Here is a term paper on ‘Swaps’. Find paragraphs, long and short term papers on ‘Swaps’ especially written for school and college students.

Term Paper on Swaps

Term Paper Contents:

- Term Paper on the Introduction to Swap

- Term Paper on the Currency Swaps

- Term Paper on the Debt-Equity Swaps

- Term Paper on the Nature of Swaps

- Term Paper on the Types of Swaps

- Term Paper on the Motivation for Swaps

- Term Paper on the Economic Advantages of Swaps

Term Paper # 1. Introduction to Swap:

ADVERTISEMENTS:

Swaps and switches are derivatives and synthetic markets among the financial markets. These can be seen in gilt-edged markets, money market, forex market, interest rate and currency markets. These are derived from the existing instruments through exchange of one instrument for the other. Swap in defined as an exchange contract between two parties for two instruments of different yields, interest rates and currencies.

Switch is also similar to swap. In gilt-edged market, banks and FIs, exchange one loan of a definite maturity and yield for another of different maturity and yield. The asset portfolio is adjusted from time to time for changes in yield, liquidity and maturity and in the process, banks require a short-term loan of two or three years and they have too many loans maturing between 5 to 10 years but less between 1 to 5 years. Switch is not exchange of a security for cash but an exchange of one security for another both in the spot market.

Swap is an agreement for exchanging of forward dollars for spot dollars and vice versa or of floating rate instrument for a fixed rate instrument. Swap is of different varieties say Coupon Swaps, Basis Swaps and Currency Swaps from one currency to another. It can also be an exchange of forward for spot currency. Some swaps will hedge both interest rate risk and currency risk.

Swaps and switches reduce the risks, and costs involved. They are hedge instruments, used as risk management instruments. They widen the market, increase depth and width of the market and sophistication of operations in the financial markets.

ADVERTISEMENTS:

Term Paper # 2.

Currency Swaps:

ADVERTISEMENTS:

A swap contract can be entered in two or more currencies, involving two or more parties. More often than not, banks are intermediaries between two parties to the swap. An MNC, say Suzuki has borrowed in Japanese yen at a fixed rate. It wants dollars for its operation in India. It can swap its exchange risk by entering into a contract for giving dollars at a floating rate or fixed rate, for yen, it has got at a fixed rate.

If it wants both exchange risk hedge and interest rate hedge, Suzuki might surrender its yen loan at a floating rate to a dollar loan at a fixed rate. Many banks — domestic and international — arrange these swaps for a charge or commission. If they do not wish to take the risk themselves they can cover it in the inter-bank market.

Currency swap is a contract or agreement and is not a loan by itself. Currency Swap gives to the parties the right to offset, namely, a non-payment of principal or interest with corresponding non-payment in the other currency. In currency swap there is always an exchange of principal amount at maturity, based on the original amounts of currency at the pre-determined exchange rate.

ADVERTISEMENTS:

This means that a swap contract behaves like a long dated forward exchange contract, where the forward rate is the current spot rate. Forward rates of a currency are a function of spot rates and expected interest rate differentials, according to Interest Rate parity theory.

The differences in forward exchange rates between say U.S. dollar and German D.M. is due to differences in interest rates between USA and Germany. If a swap in interest rates is taken between D.M. and US dollars it will automatically protect from the changes in forward rates.

Term Paper # 3.

Debt-Equity Swaps:

This is something similar to exchange of debt for equity of the domestic companies. Financial Institutions are given the right to convert their loans given to a company into equity of that company, if it has failed in repayment of installment of debt and interest payment. This right is used very infrequently and under same conditions, when the management is recalcitrant and proved inefficient and company will go into further red, if things are not set right.

The LDC debt equity swaps relates to the debt of the domestic corporates given to international banks. Six major debtor nations, namely, Chile, Brazil, Mexico, Venezuela, Argentina and Philippines have initiated these debt-equity swaps.

During the eighties, many Latin American countries were in a debt trap unable to repay their loans to MNCs and international banks. Then the European and U.S. banks found a way of settling their debt at a discount which ranged from 20% to 50%. These debts are sold in the secondary market comprising of big commercial banks, Investment banks and even MNCs.

Sometimes an international bank acts as an intermediary for sale of this discounted debt in the secondary market. Suppose the Nissan Motors, an MNC operating in Mexico wanted to invest an additional $ 60 million to expand its truck factory. Citi Corp offered to get a debt equity Swap for Nissan. Citi Corp. combed the area and observed all the formalities and got a debt of $ 70 million to be given in the form of peso for an equivalent S 60 million in dollars — a write off of $ 10 million. The Citi Corp. gave Nissan S 60 million in pesos for an equivalent U.S. dollars of $ 40 million, of which $ 2 million is taken away by the Citi Corp, as its fees for the deal.

Debt swaps allow investors to acquire the domestic country’s currency more cheaply than official exchange rate allows. The domestic currency is given for investment in the country as equity in investment in exchange for the debt in foreign currency due by that country.

The foreign currency debt is discounted by 10-50% and sold to a foreign bank in the secondary market and equivalent amount of local currency is given to the MNC, for the surrender of dollars by the MNC. This is done at a highly discounted price. In the above example, Nissan paid only $ 40 million to acquire S 60 million worth of pesos of Mexico for investment as equity in the subsidiary of Nissan in Mexico.

ADVERTISEMENTS:

MNCs get a cheaper method of financing their operations in a developing country through debt equity swaps. A firm buys a country’s dollar debt in the secondary loan market at a discount and swaps it into equity in the local market. The major international banks like American Express or Citi Corp, do the intermediation for the sale of debt in the secondary market at a discount in dollars.

These dollars are sold to MNCs, who want dollars to invest as equity in those countries. It benefits both the giver and the taker. The Mexico government got $ 70 million loan paid off for S 60 million — a gain to the Mexican Government. The debt is repaid. The purchasing MNC buys these dollars for conversion to local currency of the indebted country for the operations of its subsidiaries, at a rate cheaper than the official exchange rate.

Term Paper # 4.

Nature of Swaps:

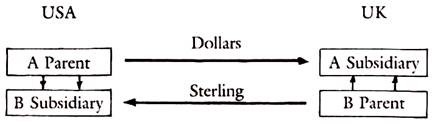

A swap in international parlance is an agreement between two or more counter parties to exchange the obligations arising from two or more debt instruments. These swaps are restructuring agreements of obligations from any of the debt instruments. Assume that parent company A (USA) has a subsidiary in UK called A (UK). Similarly there is a parent company B (UK) which has a subsidiary in USA, B (USA).

ADVERTISEMENTS:

The parent company A (USA) wants to invest in its subsidiary in UK and needs Sterling of this purpose. And B (UK) wants to send funds to its subsidiary in USA called B (USA) and requires dollars for this purpose. Then with or without the help of an international bank to act as an intermediary, the parties can enter into a swap deal of the loans in Sterling and dollar; without US company sending Sterling to its UK subsidiary, B (UK) provides dollars to B (USA). These transactions can be shown in the following chart as flow of funds or swaps of loans.

Swap of Funds:

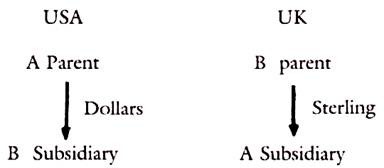

In the above chart A parent has to borrow Sterling as a loan and B parent has to borrow Dollars as a loan.

ADVERTISEMENTS:

These loans can be swapped so that A parent gives Dollars to B subsidiary and B parent gives Sterling to A subsidiary as shown below:

Term Paper # 5.

Types of Swaps:

There are different types of Swaps, namely:

1. Interest Rate Swaps.

2. Fixed Rate Currency Swaps.

ADVERTISEMENTS:

3. Cross Currency Interest Rate Swaps.

4. Basis Swaps.

1. Interest Rate Swaps:

Suppose a party has an obligation to pay a fixed rate of interest on a bond and another party has a floating rate debt instrument. If these parties exchange their interest obligations, then the principal amount remains with the original parties. The principal amount should be the same in the case of both the parties. The principal amount is not swapped, as it is in the same currency and for the same amount. Only interest rate payments are swapped.

Both the parties should gain, otherwise they will not agree to the swap. The gain will be in the form of lower costs.

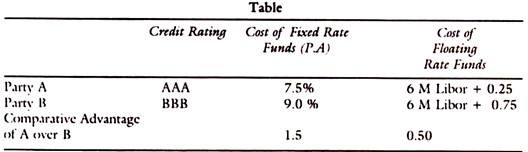

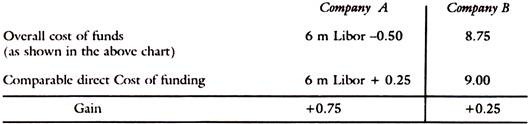

Consider Party A and B as shown in the following chart:

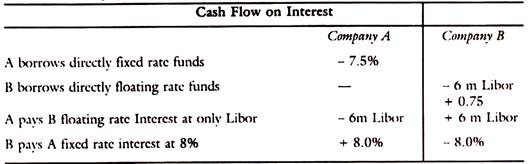

A is rated Triple A and cost of funds is lower for A than for B. These two parties enter into an agreement of interest Rate Swap. A borrows fixed rate and lends floating rate to B and B borrows floating rate and lends fixed rate. This should be a win-win situation when both parties stand to gain. For B Company to do a swap, its cost of funds should be lower below what it would have to pay, if it had to directly enter the market.

The principal amount remains with the original parties and only the cash flows due to interest payments are exchanged.

Company ‘A’ borrows at fixed rate and pays 7.5%, but pays to B Libor + 0; ‘B’ company borrows floating and pays 6M Libor + 0.75 but pays to A fixed interest at 8%. Here B got rid of the uncertainty of floating rate and hence reduced the risk.

A takes the risk but gets the funds at lower rate than it can get directly in the market, i.e., Libor + 0.25.

The gain for each of the parties is as follows:

The gain is there for both the parties, but the gain is more for the company A than company B due to its higher credit rating and its lower cost of borrowing.

2. Fixed Rate Currency Swaps:

Fixed Rate Currency Swaps are transactions between two parties with fixed rate interest liabilities but in different currencies. Each exchanges his fixed rate interest liability in one currency for fixed rate interest liability in another currency. For this exchange to be effected the initial exchange rate at which the principal and fixed interest payments are to be exchanged and the subsequent exchange rate at maturity when the principal amounts have to re-exchanged are to be agreed upon. Whether the actual exchange takes place physically or it is done on a national basis, it has to be agreed upon what are the principal amounts due at maturity and the interest amounts to be paid as per schedule.

This will result in an effective transformation of debt raised in one currency into a stream of flows of fixed amounts in another currency. To be more specific A has a natural advantage of borrowing in Swiss franc, while he needs the U.S. dollars. There is another party ‘B’ who has borrowed in dollars and this stream of dollar payments can be swapped to ‘A’, in exchange for a flow of Swiss franc payments to ‘B’. If B does not have inflows of Swiss franc, he has to hedge these payments through the forward exchange market. These deals are put through the reputed international bankers.

The advantages are obvious. One prefers a currency in which he wants the loan and he wants a hedge so that he knows how much funds he has to set apart periodically. Lastly, these swaps provide major cost savings. The swap enables the counter parties to arbitrage to have access to markets in which they are strong or have a preference. Each gets the currency which he wants and the market to deal in which he has relative strength of advantage. Unless both parties to the swap stand to gain such swap does not take place. It has to satisfy the relative preferences of each party.

3. Cross Currency Interest Rate Swap:

ADVERTISEMENTS:

The cross currency interest Rate swap is a swap of both the currency and the interest rate. A company has borrowed through a US dollar denominated fixed coupon rate bond; but the company’s requirement is a D.M. denominated floating rate bond to be used for its German subsidiary. His fixed rate U.S. dollar bond is now exchanged for the floating rate D.M. denominated bond. This can be assigned through an intermediary or a bank. This should be suitable and gainful to both the parties.

The currency swap market has grown rapidly, due to the growth of local capital market and the respective Euro-Currency market in a wide range of currencies. The most frequently used currencies are U.S. $, Japanese yen, German D.M. pound sterling, Canadian dollar, Swiss franc etc. More recent currency to be used is Euro.

Multi-legged Swap:

In this swap market there are more than two parties and notably an intermediary bank of international operations. The bank acts as a counter party to each company and takes the risk for each company and is rewarded by a return for taking the risk. The bank provides company with what it wants, say Floating rate interest bond in D.M. and takes its fixed rate interest bond in U.S.$.

Similarly, for another party, it takes its Floating rate interest bond in Swiss francs in return for its fixed interest bond in U.S.$ . This process goes on and this may lead to the bank having uncovered risks while the companies are all hedged by the cover facilities provided by the Bank. This is called Multi-legged Swap.

4. Basis Swaps:

This is a Swap of interest rate basis from one of floating on U.S. Treasury bill rate to that of Libor or from that of floating on commercial paper to U.S. Treasury bond rate etc. This refers to the basis on which the floating rate is linked. Basis Swaps also apply to cross currency swaps, where interest is on a floating basis in each currency.

Interest Rate Swaps in India:

Despite the halting progress of the convertibility of the Rupee, the deregulation of domestic interest rates is progressing steadily. Until 1994, the RBI set the rates at which banks borrowed money and lent and the spread between them is their profit. Since 1994, the RBI has been dismantling the controlled interest rate regime. Banks can now set their own borrowing and lending rates.

The only remnants of regulation is the interest rates on savings accounts and on deposits of 1 to 15 days. Similarly on the lending side, the left over controls are on the lendings below Rs. 2 lakhs, export credit and loans for housing and to weaker sections. The banks are still controlled for monetary control purposes by the CRR and SLR.

The RBI has asked the banks to set up a system under which they will be forced to recognise their cash flows and interest rate risk exposures through the Asset- liability management process. The banks will now have to grapple with interest rate and liquidity risks.

The interest rate swap is one instrument through which anybody can hedge risk of interest rates. Banks are already taking credit risks, which they try to reduce by better appraisal, greater care in lending and emphasis on quality lending which will reduce the bad and doubtful debts. On top of this, the flexible interest rate policy and fluctuating rates have forced banks and all players in the financial Markets to run for a cover for interest rate risk.

An Interest Rate Swap (IRS) is a transaction between two parties, whereby there is a national exchange of and re-exchange of flows of interest and /or principal. It involves the receipt and payment of interest during the life of the Swap. This exchange may involve one from fixed rate to floating rate interest payments and vice-versa.

Similarly one can hedge the rise in interest rate. One can also go short on interest rates, if he expects a fall in rates. Once the banks can hedge on interest rates they are sure of the payments and they can accordingly adjust the receipts through the lending rates. The transaction in IRS market will not attract CRR and S.L.R.

There is no inter-bank term money market now due to the CRR and SLR provisions. This market will help the growth of debt and derivative markets in India. RBI has allowed banks to develop IRS market in India.

Banks will have to segregate the credit risk and interest rate risk. Interest rate risks will have to be eliminated in risk management. In making any financing decision, it is now easier to come to a conclusion of credit risk that they can take and credit policy they should adopt.

IRS will reduce the spreads between banks’ lending and borrowing rates and between bid and offer rates in gilts trading. The benefits that follow from this derivative market are many to both bank and non-banks participants in financial markets. IRS will develop the debt market and impart liquidity to NCD market.

One example of the benefits of this derivative market can be given by the low cost of flexible mortgage loans that the Americans enjoy. These are available to them because of a large market in Mortgage backed securities and the existence of a sophisticated interest rate derivative market, there.

Accounting and documentation treatment and removal of stamp duty on such contracts of IRS will have to be accepted for IRS to grow in India. Standard futures and options contracts will have to be allowed and developed. Otherwise, IRS will grow only so far as the forward exchange market has grown.

Interest Rate and Currency Swaps:

Corporates use the interest rate and Currency Swaps as special financing vehicles for reducing costs and risks in financing their foreign investments. In the deregulated and free markets, there are wide fluctuations in Currency rates and interest rates. Swap has led to a refinement of risk management technique which in turn led to MNCs’ greater involvement in the international capital market.

An interest rate Swap is an agreement between two parties to exchange interest payments in a foreign currency for a specific maturity upon a notional amount. This notional amount is the principal against which interest is calculated and which does not change hands. The main types of Swaps are coupon Swaps and basis Swaps.

The coupon Swaps refer to the exchange of payments of interest from a floating rate basis to a fixed rate basis, and vice versa. The basis Swap refers to one wherein two parties exchange floating interest rate payments, based on two different reference rates, one say on Treasury bond and the other on Treasury bill or on Libor.

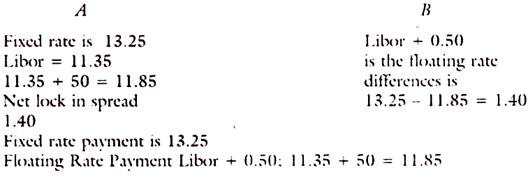

A floating rate loan can be 50 basis points on the Libor rate. The basis point is 0.01% of the quoted rate. The Swap is as between A and B.

If Libor goes upto 13.00, then 13.00 + 50 = 13.50 will be payable by him instead of 13.25.

The hedge is set at an upper limit of libor.

The banks will be counter party to provide this hedge by Swap to the exporters and importers, traders and manufacturers and to any debtors in general. The banks take the risk and cover it up in the inters bank market.

Advantages:

Interest Swaps reduce the risk when they are acting as a hedge. They also reduce costs. When different parties have different credit rating and their cost of borrowing is accordingly decided. The differences in terms of borrowing in different markets arise due to the risk and creditworthiness of the borrowing party. Party ‘A’ is having a low rating (BBB) and cannot secure at floating rate market or the rate of libor.

But a bank with a high credit rating (of AAA) can borrow at Libor. B (the Bank) then borrows at Libor and Swaps with ‘A’ who borrowed in a fixed rate of 12.5% or at Libor + 0.50. When the Libor is 11% and the Swap is at 11.5%, then there is no gain to A, as he can borrow at Libor + 0.50. If the Swap is at 11.25%, and he can borrow at 11.50% then ‘A’ stands to gain and reduces his cost by 0.25%. If one has to borrow at fixed rate of 12.50%, but he can borrow floating rate of 11.50% and Swaps for a fixed rate of anything from 11.50% to 11.75%, he gains in costs.

‘B’ also gains as he has borrowed at 11.00% from the floating rate and exchanged it for 11.75%, which is still lower than what he can borrow from the fixed rate market (12.50%).

RBI Scheme of Interest Rate Swaps:

Scheduled commercial banks, excluding the RRBs, primary dealers (PDs) and all India financial institutions (FIs) are free to undertake interest rate Swaps. The purposes for which they can undertake Swaps as a financial product are for trading, hedge or balance sheet management or for market making. They can offer these products to corporates who wish to hedge the loans on their books. Once these institutions undertake these transactions on a regular bases they have to inform the RBI.

These transactions for hedging and trading have to be recorded separately. Those for hedging purposes shall be accounted for on an accrual basis. Those for trading purposes should be marked to the market (value at the ruling market price). The fees or income and expenses relating to Swaps should be recognised in the Income and Expenditure Statement at the time of settlement.

The participants should have to maintain the capital adequacy norms in the case of banks and FIs, in respect of these assets. The PDs have to maintain additional capital at 12% of risk weighted assets towards credit risk on interest rate contracts. They have to disclose all the details in their balance sheets on the outstanding contracts, their notional principal amount, nature and terms, etc., including information on credit and market risk and accounting practices adopted for Swaps.

The fair value is the estimated amount that they would pay or receive to terminate the Swap. There are no restrictions on the size or tenor of any interest rate Swap. The RBI wants the market to develop and did not lay down any bench mark interest rates like money market or debt market rates.

Term Paper # 6. Motivation for Swaps:

The need for swaps arose out of felt needs of corporates to hedge the underlying risk and uncertainty of financial outlays and outflows. The risks may arise out of trade in merchandise items or invisible items of balance of payments. Even in capital account, foreign borrowings require both interest rate risk coverage and currency risk coverage.

In respect of domestic financial markets also all the risks mentioned above are there except for the currency risk. The swaps in the domestic markets are required for risk coverage in interest rate changes, yield adjustments, timings of inflows and of outflows to be synchronised, Asset liability matching, and adjustments for duration of the portfolio. In trading in the financial markets, particularly in the gilted market, yield and price differences as between loans attract Swaps.

Swaps from fixed interest to floating interest rate loans is an example to adjust the yield pattern. Similarly portfolio adjustments require the change of the portfolio composition to tune the expected inflows to come at the timings of expected outlays. This is called portfolio duration adjustments.

Risk and uncertainty hedge is also an objective of swaps. For example, risk hedging can be done by a swap between floating rate loan and fixed interest loan and for swifting the basis of interest rate fixation from Libor based (as Libor plus) to one based on Treasury Bill rate or a Government bond or Bank Rate. Lastly, there are two basic objectives, namely, income and capital gains in addition to hedge against risk. Swaps will enable the parties to the contract to exchange the principals at maturity at the Current spot rate or predetermined exchange rate or swaps of coupon rates only are also possible.

Term Paper # 7.

Economic Advantages of Swaps:

Swaps provide real economic advantages to both the parties to the swap. Otherwise swap will not take place. If Arbitrage functions fully and the markets are perfectly efficient, there will be no advantage in swaps. But imperfections in the markets do exist leading to differential in risk-return characteristics. The impediments to perfect markets exist in the form of legal restrictions on spot and forward deals different perceptions of risk and credit worthiness of two parties, tax differentials, etc.

A.U.S. MNC operating in Germany wants to hold dollars although D.M, is more stable than dollars at that time, because the operator is more familiar with U.S. dollar than with D.M. Both parties receive a cost advantage because they borrow initially in the market where it has a comparative advantage and then swap for its preferred currency and interest rate liability.

Currency swap saves in costs, promotes liquidity and depth in the markets and/ or provides a hedge to the risk that the party is exposed to. Currency swaps are used to help financing the long-term requirements of funds for the projects of MNCs.

In many foreign countries, long-term capital forward foreign exchange markets are absent and not well developed. In this scenario, swaps are useful as special purpose vehicles for meeting the financial needs of MNCs and for providing liquidity to these markets. Imperfections and absence of perfect arbitrage system help the growth of the swap markets.