In this article we will discuss about the principles of taxation.

The most important source of government revenue is tax. A tax is a compulsory payment made by individuals and companies to the government on the basis of certain well-established rules or criteria such as income earned, property owned, capital gains made or expenditure incurred (money spent) on domestic and imported articles.

Since many people object to paying taxes, taxation involves compulsion. The taxpayers are required to make certain payments, regardless of their individual wishes or desires in the matter. Because of this compulsion, the collection of taxes may have very significant effects upon the behaviour of individuals and the functioning of the economy, which must be taken into consideration in selection of taxes if the tax structure is not to interfere with the attainment of the economic goals of society. Furthermore, if the goals of society are to be realised, the burden of the taxes must be distributed among various persons in a manner consistent with these goals.

No tax is ideal, but taxes are inevitable if the government is to obtain revenue to pay for its expenditure. The government tries to satisfy most taxpayers by ensuring that taxes are fair and reasonable.

ADVERTISEMENTS:

The major objective of taxation is to raise revenues. But other objectives are also important in the design of a tax system. The principle of taxation can be chosen only in terms of the goals which are accepted as the appropriate objectives of the economic system.

In a modern economy, four such goals are of considerable importance for optimum economic welfare:

(1) Maximum freedom of choice, consistent with the welfare of others

(2) Optimum standards of living in terms of available resources and techniques and in the light of consumer and factor-owner preferences;

ADVERTISEMENTS:

(3) An optimum rate of economic growth; and

(4) A distribution of income in conformity with the standards of equity currently accepted by society.

In terms of these goals, three major principles or desirable characteristics of the tax system have come to be generally accepted:

1. Economic effects:

ADVERTISEMENTS:

The tax structure must be established in such a way as to avoid interference with the attainment of the optimum.

2. Equity:

The distribution of burden of the tax must conform with the pattern of income distribution regarded as the optimum by the consensus of opinion in a modern society.

3. Minimum costs of collections and compliance, consistent with effective enforcement:

The rule requires that taxes be established in such a manner as to minimise the real costs of collections, in terms of resources required as in terms of the direct inconvenience caused to the taxpayers. In fact, different writers have formulated the different theories, at different times, relating to the equitable distribution of the burden of taxation among the people.

The principles of taxation, that is, the appropriate criteria to be employed in the development and evaluation of the tax structure, have received attention from the days of Adam Smith.

Adam Smith developed his four famous canons of taxation:

(1) Equity:

The amount payable by taxpayers should be equal, by which he meant proportional to income;

ADVERTISEMENTS:

(2) Ability:

The taxpayer should know for certain how much he will have to pay;

(3) Convenience:

There should be convenience of payment;

ADVERTISEMENTS:

(4) Economy:

Taxes should not be imposed if their cost of collection is excessive.

The following are the most important principles of taxation:

1. Neutrality:

ADVERTISEMENTS:

Prima facie, a tax system should be designed to be neutral, i.e., it should disturb the market forces as little as possible, unless there is a good reason to the contrary.

As a general rule, people do not like tax payment. In fact, every tax provides an incentive to do something to avoid it. Since the government is under compulsion to collect taxes, it is not possible to guarantee complete neutrality. The tax system must, therefore, seek to achieve neutrality, by minimising the disturbance to the market that comes from taxation.

2. Non-neutrality:

Sometimes it becomes essential to maintain non-neutrality for meeting certain social objectives. These objectives can be secured by providing tax incentives. This means that in some cases, it may be desirable to disturb the private market.

For example, the government may impose tax on polluting activities, so as to discourage firms to pollute the environment. Likewise, a tax on cigarettes will serve a two-fold purpose: raising revenue and discouraging consumption of this harmful item. In both the cases, the market is disturbed but in a desirable way.

3. Equity:

ADVERTISEMENTS:

Taxation involves compulsion. Therefore, it is important for the tax system to be fair. On grounds of equity it has been suggested that a tax system should be based on a principle of equal sacrifice or ability to pay. The latter is determined by (a) income or wealth and (b) personal circumstances.

Richard Musgrave has argued that taxes are to be judged on two main criteria: equity (Is the tax fair?) and efficiency (Does the tax interfere unduly with the workings of the market economy?) It comes to us a surprise that economists have been mostly concerned with the latter, while public discussions about tax proposals always focus on the former.

We may, therefore, start with the concept of equitable taxation:

(a) Horizontal Equity:

There are three distinct concepts of tax equity. The first is horizontal equity. Horizontal equity is the notion that equally situated individuals should be taxed equally. More specifically, persons of equal income should pay identical amounts in taxes. There is hardly any controversy about this principle. But it is very difficult to apply the concept in practice.

Let us consider, for example, the personal income tax. Horizontal equity calls for two families in the same income to pay the same tax. But what if one family has eight children and the other has none? Or, what if one family has unusually high medical expense, while the other has none (even if two families have the same number of members)?

ADVERTISEMENTS:

(b) Vertical Equity:

The second concept of fair taxation follows logically from the first. If equals are to be treated equally, it logically follows that un-equals should be treated unequally. This precept is known as vertical equity. This concept has been translated into the ability to pay principle, according to which those most able to pay should pay the maximum amount of taxes. Broadly, the principle suggests that the fairest tax is one based on one’s financial ability to support governmental activities through tax payments.

The ethical base of this principle rests on the assumption that one rupee paid in taxes by a rich person represents less sacrifice than does the same rupee tax paid by a poor man and that fairness demands equal sacrifice by both rich and poor in support of government. Thus, a rich man must pay more money in taxes than would a poor man for each to bear the same burden in supporting services provided by the government.

Thus, horizontal equity suggests that people who are equal should pay equal taxes: vertical equity suggest that, un-equals should be treated unequally. Specifically, the rich should pay more taxes than the poor, since wealth is considered an appropriate measure of one’s ability to pay taxes.

The Benefit Principle:

From the conceptual and practical points of view there is hardly any conflict between the principles of horizontal and vertical equity. But there is a third principle of fair taxation which may often violate commonly accepted notions of vertical equity.

ADVERTISEMENTS:

The principle recognises that the purpose of taxation is to pay for government services. If taxes are imposed according to the benefit principle, people pay taxes in proportion to the benefits they receive from government spending.

Therefore, those who derive the maximum benefits from government services such as roads, hospitals, public schools and colleges should pay the maximum tax. However, if the benefit principle of taxation is followed, the government will be required to estimate how much various individuals and groups benefit, and set taxes accordingly.

According to the benefit principle of taxation those who reap the benefits from government services should pay the taxes. The benefit principle holds that people should be taxed in proportion to the benefits they receive from goods and services provided by the government. This principle is based on the feeling that one should pay for what one gets.

One clear example is road tax. Receipts from road taxes typically are set aside for maintenance and construction of roads. Thus, those who drive on the roads pay the tax. But one question remains unanswered: do those who use the roads pay the tax roughly in proportion to the amount they use them?

The principle also leads to an economically efficient solution to the questions of how much government should provide and who should pay for it. However, using the benefit principle has several practical difficulties that render it impossible to apply it for many publicly supplied goods and services.

When a good or service supplied by the government has the exclusive and rival characteristics of a private good, benefits can be computed rather easily and users can be charged accordingly. Examples include road tax, toll tax and transit fees. When a publicly provided service is non-rival and nonexclusive (a pure public good) the benefit principle is just a theoretical concept because the benefits cannot be measured.

ADVERTISEMENTS:

Problems:

In fact the necessity for different taxes generally makes benefit taxation somewhat impractical for pure public goods. First, the public sector provides numerous public goods, and the cost of obtaining enough information to permit levying appropriately different taxes may be very high.

Furthermore, most individual taxpayers often refuse to reveal their ‘true’ preferences because once the ‘public’ good is provided, individuals cannot be excluded from enjoying the benefits whether they pay taxes or not. This characteristic of public goods goes by the name ‘free riders’.

Let us suppose taxes are based on one’s reported assessment of the benefits one receives from the good. In essence, taxation is voluntary. Some taxpayers might assert that they want little or none of the public good (like a road, or a public park or a bridge) in question.

Clever people might even assert that they are harmed by the public good. So, they should receive subsidies from the government. Once other people agree to buy some of the public good, free riders are able to enjoy the good or service.

If most people want to enjoy the good or service free of cost (or, they attempt to ‘free ride’), the public good may not be available at all. Generally, it will be available in less than sufficient quantities. As a result of the inability to ascertain people’s true preferences for public goods, the benefit principle, while interesting analytically, is seldom used in practice.

So, it is not possible to implement the principle in practice. Most people will enjoy the benefits of public expenditure but will be reluctant to pay taxes. To overcome this problem, an alternative principle has been suggested, viz., the ability to pay principle.

This principle may now be discussed:

The Ability-to-Pay Principle:

If the objective of the government is to redistribute income, it should set taxes according to the ability-to-pay principle. However, it is difficult to measure ability. There are, in general, three measures of ability: income, expenditure and property. But none is full-proof.

1. Income:

Income is said to be a better measure of ability than wealth. But here also some difficulties are encountered. All work do not involve the same sacrifice. A man earning Rs.500 through toil and trouble will not be a position to pay taxes as one earning the same amount without any effort (from paternal property) or gambling or through chance (lottery).

One with the same level of income as another may have more dependents and more liability and thus lower ability to pay. Moreover, the marginal utility of money differs from man to man. It is higher to a man with lower income and vice versa. So, in the ultimate analysis, income is not a good test of ability.

2. Expenditure:

According to Prof. N. Kaldor, expenditure is the best possible measure of ability. He advocated an expenditure tax which was tried in India for sometime but withdrawn subsequently. A poor man may spend more if he has more dependants and if he has to look after his old parents. So, his expenditure may be higher than his colleague belonging to the same income bracket. But his expenditure does not reflect his true ability to pay.

3. Property:

Possession of wealth or property is a reflection of well- being, but to a limited degree. For example, if two persons have the same amount of wealth, they are not equally well-off. One may have some productive wealth like a building which yields a steady income. Another may have unproductive wealth (i.e., jewellery) of the same value. Naturally, their ability to pay taxes will differ greatly.

Two basic indices (measures) of the ability to pay, viz., income and wealth provide a justification for progressive personal taxes. If taxes are imposed on the basis of the ability to pay principle, higher taxes will be paid by those with greater ability to pay, as measured by income and/or wealth.

The measures of ability differ from tax to tax. For example, in income taxation, the measure of ability is income; in wealth taxation, it is the value of property (wealth).

A practical problem arises when we try to translate the idea (or notion) into practice.

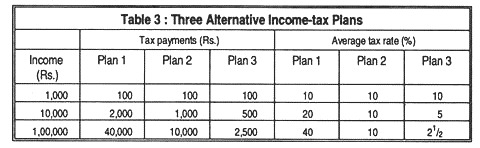

Let us consider the three alternative income tax plans listed in Table 3:

Under all three plans, families with higher incomes pay higher income taxes. So, all these plans may be said to be operate on the ability to pay principle of taxation. Yet they have different distributive consequences.

Plan 1 is a progressive tax: the average tax rate is higher for richer families. Plan 2 is a proportional tax; every family pays 10% of its income. Plan 3 is quite regressive: since tax payments rise more slowly than income, the tax rate for richer families is lower than that for poorer families.

It appears that under plan 3 the principle of ‘fairness’ is violated. However, the modern system of progressive personal income tax seems to be based on the notion of vertical equity. Other things being equal, progressive taxes are seen as ‘good’ taxes in some ethical sense while regressive taxes are seen as -bad’. On these grounds, advocates of greater equality of income support progressive income taxes and oppose sales taxes.

However, progressivity in taxation is not necessary for vertical equity. A proportional income-tax system could well satisfy the equity principle.

Other Principles (Optional):

A few other principles of taxation have also been suggested from time to time such as the following:

The Cost of Service Principle:

According to this principle, the tax to be paid by an individual should be equal to the cost of services incurred by the government in rendering the service to him. Thus, if the government spends Rs 50 for providing a particular service to A, he should pay a tax of Rs 50.

The principle can be applied in the case of government services like railways, postal services, etc. But the application of this principle in taxation involves some difficulties. First, when the government spends some money for the people at large, it does so in a general way.

So, the cost of services incurred for different individuals cannot be separately calculated. Secondly, the application of this principle requires the poor to pay taxes at higher rates than the rich as the government generally spends more for the poor than for the rich.

Finally, if this principle be applied in the case of pension holders, the latter would have to pay taxes more than the amount of pension to cover the administrative expenses for giving such pension, but this would be absurd.

The Principle of Least-aggregate Sacrifice or Minimum Sacrifice Principle:

Some writers interpreted the ability to pay principle in terms of equal sacrifice and minimum sacrifice. According to this principle, taxes should be so designed as to cause the smallest possible real burden or the smallest possible sacrifice to the community.

According to Pigou, the burden of taxation is to be distributed among the people in such a way that the aggregate sacrifice of the community for paying taxes should be the least, i.e., the minimum. This can be done by taxing only the rich as the marginal utility of money to them is lower than what it is to the poor.

But difficulties may arise in measuring the aggregate sacrifice of the community owing to the difficulties in knowing the correct marginal utility of money, which itself is a subjective phenomenon (only windfall gains should be taxed at a high rate since they involve least sacrifice).

Conclusion:

In practice, the policy of a government can hardly be based solely on any of the above principles. These principles set merely as guidelines to the government in framing its tax policy which is prepared having regard to various considerations like the tax yield, equity, social and economic effects and the requirements of the country.

At different times, certain principles of taxation have been suggested on the basis of Smith’s four basic canons. According to the so-called benefit principle, the amount a person should pay in taxes should be related to the benefit he might expect to receive in return.

But this principle is difficult to apply in reality since, under this principle, lower income groups would be called upon to pay most. Similar and equally impracticable is the cost of service principle, according to which a person’s tax liability would be based on the cost of the public services which he enjoys.