing the available resources, the management needs relevant accounting information. Hence, the accounting information enables the management to plan for the future systematically.

3. Managerial Control:

Control complements the Planning. Normally, it involves four steps viz. – (a) establishment of performance standards based on the objectives of the organization, (b) measurement and reporting of actual performance, (c) comparison of actual results with the standards set to find out the differences between the two, (d) taking appropriate corrective and/or preventive measures to ensure that no adverse variance takes place in future.

It may be noted here that the performance standards are influenced by the planning function. Though it is a challenging task, it is necessary to set real standards for each of the important tasks. Whenever the actual performance is lower than the standard set, it is necessary to analyze the reasons for the same and to take appropriate corrective action to ensure that this type of variation does not recur in future.

In each of the four steps, the management needs relevant accounting information. Therefore, accounting information is of immense help to the management in achieving the planned and desired result.

4. Evaluation of Performance:

It is necessary to evaluate the performance of the organization both on continuous basis and on periodical basis. This is necessary to find out the financial soundness of the organization, to find out whether a business activity/product resulted in profit or loss, to assess the efficiency of different departments of the organization, to ascertain whether each of the products is earning profit, whether the firm is functioning more efficiently and profitably when compared to its competitors in the industry, etc.

For all these exercises, the management needs accounting information. This shows the importance of accounting information in evaluating the performance of the organization and its divisions.

5. Assistance to External Parties:

Accounting information is also useful to all the categories of external parties such as shareholders, debenture holders, financial advisors, governments, tax offices, employees and their trade unions, etc., of business organizations.

Meaning of Accounting – Users of Accounting Information: Owners and Other Investors, Prospective Investors, Financial Institutions/Lenders and More…

Users of accounting information (or accounting reports, statements, etc.) are many and they can be classified into two broad categories as internal parties (or users) and external parties (or users). This classification is based on whether the parties or users need information to take decision in their own interest (external parties) or in the interest of the company (internal parties).

It is unequivocal that a large number of parties need accounting information from their companies for various reasons and purposes. Basically, they need information to take appropriate decisions.

However, these decisions differ from one party to another and from one sub-group to another within a group as presented and analysed below:

1. Owners and Other Investors:

Both the individual and institutional investors comprising of both the shareholders, debenture holders, etc., need information to assess the risk involved and return expected in relation to their investments.

The present investors (including the owners) need information to decide whether they should continue to invest in a business or to dispose of their present holdings and invest on the financial instruments which promise higher rate of return with lower or same degree of risk. Further, they need accounting information which enable them to assess whether a business is capable of paying dividends regularly and whether there is any scope for capital appreciation.

They also need relevant information to evaluate the policies and performance of the management of the company. Because, the overall performance of an organization depends, to a greater extent, upon its management policies and programmes. Hence, this group needs detailed information such as- (a) rate of growth in sales, volumes, etc., (b) profit – Gross Profit Margin, Operating Profit, Net Profit Contribution, Divisible Profit, etc., (c) investment – amount of capital invested, cost price of assets owned, etc., (d) profitability – Return on Investment, Earnings per Share, Return on Equity, etc., (e) value of the business – Market Price of the Equity, etc.

2. Prospective Investors:

The prospective investors (i.e., the persons/institutions who/which wish to invest on the securities of an organization) would like to know about the safety of their proposed investments and also the expected/promised return on investment. Therefore, they need information to decide about purchasing the financial instruments of a company.

3. Financial Institutions/Lenders:

Financial Institutions which lend money to the business organizations require information from the borrowing organization to assess whether it (i.e., borrowing organization) is capable of paying the interest regularly as and when it falls due, and also to repay the principal loan amount immediately after the expiry of the loan period.

Therefore, the financial institutions need relevant accounting information to assess the liquidity position of the borrowing organization. The information required include Cash Flow Statement, Current Assets, Current Liabilities, security of assets offered against the current loan, fund required, etc.

4. Suppliers/Creditors:

Suppliers of different inputs to the organization (more particularly those who supply the inputs on credit basis) need information from the buying-organization to evaluate the short-term liquidity of the business. This is necessary to find out whether the

business is able to pay the amount when it falls due.

They (i.e., suppliers or creditors), therefore require information on the pattern of cash flow, working capital position, payment policy, etc., to judge the credit worthiness of the buying-organizations.

5. Employees and Trade Unions:

Employees and their fora viz., trade unions require information from their organization to evaluate the stability and continuing profitability of the organization. More particularly, they are interested in assessing the ability of their employer-organization to pay them periodically, promotional prospects and the mechanism to maintain pension fund and retirement benefits.

Therefore, they need information on various aspects such as, growth rates in revenue and profit, pattern and amount of investment made by the organization in its business, employment statistics such as number of persons employed, periodical wages and salary bill, company pension contributions, pattern of investment or deposit of pension fund mobilized, security thereof, etc.

6. Governments and their Agencies:

Governments are providing a number of facilities to the corporate world and they have the responsibility to protect the interest of all sections of the society. Therefore, it is necessary to ensure that the business enterprises are functioning properly. Further, it is necessary to ensure that the corporate enterprises are remitting various taxes, duties, etc., to the state exchequer.

Hence, the governments and their agencies and departments require accounting information. For instance, the Tax Departments of the governments need information to assess, levy and collect different kinds of corporate taxes — income tax, value added tax, customs, production tax, local taxes and rates, etc.

7. Financial Analysts and Advisers:

Financial analysts and advisers, brokers and other financial intermediaries constitute an important group of users of accounting information. It is more so in the case of the companies whose financial instruments (such as shares, debentures, etc.) are listed on a recognized stock exchange.

They need complete financial and other data in order to analyze the performance of the business enterprises. This is necessary to undertake a comprehensive evaluation of the performance of the undertakings so that they can advise their clients appropriately.

8. Customers:

Customers of the organizations require information about the ability of the business to survive and prosper. They (i.e., customers) may have a long-term interest (more particularly, in the case of institutional customers) in the range of products and services of the companies and also in their ability to supply quality goods and services regularly and timely.

Hence, they need information relating to improvement in the quality and functional value of the existing products, development of new product, prices, etc.

9. Managerial Personnel:

Management at different levels needs accounting information for the purpose of taking various managerial decisions ranging from tactical to strategic decisions. Of course, the nature and kind of information required by the management differ from one decision to another.

For example, for deciding the price for a new product, the management of the company needs information about a number of aspects such as, cost of production and sales, prices of similar product in the market, etc. On the other hand, if a company wants to take equipment replacement decision, it needs information about undepreciated book value of the existing machine, its remaining useful life, production capacity, current trade-in-value, repairs and maintenance costs, price of the new machine, its production capacity, useful life, etc.

10. Researchers:

For the researchers who intend to take up research work in the area of the corporate world and accounting aspects, accounting information is of immense value. Therefore, the researchers also fall into the category of users of accounting information.

11. General Public:

As the tax-payers, the general public is also interested to know the performance of the organizations. Hence, they need accounting information.

Similarly, a number of other parties use accounting information for the purpose of taking various decisions.