Beginner’s Guide to Wages! This article will help you to understand the following things:

1. Meaning and Definition of Wages 2. Characteristics or Peculiar Features of Labour 3. Definition of Wages 4. Kinds or Characteristics of Wages 5. Factors Determining Real Wages 6. Causes of Difference in Wage Rates 7. Causes of Low Wages to Women and other details.

Meaning and Definition of Wages:

Wages are the remuneration paid to labour for its productive services whether mental or physical.

Since the term labour refers to all kinds of workers (unskilled, skilled or blue collar and white collar workers, as well as independent workers like teachers, medical practitioners, etc.) the term wage also has a broad connotation.

ADVERTISEMENTS:

It includes pay, salary, emoluments, fee, commission, bonus etc.—all kinds of income earned by labour, as a factor of production. In fact, wages may be regarded as the price per unit of time for the productive efforts of labour.

Therefore, ‘Labour’ is a prime and active factor of production. As a factor of production labour possesses some peculiar features which affect the wage rate in the market. It will therefore be useful to know about these features before studying the theory of wage determination.

Characteristics or Peculiar Features of Labour:

The important features or characteristics of labour are as follows:

1. Labour is a Living Human factor of Production:

As we are aware that labour is a living human factor of production, therefore he must essentially get the reward at least equal to his cost of living. It is on the basis of this reward that the minimum level of wages is determined.

2. Labour cannot be Separated from the Labourer:

ADVERTISEMENTS:

Because of this reason a worker has to make himself physically present at the site of work. And in addition to wages, every worker takes into consideration the environment of the working place, working conditions, climate, season, behaviour, educational, medical and other facilities also before accepting the offer to work.

3. Labour is Perishable:

Storage of labour is not possible. If a labourer sits idle in his house, the working hours gone cannot be restored again. Labour not performed is labour, destroyed. It is because of this reason that a worker prefers to work on a lower wage that to sit idle in the house. It weakens the bargaining power of the labourers.

4. Weak Bargaining Power:

Labour has a weak bargaining power in comparison to entrepreneurs and employers. That is why labourers are exploited and paid low wages.

5. Changes in the Supply of Labour are Slow:

Because supply of labour depends on population and training facilities and changes in both of them are slow. In this situation the wages of labourer are affected mainly by the demands. Wages rise with the increase in demand and fall with the decrease in demand.

6. Differences in the Efficiency of Labour:

ADVERTISEMENTS:

There are differences in the efficiency of labour. Some labour is more efficient than the other. It may be due to training or due to some other reasons. Difference in efficiency creates difference in wages also.

7. Labour is both means of Production and Source of Consumption:

On the one hand labour acts as a means of production to produce various goods and services in the country and on the other, he consumes these goods and services to satisfy his wants. Thus, on the one hand labour is the producer and on the other, consumer. That is why wages have two aspects; One is cost aspect and the other is income or demand aspect. This feature of labour has important bearing on the relationship between wages and employment.

Definition of Wages:

Labour in Economics means all kind of work for which reward is paid. Any type of reward for human exertion whether paid by hour, day, month or year and paid in cash, kind or both is called wages.

According to Benham – “A wage may be defined as a sum of money paid under contract by an employer to a worker for services rendered.”

According to Marshall – “Wages are the price paid for the service of labour.”

According to Seligman – “Wages are the remuneration of labour.”

Regarding wages J. B. Clark has said – “Wages is the remuneration paid to the worker for the effects undertaken to him.”

Thus, we can say that wage is the price of productive labour. The marginal productivity theory, indeed, provides a fairly satisfactory explanation of wage determination but its main shortcomings is that it does not consider the supply aspect of labour and concentrates on the demand side.

The modern theory of wages is an extension of this theory in a more logical and rational way. It states that like all other prices the price of labour, i.e., the wage rate, is determined by the interaction of the forces of demand for and the supply of labour in a given market situation.

Kinds or Characteristics of Wages:

Wages from the point of view of payment may be classified as:

(a) Cash Wages or Wages in Kind:

ADVERTISEMENTS:

This type of wage is paid in cash or in kind.

(b) Time Wages:

When the payment of wage rate is fixed per hour, per day or per month is known as time wages or period wages.

(c) Piece Wages:

Piece wages are those wages in which the payment of wages is made on finishing a specified job or on the completion of the work for which the contract has been made.

ADVERTISEMENTS:

In economics different names have been given to wages paid to labourers and they are as follows:

(i) Salaries: Payment made to higher staff in an organisation is called salaries, and

(ii) ‘Pay’ to the lower staff, like: clerks and typists in the office or organisation.

(iii) Wages is the payment to workers.

ADVERTISEMENTS:

(iv) Fees for persons doing independent professions like—lawyers and doctors.

(v) Commission to agents or middle men, brokers etc.

(vi) Allowances are payment given for special works or for special reasons or for particular task.

For example:

Travelling allowance, dearness allowance etc.

(d) Time and Price Wages:

Further, payment of wages are made weekly, fortnightly or monthly and partly at the end of the year in the form of bonus. These are time wages. But the bonus may be a task wage if a work is finished within a specified period or before that.

ADVERTISEMENTS:

Sometimes, time wages are supplemented by wages earned by working extra time. They are over-time wages. Wages are also paid in accordance with the amount of work done, say in a shoe factory or a tailoring department as per one pair of shoes or pants manufactured. If the rate per pair of shoes or per pants is Rs. 50, a worker will be paid according to the number of shoes or pants manufactured. These will be price wages.

(e) Minimum Wages:

Minimum wage is that wage which provides not only for the bare sustenance of life but also for the preservation of the efficiency of the worker. It is the minimum that must be paid to the worker to cover his and his family’s bare necessities including some measure of education, medical and other amenities.

Prof. Morris Dobb defines a minimum wage as “the standard rate which a trade union attempts to establish by collective bargaining“. These days a national minimum wage for all types of employments has been fixed by law.

(f) Fair Wage:

A fair wage is something more than the minimum wage providing mere necessities. While the lower limit of the fair wage must obviously be the minimum wage, the upper limit is set by what may broadly be called the capacity of the industry to pay. Fair wage compares reasonably with the average payment for similar task in other trades or occupations requiring the same degree of ability.

Between these two limits (minimum and maximum) wages should depend on a consideration of the factors like:

(i) The productivity of labour,

ADVERTISEMENTS:

(ii) The prevailing rates of wages in the same or similar occupations in the same region or neighbouring regions,

(iii) Level of national income and its distribution and the place of the industry in the economy of the country.

(g) Living Wage:

Living wage has been defined by Justice Higgins as such—”Living wage is one which is appropriate for the normal needs of the average employee, regarded as human being in a civilized community.” The living wage should enable the male earner to provide for himself and his family not merely the bare essentials of food, clothing and shelter, but also a measure of frugal comfort including education for children, protection against all ill-health, requirements of essential social needs and a measure of insurance against the more important misfortunes including old age.

Thus, we can say that living wage is a wage which provides the workers with a standard of life furnishing him the necessaries of life plus certain amenities considered necessary for the well-being of the worker determined in terms of the position of the worker in a particular society.

(h) Money-Wages or Nominal Wages:

Wages paid and received in terms of money are called cask money wages. It includes monetary payments only. This is also called nominal or money wage.

For example:

ADVERTISEMENTS:

The salary of Rs. 3,000 per month to a teacher, Rs. 50 per day remuneration to a factory worker or Rs. 40 as the stitching charges of a shirt to a tailor—all are examples of money wages. Now-a-days wages are generally paid as money wages almost in all countries of the world.

(i) Real Wages:

Real wages means the purchasing power of money wages in terms of goods and services consumed by the wage-earners plus other facilities provided by the employer, free of cost. Thus, except the goods and services that can be purchased by money wages, all facilities, concessions and advantages received by the labourers are also included in the computation of real wages. For instance, free uniform for policemen, railway workers and many others, free travel to and from work for those engaged in passenger transport undertakings, the use of a car by some business executives, free board and lodging for some hotel workers are all that form the part of real wages.

According to Thomas – “Real wages refer to the net advantages of worker remuneration i.e., the amount of the necessaries comforts and luxuries of life which the workers can command in return for his services.”

Economist Seligman has written – “Real wages are actual commodities that money wages can buy.”

According to Adam Smith – “The real wages of labour may be said to consist in the quantity of the necessaries and conveniences that are given for it, its nominal wage is the quantity of money. The labourer is rich or poor, is well or ill rewarded in proportion to the real not the nominal wages of his labour.”

Explaining ‘Real Wages’ in detail it can be said that the amount of goods and services a given money wage can buy in the market, at any particular time is called real wages. Thus, real wage is the amount of purchasing power received by a worker through his money wage.

ADVERTISEMENTS:

Real wage, as such, depends on two factors:

(i) Amount of money wage, and

(ii) The price level.

Thus, real wage can be measured as under:

R = W/P

where R = Real Wage

W = Money Wage

P = Price Level

From this it will be clear that with a rise in the privet level, money wages remaining constant, real wages decline. Similarly, with general price stability when money wages increase, real wages also rise in the same proportion. And when prices rise greater than rise in money wages, the real wages would decline.

In India, this has been very common in recent years. Thus, there is no direct relation at all the times between money wages and real wages. For this reason, in India the money wage earning labour force and employees are paid extra D.A. by way of compensation because of ever-increasing price-rise.

Further, real wage is determined by the ratio of money wages to cost of living.

Another measure of expressing real wage is:

Real wage= Money Wage /Cost of Living Index

Thus, it is the real wage which determines the standard of living of workers. Adam Smith has said that “the labour is rich or poor, is well or ill rewarded, in proportion to the real, not to the nominal value of his wages.” Here, the cost of living index is measured as consumer’s price-index number.

In a still broader sense, however, real wages apart from purchasing power of money wages, include other real benefits or advantages associated with the job. The true reward of labour in any occupation is measured not by its money income but by its net advantages, viewed in this sense, when a worker has to choose between two jobs, he has to consider not the money wages but the real wages involved therein. Thus, if he finds that real wages are greater in one job though money wages are less as compared to the other, he should choose the former.

Factors Determining Real Wages:

Strictly speaking, real wages are estimated by taking the following factors into consideration:

1. The Purchasing Power of Money:

As we have seen earlier that the real value of money wage is its purchasing power—which has an inverse relationship to the price-level. Thus, a high price-level means a low real wage from a given money wage and vice-versa. At higher prices, people can purchase goods and services which can be purchased at lower price- levels.

2. Additional Facilities and Incidental Gains:

Allowance must be made for the extra benefits such as free boarding and lodging, price concessions in commodities, subsidized canteen, free transport services, pensions etc., while calculating real wages. Such incidental benefits are called “fringe benefits”, which may be considered as powerful determinants of real wages and are added in calculating real wages.

3. Scope for Additional Earnings:

In jobs where there is scope for making extra income, the real wage is high. For instance, tips may be earned by waiters in posh hotels, professors may write books and can earn more than their regular salaries. Similarly, teacher’s private tuitions, office employee’s additional part-time jobs etc. are the other most appropriate illustrations.

4. Working Conditions:

Conditions of work and service also affect real wages. Conditions of service such as the number of hours of work, number of holidays, regularity or irregularity of employment, the agreeableness or disagreeableness of the environment, etc. also affect the determination of real wages.

Suppose, for instance, firm A pays Rs. 4,000 monthly salary but gives two days off per weak and firm B also pays Rs. 4,000 monthly salary but has only one day off, then the real wage of the former is high. Similarly, though a college lecturer gets Rs. 8,000 as his pay as compared to a junior officer in a bank who gets Rs. 9,000 per month, the real wage of the lecturer is higher than that of the latter because he gets nearly three months as vacation during a year.

5. Possibility of Promotion or Success:

Real Wages would be high in the case of jobs where there is possibility of quick promotions and vertical mobility, so that along with prestige, higher income can be earned in the future.

6. Social Prestige:

There are some jobs which even though vary comparatively low wage, but their social prestige being very high, the real wage is high e.g., teaching is regarded as a noble profession. Thus, a teacher’s psychological satisfaction and real wages are higher than his salary.

7. Trade Expenses:

This refers to the expenses one has to incur in the course of one’s occupation. These expenses are high in some occupations while in other may be moderate. These expenses should be deducted from the money income in order to arrive at the real wage.

For example:

Jobs requiring high trade expenses tend to reduce the real wages of a worker, e.g., a lawyer has to maintain his office etc. of his own, so his monthly income of Rs. 2,000 brings him a low real wage than a manager of a firm with the same salary. The same is the case with medical practitioners, who have to spend on the establishment and maintenance of dispensaries.

8. Future Prospects:

An occupation carrying the promise of better prospects of promotion in the future is considered to be better than the one which does not do so, even though .the money wages offered by the latter may be high.

9. Nature of Work:

The nature of work also pays an important role in the determining the level of real wages. Some jobs are pleasant, while others are not. Similarly, some occupations are enjoyable while others are dis-agreeable. All these considerations have to be given weight-age in determining real wages. Further, if the job is hazardous and risky or seasonal in nature the money wage is high but real wage is low.

10. Regularity of Work:

A permanent job, even though it carries a smaller money income, is considered to be better than a temporary job which may yield high rewarded in terms of money.

11. Climate and Conditions of Work:

The real wages of persons working under unhealthy climates and conditions are comparatively lower than those working under healthy climates as they have to spend a lot of money on medicines.

Causes of Difference in Wage Rates or Why Wages differ from Place to Place and from Industry to Industry?

The general rule is that Wages of labourers depends on the demand for and the supply of labour at that place or in that industry. The following are the important factors which influence the demand for labour and its supply which causes difference in Wage rates:

1. The Agreeableness or the Disagreeableness of the Employments Themselves:

This has been called the main cause of variation in wages. People are prepared to accept a low paid job which is pleasant and light as against a tiresome and dirty job which offers more pay.

For example:

“The most detestable of all employments that of public executioner, is, in proportion to the quantity of work done better paid than any common trade whatever.”

2. The Easiness and Cheapness or the Difficulty and Expense of Learning them:

The occupations which are easy and cheap to learn carry low wages as against those which are difficult, more expensive and take more time learn.

For example:

The wages for the services of lawyers, physicians and engineers are higher as compared to the workers of other occupations.

3. The Constancy or Inconstancy of Employment:

Jobs of a temporary nature carry higher wages than those which are of permanent nature.

For example:

A factory worker earns less per day as against a mason, for the latter gets work only for a part of the year.

4. The small or Great Trust which must be Reposed in those who Work:

Persons in whom greater trust of responsibility is reposed are paid higher wages than the ordinary lot.

For example:

The wages of goldsmith and jewelers are everywhere superior to those of many other workmen on account of the precious material with which they are entrusted. Salaries of managers of corporations are said to be high because they accept heavy responsibility.

5. The Probability or Improbability of Success:

Where in any business or in any work there are chances of total failure, the reward must be high enough to cover risks of failure. But if the occupation holds out hopes for a few great prizes with the coveted distinction of a conspicuous position in the public eye, it usually attracts competitors in such large numbers that the average remuneration may be very low.

6. Equipment or Tools used by the Worker:

The marginal productivity of labour depends on the kind of tools used. One of the main reasons why the earnings of cultivators in India are low is that their tools and equipment’s are poor. An equally efficient farmer earns less in India than in America where he has better tools and implements.

7. Chances of Supplementary Income:

Where in any organisation there is chances or a possibility of having extra income the regular wage may be lower.

For example:

College teacher’s salaries are lower but they have opportunities of earnings extra income by writing books, undertaking private tuition or by examining answer books.

8. Division of Society in Various Non-Competing Groups:

In India caste system, environment, inheritance, training and labour groups are some of the main factors which create non-competing groups in the society and workers belonging to different groups are paid at different wage-rate.

9. Government Regulations

Sometimes Government or various company’s authorities fix minimum wages in particular trades, thus reducing differences between one organisation to another.

10. Level of Efficiency, Education, Training and Practical Experience Involving Heavy Expenditure:

Wages in such industry or organisation will be higher than an organisation or industry where such training is not needed.

For example:

The remuneration of an expert surgeon, who has taken ten years to lean, his job, is bound to be greater than that of an ordinary language teacher who is fit to start his work after a year’s training only.

The above causes of wage differentials are prevalent in a society because men differ in efficiency and so do their wages.

Causes of Low Wages to Women:

Women normally receive less wages or remuneration in comparison to men because of the following reasons:

1. Lack of Physical Strength:

Women cannot do an equal amount of physical work as compared to men. They are physically weaker and as such cannot undertake strenuous labour carrying higher wages. Therefore, they are paid less amount.

2. Limited Work for Women:

There are few occupations open for women. Customs and prejudices shut them out from many work or jobs. Hence, there is overcrowding in that occupation which they can do or can take up. Therefore, their earnings are consequently low.

3. Lack of Organisation:

Women are not well-organised, hence they are weak in doing bargains. They have thus to be satisfied with low wages which they get.

4. Lack of Mobility:

Women lack mobility power. They don’t want to go outside the place leaving their children and husband. Therefore, they agree to accept low wages for their work.

5. The Income of Women is Supplementary Sources of Income:

The income of women usually help only to supplement the income of the family, which mainly depends on the income of the man’s wages. Therefore, it has been seen that supplementary income is generally low which women accept.

6. Lack of Stability in Service:

Women generally do not take up working and to earn wage a life-long career. Their main objective is to marry and settle down to family life. Hence, they care less and do not try to improve their prospects.

7. Lack of Education and Training:

In comparison to men, women are less educated and they seldom go for training, therefore, they agree to work at lower wage.

8. Absence from Work:

Because of several personal causes and family reasons, women are mostly irregular from work. They are absent if their children are ill or during maternity time their absence cannot be avoided. Therefore, their wages are less on account of irregularity.

Different Theories of Wage-Determination:

Various theories have been put forward from time to time to explain as to how wages are determined. We discuss some old theories and our detail discussions have been made regarding marginal productivity theory and the modern theory of wages.

Some Old Theories of Wages:

(1) Subsistence Theory:

The subsistence theory of wages was first formulated by the physiocratic school of French Economists of 18th century. This theory was further developed and improved upon by German Economists who called it as the Iron Law of Wages or the Brazen Law of Wages.

According to this theory, labour power is a commodity and its price is determined by a bargain between employers and labourers. This theory lay down that the workers are paid to enable them to subsist and perpetuate the race without increase or diminution. If the workers are paid more than subsistence wage, their numbers would increase as they would procreate more and this would bring down the rate of wages.

If the wages fall below the subsistence level, the number of workers would decrease—as many would die of hunger, malnutrition, disease, cold etc. and many would not marry, when that happened the wage rates would go up.

The natural price of labour is that price which is necessary to enable the labourers one with another to subsist and perpetuate their race without either increase or diminution. There is a minimum limit of wages below which labour supply will not be available. At the same time, this theory represents a pessimistic view point as labour is bound with the minimum standard of living.

Its Criticisms:

This theory has been criticised on the following grounds:

1. This theory has been wrongly based on the Malthusian theory of population:

The subsistence theory of wages is based on the Malthusian theory of population which in turn is a highly controversial and defective theory and never has its applications in western countries. It is wrong to say that population will increase if the economic condition of the labour is improved. At present, better economic condition is associated with lower birth rate.

2. This theory is one-sided:

The subsistence theory does not take into consideration the demand for labour. It considers only the supply of labour and the cost of production.

3. This theory is unable to explain the difference in wages:

This theory is unrealistic and it fails to explain the wage differentials in different regions and among different categories of workers.

4. This theory is highly pessimistic for the working class:

It presents a very dark picture of the future of the society, because in developed countries, workers are not merely contented with fulfillment of basic needs. They also require luxuries of life to raise their standard of living.

5. This theory does not pay any attention to the efficiency and productivity of the workers:

Here wage rate for all workers tends to be equal to the minimum subsistence level. But it need not be so because workers differ in efficiency and productivity.

6. Historically, this theory has been considered as incorrect:

Because experience shows that a rise in wages is not necessarily accompanied by an increase in population, rather it is followed by a decline in the rate of growth of population.

(2) The Standard of Living Theory of Wages:

This theory is a modification of the subsistence theory of wages. Here, standard of living means much more than mere subsistence level. It includes not only the necessaries of life, but such things as a certain amount of education, a certain amount of comfort and leisure at regular intervals etc.

Further, the standard of living may affect wages by affecting the marginal productivity of workers. A high standard of living which enables workmen to have more nourishing food, better homes, freedom from worries etc. increase their efficiency to a large extent.

If wages do not cover the standard of living, labourers may be unwilling to marry and have children. The supply of labour in that group will fall as a result its wages would rise. It has been said that this theory is better than the subsistence theory of wages, because it takes into account efficiency and productivity of workers.

Its Criticisms:

The important criticisms of this theory are as follows:

1. This theory fails to explain wage differentials:

Standard of living is not the measuring rod for a worker to receive good wages. It is rather because a higher standard means better training, better education, better food, which increases greater efficiency and therefore, higher wages are paid.

2. High standard of living and a high rate of wages are mutually interdependent:

As a high standard of living may cause high Wages, so also high wages are necessary condition for maintaining a high standard of living. Thus, there is some circular reasoning.

3. In this theory there is no direct relationship between wages and population:

In this connection the advanced countries are of this opinion that rise in wages is not accompanied by an increase in population but by a decline in population i.e., the increase in standard of living.

4. This theory is one-sided:

This theory takes no account of the demand for labour and its influence in determining the remuneration of labour. It is purely supply theory and as such is one-sided. Therefore, it has been said that the theory may be accepted as true with some qualifications.

The influence of standard of living on wages is mainly indirect. It is direct in so far as the standard of living increases the efficiency of workers and thus the productivity of the industry as a whole and in so far as it can increase the bargaining power of the worker. Thus, the standard of living is the effect of higher wages and not the cause of it.

(3) Wages Fund Theory:

The Wages Fund Theory was developed by J. S. Mill. He maintained that a certain fixed proportion of the capital of a country was set apart for payment as wages of labourers. He has written that—”Wages depend upon the proportion between population and capital, or rather between the number of the labouring class who work for hire and the aggregate of that may be called wage-fund which consists of that part of circulating capital which is explained in the direct hire of labour.” Further, he was mentioned that wages are determined by two factors.

(i) Wage fund:

It is that amount of capital which is set apart by the entrepreneurs for the direct purchase of the services of labour.

(ii) Population of labour who are in labour market:

It means that section of labour which enters the labour market for employment. The total wage-fund available for distribution among labourers is a fixed sum, the result of past saving or accumulation. Wage fund constituted the demand for labour and the average rate of wages was determined by dividing the fund by the number of workmen. So it follows that if the general rate of wages is to rise, either of the two things must happen, i.e., the fund must increase or the supply of labour must diminish. But the increase of the fund is rather a slow process because savings increase slowly.

Hence this corollary that if labourers were to better their conditions, they must restrict the number of their children. Further, if any group of labourers succeeds in exacting higher wages, the only result will be that other labourers would get less.

Its Criticisms:

This theory has been widely criticised on the following grounds:

1. This theory is unscientific:

This theory gives an idea of unscientific fixed fund. Wages are paid out of national income and not out of a fixed fund set apart by entrepreneurs for the purchase of the services of labour.

2. This theory is highly unrealistic:

Because this theory is not in a position to explain the existence of wage differential among workers. Critics says that if the wage fund is fixed and the wage rate depends upon the number of workers seeking employment, then it follows that the wage rate must be uniform throughout the country.

3. This theory is far away from the facts of life:

This theory presumes that labour is homogeneous. But this assumption is not in conformity with the facts of life.

4. In this theory the influence of trade union has not been takes into consideration:

In modern times, trade unions are important to affect a rise in the wage level. These theories do not explain this phenomenon.

5. It ignores completely the effect of productivity:

The important defect of this theory is that it completely ignores the effect of productivity on wages, When we know that wage, fund comes from labour. It is an accepted fact that higher the efficiency the higher will be the Wages. But this theory does not take note of this fact.

6. Actually wages do not have relationship to the total amount of capital available:

Because in some i.e., in developing countries or in new countries wages are high even through capital in scarce.

(4) The Residual Claimant Theory:

The Residual claimant theory of wage was propounded by an American Economist Francis. A. Walker who has written “the wages of labourers are paid out of the product of his industry.” This theory maintains that wages represent the amount of value created in the production which remains after payment has been made for all these factors of production. In other words labour is the “residual claimant”.

The wages are equal to the whole production minus rent, interest and profit. This theory tries to prove that if the productivity of the workers increases, the production will rise and as a result there will be increase in the residual meant to be distributed as wages. It also recognises that the workers have a stake in the national income of the country.

Its Criticisms:

The Residual claimant theory of wages has been criticised on the following grounds:

(i) The theory has been called one-sided:

Because it approaches the problem from the side of demand only it ignores completely the supply side.

(ii) It ignores trade unions action:

In this theory the actions of the trade unions have been ignored completely.

(iii) There is no need for a separate theory:

Critics have said that the prices are determined by the forces of demand and supply and there appears to be no need of any separate theory of wages.

(iv) Major weakness of this theory:

A major weakness of this theory is that “it lacks a positive method of determining what the level of rent, interest and profits should be.”

(v) Theory fails to explain residual claimant:

This theory does not explain why labour should be the residual claimant to the product of the industry. In reality, it is the entrepreneur and not the worker who is the residual claimant.

(5) The Marginal Productivity Theory of Wages:

The Marginal Productivity Theory of Wages is just an application of the marginal productivity theory of distribution. According to this theory the wages in a competitive market tend to be equal to the marginal product of labour. Marginal productivity is an addition to total productivity resulting from the employment of an additional unit of labour.

As the value of a commodity tends to equal its marginal utility to the individual, so given the supply of labour its wages will tend to equal the marginal productivity of one unit of labour to the employer. Marginal net product of one unit of labour is equal to the value of the output that remains when one unit of labour is added to or withdrawn from a firm, assuming that the supply of other co-operating agents is kept fixed and that it is organised in the most economical manner in all cases.

Assuming no change in the supply of other co-operating factors of production, and no change in the price of the product of labour, employment of more and more units of labour in a firm will increase the product at a diminishing rate.

An employer will go on adding more and more units of labour; productivity per worker diminishes, until a point will come when the value of the increase in the product due to the employment of an additional unit of labour is equal to wages paid to the worker. That unit of labour is the marginal unit and since all units are by hypothesis, of equal efficiency, its rate of wages will settle the rate paid to every other unit.

If the wages are above the marginal net product of labour, employers will curtail the volume of employment they offer to labour. Similarly, if wages are below the net product, employers will bid more for the services of labour. Hence, in order that equilibrium may exist no i.e., in order that firms may neither expand or contract, wages must be equal to the net product of the marginal labourer.

Its Criticisms:

The important criticisms of this theory are as follows:

1. This theory fails to take account of influences acting on the supply side:

A wage is not merely a price paid for a factor; it is also the income of a labourer and as such, reacts on his efficiency.

2. We cannot ignore the reactions of payment of wages on the supply side:

Wages must not only be equal to the marginal product of labour, it must also be adequate to support his standard of living. If wages do not cover the standard of living of workers, then either the standard will be lowered, in which case his efficiency may suffer, and marginal net product will fall or the birth-rate may decline, the supply of labour will fall, resulting in an increase in marginal net product. Hence, we cannot ignore the reactions of payment of wages on the supply-side.

3. The theory assumes the existence of perfect competition in the labour market which is not true:

It should be noted that this theory assumes the existence of perfect competition in the labour market. In real life competition in the labour market is seldom perfect. Masters are everywhere in a sort of tactic combination as against labourers.

4. Improvements in industrial technique and organisation have not been taken into account:

Improvements in industrial techniques and organisation have been the principal source of increase of wages. We must also take into account the influence of simultaneous increase in the supply of other factors, notably of capital which is after all the normal case.

5. The theory takes many things as constant which is also not correct:

It does not, therefore, furnish a complete explanation of wages. It merely “throws into clear light the action of one of the causes that govern Wages.”

Modern Theory of Wages or Demand and Supply Theory of Wages:

As we are aware that the price of a product is determined by its demand and supply. The price of labour, i.e., wages is also determined by the forces of demand for and supply of labour. Hence, to understand the theory of Wage determination we have to understand and analyse the demand for and supply of labour and the forces affecting them. The modern theory of demand and supply is more logical and rational because it is determined by the interaction of the forces of demand for and supply of labour in a given market situation.

The Demand for Labour:

The demand for labour refers to the amount of labour of a given type that will be employed by firms at a given wage rate in a given region per unit of time. The demand for labour by an employer is a derived demand. It is dependent upon the demand for the product which the labour helps to produce.

In fact the demand for labour depends on various factors and important among them are:

1. Productivity of Labour:

The most important and fundamental factor governing the demand for labour is its productivity. Productivity, especially marginal productivity of labour determines the firm’s demand price of labour. The marginal productivity of labour is measured as the marginal revenue product of labour in terms of money.

2. The Technique of Production and the Technology Involved in it:

The technique of production and the technology adopted and employed in the production gives the picture for the demand for labour. The nature of production and the corresponding technique of production are basically the important item for the demand of labour.

Basically, there are two techniques, namely:

(i) The labour intensive technique, and

(ii) The capital intensive technique of production.

If the firm adopts labour-intensive technique, it has to employ a large proportion of labour in relation to capital, so the firm’s demand for labour would be high. If however, capital intensive technique is used, then the firm’s demand for labour would be comparatively small.

Another impact comes from technological improvement. When due to technological advancement, labour productivity, i.e., MRP of Labour, improves, the MRP Curve shifts which implies an increase in demand for labour.

3. Demand for the Product:

Since demand for labour is a derived demand, it is derived from the demand for the product produced by its use. The higher the consumer demand for the product, the greater would be the producer demand for labour used in its production.

4. The Price of Capital Inputs:

Since labour and capital have some degree of substitutability, the demand for labour also depends on the prices of capital-inputs. For example—If the price of machinery rises, then the employer will have a tendency to substitute men for machine. Consequently, the demand for labour would rise.

Similarly, if capital becomes cheap, it will be substituted for labour, hence the demand for labour tends to decrease. A firm or a producer demands more labour at low wages and less labour at high wages. Therefore, the demand curve for labour of a firm slopes downwards from left to the right.

Since the MRP Curve is downward sloping the demand curve for labour also slopes downward. The firm’s demand curve for labour shows the different amounts of labour that the firm would employ at various levels of wages.

The market demand curve for labour is obtained by adding the demand curves of all the firms operating in the market. This will also be a downward sloping curve which indicates inverse relationship between wage-rate and the demand for labour.

The Supply of Labour:

The supply of labour means the number of workers that would offer themselves for employment at each possible wage-rate. The relationship between wages and the quantity of labour is a direct one.

Usually, it has been seen that a greater quantity of labour is offered at rising wage levels. That is why, the supply curve of labour slopes upwards from left to right. An industry will be faced with such a supply curve. It can only attract more labour by offering high wages.

In this connection Bober’s view is that—assuming a given productivity of workers, the supply of labour is a function of two variables—

(i) The number of workers actually presenting themselves for work at different wage rates, and

(ii) The number of hours they are willing to work per day or per week.

The supply of labour depends mainly on two things:

(i) The size of the population,

(ii) The proportion of the population willing to work i.e., labour force and the number of hours worked by each individual.

Similarly, the supply of labour can be increased in three ways:

(a) By a rise in total population or

(b) Rise in the labour price or

(c) Rise in the number of hours worked.

There is a direct relationship between wage-rate and supply of labour. In other words, the supply of labour rises with the rise in wage-rate and falls with the fall in wage rate. Therefore, the supply curve of labour is a positively upwards sloping curve.

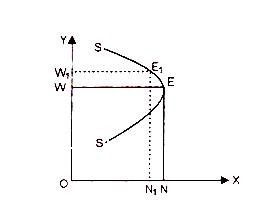

As we are aware that generally the supply curve of labour is a positively upward sloping curve yet sometimes after a point it turns to the left or becomes a sloping supply curve. Backward bending supply curve indicates that the supply of labour is reduced when there is an increase in the wage-rate.

Often this question arises as to why this happens? or, what are the reasons for backward bending supply curve ?

It is because of the following two reasons:

(i) Reduction in the number of laborers willing to work:

Very often it has been observed that when the wages of the male-members of the family are increased, the ladies, aged persons and children stop working, hence the supply of labour is reduced.

(ii) Work-Leisure Ratio or the Income-Substitution Effect:

Generally, economists explain the backward sloping supply curve in terms of change in the work-leisure ratio. The supply of labour will depend on the work-leisure ratio that the labourers would like to maintain. When wage-rate increases worker’s income also increases. Now workers may like to have more leisure in order to enjoy their earnings.

In the case a rise in real wages leads households to consume more commodities and also to consume more leisure. This means that they will be willing to work less hours per week. Thus, people now prefer more leisure and less work, it means there is a fall in work-leisure ratio. This will also reduce the supply of labour.

Thus when supply of labour falls with the rise in wage-rate, the supply curve of labour becomes backward sloping curve. This has been shown in the diagram. In the diagram SS is the supply curve of labour which is backward bending after point E. It informs that at OW wage-rate the supply of labour is ON and when wage-rate rises to OW1, the supply of labour falls to ON1.

Equilibrium Wage-Rate or Wage Determination under Competitive Conditions:

From our foregoing analysis we have learnt that normally a supply curve of labour is an upward sloping curve while the demand curve for labour is a downward sloping curve. Under competitive conditions there are a large number of firms setting their independent demand for labour. So their individual demand is just a fraction of the total labour force in the market.

Similarly, on the supply side, there are a large number of homogeneous but in-organised workers seeking individual employment. Again labour is assumed to be perfectly mobile between different firms and regions.

In such a perfectly competitive conditions labour market along with perfectly competitive conditions in the product market, the equilibrium wage will be determined at which the demand for a given type of labour is equal to its supply. From the above wherever these two curves intersect, where demand for and supply of labour become equal, that will give the equilibrium point and will determine the equilibrium wage-rate.

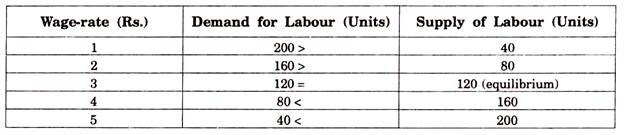

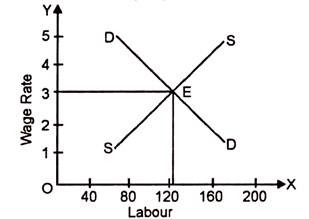

This is illustrated in the following example and diagram:

Example:

In the example and diagram equality between demand for and supply of labour is established at the wage-rate of Rs. 3. Here both demand for and supply of labour is equal to 120 units. Hence Rs. 3 will be the equilibrium wage-rate.

If the wage-rate is below Rs. 3, the demand for labour exceeds the supply of labour which push up the wage-rate. On the other, if wage-rate is above Rs. 3, the supply of labour exceeds the demand for labour which will pull down the wage-rate and ultimately equilibrium is established at Rs. 3.

Changes in demand curve or supply curve or in both will affect the equilibrium wage-rate. Given the supply curve, if demand for labour increases wages also increase and if demand for labour decreases wages also decrease. Contrary to it, given the demand curve if supply of labour increases wages will decrease and if supply decrease and if supply of labour decreases wages will increase.

Since in perfect completion VMP of labour and MRP of labour are one and the same thing, in this market the VMP curve becomes the firm’s demand curve for labour. It means at equilibrium-point where demand and supply curves meet with each other, the equilibrium wage rate will be equal to the value of marginal product of labour.

Thus, wage-rate under perfect competition market is determined by the free play of the forces of demand and supply wage-rate depends on the bargaining power of both labourers and entrepreneurs. We also know that the bargaining power of labourers is weak in comparison to the bargaining power of entrepreneurs, hence wage-rate is determined in favour of entrepreneurs. And that is why workers try to increase their bargaining power through trade union.

Wage Determination under Imperfect Competition:

In Perfect Competition equilibrium wage-rate is equal to the value of marginal product of labour but this is not the case in imperfect competition. The demand curve for labour in imperfect competition market is determined by the MRP curve.

Hence at equilibrium point wage-rate is equal to marginal revenue product of labour. As in imperfect competition MRP < VMP, in this market situation wage-rate remains below the value of marginal product of labour. This has been termed as “exploitation of labour” by the economists.

Collective Bargaining and Wage Determination:

Trade unionism is the integral part of working life in the modern industrial system. A trade union means unification of labour with a view to collective bargaining for settlement of terms of employment with the employer. Through collective bargaining, workers act as a group in labour market.

Thus, a monopolistic hold may be acquired by the workers in supplying their labour. Through collective bargaining, thus, workers try to influence the terms of wages. Using their collective strength, they may force the employer to raise the wage rate. While adopting the process and force of collective bargaining for determination of wages, however, trade unions always face a dilemma regarding their objectives.

Basically a trade union is seeking:

(i) Higher wages,

(ii) More employment of workers.

But it faces a dilemma that under competitive conditions of the market it cannot raise wages through collective bargaining without creating unemployment, and it can raise employment only with a lower rate. Thus, in competitive conditions in the labour and product market, collective bargaining cannot raise wage-rate without causing unemployment. Same thing happens even if there is monopoly in the product market.

Therefore, from what has been written above, the important analysis can be drawn that whether collective bargaining can achieve a high wage together with more employment depends on the conditions prevailing in the labour market and the commodity market. Furthermore, trade unions can raise wages by improving the labour productivity through training etc.

Can Trade Unions Get Wages Raised?

There are two views regarding this:

1. Old economists view, and

2. Modern economists view.

Old Economists View:

Old economists held the view that since the wages are equal to the marginal productivity of labour, there is no scope for raising the wages. But modern economists do not agree with this view. According to them, there are many situations in which trade unions can play an effective role in raising the wages.

Following are such situations:

(i) It is possible that sometimes workers are paid less than their marginal productivity. In this case trade unions can easily get wages raised to the extent of their marginal productivity by just pressure on the employers.

(ii) If workers are paid wages equal to their marginal productivity, will it be possible for trade union to raise wages in this situation? Suppose, if employers raise wages under pressure will it be possible for them to pay the wage-rate well above the marginal productivity of labour in the long-run? It is very important question which should be considered and analysed.

Modern Thought:

Modern economists are of this view that the trade union can raise and maintain the wage-rate well above the present marginal productivity of labour. They advance reasons in their support that—when wages are raised under the pressure of collective bargaining of the trade unions, these increased wages raise the marginal productivity of labour also. In the olden days workers were paid so little that they were malnourished and inefficient Higher wages then might have made them more efficient and thus it has resulted them in raising their productivity.

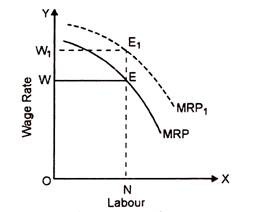

With the rise in wages, marginal revenue productivity curve for labour shifts to the right. Now with the new and higher marginal revenue productivity curve it becomes quite possible for the employers and trade unions to maintain this new level of wage-rent.

This can be illustrated by the following diagram:

In the beginning as per the original MRP curve, ON quantity of labour gets the employment at OW wage-rent. Now suppose trade unions exert pressure and wage-rate is raised to 0W1 and with the result of this increased wage-rate MRP curve also shifts to the right and becomes MRP1 curve.

At this new MRP1 curve it will be possible for the ON labourers to get employment at the increased wage-rate OW. Thus, trade unions have successfully raised the wage-rate without increasing unemployment.

(iii) Further, it has been said that trade union can raise wages by increasing the marginal productivity of labour through some other measures also.

For example:

They can be persuade and pressurize the employers to provide better machines and tools and implements to the labourers, to improve and better their working conditions and to make provisions for better medical and other facilities. All this will raise the efficiency and productivity of labour.

(iv) Making arrangement for training and eradication of various social evils:

Trade unions can themselves do some work to raise the productivity of their member workers, e.g., making arrangement for training and eradication of social evils and the use of intoxicants. In this way, if once the marginal productivity of labour is raised through any of these means, then they can raise the level of wages by putting and exerting pressures on the employers.

(v) Trade unions can raise the wage-rate by raising the demand for labour:

To increase the demand for labour they can make efforts in many directions, for instance, by demanding restrictions on the import of some commodities and on the use of labour-saving machines in the production.

(vi) The trade union can get the wages raised for a particular type of labour:

Further, it has been observed that the trade union can get the wages raised for a particular type of labour in an industry by lowering the wages of other types of labour or by cutting down the remunerations of other factors of production used in the industry.

(vii) Trade union can raise the wages of inelastic labour:

If the demand for a particular type of labour is relatively inelastic in an industry, trade unions can easily raise the wages of that type of labour in that industry.

(viii) If the demand for a product is less:

If the elasticity of demand for a particular type of product produced by the labour is less, trade unions can raise the wage-rate for this labour. In such cases the resultant increase in the cost of production can easily be shifted on the consumers by the producers through price-hike. Thus, the burden of increased wage-rate does not rest on the producers, hence, they gladly and readily agree to raise the wage-rate.

(ix) If the wages are in small fraction of the total cost of production:

It has been noted by the trade unions that if the wages are a very small fraction of the total cost of production, employers generally do not refuse when pressurized by the trade unions to raise wages. Thus, by going through the aforesaid discussions its analysis reveals that there are a number of situations and circumstances in which trade unions can raise the level of wages by using their collective bargaining power and situation. Therefore, the role of trade unions in these days is regarded as very important in the determination of wage-rates.

Wages and Trade Unions:

As we have seen that wages are determined by the forces of demand for and supply of labour. The bargaining power of workers and employers has an important bearing on wage-determination. We have also seen that ordinarily the bargaining power of labour is weak in comparison to the bargaining power of the employers; wages therefore tilt against the labourers. That is why an effort is made to strengthen the bargaining power of the workers by organising them through unions.

One of the reasons given for the formation of Trade Unions is the feelings that unorganised workers, facing financially strong employers, lack equality of bargaining power. Through union organisation it is hoped that a greater equality of bargaining power can be restored.

When trade unions and employers bargain on wages, wage-rate determination always depends on the relative strength of their bargaining powers. If the bargaining power of the trade unions is greater, the wage-rate will be high, and if the bargaining power of the entrepreneurs is high, wage-rate will be low.