Wage and salary administration is defined as the process by which wage and salary levels and structures are determined in organisational settings.

Wages are payments for labour services rendered frequency, expressed in hourly rates, while a salary is a similar payment, expressed in weekly, monthly or annual rates.

Thus the term ‘wage’ frequently connote payments in terms of the number of hours worked and may fluctuate depending upon hours actually worked.

The determination of wage rates, administration of wage policies and satisfying the employees as regards to wages and rates of wages is an important aspect of wage administration.

ADVERTISEMENTS:

As a matter of fact wage and salary administration is one of the major responsibilities of modern manpower management.

Learn about:-

1. Introduction to Wage and Salary Administration 2. Meaning and Definitions of Wage and Salary 3. Concepts 4. Nature and Characteristics 5. Purpose and Objective of Wage and Salary Surveys.

6. Aspects 7. Principles 8. Elements 9. Steps Involved in Determination of Wage Rate 10. Process of Wage and Salary Survey 11. Factors Affecting Wage and Salary.

ADVERTISEMENTS:

12. Factors Considered to Form a Sound Wage Policy 13. Types of Wage and Salary Surveys 14. Important Classification of Wages 15. Structure 16. Systems 17. Factors Affecting Wage/Salary Levels.

18. Wage Institutions in India 19. How to Control Wage and Salary Administration 20. Problems.

Wage and Salary Administration: Definitions, Concept, Characteristics, Factors, Structure, Problems and Other Details

Wage and Salary Administration – Introduction

Wages constitute the major factor in the economic and social life of any community in an economic sense; wages represent payment of compensation in return for work done. In a sociological sense, wages characterize stratification of occupational categories. In a psychological sense, wages satisfy need directly and indirectly in response to changing employee aspiration.

Its constitutes one of several elements of job satisfaction and is instrumental for the satisfaction of some needs more than others. In a legal sense, the term wages or salaries has acquired various connotations, depending on the context and has become a subject of special law in many countries. It is most important to an industrial worker because his standard of living and that of his family depends upon his earnings.

ADVERTISEMENTS:

Wages have at least two connotations from the stand points of employers and employees in organisational settings – (i) First, the employers perceive wages as a cost of their business efforts and are keen to reduce labour cost per unit of output. Explicitly, wages form an important cost factor for the enterprise. Although the employers are inclined to save this cost, they have also come to realize that it would not be possible for them to attract and maintain an effective workforce without compensating it adequately, (ii) Second, employees consider wages as a means for satisfying their needs in terms of an expected standard. They desire to receive at least as much remuneration as other individuals equipped with similar skills for doing similar work.

Traditional theorists define wage and salary administration as the process by which wage and salary levels and structures are determined in organisational settings. Wages are payments for labour services rendered frequency, expressed in hourly rates, while a salary is a similar payment, expressed in weekly, monthly or annual rates. Thus the term ‘wage’ frequently connote payments in terms of the number of hours worked and may fluctuate depending upon hours actually worked.

The determination of wage rates, administration of wage policies and satisfying the employees as regards to wages and rates of wages is an important aspect of wage administration. As a matter of fact wage and salary administration is one of the major responsibilities of modern manpower management.

It is of course a line responsibility but continually increasing complication have demanded the attention of specialized staff members. Hence, the experts in personnel area have to take due care of this important function continuously.

Labour is the most important factors of production. Labour expects fair compensation for its contribution to the process of production. The term ‘wages’ is probably the broadest of all designations applied to workers compensation. In popular usage, it refers to payments for services, whether mutual or maintained whether based on hours of employment, units of output or some other yardstick.

In this usage, the term includes salaries, bonus, premium and commissions, etc., in modern times; the word ‘wage’ is used in some restricted sense. In this sense, it refers to compensation paid for services of hourly-rated or order to non-supervisory and non-clerical employees.

Wage and Salary Administration – Meaning and Definitions

In simple words wages means reward for the labourer for his services rendered to the industry. These can be paid on per unit, per hour, daily, fortnightly, weekly, or monthly basis. Labourers render services of both types i.e. mental and physical.

Some of the definitions of wages are as follows:

According to Prof. Straitoff, “Wages is the reward of that labour which creates utility.”

ADVERTISEMENTS:

As per the ILO, “Wages refer to the payment which is made by the employer to the labourer for his services hired on the conditions of payment per hour, per day, per week, or per fortnight.”

In the words of Jaod, “Wages are the income that an employee gets for his services.”

According to Benham, “Wages are a sum of money paid under contract by an employer to a worker for services rendered.”

As per McConell, “Wages are the price paid for the use of labour.”

ADVERTISEMENTS:

According to Yoder and Haneman, “Wages are the compensation for the wage earners, the numerous employees.”

The development of rules of wage administration has to be done, after the rate ranges have been determined. Rules have to be developed to determine to what degree advancement will be based on length of service rather than merit; with what frequency pay increases will be awarded; how controls over wage and salary costs can be maintained; what rules will govern promotion from one pay grade to another, etc.

At the next stage, the employees are to be informed of the details of wage and salary programme. Although most hourly-paid workers are informed through the wage contract about the details of wage programme, a substantially smaller number of salaried employees have such information about their jobs.

It is considered advisable, in the interest of the concern and the employees, that the information about average salaries and ranges in the salaries of group should be made known to the employees concerned; for secrecy in this matter may create dissatisfaction; and it may also vitiate the potential motivating effects of disclosure.

Wage and Salary Administration – Basic Concepts

ADVERTISEMENTS:

Compensation may be defined as money received in the performance of work, plus the many kinds of benefits and services that organizations provide to their employees. ‘Money’ is included under direct compensation (popularly known as wages, i.e., gross pay); while benefits come under indirect compensation, and may consist of accident and health insurance, the employer’s contribution to retirement, pay for vacation or illness, and employer’s required payments for employee welfare as social security.

A ‘wage’ (or pay) is the remuneration paid, for the service of labour in production, periodically to an employee/worker. “Wages” usually refer to the hourly rate or daily rate paid to such groups as production and maintenance employees (“blue-collar workers”).

Indian Labour Organisation (ILO) defined the term wage as “the remuneration paid by the employer for the service of hourly, daily, weekly and fortnightly employees”.

‘Salary’ normally refers to the weekly or monthly rates paid to clerical, administrative and professional employees (“white-collar workers”).

Earnings are the total amount of remuneration received by an employee during a given period. This includes salary, dearness allowance, house rent allowance, city compensation allowance, other allowance, overtime payments, etc.

Nominal Wage- It is the wage paid or received in monetary terms. It is also known as money wage.

ADVERTISEMENTS:

Real Wage- It is the amount of wage arrived after discounting nominal wage by the living cost. It represents the purchasing power of money wage.

Take Home Salary- It is the amount of salary left to the employee after making authorized deductions like contribution to the provident fund, life insurance premium, income tax and other charges.

Cost to the Company (CTC)- The concept ‘cost to the company’ includes payment made to the employee including pensions, health insurance, death in service, gratuity, company car or own the car scheme, child care provisions, subsidized meals, etc. The CTC includes all the investments made by the employer to the employee including the monetary and non-monetary benefits.

The ‘wage levels’ represent the money an average worker makes in a geographic area or in his organisation.

Wage Rate- It is the amount of remuneration to a unit of time excluding incentives, overtime pay, etc.

The term ‘Wage Structure’ is used to describe wage/salary relationships within a particular grouping. The grouping can be according to occupation, or organisation, such as wage structure of craftsman (carpenters, mechanics, bricklayers, etc.)

ADVERTISEMENTS:

The Wage Structure or ‘Grade’ is comprised of jobs of approximately equal difficulty or importance as determined by job evaluation.

Job- A “job is a group of positions that are similar as to the kind and level of work”. In some instances, only one position may be involved, simply because no other position exists. For example, in a small organisation, there will be only one position of personnel manager. But in large organization, there may be ten employees with the same title, yet each may perform slightly different work.

Job Analysis- The US, department of labour defined job analysis as “the process of determining (by observation and study) and reporting pertinent information relating to the nature of a specific job. It is the determination of the task which comprises of the jobs and of the skills, knowledge, abilities and responsibilities required of the worker for a successful performance and which differentiate one job from all others”. Job analysis include job description and job specification.

Job Description- “Job description is an organized, factual statement of the duties and responsibilities of a specific job.” In brief, it should tell what is to be done, how it is done and why? It is a standard of function, in that it defines the appropriate and authorized content of a job.

Job Specification- A job specification is “a statement of minimum acceptable human qualities necessary to perform a job properly.” It is a standard or personnel and designates the qualities required for acceptable performance.

Job Classification- A job classification is “a grouping of jobs on some specified basis such as the kind of work or pay”. For example, a teacher, a doctor, an engineer, etc.

ADVERTISEMENTS:

Wage and salary structure consists of the various salary grades and their different levels of single jobs or groups of jobs. The term wage structure is used to describe wage/salary relationships within a particular grouping.

The grouping can be according to occupation, or organization, such as wage structure of craftsman (carpenters, mechanics, bricklayers, etc.). The wage structure or grade is comprised of jobs of approximately equal difficulty or importance as determined by job evaluation.

So, the term wage and salary structure means the pattern or the breakup of the salary paid to the employees in their respective organization.

Actually, wage structure represents wage relationships of all kinds. Analysis of wage differentials of any kind (geographic, industry, community, or occupation) deals with wage structure issues. But because our primary focus is on pay decisions in organizations, our concern is with pay differences between jobs.

Decisions on wage relationships among jobs within an organization are largely within the control of the organization’s decision makers. Wage level decisions are usually influenced more by forces external to the organization that are wage structure decisions.

One way of looking at this is that the wage level decision is primary in attracting employees to the organization. Wage structure decisions, then, are intended to achieve retention of employees through prevention of dissatisfaction and encouragement of employee cooperation. Then the wage system decision is designed to provide employee motivation and performance.

Wage and Salary Administration – Nature and Characteristics

Nature:

1. The basic purpose of wage and salary administration is to establish and maintain an equitable wage and salary structure.

ADVERTISEMENTS:

2. It is concerned with the establishment and maintenance of equitable labour cost structure i.e. an optimal balancing of conflicting personnel interest so that the satisfaction of the employees and employers is maximised and conflicts are minimised.

3. The wage and salary administration is concerned with the financial aspects of needs, motivation and rewards.

4. Employees should be paid according to the requirements of their jobs i.e. highly skilled jobs are paid more compensation than low skilled jobs.

5. To minimise the chances of favouritism.

6. To establish the job sequences and lines of production wherever they are applicable.

7. To increase the employees’ morale and motivation because a wage programme can be explained and is based upon facts.

Characteristics:

1. Payment of wages is in accordance with the terms of contract between the employer and the worker.

2. The wages are determined on the basis of time-rate system or piece-rate system.

3. Wages change with the change in the time spent by the labourer.

4. Wages create utility.

5. Wages may be paid weekly, fortnightly, hourly, or on monthly basis.

6. Wage is the reward paid to the workers for the services rendered by them.

7. Wages can be paid in cash or in kind.

8. All kinds of allowances are included in wages.

Wage and Salary Administration – 10 Important Objectives

Its objectives are:

i. To compare or draft company HR policy

ii. Find out the income level and return ratio of similar industries

iii. To understand wage differentiations

iv. To examine the competitiveness of entry level employees

v. To establish hiring rates favorable to the community

vi. To keep abreast wage and salary rates with production cost

vii. To minimize labour turnover due to pay disparity

viii. To increase employee’s satisfaction and morale

ix. To learn about the trend of perks and benefits in the market

x. To resolve existing labour problems concerning compensation.

Wage and Salary Administration – 9 Important Aspects

Good wage administration should have the following aspects:

i) Wage policies need to be properly made keeping in mind –

a) Interest of management,

b) Interest of employees,

c) Interest of consumers, and

d) Community

ii) Difference of pay based on job requirements like skill, effort, responsibility, working conditions and mental and physical requirements.

iii) Wages and salaries should have parity existing in the labour market.

iv) The payment plan should distinguish between jobs and employees.

v) Wage policies should have clarify, and it should be in written form so as to enable uniformity and stability.

vi) Wage decisions need to be carried out only against organisation’s well formulated policies.

vii) Management should ensure that employees are fully aware of the existing wage policies.

viii) Proper evaluation of wage policies to be carried out as and when it is required and also to be checked. They need to be adequately amended and updated at regular intervals.

ix) Performance rating and job description should be periodically checked and updated for ready reference.

It is a common experience, supported by Behavioural Science research that, while pay in itself is not necessarily the strongest motivator, any unjustifiable inequity or an unacceptably low level of reward causes great dissatisfaction. One of the most important functions of human resource management is to provide equitable compensation to employees for their contributions.

The factors affecting the determination of equitable compensation are many, varied and complex, and management has to arrive at some decision concerning the basic wage or salary.

Compensation means different things to different people; it depends on a person’s perspective. From employee’s point of view, compensation may be considered as a return for their efforts or a reward for satisfactory or outstanding work. It may indicate the value the employer attaches to their skills and abilities – the return on their investment in education and training. In the case of most of the employees, their pay matters a lot in determining their socio-economic well-being.

Wage and Salary Administration – 6 Main Principles

Development and administration of sound wages and salary policies are not only important but also complex managerial functions. The complexities stem from the fact that on the one hand, a majority of union management problems and disputes relate to the question of wage payment and on the other, remuneration is often one of the largest components of the cost of production. Thus, it influences the survival and growth of an organisation to the greatest extent.

The influence of remuneration over distribution of income, consumption, savings, employment and prices is also significant. This aspect assumes all the greater importance in an undeveloped economy like India where it becomes necessary to take measures for a progressive reduction of the concentration of income and/or to combat inflationary trends. Thus, the wage policy of an organisation should not become an evil to the economy.

There are several principles of wage and salary plans, policies and practices.

The important among them are:

(i) Wage and salary plans and policies should be sufficiently flexible;

(ii) Job evaluation must be done scientifically;

(iii) Wage and salary administration plans must always be consistent with overall organisational plans and programmes;

(iv) These plans and programmes should be in conformity with the social and economic objectives of the country like attainment of equality in income distribution and controlling inflationary trends;

(v) Both these plans and programmes should be responsive to the changing local and national conditions; and

(vi) These plans should simplify and expedite other administrative processes.

Wage and Salary Administration – Top 10 Elements of Wage and Salary System

Wage and salary system should have relationship with the performance, satisfaction and attainment of goals of an individual.

Henderson identified the following elements of wage and salary system:

(i) Identifying the available salary opportunities, their costs, estimating the worth of its members of these salary opportunities and communicating them to employees.

(ii) Relating salary to needs and goals.

(iii) Developing quality, quantity and time standards relating to work and goals.

(iv) Determining the effort necessary to achieve standards.

(v) Measuring the actual performance.

(vi) Comparing the performance with the salary received.

(vii) Measuring the job satisfaction gained by the employees.

(viii) Evaluating the unsatisfied wants and unreached goals of the employees.

(ix) Finding out the dissatisfaction arising from unfulfilled needs and unattained goals.

(x) Adjusting the salary levels accordingly with a view to enabling the employees to reach unreached goals and fulfill the unfulfilled needs.

Wage and Salary Administration – 5 Steps Involved in Determination of Wage Rate

Determination of wage rate of employees is one of the basic activities of management. Good wage package creates a situation for attraction of outside/external candidates for any organizational job and also for retention of existing dynamic, competent employees in the organization.

So, organization’s survivality, growth and development depend to a great extent on quantum of wages employees receive from the organization. Attractive compensation makes the people contented, happy, loyal, drives them to produce quality goods and service, facilitates to promote healthy industrial relations. Hence, fixing rational, justified and appropriate wage rate for employees is of great need today.

For determining such wage rate organization needs to take steps like:

i. Collecting information from other companies in respect of wages paid by them to their employees (wage survey)

ii. Evaluation of each job (ascertaining worth of each job) of the organization.

iii. Classifying similar jobs into pay grades (establishing pay grades)

iv. Developing wage curve for assigning pay rates to each pay grade.

v. Developing pay-rate level (pay rate ranges) and adjusting pay rates.

Wage and Salary Administration – Steps Involved in Wage and Salary Survey

Wage and salary survey is conducted in varied forms depending upon the purpose, time constraints and scope.

The method, however, follows the following steps:

Decide – What? Why? Where? Who? and When?

First of all, which jobs of which nature are to be compared, what class of workers’ compensation is to be surveyed, which company and area are to be surveyed and the employee’s cadre are to be determined.

This means that at the planning stage, the management has to do a SWOT analysis to determine the appropriate human resources and their job worth in the market to meet the challenges of possible threats and opportunities.

Then decide who and when will conduct the survey and plan the method, sample, time and tools of collecting the data to be planned. However, these decisions may vary according to the class of survey, size of organizations, cost and money involved, and the accuracy desired.

Step # 2. Source and Sample Selection:

Source and the sample size will again depend on the class or the type of survey, and the survey method adopted. If it is a commissioned or packaged survey, we need to decide the institution, agency or the management consultancy to collect the data.

In case of an external or participative survey, we need to decide the names of member industries as a sample. In an internal survey, we need to identify which jobs details are required, and what records or information are required. We can then decide the source and the samples.

Again depending upon the type of survey, the questionnaire, the points for discussions and the format for recording the data should be first determined. Using the predetermined tools and the formats, the required data to be collected is disseminated and recorded.

Step # 4. Analyzing and Interpreting:

Data is then analyzed and interpreted in line with the purpose of the survey such as:

(a) Entry-level job rates,

(b) Position of the company on the market,

(c) Company pay structure in line with competitors, and

(d) Factors to be considered for designing pay structures.

In the booming business opportunity and competitive environment, every organization is striving hard to recruit talent at all levels of employment but they are forced to compete with the market rates also. Wage and salary surveys are, therefore, scrutinized for the above purposes to design their compensation packages to attract employees at all levels.

The observations or findings are then summarized to have comprehensive data to design the appropriate compensation structures.

Wage and Salary Administration – 8 Main Factors Affecting Wage and Salary Levels

The wage policies differ from organization to organization. Marginal units pay the minimum necessary to attract the required number and kind of labour. Often, these units pay only the minimum wage rates required by labour legislation, and recruit marginal labour.

At the other extreme, some units pay well above the going rates in the labour market. They do so to attract and retain the highest caliber of the force. Some managers believe in the economy of higher wages. They feel that, by paying high wages, they would attract better workers who will produce more than the average worker in the industry.

This greater production per employee means greater output per man-hour. Hence, labour costs may turn out to be lower than those existing in firms using marginal labour. Some units pay high wages because of a combination of favourable product market demand, higher ability to pay and the bargaining power of a trade union.

But a large number of them seek to be competitive in their wage program and aims at paying somewhere near the going rate in the labour market for the various classes of labour they employ.

Most units give greater weight to two wage criteria, viz., job requirements and the prevailing rates of wages in the labour market. Other factors, such as changes in the cost of living, the supply and demand of labour, and the ability to pay are accorded a secondary importance.

A sound wage policy is to adopt a job evaluation programme in order to establish fair differentials in wages based upon differences in job contents.

The main factors influencing wage or salary levels are:

1. Job Needs – Different types of jobs require different levels of both physical and mental skills. Some require high skills so pay is high on the other hand simple, routine jobs where skill requirement is low are paid low.

2. Ability to pay – Ability to pay depends upon the profit earning capacity of the organization MNCs pay relatively higher salaries due to their higher paying capacity.

3. Cost of living – Due to inflation, the real wages decline affecting the purchasing power of workers. Therefore, dearness allowance is given according to change in consumer price index.

4. Prevailing wage rates – Prevailing wage rates in competing firms with in an industry are taken into account while fixing wages & company that does not pay comparable wages may find it difficult to attract and retain talent.

5. Union – Highly unionized sectors generally have higher wages because well-organised unions can exert pressure on management and obtain all sorts of benefits and concession to workers.

6. Productivity – In many organizations, pay is linked to productivity or performance of workers.

7. Demand and supply of labour – The demand for and the supply of certain skills determine prevailing wage rates. E.g. – High demand for IT Professionals ensure higher pay for them.

8. State Regulations – Wage policy and laws of the government exercise a significant influence on wage levels. Government has enacted laws to protect the interests of the working class. No organization can violate laws relating to minimum wages, payment of bonus, dearness allowance and other allowance etc.

Wage and Salary Administration – 6 Important Factors Considered to Form a Sound Wage Policy

The price to be paid as wage or salary for the utilisation of services of an individual-worker or executive – is affected by a number of factors as follows:

1. Demand and Supply:

Demand for and supply of labour and its availability will have great influence on the determination of wage rates. If there is a shortage of labour, the wages demanded will be high. If, on the other hand, labour is plentiful, workers will be too willing to work at low rates of wages. But in recent years both management and labour has been becoming less and less dependent on this “law” as a basic factor.

Payment of high wages at times when labour is scarce leads to difficulties in meeting cost standards, and reduction in wages is almost impossible. The payment of low wages when labour is abundant often causes resentment in the long run and so saving in wages is outweighed by a sense of dissatisfaction and low productivity.

2. “Giving Wages”:

The giving wage is usually the ruling wage, in any locality, but some companies pay higher rates in order to foster the continued goodwill of workers in the community.

3. Cost of Living:

The cost of living or more precisely changes in the cost of living which affect the purchasing power of the wage have been used with profit by many companies. Where, however, the employers are short sighted and ignore the changes in the cost of living, trade unions come out with a demand for a wage rate which takes into account the current cost of living index.

4. Union-Management Negotiations:

A well-organised labour which is directed by strong leadership is usually in a position to secure higher wage levels through union management negotiations. Collective bargaining can be a useful method if pursued rationally by both the managements and unions. It can give the enterprise a predictable wage burden, and the workers the predictable income.

5. State of Competition:

The wage level is also affected by the degree of competition in the market for the products of an industry. In a state of perfect competition (which is hardly ever present), the level of wages may be at par with the value of the net addition made by the workers to the total output. If there is imperfect competition in the product market, the wages are not likely to reach this level.

6. State Regulation:

Often it was found that the bargaining power of the workers was not strong enough to ensure fair wages. Consequently, the State found it necessary to step in. To ensure the payment of a minimum wage in certain specified industries and occupation the Minimum Wages Act was passed in 1948. Payment of bonus was made compulsory under the Payment of Bonus Act, 1965, and fringe benefits given under the Employees State Insurance Act, 1948, and Provident Fund Act, 1952 and so on.

Other Factors:

In addition to above factors, there are some others which influence actual wage levels in an organisation. These may be the firm’s ability to pay, the level of national income and its distribution, the place of industry in the national economy, e.g., in a strategic industry wage level could be quite high.

Wage and Salary Administration – Types of Wage and Salary Surveys: Commissioned/Packaged Survey, External or Participative Survey and Internal Survey

Wage surveys are conducted in different ways depending upon the company’s objectives or purpose, the size of the company and the time and cost constraints.

The types of survey are mostly of following types:

1. Commissioned or Packaged

2. External or Participative

3. Internal or Mutual.

These can be categorized as:

i. Generally published surveys

ii. Compensation club survey

iii. Customized surveys.

1. Commissioned /Packaged Survey:

These are also termed as generally published surveys as the data are collected from a research body or agency that keeps on conducting such surveys and provides the data on request. However, they charge for it. These data should, however, be scrutinized as they may be for the same industry but may not match the size or the numbers of employees and the numbers of jobs necessary for any particular industry.

2. External or Participative Survey:

This is also referred to as a compensation club survey as in this survey member industries share the data with the member who wishes to do the survey through questionnaires or personal meetings or phone calls.

This type of survey is done within the organization and involves dissemination of the internal records or questioning personnel or employees.

In this type of survey, the surveyors extrapolate the existing secondary data of the company to work out wage differentials.

Wage and Salary Administration – Classification of Wages: Living Wages and Minimum Wages

Classification of wages is:

1. Living wages

2. Minimum wages

1. Living Wages:

This has been defined in different ways in different countries. The most suitable definition is given by Justice Higgin, “Living wages should be sufficient to ensure the workman’s food, shelter and clothing; frugal comfort provision, evil days, etc., as the skill of an artisan, if he is one.”

According to the fair wages committee report, the living wages must be a le to make the male earner to provide himself and his family not only basic necessities, viz.- food, clothing and shelter but also education for the children and protection against ill-health and essential social needs. The living wages means provision for the bare necessities with certain amenities considered necessary for the well-being of a worker in terms of his social status.

This provision has the reference to Article 43 of Indian Constitution.

2. Minimum Wages:

This is the lowest wage. With this wage a worker and his family can just pull on the life; in other words, it can provide a minimum level of subsistence. This includes food, shelter and clothing. Minimum Wage in a country is fixed by the Government in consultation with business organisations and Trade Unions. When minimum wages are fixed, it is the duty of the government that employers are not exploiting the work force.

The law for minimum wages is fixed from time to time by Administrative Commission of the Government with variation in the wage rates. The very purpose of fixation of wages from time to time has become necessary due to variation in the price level as a sequel to varying economic conditions.

Government of India passed the Minimum Wage Act in 1948. According to the Act, wage should include such factors as local economic conditions, transportation cost and the size of units in the industry in fixing Minimum Wages.

Minimum wage act is supposed to have the following benefits:

i. This law prevents exploitation of employees, undue advantage of employing individuals who possess very little bargaining power.

ii. The law abolishes the competition in lower strata of workers with the upper grades and tend to prevent depressing the wages.

iii. The productivity of industry is increased by foreign employees to use the most efficient production methods and ultramodern equipment in order to enable employees earn their living /wages and at the same time the worker is stimulated to increase his efficiency so as to help him hold his position.

Wage and Salary Administration – Structure of Wage/Salary Structure in India

In simple language, a salary and wage structure is a series of wage rates/grades that obtain in an organization for compensating labor. According to Prof. Dunlop, a wage structure ‘is the complex of rates within firms differentiated by occupation and employees and the complex of inter-firm rate structure’.

A wage structure of a plant or an office or more broadly, of a national economy, can be viewed as a series of wage rates designed to compensate workers for varying skills and abilities required in the production process. The most significant aspect of a wage structure is not only the number of workers or staff at each rate in the scale of pay, but also the relative importance of each rate.

Each rate/grade is designed to pay the workers/staff for his/her skilled performance on the respective job. The rate is for the given job/designation-wise. In PSUs, there is a well-defined wage structure for artisans, supervisors and managers. The wage structure is designed and reviewed every five years or so, as per the terms of the wage agreement/contract in vogue/decided through the process of collective bargaining.

Progressive employers like the Tatas, the Aditya Birla Group, Wipro and others have well designed wage structure as per their wage policy.

In the Indian context, a wage/salary structure may be divided into four components:

(a) Basic wage,

(b) Dearness allowance,

(c) Allowances, and

(d) Fringe benefits.

(a) Basic Wage:

A basic wage is the base rate in the respective grade/scale of the wage structure developed as a result of the agreement reached after the collective bargaining process, or on the basis of the recommendations made by the Fair Wages Committee, 1948 as also the 15th Indian Labour Conference, 1957 and the various rulings of tribunals and courts in the post-independence period.

The basic wage is fixed reviewed and bargained in the wage negotiation or awards, Wage Boards or Pay Commissions. In the industry, especially in large manufacturing organizations there are normally eight to ten wage grades applicable to workers/artisans and supervisors, with each grade having its base rate. Likewise, there are Executive grades/scales of pay ranging between E 1 to E 8, each scale applicable to given designations or hierarchy of executives. In fact, each organization has its own scale of pay.

In PSUs usually, there are systematically defined grades and scales of pay, ranging between E 1 to E 8 for executives and similarly some eight or nine grades for artisans, etc. In non-executive scale, the first scale is applicable to the lowest level of wage earner, e.g., attendant, peon or an auxiliary worker/helper (unskilled categories). In executive grades, E 1 refers to an Executive entrance grade and E 8 refers to General Manager’s grade.

Each scale has a different basic rate, so the question is, what is the basis of the differential in the wage structure?

To summarize, the following factors are taken into consideration in working out the wage differential:

i. Level of skill required on the job

ii. Level of training required on the job

iii. Physical and mental effort needed

iv. Level of experience needed on the job

v. Fatigue arising out of stress/strain on the job

vi. Level of responsibility the job demands.

Likewise, there are different wage grades of pay for workers/artisans operating at different levels, as say unskilled, or semi-skilled or skilled or highly skilled categories. As of now, in PSUs, there are around ten grades. Workers/artisans are placed in the respective grades as per the job specification/their merits.

(b) Dearness Allowance:

Dearness allowance (DA) is a part of the negotiated wage/pay agreement in an organization. The objective for paying dearness allowance is to neutralize the rise in prices of essential commodities. Dearness allowance is linked to the All-India Consumer Price/index AICPI. Every point rise or fall in the index is linked to money value. And, so the dearness allowance varies according to the index.

During the course of wage negotiations, following the process of collective bargaining, the management on behalf of the employer, and the union on behalf of the workers agree to merge a part of the existing DA to the basic rate, thus upgrading the wage scales/grades level which provides for incremental retirement and other benefits related to the rate/basic pay, e.g., entitlement for company housing, travel, PF contribution, etc.

DA reduces the impact of inflation in the economy on the wage earner. As per the formula, the cost of living index takes the given year as a base year, which relates to the ongoing fluctuations in prices, in terms of essentials to a series of numbers and index. The numbers are translated to monetary wage terms to by the HR experts. DA is, thus, paid to neutralize the rise in prices.

(c) Allowances:

Allowances are another form of compensation to a wage earner, which are negotiated as a part of wage revision in the collective bargaining process.

Today there are a large number of allowances paid in the variety of organizations:

i. Car allowance/conveyance reimbursement

ii. City compensatory allowance

iii. Transport allowance/subsidy for outstation workers

iv. Deputation allowance for staff on deputation

v. Education, servant, mail and cook allowance

vi. Cash allowance for staff of accounts dept. on cash disbursement

vii. Book allowance

viii. Milk allowance

ix. Hazard allowance for working in a hazardous workplace

x. Acting allowance to executives

xi. Family allowance to non-family stations

xii. Site working allowance.

(d) Fringe Benefits:

A fringe benefit is an indirect benefit and constitutes a major part of the wage and the benefit is not merely fringe or peripheral. Some define fringe benefits as a wage cost, not directly linked to employees’ productive efforts, sacrifice, service /performance. Fringe benefits no doubt, are non-wage benefits offered to staff/employees in an organization.

These benefits are effective methods of attracting and retaining talent in the company. This is a supplementary compensation to employees. It boosts the real earnings and provides extra spending money to employees. It is also termed as an economic security to the workers/staff.

Fringe benefits also known as perks or perquisites include:

i. Providing status to an executive by giving entitlement to use company’s car with/without chauffeur, allowing entertainment facilities, holidays, foreign travel, telephone facility at home, mobile phone, etc.,

ii. Providing security through insurance coverage and the employee medical facilities for himself, family and his dependants, children’s education facilities/subsidies; and work benefits like air conditioner in office and residence, secretarial services, training for development in India/abroad, company scholarship for higher education, and

iii. Key benefits are provided which includes share scheme, profit sharing, retirement counseling and loan for housing at nominal rates of interest.

The extent of benefits under (a), (b) and (c), provided to the employees, depend upon the company’s ability to spend on fringe benefits. Attendance bonus, service bonus are the other fringe benefits. Most of these benefits are non-statutory but in the case of statutory benefits, the same have to be provided by the employer.

Such benefits are under the Employees’ Provident Fund Act for all employees and ESI are good examples. Profit sharing bonus is another statutory benefit in vogue, and the Gratuity payment scheme under the Gratuity Payment Act are all statutory benefits for the employees. Fringe benefits are also bargainable in the collective bargaining process.

Wage and Salary Administration – 5 Important Systems for Fixing Salary

Salary is structured, fixed, adjusted on the basis of several systems.

The important among them are:

(1) Wage Theories;

(2) Job Evaluation;

(3) Wage/Salary Survey;

(4) Various Factors Affecting Wage and Salary Levels.

(5) Wage Fixation Institutions in India

System # 1. Wage Theories:

There are a number of theories on wages.

Important among them are discussed hereunder:

(i) The Just Wage Theory – This was the first theory on wages advocated during medieval period. The essence of this theory is that the worker should be paid on the level of maintaining himself and his family.

(ii) Subsistence Theory – According to Ricardo “the labourers are paid to enable them to subsist and perpetuate the race without increase or diminution.”

(iii) Standard of Living Theory – Karl Marx pointed out that the “Wage of labour is determined by a traditional standard of living, which, in turn, is determined by the mode of production of the country concerned.”

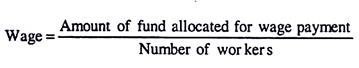

(iv) The Wage Fund Theory – According to J.S. Mill, the wages are determined on the basis of the relationship between the amount of fund allocated for the purpose of wage payment and number of workers in a country.

(v) Residual Claimant Theory – According to Walker, the wages are determined on the basis of the amount left after the payment of rent, profits and interest to land, entrepreneur and capital respectively out of the production value.

The amount of wages = Production value – (Rent + Profits + Interest).

(vi) Marginal Productivity Theory – According to J.B. Clark, the wages are determined on the basis of marginal contributions of the worker to the production. The employer stops employing further workers where the contributions of the most recently employed worker are equal to his wages.

(vii) The Bargaining Theory of Wages – According to this theory the wages and other terms of employment are determined on the basis of the relative bargaining strength of the two parties, viz., the employer and the employees. Webbs stated that, “the conditions of the market which under a system of free competition and individual bargaining determines the conditions of employment.”

(viii) Contribution of Behavioural Scientists to the Wage Theories – According to behavioural scientists, wages are determined on the basis of several factors like the size, nature, prestige of the organisation, strength of the union, social norms, traditions, customs, prestige of certain jobs in terms of authority, responsibility and status, level of job satisfaction, morale, desired lines of employee behaviour and level of performance.

Thus, the first five wage theories influenced the wage determination until 19th century. But the influence of these theories had been reduced to a greater extent during the 20th century. The bargaining theory of wages and the behaviour theory of wages influence much the determination during the present century. The modern and important system of salary administration is job evaluation.

System # 2. Job Evaluation:

Job evaluation determines the relative worth or money value of jobs. It may be defined as a process of determining the relative worth of jobs, ranking and grading them by comparing the duties, responsibilities, requirements like skill, knowledge of a job with other jobs, with a view to fixing compensation payable to concerned job holder.

Jobs can be evaluated on the basis of various methods/techniques. Thus, job evaluation is a part of pay fixation machinery along with other concepts like wage theories, seniority, performance, career progression, wage survey and other factors influencing wage determination.

System # 3. Wage/Salary Survey:

Survey is an investigation of current position. Salary survey is one of the techniques useful in salary administration. The purpose of this survey is to collect competitive salary data regarding various jobs in the labour market and provide the same for salary administration.

A salary survey enables an organisation to find out what other organisations pay for specific jobs and the basis for payment of the existing salary level. The going rate or the market rate in that particular region influences die wage rate of the organisation. Mostly, the organisations are forced to pay the wage equivalent to the going rate.

Factors Affecting Wage/Salary Levels – 6 Factors

Generally, a large number of factors influence the salary levels in an organisation. Significant among them are- (i) Remuneration in Comparable Industries; (ii) Firm’s Ability to Pay; (iii) Cost of Living; (iv) Productivity; (v) Union Pressure and Strategies; and (vi) Government Legislations.

(i) Remuneration in Comparable Industries:

Prevailing rates of remuneration in comparable industries constituted an important factor in determining salary levels. The organisation, in the long-run, must pay at least equal to the going rate for similar jobs in similar organisations. Further, the salary rates for the similar jobs in the firms located in the same geographical region also influence the wage rate in the organisation.

The organisation has to pay the wages equal to that paid for similar jobs in comparable industries in order to secure and retain the competent employees, to follow the directive of courts of law, to meet the trade union’s demands, to satisfy the employee need for the same social status as that of the same categories of employees in comparable organisations.

Comparable industries constitute the organisations engaged in the same or similar activities, of the same size, in the similar type of management, i.e., public sector or under the management of the same owners, organisations located in the same geographical region etc.

(ii) Firm’s Ability to Pay:

One of the principal considerations that weighs with the management in fixing the salary levels is its ability to pay. But in the short-run, the influence of ability to pay may be practically nil. However, in the long-run, it is quite an influential factor. In examining the paying capacity of an organisation, apart from profitability, various expenses that the industry has to bear, certain trends in prices of products/services that are to be charged by the industry should also be taken into account.

In addition, total cost of employees (salaries, allowances, cost of fringe benefits etc.) should be taken into consideration in determining the ability to pay. Trade Unions demand higher wages when the company’s financial position is sound. But they may not accept wage reduction, when the company is financial position is in doldrums.

Hence, the management has to take decision judiciously. Further, certain incentives are linked to the profitability. Thus, whatever the influence of other factors may be, the organisation cannot pay more than its ability to pay in the long-run.

(iii) Cost of Living:

The cost of living is another important factor that influences the quantum of salary. The employees expect that their purchasing power be maintained atleast at the same level, if not increased by adjusting wages to changes in cost of living. In fact, in recent years, in advanced countries, “a number of labour agreements have ‘escalator’ clauses, providing for automatic wage and salary increase as cost of living index rises.”18 Dearness allowance is an allowance granted to the employees with a view to combating onslaughts of soaring prices.

(iv) Productivity:

An interesting development in wage determination has been productivity standard. This is based on the fact that productivity increase is also the result of employee satisfaction and contribution to the organisation. But wage productivity linkage does not appear to be so easy since many problems crop up in respect of the concept and measurement of productivity.

But, although the wages are not linked directly to the productivity, in an organisation, changes in productivity have their impact on remuneration. This criterion received consideration of wage boards, “not only because it constituted a factor in the fixation of ‘fair wage’ but also because it was directly related to such questions as desirability of extending the system of payment by result.”

(v) Union Pressure and Strategies:

The wages are also often influenced by the strength of unions, their bargaining capacity and their strategies. Arthur M. Ross, concluded that “real hourly earnings have advanced more sharply in highly organised industries than in less unionized industries.” Unions pressurise management through their collective bargaining strategies, political tactics and by organising strikes etc.

Trade unions influence may be on the grounds of wages in comparable industries, firm’s financial position, rising living cost, government regulations, etc. It may be noted here that the unions may have the wage raised particularly in those industries where the wage level is below that of other comparable industries.”

(vi) Government Legislations:

Government legislations influence wage determination. The two important legislations which affect wage fixation are- The Payment of Wages Act, 1936 and The Minimum Wages Act, 1948. The important provisions of The Payment of Wages Act, 1936 are- ensuring proper payment of wages and avoiding all malpractices like non-payment, under payment, delayed and irregular payment, and payment in kind and under-measurement of work.

The Act covers all employees drawing the wage up to Rs 1,000 per month. The Act stipulates that the organisations with less than hundred workers should pay the wage by the seventh and the organisations with more than 100 employees should pay by the tenth of next month.

The Act also stipulates time for payment of dues to the discharged employees. Under the Act, fines can be levied but after due notice to the employees and the fine deductions are restricted to 1/32nd of the wage.

The important provisions of The Minimum Wages Act, 1948 are-The Act seeks to protect the workers from underpayment of wages for their efforts. It presented the guidelines for the fixation of minimum wages which is just sufficient to meet the basic needs of workers and to keep a man’s ‘body and soul’ together.

Statutory minimum wage is determined according to the procedure prescribed by the relevant provisions of the Act. The Act provides for fixing of- (i) Minimum wage in certain employments; (ii) Minimum time rate; (iii) Minimum piece rate; (iv) Guaranteed time rate; (v) Overtime rate; and (vi) Basic pay and D.A. The Act also provides for revisions of minimum wage at fixed intervals.

Wage Fixation Institutions in India – Collective Bargaining and Adjudication, Wage Boards and Pay Commissions

Wages are fixed by the following institutions in India. They are- (i) Collective Bargaining and Adjudication; (ii) Wage Boards; and (iii) Pay Commissions.

(i) Collective Bargaining and Adjudication:

Collective bargaining is a procedure in which compromise is reached through balancing of opposed strengths. It is a means through which employee problems relating to various issues including wages are settled. If these problems are not settled through collective bargaining, they may be settled through voluntary arbitration or adjudication. The awards given or reached by or through the arbitrator or adjudicator or collective bargaining agreements from the basis for fixing wages in various organisations.

(ii) Wage Boards:

This is one the important institutions set-up by the Government of India for fixation and revision of wages. Separate wage boards are set-up for separate industries. Government of India started instituting Wage Boards in accordance with the recommendations of Second Five Year Plan, which were reiterated by the Third Five Year Plan. Wage Boards are not governed by any legislation but are appointed on ad-hoc basis by the Government.

Each Wage Board consists of one neutral Chairman, two independent members and two or three representatives of workers and management each. The Wage Boards have to study various factors before making its recommendations. The recommendations of the Wage Board are first referred to the Government for its acceptance. The Government may accept with or without modification or reject the recommendations of the Wage Board. The recommendations accepted by the Government are enforceable by the parties concerned.

The Wage Boards take the following factors into consideration for fixing or revising the wages in various industries:

(a) Job evaluation.

(b) Wage rates for similar jobs in comparable industries.

(c) Employees’ productivity.

(d) Firm’s ability to pay.

(e) Various wage legislations.

(f) Existing level of wage differentials and their desirability.

(g) Government’s objectives regarding social justice, social equality, economic justice and economic quality.

(h) Place of industry in the economy and society of the country and the region.

(i) Need for incentives, improvement in productivity etc.

The Wage Boards fix and revise various components of wages like basic pay, dearness allowance, incentive earnings, overtime pay, house rent allowance and all other allowances.

(iii) Pay Commissions:

This is another institution which fixes and revises the wages and allowances to the employees working in government and government departments. Pay Commissions are separately constituted by Central and State Governments. Central Government so far has appointed four Pay Commissions.

Wage and Salary Administration – How to Control Wage and Salary Administration

Wage and salary administration should be controlled by some proper agency. This responsibility may be entrusted to the personnel department or to some job executive. Since the problem of wages and salary is very delicate and complicated, it is usually entrusted to a Committee composed of high-ranking executives representing major fine organisations.

The major functions of such Committee are:

(i) Approval and/or recommendation to management on job evaluation methods and findings;

(ii) Review and recommendation of basic wage and salary structure;

(iii) Help in the formulation of wage policies; from time to time;

(iv) Coordination and review of relative departmental rates to ensure conformity; and

(v) Review of budget estimates for wage and salary adjustments and increases.

This Committee should be supported by the advice of the technical staff. Such staff committees may be for job evaluation, job description, merit rating, wage and salary surveys in an industry, and for a review of present wage rates, procedure and policies.

Alternatively, the over-all plan is first prepared by the Personnel Manager in consultation and discussions with senior members of other departments. It is then submitted for final approval of the top executive. Once he has given his approval, for the wage and salary structure and the rules for administration, its implementation becomes a joint effort of all heads of the departments.

The actual appraisal of the performance of subordinates is carried out by the various managers, who in turn submit their recommendations to higher authority and the latter, in turn, to the personnel department.

The personnel department ordinarily reviews recommendations to ensure compliance with established rules of administration. In unusual cases of serious disagreement, the president makes the final decision.

Wage and Salary Administration – Problems

Wage and salary administration involves consideration of various interests such as those of employers, employees, government and society at large. The employer is interested in securing a satisfactory level of output in tune with the remuneration paid to his employees, establishing standard wages for standard occupations, adjusting wages to changes in the market, maintaining equity in wage relativities, rewarding efficient employees through incentives or performance-based remuneration and providing effective arrangements for dealing with compensation issues.

A sound compensation policy may also contribute to achieving certain social objectives by ensuring more equitable compensation, reduction of wage exploitation and satisfying employees’ ambitions. The interests of the employer may not be in conformity with those of the employees and their union. Difficulties may also have to be encountered in ensuring compliance with governmental policy in the field.

In balancing the many conflicting considerations, organisational goals may appear controlling, but over any significant period they probably cannot be allowed to conflict with socially prescribed objectives. These problems of establishing a balance between employer’s interests and those of others are manifested in various areas of compensation; the more notable of these are described below.

An important field of compensation is the wage and salary level. Problems in this area are directly related to the conditions of labour market. If the level of wages and salaries is too low, there will be the problem of attracting and maintaining a competent workforce.

There may also be difficulties in complying with statutory rates of wages or those awarded by tribunals and courts, and also the rates arrived at as a result of bargaining. On the contrary, if the level of wages and salaries is too high, the competitive position of the undertaking in the product market will deteriorate.

The setting of an appropriate level of wages and salaries calls for a careful consideration of several factors such as – (i) market conditions, (ii) governmental policy and regulation, (iii) prevailing level of wages in comparable employments, (iv) collective bargaining and union wage policy and (v) management’s approach towards proper wage and salary level.

Wages and salaries paid to employees on different jobs within an organisation constitute an important field of compensation. Many organisations work out the wage structure on the basis of “job evaluation.” The main concern of the management is to prevent wage inequities and correct anomalies wherever necessary.

During more recent years, especially after the advent of globalisation and emergence of highly competitive product markets, managements have to give serious attention to remunerating different categories of employees on the basis of their performance and productivity. Setting of wage and salary structure by the management also involves the problem of strategic decisions regarding various components of wages.

In many organisations, the wage structure is based on collective agreements, industrial awards, court decisions or wage board recommendations. In these cases, the freedom of management to work out the wage structure for its organisation is severely curtailed.

3. Wage Fixation for Individual Employees:

The setting of wage structure and determination of the level of wages involve pricing of various jobs. Very often, problem arises as to whether all the employees employed on the same job should be paid the same wage. Payment of the same wages to all employees employed on the same job may lead to dissatisfaction among efficient and senior employees. The problem is generally sought to be solved in two ways.

The first is the adoption of incentive system or performance-based remuneration. Another method is that of setting up wage ranges—a starting rate, a standard rate and a maximum rate for individuals on the same job. In such a case, procedures have to be devised for enabling individuals to move through the ranges.

One such procedure may be automatic increases based on length of service. Another may be to allow increases on the basis of merit rating or performance appraisal. The third may be a combination of both.

Generally, there are two principal methods of wage payment. These are as follows – (i) payment on the basis of time such as by hour, day, week or month (time rate), and (ii) payment on the basis of output that is by piece produced (piece rate). In a particular organisation, either or both may be used depending on the arrangement of work and consent of the parties. Where incentive schemes are in operation, there is a problem of selecting the most suitable of these or a system combining both may be adopted.

5. Compensation for Executives and Managerial Personnel:

The problem of remuneration of executives and managerial and professional personnel is not generally tackled in a planned and systematic manner. This has been in contrast to more or less careful attention to the pay problems of workers. Efforts have been made to design pay plans for them in such a way so as to offset the effects of progressive income tax. One way for satisfying this group has been providing them with substantial fringe benefits not coming under the purview of income tax law.

However, in India, recent amendments to income tax law have brought a number of fringe benefits under the coverage of taxation. As a result, the advantages available to this class of personnel through the availability of fringe benefits have materially declined. Despite these limitations, lucrative schemes of performance-based remuneration and rewards for these categories of personnel have been adopted in most of the competing industrial organisations.

To the management, control constitutes the central problem in wage and salary administration. Control in wage and salary administration involves the evaluation of the sufficiency and efficiency of the solutions reached on the total compensation problem. The management has to control both payroll and labour cost, and also has to realise that the value in return of wage bill is more important than the wage bill itself.

More specifically, control in wage and salary administration involves evaluation of achievements in many areas including the following:

(i) Whether the total wage bill constitutes a specified proportion of sales;

(ii) Whether the pay for jobs is within the ranges set up for them;

(iii) Whether efficient employees on the payroll are being maintained;

(iv) Whether the general level of wages is in tune with the conditions of labour market;

(v) Whether individual wages and salaries are worked out on a consistent basis.

Control also demands creation of standards for comparing the efficacy of the practices in every phase of wage and salary administration, including wage bill, forecast, basic rates, rate-ranges and wage and salary data in the community and the industry.